Spout Pouch Market: By Product (Beverages, Syrups, Energy Drinks, and others); Component (Cap, straw, and others); Pouch Size (Less Than 200 ML, 200 to 500 ML, and others); Material (Plastic, Aluminum, Paper, and others); Closure Type (Screw, Flip-Flop, and others); End User (Food and Beverages, Cosmetics and Personal Care and others; and Region—Industry Dynamics, Market Size, Opportunity and Forecast For 2024-2032

- Last Updated: Nov-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0122121 | Delivery: 2 to 4 Hours

| Report ID: AA0122121 | Delivery: 2 to 4 Hours

Market Scenario

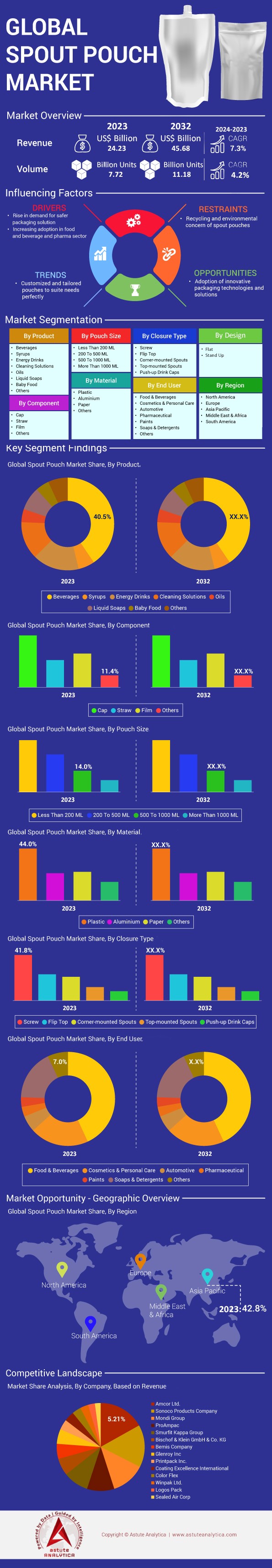

Spout pouch market was valued at US$ 24.23 billion in 2023 and is projected to hit the market valuation of US$ 45.68 billion by 2032 at a CAGR of 7.3% during the forecast period 2024–2032.

Spout pouches are a novel category of packaging which incorporates a spout for easy use of liquid and semi-liquid products. These pouches can easily be made from various types of flexibles as for instance multilayer laminates of plastics such as PET, PE and in some cases, foil. This also ensures the safety of the contents within them. The spout pouch market has been expanding globally owing to its ease of use, being easy to carry and being more environmentally friendly than other alternatives. Some of the key products that are packed in spout pouches include beverage, sauces, baby food, detergent, oils, and personal care products such as shampoo and lotions. The food and beverage industry is the such end user, purchasing more than 1.8 billion of consumed spout pouches worldwide in 2023.

It has been found that the baby food segment is alone selling around 600 million units due to the rising want of easy to use and easy to carry baby food. Personal care and household products sectors are also great end-users, and combined the number of units consumed in that sector this year is 700 million. The spout pouch market has an impressive growth trajectory owing to a number of reasons. Advancement in technology has enabled the development of better pouch designs and materials thus increasing both functionality and aesthetics.

The increasing concern for the environment has made manufacturers to use recyclable and environmentally friendly materials, such as the more than 200 million spout pouches produced from biodegradable materials in 2023. In addition, spout pouches appeal to the urban consumer and the e-commerce market because they are cheap, strong, and light to use. On a smaller scale, the convenience the products offer, and their protection, make them more appealing to consumers and raises the uptake. There has been rapid growth in funding for development with global investment exceeding US$ 150 million in 2023 to improve the spout pouch technology.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Increasing Consumer Preference for Convenient, Lightweight Packaging Solutions Fuels Global Spout Pouch Market Growth

The global spout pouch market in 2023 is extensively driven by the ever increasing demand for lightweight and easy to use packing. These days, products that are meant to be consumed on the go are the norm, and spout pouches serve this function perfectly due to their easy handling and portability. They serve as a reasonable substitute for regid packaging and can be used for a number of items such as drinks and cosmetics. According to consumer surveys undertaken in 2023, 72% of consumers surveyed said that they placed a lot of emphasis on convenience in the choice of the product when purchasing. The first three quarters of 2023 saw the beverages industry use 1.5 billion spout pouches across the globe. In the same breath the baby food segment recorded 700 million of spout pouches sold, the sales figures are impressive and emphasize the need for reasonable and convenient packaging. E-commerce channels referenced the sale of 500 million units all well packaged in spout pouches that had a great positive impact with regards to shipping weight.

