Spices and Seasonings Market: By Type (Hot Spices, Mild Spices, Aromatic Spices, and Herbs); Seasoning Type (Salts, Pepper, Sugar and Light Flavored Sweeteners, Acids); Distribution Channel (Online and Offline); Application (Meat & poultry products, Snacks & convenience food, Soups, sauces, and dressings, Bakery & confectionery, Others); End User (Residential and Commercial); and Region—Industry Dynamics, Market Size, Opportunity and Forecast for 2026–2035

- Last Updated: 29-Dec-2025 | | Report ID: AA0922303

Market Scenario

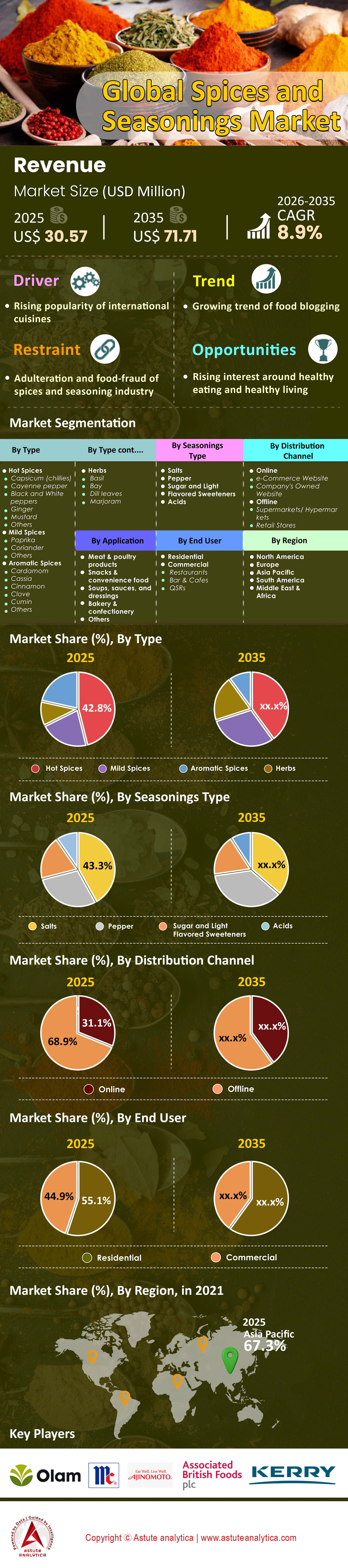

Spices and seasonings market was valued at US$ 30.57 billion in 2025 and is projected to generate a revenue of US$ 71.71 billion by 2035 at a CAGR of 8.9% during the projection period 2026–2035.

Key Findings

- Based on type, Hot spices, holding a substantial 42.8% market share in the spices and seasoning market.

- Based on seasoning, salt is emerged as the market leader. It accounts for more than 43.30% revenue share of the overall market.

- Based on application, meat and poultry is the primary consumers of the spices and seasonings around the world.

- Based on distribution channel, offline retail segment maintains a significant presence in the spices and seasonings market, capturing 68.9% of the market share.

- Asia Pacific is the dominant market leader with over 67.30% market share.

The global spices and seasonings market demonstrated robust expansion in 2024, driven by rising consumption, diversified product innovation, and strong trade performance from key exporters—primarily Vietnam and India. Vietnam led pepper exports with 250,600 metric tons valued at USD 1.31 billion, while India achieved record spice shipments worth USD 4.72 billion. This export dynamism reflects growing global demand for authentic flavor profiles and ethnic cuisines.

On the production front, capacity utilization remained high, with India and Vietnam sustaining critical output levels amid tightening inventories and price volatility. Across major commodities such as pepper, cumin, and turmeric, pricing surged by over 40% year-on-year due to constrained supplies and escalating logistics costs.

Corporate performance echoed spices and seasonings market momentum. Wherein, industry leaders like McCormick, Kerry Group, and Olam reported strong revenue and EBITDA growth, supported by product diversification and operational efficiencies. Concurrently, evolving consumer preferences for organic, blended, and digitally available spice products accelerated category growth. Looking ahead, continued expansion in e-commerce distribution, health-driven consumption patterns, and supply chain modernization are expected to push the global market valuation beyond USD 25 billion by 2028, reaffirming its long-term growth trajectory.

