Spain Gambling Market: By Type (Sports (Fixed Odds Sports Betting, Pari-Mutuel Betting (Horse and Dog racing), In-Play/Live Betting, Exchange Betting, Spread Betting, Others), Casino (Blackjack, Baccarat, Teen Patti, Three Card Poker, Four card poker, Red Dog, Others), Lottery Games (Scratch-offs, Bingo, Keno), Electronic Gaming Machines and Others); Channel Type (Offline (Casinos, Betting shops/halls, Arcades, Bookmakers), Online, Virtual Game); Payment Method (Credit and debit cards, E-wallets, Prepaid cards and Vouchers, Bank Transfers, Cryptocurrencies, Others); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: Mar-2025 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA03251257 | Delivery: Immediate Access

| Report ID: AA03251257 | Delivery: Immediate Access

Market Scenario

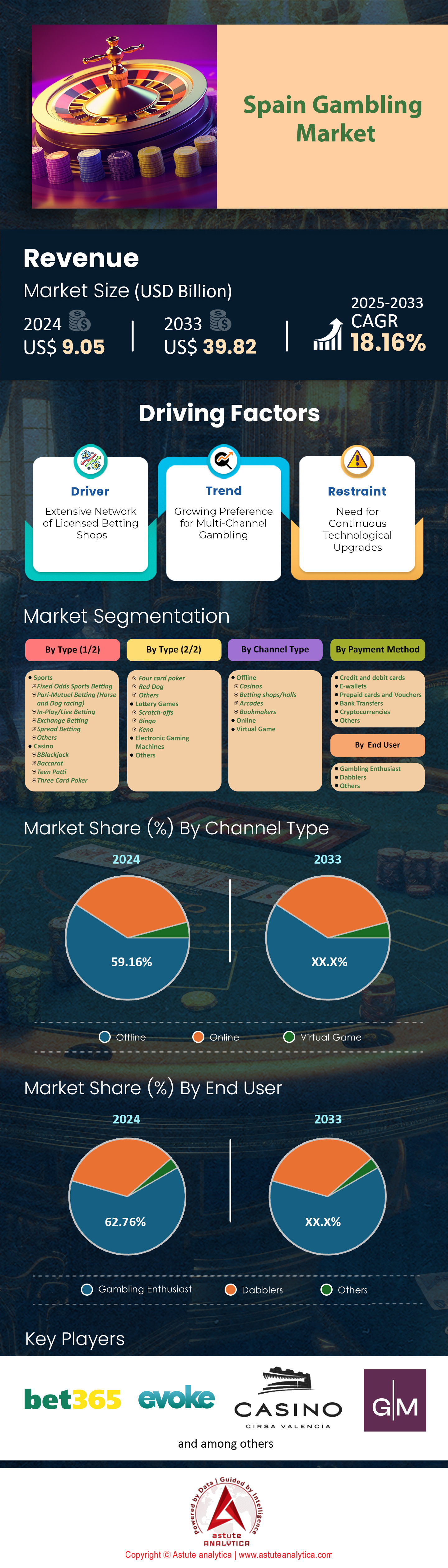

Spain gambling market was valued at US$ 9.05 billion in 2024 and is projected to hit the market valuation of US$ 39.82 billion by 2033 at a CAGR of 18.16% during the forecast period 2025–2033.

Spain’s gambling industry reached unprecedented levels in 2024, with the online sector at the forefront. Gross gaming revenue (GGR) climbed to €1.45 billion, up 17.6% from 2023, according to the Dirección General de Ordenación del Juego (DGOJ) (DGOJ, 2024 Annual Report). This growth was propelled by a 19.6% increase in player deposits (€4.58 billion) and a 19.7% rise in withdrawals (€3.15 billion) (DGOJ, 2024). Online casino games, especially slots, led with €730.7 million in revenue—a 17% jump—while sports betting contributed €491.8 million (Gambling Insider, 2024). For players and operators, this paints a picture of a vibrant, cash-rich market where variety and accessibility are key.

What’s fueling this surge? Regulatory openness and payment advancements are the backbone of the Spain’s gambling market growth. Spain permits credit and debit cards for gambling—unlike the UK’s ban—driving over 53% of online transactions (Statista, 2024). Visa, with a 57% market share, and Mastercard dominate, backed by 46 million cards in circulation (DGOJ, 2024). Debit cards appeal to budget-conscious players, while credit cards suit risk-takers, supporting a market where active accounts spiked 26% to 3.8 million (Gambling Insider, 2024). Digital wallets like PayPal (30% share) and Bizum are rising, but cards hold firm. Enhanced biometric security since 2023 further ensures trust and ease, keeping players active and operators thriving. For those betting on Spain, these payment trends are critical to watch.