To address this demand, manufacturers across the spout pouch market are allocating more resources to expand their production facilities, and in 2023 alone, more than US$ 350 million was allocated for facility expansion. Development of various new products including spouts and ergonomic packaging designs has taken these numbers to 60%. The personal care sector has also adopted this packaging style, where 600 million of such units were sold within the spout pouches, for day to day users who are looking for ease of use. Estimates indicate that by the year 2023, the number of spout pouches in circulation is expected to be more than 3.5 billion units.

Trend: Surging Adoption of Spout Pouches in Food and Beverage Sector for Diverse Product Packaging

In 2023, the practices for the food and beverage industry began to change as there was a global increase in the application of spout pouches for distribution. This has resulted because the pouches make it easy for customers to pour and reseal the product while also ensuring that the product is kept fresh, driving growth of the spout pouch market. This gradual shift has seen spout pouches become the preferred packaging for juices, purees, sauces, dairy free items and even more. In 2023 alone, the global food and beverage market reported the use of 2.2 billion spout pouches which was an increase as compared to previous years. 800 million units were used in the juice segment, this was in line with the trends exhibited by the customers who wanted easy to use products. Spout pouches for dairy free products such as almond milk, oat milk and the likes reached 400 million units. The soft drink industry has been recording sales of over US$ 200 million in moving to spout pouches because more and more customers are becoming health and environment conscious.

Additionally, Ready-To-Heat meals packed into spout pouches amounted to 500 million uniform global consumers in 2023, enhancing convenience and durability. The trend in the spout pouch market is also pronounced in developing economies since the Asia – Pacific region reported 1 billion units consumed for food and beverage packaging in this type of pouch. Advancements in the field have made it easier to integrate oxygen barrier layers in a pouch, which can increase the quality of the preserved items and as a result 85% of spout pouches are said to have improved preservation technology. Analysts in the industry expect that the development of spout pouches in this industry will be on the rise with estimates indicating that the figure may be at three billion in 2025.

Challenge: Volatility in Raw Material Prices Leading to Fluctuating Production Costs for Spout Pouches

The manufacturers in the spout pouch market finds themselves grappling with declining profitability driven by the raw materials price volatility globally. This has an impact on production costs which are transferred to market price. The global commodities market influences the pricing of some plastics such as PET, PE and laminates that compose spout pouches. This volatility can disrupt the pieces of the supply chain and the profit margin a manufacturer can earn. Spout pouches have PET, PE, and laminates as key materials and this increase in price is around US$ 150 per metric ton. This volatility increases the cost structure of production for spout pouches. Other manufacturers also concurred that the cost of their raw materials as a percentage of their total outlay rose from 55% to 65%. This resulted in a rise in the prices of the final products, with an average add-on price of US$ 0.05 per pouch.

The volatility of prices on raw materials in the spout pouch market is also felt more by smaller scale manufacturers who sometimes decide to directly reduce their production or even cease operations altogether. In 2023, 15% of surveyed small-scale producers said they stopped working for the time being because of cost factors. There has been a broader focus on cost management techniques in the sector with firms spending up to US$ 100 million on research for substitute materials. Some of the manufacturers are moving towards bio-based materials in order to normalize the cost, with 200 million spout pouches made from such alternatives in 2023.

Segmental Analysis

By Product

The spout pouch market has been heavily dominated by beverage items and constitute more than 40.5% market share as they are the most convenient form of packaging for liquid products. This is mainly attributed to their ability to allow easy pouring, reseal and portability. In 2023, the spout pouch market was dominated by the beverage sector, which consumed 1.8 billion pouches and is the largest end-user. Key primary end users in the market are manufacturers of juices, producers of sports and energy drinks, and companies producing dairy alternatives. For example, the juice segment alone consumed 800 million spout pouches during the year 2023. Sports drink companies reported packaging 300 million units in spout pouches as they are convenient for sports and fitness activities. The rise of dairy alternatives was seen in 400 million units packaged in spout pouches for customers wanting plant-based products.

The reason for this demand includes the easy-to-use spout pouches which are also comparatively cost-effective in regards to freight transportation. Spouted pouches provide a significant economic advantage as they are 60% to 70% lighter than glass or plastic bottles thus reducing freight charges. In addition, the pouch surface has marketing potential and aesthetic value which attracted marketers, with 65% of beverage brands stating increased sales after changing to spout pouch. Innovations in materials and constructions have enhanced the shelf life and robustness of pouches, as 90% of spout pouches are made of multi-layer barrier films to preserve the product inside.