To Get more Insights, Request A Free Sample

Which 5 Spices Rule the Global Palate?

While the world’s flavor library is vast, five distinct spices have cemented their status as the heavyweights of global consumption in 2025. Black Pepper, often hailed as the "King of Spices," continues to dominate, accounting for approximately 38% of the global spice trade volume. Its ubiquity in industrial food processing and households alike makes it indispensable. Following closely are Chilies (Capsicum), driven by an exploding demand for "heat" in Western snacks and Asian cuisines; the global trade for dry chilies alone surpassed USD 1.5 billion in value this year in the spices and seasonings market.

Cumin secures the third spot, largely due to its essential role in Middle Eastern, Indian, and increasingly, Latin American dishes. Turmeric ranks fourth but is the fastest grower in terms of value, riding a wave of "functional wellness" applications; global transaction prices for turmeric recently hovered around USD 1.92 per kilogram due to its anti-inflammatory reputation. Finally, Ginger has seen an 18% surge in organic export volumes, fueled by the beverage and pharmaceutical sectors. Together, these five powerhouses dictate the rhythm of global trade flows within the spices and seasonings market.

Who Controls the 14-Million-Ton Production Engine?

The sheer scale of the spices and seasonings market is staggering. As of late 2025, total global spice production is estimated to have reached 13.8 million metric tons, inching closer to the forecast of 14.3 million metric tons by 2028. This production engine is not evenly distributed; it is heavily consolidated within a few key geographies. India remains the undisputed titan, contributing nearly 44% of the world's total output, with a domestic production estimated at 6.2 million metric tons for the 2025 fiscal cycle.

Behind India, China holds the second position, particularly dominating the garlic and ginger segments with an output exceeding 1 million metric tons. Vietnam remains the strategic hub for pepper, having exported 250,600 metric tons in 2024. Meanwhile, nations like Indonesia and Brazil are critical players for cloves and pepper, respectively. However, climate volatility has impacted yields; for instance, Madagascar, the primary source of vanilla, faced severe weather shocks that disrupted supply chains, reinforcing the market's fragility.

Which Industry Giants Dominate the Competitive Landscape?

The competitive tier of the spices and seasonings market is highly concentrated, with four behemoths orchestrating global flavor trends. McCormick & Company retains its crown as the market leader, having generated net sales of USD 6.6 billion in 2024. Their dominance is fueled by a dual strategy of retail brand strength and industrial flavor solutions.

Following them is the Kerry Group, a powerhouse in taste and nutrition, which reported revenue of EUR 8.0 billion (approx. USD 8.7 billion), leveraging deep R&D to capture the foodservice sector. The third pivotal player is Ajinomoto Co., Inc., which commands the Asian market and the global umami/flavor enhancer segment. Finally, Olam Group (specifically its 'ofi' division) serves as the backbone of the supply chain. With an operating profit (EBIT) of SGD 1.07 billion, Olam’s control over the raw material source—from farm gate to factory—gives it unmatched leverage in pricing and logistics.

How Are Trade Wars and Tariffs Reshaping Supply Chains in 2025?

The year 2025 has been defined by unprecedented trade turbulence within the spices and seasonings market. The implementation of new tariff regimes by the U.S. administration in August 2025 sent shockwaves through the industry. A 10% baseline tariff on general imports, coupled with targeted duties of up to 50% on nations without bilateral agreements, has fundamentally altered cost structures. Specifically, Vietnamese spices faced a 46% tariff, while retaliatory measures saw duties on Chinese garlic and paprika skyrocket to 145%.

These policies have forced a rapid diversification of supply chains. U.S. importers, who brought in over USD 466 million in specific spice categories last year, are scrambling to pivot sourcing towards India and Brazil to mitigate costs. Consequently, freight dynamics have tightened; shipping a container from Vietnam to the U.S. West Coast now costs approximately USD 3,700, squeezing margins for distributors. This geopolitical friction is arguably the single most significant disruptor in the current spices and seasonings market trajectory.

Who Drives the Demand? Identifying the Power Users

Demand for spices in the global spices and seasonings market is trichotomous, split between Food Processing, Food Service, and Retail. The Food Service sector (HoReCa) is currently the largest volume driver, accounting for approximately 59.9% of market revenue. This is fueled by the post-pandemic resurgence of dining out and the rapid expansion of quick-service restaurants (QSRs) experimenting with global flavors like Peri-Peri and Chipotle.