Growth aside, hurdles remain in the gambling market. Marketing costs ballooned 30.4% to €526.3 million, with bonuses hitting €261.5 million, underscoring fierce competition among 77 licensed operators (DGOJ, 2024). New regulations, like the 2025 €25,000+ transaction reporting rule, may deter high rollers, while €69 million in fines in 2024 hint at stricter enforcement (Gambling Insider, 2024). Still, with a projected CAGR of 10.9% through 2030, Spain’s gambling market—led by casino games (50.5% of GGR) and sports betting (39.8%)—is unstoppable.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Extensive Network of Licensed Betting Shops

The proliferation of betting shops across Spain's gambling market represents a crucial driver of market growth, with the network expanding significantly since 2008. The country's three largest operators - Sportium, Codere, and Luckia - collectively manage nearly 4,000 betting establishments nationwide, demonstrating the robust physical presence of gambling venues. In Madrid alone, the number of betting shops has grown from 184 in 2014 to 416 in 2023, reflecting a substantial 126% increase in just nine years. The average betting shop generates approximately €25,000 in weekly revenue, with peak periods during major sporting events driving up to 40% higher turnover.

The strategic distribution of these venues is carefully planned, with operators investing an average of €300,000 per location to ensure optimal market coverage. Many establishments feature between 50-100 dedicated machines, creating comprehensive gaming environments that cater to diverse consumer preferences. The network's effectiveness in the gambling market is further evidenced by the high foot traffic, with popular locations serving around 2,000 customers during peak weekend periods. Regional regulations, such as Madrid's cap on annual growth at 1%, help maintain market stability while ensuring sustainable expansion. This extensive network has created over 15,000 direct employment opportunities across Spain, contributing significantly to local economies while maintaining strong community presence.

Trend: Growing Preference for Multi-Channel Gambling

The integration of offline and online gambling platforms in the gambling market has emerged as a dominant trend in Spain's gambling landscape, with 76.67% of sports betting participants now engaging through both internet and mobile apps alongside traditional venues. This multi-channel approach has driven a fivefold increase in total betting volume, from 460 million euros in 2013 to 2.1 billion euros in 2023. The average multi-channel gambler spends 30% more than single-channel users, with typical monthly expenditure reaching €180 across all platforms. Digital platforms process over 25 million daily transactions, highlighting the scale of integrated operations.

The trend is further supported by technological investments, with operators allocating significant resources to create seamless experiences across channels. Leading venues in the gambling market report that 65% of their regular customers now use both physical and digital services, spending an average of 45 minutes per online session while maintaining regular visits to physical locations. The adoption of unified loyalty programs has resulted in a 40% increase in customer retention rates, with members typically engaging with gambling services 3.5 times per week across various channels. This integration has also led to the development of hybrid events, where physical tournaments attract up to 150 participants while simultaneously engaging online audiences of over 1,000 viewers.

Challenge: Need for Continuous Technological Upgrades

The imperative for constant technological advancement presents a significant challenge for Spain's gambling market operators, particularly in terms of infrastructure costs and implementation complexities. The industry faces substantial upgrade expenses, with venues investing an average of €500,000 annually in technological improvements to remain competitive. Legacy system integration issues affect approximately 60% of established venues, resulting in an average of 72 hours of operational downtime during major upgrades. Training requirements for new systems typically demand 40 hours per employee, with larger venues employing up to 50 staff members needing regular technical training.

The challenge is compounded by cybersecurity requirements and regulatory compliance needs, with operators spending approximately 15% of their annual technology budget on security measures alone. Implementation of new systems requires extensive testing periods, averaging 3-4 months before full deployment, during which venues operate at reduced capacity. The gambling market faces a significant skills gap, with 70% of venues reporting difficulties in recruiting qualified technical staff, leading to increased reliance on external consultants at an average cost of €8,000 per month. These technological demands are particularly challenging for smaller operators, who must balance the need for modernization with financial constraints while maintaining competitive service levels. The rapid pace of technological change means that major systems typically require replacement or significant upgrades every 2-3 years, creating a continuous cycle of investment and implementation challenges.