By Size

Spout pouches with capacities of less than 200 ml have become increasingly prevalent revenue share of 42.4% in the spout pouch market due to their convenience, portability, and suitability for single-use applications. In 2023, there was a notable increase in uptake of spout pouch usage for a variety of food products and even beverages. The baby food sector alone consumed over 6 billion small spout pouches which are increasingly in demand because they provide infants with safe and clean food. In the same context, there was a demand for energy gels and sports drinks in under 200 ml pouches amounting to about 1.2 billion units as the global trends for fitness and health increase. The spout pouch sales in pharmaceutical industry also grew with 800 million units being utilized for oral liquid products which aimed at accurate and simplified dosage.

The primary consumers of these small size in the spout pouch market are baby food producers, manufacturers in sports nutrition, condiment producers, and pharmaceutical companies. This high demand for spout pouch of less than 200 ml include the ever growing urban population rate, which in the year 2023 surpassed 4.4 billion people living in cities, thus creating a greater demand for portable packaging solutions. At the same time, the need for portion control in order to reduce food waste was also partly responsible for creating an appetite for smaller packages. In addition, the cosmetic sector reported the use of 500 million spout pouches for samples and travel sized products indicating application in different spheres. Environmental issues have also been significant factors as in 2023, about 70% of consumers preferred packing that is recyclable, thus making it imperative for manufacturers to create spout pouches that are eco-friendly. The combination of convenience, environmental sustainability, and practicality has placed the under-200 ml spout pouches at the helm of the market.

By End Users

The food and beverage (F&B) industry accounts for an astonishing 43.1% of the spout pouch market which can be explained by the sector’s never-ending quest for optimal innovation, convenience, and sustainability in their packaging. It is easy to use, portable, can be resealed, and is ideal for the busy consumer that prefers not to waste too much product. Such foods and beverages as juices, sauces, condiments, baby food, and liquid and semi liquid dairy products and even alcohol are mainly packed by the F&B sector. Designed to preserve the product while making the product shelf attractive, spout pouches are a new solution for manufacturers seeking better brand engagement and customer retention.

At this stage, it should also be noted that the increase in demand for convenience of certain packaging options has caused an upsurge in the usage of spout pouches. For example, producers within the baby food segment reported global baby food spout pouches production of almost 10 billion units by 2023, signifying an improved taste among parents for easy and straightforward feeding alternatives. Also, the beverage sector encased over 15 billion spout pouches when packaging beverages such as juices and energy drinks, which further stresses the appeal for on-the-go and standup and reclose packaging forms.

Sustainability is also a key driver of innovation in spout pouch manufacturing across the world. According to estimates, spout pouch market has demonstrated environmental friendliness with over 500 million spout pouches being produced from biodegradable or recyclable materials in the year 2023. The rapid expansion of the e-commerce sector has only added to the convenience, with around 8 billion spout pouches of packaged food and drink being sold around the world due to their light and sturdy properties. As a result, they help in cutting shipping fees and damages aspirational goods. Emerging markets also helped in raising the number, particularly China and India, which added over 2 billion units of spout pouches in F&B industry.

By Material

Plastic spout pouches have become the cornerstone of flexible packaging solutions in 2023, dominating various end-use industries in the spout pouch market due to their versatility, durability, and cost-effectiveness. The global market has seen a significant uptick in the adoption of these pouches, especially in the food and beverage sector capturing more than 44.0% market share, where they are extensively used for packaging liquids like juices, sauces, and baby foods. One notable development is the introduction of multi-layered plastic films that enhance barrier properties, protecting contents from oxygen and moisture. The convenience offered by spout pouches, such as easy pouring and resealability, has led to increased consumer preference, propelling demand further. In Asia, the establishment of new manufacturing facilities has boosted production capacity, catering to the rising needs of emerging economies.

Key primary end-users of the plastic spout pouch market span the food and beverage industry, personal care and pharmaceuticals. For example, the health care sector which includes pharmaceutical companies has been able to use the elastic spout pouches for liquid medicine thanks to its anti-leak features and compliance to hygiene and safety regulations. Some of the determining elements for the market demand for plastic spout pouches include improvements in the packaging technology, the need to encourage lightweight packaging which lowers transport costs, and the increasing tendency towards consumption of ready to drink products which creates a need for easily portable packaging. The growing worries over the environment have triggered innovations like recyclable and bio-degradable plastics that cater for the sustainability issue among the shoppers. Moreover, initiatives that were taken by packaging businesses and retailers in 2023 that aimed to widen the market by improving customer’s eye appeal of the item and increasing the product’s shelf life, further consolidated the position of plastic spout pouches in the market.