In parallel, the Food Processing industry utilizes massive quantities of oleoresins and ground spices for ready-to-eat meals, snacks, and sauces. However, the Retail segment is witnessing the most qualitative shift. With home cooking remaining sticky post-2024, consumers are purchasing premium, single-origin spices; online spice sales in major markets grew by 25% this year, indicating a willingness to pay for quality and authenticity over generic blends.

What Future Trends and Innovations Are Steering Growth?

The future of the spices and seasonings market is being written by technology and wellness. AI-driven flavor profiling is a breakthrough development, with companies investing millions to predict the next viral flavor combination before it hits the shelves. Furthermore, the "Health-as-Flavor" trend is unstoppable. Spices are no longer just tastemakers; they are functional supplements. Products like turmeric lattes and ginger-infused immunity shots have driven a 20% volume increase in turmeric imports to the West.

Sustainability is another frontier. With the European Union enforcing stricter residue limits, the market is pivoting towards Organic and IPM (Integrated Pest Management) spices. Global organic spice imports grew by 15% in 2024, and initiatives like India's SPICED scheme—aimed at boosting export capacity through modernized infrastructure—are setting new benchmarks for quality compliance.

What Barriers Threaten the Spice Trade's Momentum?

Despite the optimism, the spices and seasonings market faces formidable headwinds. Climate Change is the primary existential threat; unseasonal rains in India and droughts in Brazil have caused yield fluctuations of 30-35% for crops like cumin and paprika, leading to price spikes. Additionally, the adulteration crisis remains a reputational risk, prompting buyers to demand blockchain-enabled traceability.

Finally, the Tariff War of 2025 has introduced a layer of financial unpredictability. Small-scale exporters in Vietnam and China are facing existential crises due to the prohibitive duties, potentially leading to a consolidation where only large players with diversified sourcing networks survive. Stakeholders must navigate these turbulent waters with agility, as the era of cheap, stable spice supplies appears to be drawing to a close.

Segmental Analysis

By Spice Type, Surging Global Appetite For Pungency Drives Record Exports and Production Volumes

The global demand for pungent flavors continues to redefine trade dynamics in the spices and seasonings market, with hot spices commanding a dominant 42.8% share. Heat has become a universal descriptor of modern culinary experiences, stimulating record exports from leading producers such as India and Vietnam. India exported over 715,000 metric tons of dry chili in FY 2024–25, marking a powerful response to escalating global consumption. Meanwhile, the United States imported nearly 72,000 metric tons of pepper from Vietnam in 2024 to satisfy its growing base of consumers seeking bold, fiery flavors. Vietnam, anticipating this exceptional demand, plans to produce around 170,000 metric tons of black pepper in 2025, signaling sustained production acceleration. The early months of 2025 alone recorded 27,416 tons of black pepper exports from Vietnam, proving that market appetite for pungency shows no sign of saturation. The heat-driven trade flow not only sustains export-led revenues but also reinforces the cultural ubiquity of spiciness in global cuisine.

Beyond simple pungency, escalating interest in natural flavoring and coloring ingredients is shaping future industrial sourcing across the global spices and seasonings market. Paprika, with an annual trade volume near 150,000 metric tons in 2024, has emerged as a multi-utility spice for both taste and visual enhancement. China leads this space with export revenues surpassing USD 671 million, while Europe, especially Spain, remains a major supplier with 25,000 metric tons exported. The dedicated paprika market is now valued at USD 588.2 million, underscoring its importance to food manufacturing and health-oriented product formulations. India’s success mirrors this momentum—its red chili exports touched a record USD 1.5 billion in 2024, while cumin shipments crossed 160,000 metric tons, illustrating sustained export resilience. Altogether, pungent spices remain the economic and sensory backbone of the advancing global seasonings trade.