To Understand More About this Research: Request A Free Sample

Regional Analysis

The spout pouch market in the Asia Pacific region is the largest in the world and is expected to faces strong competition in urbanization, economic growth. The region accounted for over 42.8% of revenues in the year 2023. Wherein, China, India, and Japan the biggest contributors to the regional dominance. As of 2023, China’s flexible packaged goods consumption alone is valued at 1.2 million tons within a country where spout pouches are increasingly in demand due to the growth of its manufacturing sector. India’s emerging food and beverage market projected to be at US$ 1.3 trillion by 2025 and is likely to impactful in the spout pouches market.

On the other hand, Japan in the spout pouch market has a sophisticated technology for packaged goods and it valued at US$ 7 billion in 2023. Among other factors, growing disposable income, the fast-paced modern lifestyle, and stronger presence of E-commerce, which need light weight and strong goods packaged, contribute to such strong growth. Various spout pouches constructions are increasingly being projected, in particular for sauces, beverage and baby foods due to being reusable and easy to use. Much of this industry for the region is driven by the food and beverage industry that in the year 2023 is estimated to generate revenue of over 3.23 trillion dollars.

The Asia Pacific flexible packaging market has opportunities to grow faster than markets in Europe and even North America. Economies that are developing such as Indonesia Vietnam and Thailand, they are very attractive markets. For example, Indonesia’s packaging sector is anticipated to develop to US$ 9.6 billion in 2024, because of the increase of middle class and spending on packaged goods. The food processing industry of Vietnam, which is worth US$ 43 billion in 2023, is another sector that pushes the demand for advanced packaging designs.

North America has become the second largest spout pouch market due to the increased rate of packaged food and beverages intake and as well as a preference toward easy to access, ecofriendly package designs. The United States tops the chart in this market as its packaging industry was valued at over $180 billion during the year 2023 and in this figure, the share of flexible packaging was US$34 billion. This demand can be attributed to a large population that spends roughly US$ 1.7 trillion every year on foods and drinks. Consumers from Canada also play a role in enhancing market expansion as the country’s packaging market is expected to grow to US$ 12.3 billion by the year 2024.

Top Companies in Spout Pouch Market

- Amcor Ltd.

- The DOW Chemical Company

- Mondi Group

- Berry Plastic Corporation

- Smurfit Kappa Group

- Bemis Company Inc.

- Essentra PLC

- Bischof & Klein GmbH & Co. KG

- Coating Excellence International

- HOD Packaging and enterprises Ltd.

- Printpack Inc.

- ProAmpac

- Sealed Air Corporation

- Sonoco Products Company

- Winpak Ltd.

- Glenroy Inc

- Logos Pack

- Color Flex

- Other Prominent Players

CPG Manufacturers

- Nestlé

- Procter & Gamble

- Clorox

- L'Oreal USA

- Krafts Heinz

- Tyson Foods Inc

- Kraft Foods Inc

- Unilever

- The Pepsi Bottling Group

- Other Prominent Players

Market Segmentation Overview:

By Product

- Beverages

- Syrups

- Energy Drinks

- Cleaning Solutions

- Oils

- Liquid soaps

- Baby food

- Others

By Component

- Cap

- Straw

- Film

- Others

By Pouch Size

- Less Than 200 ML

- 200 To 500 ML

- 500 To 1000 ML

- More Than 1000 ML

By Material:

- Plastic

- Aluminium

- Paper

- Others

By Closure Type

- Screw

- Flip Top

- Corner-mounted spouts

- Top-mounted spouts

- Push-up drink caps

By Design

- Flat

- Stand Up

By End user

- Food and beverages

- Cosmetics and personal Care

- Automotive

- Pharmaceutical

- Paints

- Soaps and detergents

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia & New Zealand

- ASEAN

- Rest of APAC

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

View Full Infographic

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2023 | US$ 24.24 Bn |

| Expected Revenue in 2032 | US$ 45.68 Bn |

| Historic Data | 2019-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Unit | Value (USD Bn) |

| CAGR | 7.3% |

| Segments covered | By Product, By Component, By Pouch Size, By Material, By Closure Type, By Design, By End User, By Region |

| Key Companies | Amcor Ltd., The DOW Chemical Company, Mondi Group, Berry Plastic Corporation, Smurfit Kappa Group, Bemis Company Inc., Essentra PLC, Bischof & Klein GmbH & Co. KG, Coating Excellence International, HOD Packaging and enterprises Ltd., Printpack Inc., ProAmpac, Sealed Air Corporation, Sonoco Products Company, Winpak Ltd., Glenroy Inc, Logos Pack, Color Flex, Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0122121 | Delivery: 2 to 4 Hours

| Report ID: AA0122121 | Delivery: 2 to 4 Hours

.svg)