By Seasoning, Essential Industrial and Culinary Reliance Secures Salt Position As Market Leader

As a cornerstone of flavor formulation and food preservation, salt continues to dominate the global spices and seasonings market, capturing over 43.3% of total revenue share. Its primacy extends beyond taste to biological necessity and production scalability across industries. China leads the global landscape with an output exceeding 53 million metric tons in 2024, consolidating its position as a critical global supplier. The United States, with a domestic production volume of 42 million metric tons, remains a major consumer, importing roughly 11 million tons to bridge its structural supply gap. Total U.S. consumption across industrial and edible categories reached 47 million metric tons, underpinning salt’s indispensable role in food systems. Within the spice industry, salt acts as both a flavor enhancer and a base for blended seasonings, securing its position as the backbone ingredient in the seasoning production value chain.

Simultaneously, the rise of health awareness and gourmet dining has driven notable diversification within the salt category. Himalayan pink salt, recognized for its mineral content and premium aesthetic, is gaining traction worldwide. Pakistan shipped over 4,997 export consignments in the past 12 months, while exports to China alone reached USD 6.04 million by October 2025. Industrial consumption in China totaled 23.94 million kilograms of imported Pakistani pink salt during early 2025, underlining both functional and aesthetic demand. In Western markets, the U.S. imported salt worth USD 442 million in the first three quarters of 2024, including USD 300 million worth of rock salt for industrial and deicing applications. India also sustains strong production fundamentals with more than 26 million metric tons annually. Collectively, these figures underscore how salt’s ubiquity and adaptability underpin the stability and scalability of the spices and seasonings market.

By Application, Expanding Protein Consumption Necessitates Massive Volumes Of Flavoring and Preservatives

Meat and poultry applications remain the largest consumers of spices and seasonings, driven by increasing protein consumption across both emerging and developed markets. Global poultry meat production is projected to reach 151.4 million metric tons in 2025, amplifying demand for marinades, rubs, and curing spices. The United States alone expects to produce 47.69 billion pounds of broiler meat, requiring vast inputs of pepper, garlic, and spice blends. In parallel, China consumed 29.26 million metric tons of poultry in 2024, constituting a massive integrated market for flavoring agents. With per capita global poultry consumption estimated at 6.1 kilograms in 2025, industrial seasoning use is forecast to climb proportionally. Such dependence on spices underscores their dual functional role—preserving freshness and enhancing sensory appeal. This expanding need securely positions the spices and seasonings market as a critical support segment to global protein processing.

On the manufacturing side, meat processors and ingredient manufacturers are increasingly sourcing functional extracts to enhance product quality and efficiency. For instance, the industry used over 18,000 metric tons of paprika oleoresin in 2024 as a coloring and flavoring agent for processed meats. Poultry feed producers added an estimated 6,000 metric tons of paprika-based additives during 2023–2024 to improve pigmentation and market appeal. The U.S. continued strong domestic poultry consumption at 20.18 million metric tons in 2024, while Vietnam’s smaller but fast-growing sector reached 1.8 million metric tons. The export value of specialized meat seasoning blends surpassed USD 200 million to Asia’s processing hubs, reiterating the region’s expanding production ecosystem. With global meat exports rebounding to 40.2 million metric tons in 2024, seasoning manufacturers find themselves embedded across every point of the protein value chain, ensuring flavor consistency, safety, and regional taste alignment.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

By Distribution, Extensive Physical Store Networks Remain the Preferred Channel For Sensory Purchasing

Despite rapid digitalization, the offline retail segment maintains a commanding 68.9% market share in global spices and seasonings market, reflecting consumers’ preference for tangible sensory experiences. Spice purchases are inherently visual and olfactory, as buyers often evaluate color, coarseness, and aroma before purchase. Retail conglomerates like Walmart, operating more than 10,500 outlets globally in 2025, offer unmatched accessibility to both premium and budget spice ranges. Similarly, Costco, with 890 warehouse outlets worldwide by late 2024, caters to bulk buyers and small restaurants. Grocery retailer Kroger, with nearly 2,800 stores, reinforces household-level demand, while McCormick’s extensive network across 150 countries demonstrates the continued importance of brick-and-mortar retail partnerships. These extensive store networks shape purchase behavior by providing consumers physical product validation and brand familiarity.

Expansion initiatives across retail chains further confirm the offline channel’s resilience and reach. Aldi announced expansion plans to open 800 new U.S. stores by 2028, improving affordability and spice accessibility. Sprouts Farmers Market launched 35 new locations in 2024 to serve health-conscious consumers with organic blends, while Ollie’s Bargain Outlet added 47 stores to attract budget-driven shoppers. Ethnic supermarkets such as Patel Brothers (over 50 stores) and H Mart (over 90 U.S. stores) continue bridging cultural preferences with geographic accessibility. Meanwhile, Trader Joe’s sells exclusive private-label seasonings through 540+ stores, enhancing brand variety and in-store engagement. The consistency of this physical distribution model highlights the enduring consumer inclination toward tactile purchasing experiences. Consequently, the spices and seasonings market remains anchored in physical retail networks that drive brand loyalty, volume sales, and market visibility even amid growing online competition.

To Understand More About this Research: Request A Free Sample

Regional Analysis

Asia Pacific Controls Global Supply Through Massive Production and Consumption Volumes

Asia Pacific commands a staggering 67.30% market share in spices and seasonings market, a dominance rooted in its dual role as the world's primary producer and consumer. This hegemony is driven by India, the unrivaled production engine, which exported a record 1.8 million metric tons of spices this fiscal year while simultaneously consuming 4.7 million metric tons domestically. This internal demand ensures the region remains self-sustaining even during global trade disruptions.

Vietnam complements this by anchoring the global pepper trade, generating USD 1.318 billion in export revenue in 2024 alone. Furthermore, China solidifies the region's grip on the supply chain, having exported 918,000 metric tons of garlic and ginger to stabilize global stock levels. Ultimately, Asia Pacific dictates the market trajectory because it controls the raw material source at the farm gate.

North America Drives Value Through Processed Foods and High Import Dependency in Spices and Seasonings Market

Shifting focus to the West, North America stands as the second-largest powerhouse, driven not by agricultural acreage but by high-value industrial processing and convenience trends. The U.S. market for seasoning blends alone swelled to USD 5.49 billion in 2025, fueled by a massive 373% surge in consumer demand for spicy barbecue profiles and hot sauces. Because local production is limited, the region relies heavily on imports, bringing in 150,000 metric tons of black pepper this year to feed its industrial grinders. The import value for specific spice categories topped USD 466 million, reflecting a willingness to pay premium logistics costs to satisfy the convenience food sector. This region transforms raw imports into high-margin CPG products, creating immense economic value.

Europe Prioritizes Premium Quality and Organic Certification in Spices and Seasonings

Europe maintains the third position in the global spices and seasonings market by prioritizing premiumization, sustainability, and strict regulatory compliance over sheer volume. The region imported approximately 780,000 metric tons of spices and herbs, with Germany acting as the central processing hub, absorbing 14,580 metric tons of Vietnamese pepper alone. The defining characteristic here is the demand for purity and "clean label" ingredients; European markets drove a 15% increase in global organic spice volumes throughout 2024. Consequently, buyers in this region accept higher price points, with white pepper prices averaging USD 6,884 per metric ton to meet stringent EU safety standards. Europe’s influence lies in setting the global benchmark for quality assurance and traceability.

Recent Developments in Spices and Seasonings Market

Top 5 Recent Company Developments in Spices & Seasonings (2025)

- McCormick® 2025 Flavor of the Year: Announced January 28, 2025, selecting Aji Amarillo—a fruity Peruvian pepper—for its limited-edition seasoning blend, ideal for seafood, poultry, and sauces.

- McCormick Gourmet Redesign: Launched November 5, 2025, with premium herb and spice packaging upgrades to elevate positioning in the spices and seasonings market and drive 2026 growth.

- Kerry Group's 2025 Global Taste Charts: Released January 15, 2025, forecasting trends like Sichuan spices in Europe, Indian masalas in snacks, and yuzu in beverages.

- Droosh™ New Hot Sauces & Packaging: Unveiled January 6, 2025, featuring Jalapeno Green Chutney, Sweet & Sour Mango Chutney, and redesigned spice blends for authentic Indian flavors.

- Pansuola Low-Sodium Spice Blends: Introduced October 15, 2025, by Oriola with AromaPansuola and GrilliPansuola—mineral-rich options with 50% less sodium than regular salt.

Top Companies in the Spices and Seasonings Market:

- McCormick & Company, Inc. (US)

- Olam International (Singapore)

- Ajinomoto Co. Inc. (Japan)

- Associated British Foods plc (UK)

- Kerry Group plc (Ireland)

- Sensient Technologies Corporation (US)

- Döhler Group (Germany)

- SHS Group (Ireland)

- Worlée Gruppe (Germany)

- Watkins Incorporated (U.S)

- Ariake Japan Co. Ltd (Japan)

- MDH (India)

- Other Prominent Players

Market Segmentation Overview:

By Type

- Hot Spices

- Capsicum (chillies)

- Cayenne pepper

- Black and White peppers

- Ginger

- Mustard

- Others

- Mild spices

- Paprika

- Coriander

- Others

- Aromatic spices

- Cardamom

- Cassia

- Cinnamon

- Clove

- Cumin

- Others

- Herbs

- Basil

- Bay

- Dill leaves

- Marjoram

- Tarragon

- Others

By Seasoning Type

- Salts

- Pepper

- Sugar and Light Flavored Sweeteners

- Acids

By End User

- Residential

- Commercial

- Restaurants

- Bar & Cafes

- QSRs

By Distribution Channel

- Online

- e-Commerce Website

- Company's Owned Website

- Offline

- Supermarkets/Hypermarkets

- Retail Stores

By Application

- Meat & poultry products

- Snacks & convenience food

- Soups, sauces, and dressings

- Bakery & confectionery

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia & New Zealand

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Brazil

- Argentina

- Rest of South America

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2025 | US$ 30.57 Bn |

| Expected Revenue in 2035 | US$ 71.71 Bn |

| Historic Data | 2020-2024 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Unit | Value (USD Bn) |

| CAGR | 8.9% |

| Segments covered | By Type, By Seasoning Type, By End-User, By Distribution Channel, By Application, By Region |

| Key Companies | McCormick & Company, Inc. (US), Olam International (Singapore), Ajinomoto Co. Inc. (Japan), Associated British Foods plc (UK), Kerry Group plc (Ireland), Sensient Technologies Corporation (US), Döhler Group (Germany), SHS Group (Ireland), Worlée Gruppe (Germany), Watkins Incorporated (U.S), Ariake Japan Co. Ltd (Japan), MDH (India), Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

FREQUENTLY ASKED QUESTIONS

Global spices and seasonings market was valued at US$ 30.57 billion in 2025 and is projected to generate a revenue of US$ 71.71 billion by 2035 at a CAGR of 8.9% during the projection period 2026–2035.

The heavyweights of the global palate are Black Pepper, which accounts for roughly 38% of trade volume; Chillies, with a trade value surpassing USD 1.5 billion; Cumin, essential in Middle Eastern and Indian cuisines; Turmeric, the fastest grower in value due to wellness trends; and Ginger, which saw an 18% surge in organic export volumes in 2025.

India is the undisputed leader, contributing nearly 44% of global output with a domestic production of 6.2 million metric tons. China ranks second, dominating garlic and ginger production. Vietnam remains the strategic hub for pepper exports, while Indonesia (cloves) and Brazil (pepper) serve as critical players in the 14-million-ton global production engine.

The implementation of new U.S. tariffs in August 2025 has significantly disrupted supply chains. A general 10% baseline tariff, alongside specific duties of 46% on Vietnamese spices and retaliatory duties of up to 145% on Chinese garlic and paprika, has forced importers to pivot sourcing toward India and Brazil. Additionally, freight costs have spiked, with shipping rates from Vietnam to the U.S. reaching approximately USD 3,700 per container.

The market is concentrated around four major entities: McCormick & Company, the market leader with USD 6.6 billion in net sales; Kerry Group, a powerhouse in taste and R&D; Ajinomoto Co., Inc., which commands the flavor enhancer segment; and Olam Group (ofi), which serves as the backbone of the global supply chain from farm gate to factory.

Asia Pacific controls a staggering 67.30% market share as of 2025. This dominance is attributed to the region being both the world's primary producer (led by India and Vietnam) and a massive consumer base. North America follows as the second-largest power, driven by high-value industrial processing and a heavy reliance on imports to satisfy demand for convenience foods.

The spices and seasonings market faces three primary headwinds: Climate Change, which has caused yield fluctuations of 30-35% for crops like cumin and paprika due to unseasonal weather; Adulteration, which creates reputational risks and drives demand for traceability; and Geopolitical friction, specifically trade tariffs that are altering cost structures and forcing the consolidation of smaller exporters.

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)