Segmental Analysis

By Type

The Spanish gambling market landscape sees casinos as a leading force with over 45.53% market share, primarily due to their variety of gaming options, lavish venues, and strong cultural acceptance. According to recent industry data, there are 72 licensed casinos operating across the country, with 28 located in and around Madrid. In these establishments, the average daily footfall per venue stands at 1,200 visitors, highlighting appetite for in-person gambling experiences. Many casinos feature expansive gaming floors exceeding 2,000 square meters, which accommodate a mix of slot machines, poker tables, and roulette wheels. One prominent property in Catalonia reportedly hosts over 320 slot machines and 35 table games under one roof, reflecting the industry’s commitment to comprehensive entertainment offerings. These large-scale venues include upscale dining and live performances. Such multi-faceted environments foster prolonged stays, enabling operators to capture higher revenue from food, beverages, and ancillary services. Select operators also invest in modern digital solutions for membership programs.

Casinos maintain dominance in Spain gambling market through strategic clustering in bustling urban hubs, which helps them attract both local and international clientele. Over half of the 72 casinos are concentrated in five major cities, ensuring easy accessibility and a robust supply of gaming alternatives. Many patrons cite immersive atmospheres, loyalty programs, and upscale amenities as pivotal factors that encourage repeat visits. Spain’s established regulatory framework also fosters confidence among visitors, who appreciate transparent licensing requirements and standardized operating practices. In particular, a regulated limit of 20 operating tables per establishment helps manage gambling intensity, ensuring fairness and controlled engagement. To sustain interest, some operators focus on promotional events and thematic nights, which can draw 700 additional patrons on peak days. The average visitor spends €130 on gaming and related services, reflecting notable consumer spending power. Overall, the country’s commitment to responsible gambling and investor-friendly policies continues significantly to bolster casino growth.

By Channel

Offline gambling in Spain gambling market thrives on a well-established network of retail outlets, dedicated betting shops, and traditional gaming halls. It currently holds over 59.16% market share. Current figures show more than 5,500 authorized betting shops nationwide, each catering to local preferences with regional sports wagers. Many operators invest upwards of €300,000 per venue to incorporate digital enhancements, such as electronic bingo terminals, without losing the character of face-to-face interaction. This personal touch resonates with many Spaniards, who often view gambling as a social pastime rather than mere recreation. On an average weekend, a single land-based facility can serve around 2,000 customers, underscoring the sustained popularity of in-person experiences. Additionally, certain operators organize weekly raffle events that attract at least 400 extra participants significantly, bolstering foot traffic. While online platforms offer convenience, the offline channel remains critical for players seeking communal excitement. By blending tradition with continuous innovation, brick-and-mortar establishments maintain a distinct appeal in Spain’s gambling market.

The dominance of offline gambling also stems from longstanding relationships between operators and local communities, which bolster trust in physical venues. Numerous provincial governments in the gambling market issue individual licenses for each betting shop, resulting in over 7,000 active permits across regions. This licensing approach fosters direct oversight of gambling activities, establishing well-defined guidelines on opening hours, machine allocation, and consumer protection. Many bingo halls operate with up to 50 dedicated machines, while larger facilities may exceed 100 units for added variety. To remain competitive amid the rise of online platforms, some land-based operators partner with tech firms to integrate real-time sports data into on-site displays for immersive betting experiences. Industry surveys reveal that six out of ten players prefer offline attendance for social engagement, although certain communities show growing interest in hybrid models that link physical play with digital rewards. Overall, the offline channel’s deep local roots and responsive adaptation reinforce its enduring prominence.

By Payment Method

Credit and debit cards with over 43.27% market share remain a most favored payment option in Spain’s gambling market, driven by a solid banking infrastructure and widespread card issuance. Recent financial data indicates over 90 million active payment cards in circulation nationwide, reflecting a robust penetration among adults with bank accounts. On a typical weekday, banks process nearly 25 million card transactions, including online gaming fees and in-person deposits at land-based venues. Many gambling operators collaborate with major issuers such as Visa and Mastercard, streamlining account verification through digital tools. The average transaction value for card-based payments in casinos hovers around €60, suggesting moderate yet consistent spending habits. Certain operators also advertise reward points for every euro spent, increasing the appeal of using cards over alternative methods. With more than 2,300 bank branches offering card renewal and inquiry services, Spain’s financial ecosystem ensures high accessibility, reducing barriers for both domestic and international patrons and secure payments.

This card-centric culture partially stems from the introduction of contactless technology over a decade ago, which significantly hastened checkout times in the gambling market. Several Spanish gambling venues have shortened transaction durations to under six seconds, thanks to near-field communication (NFC) terminals. For instance, a popular Madrid sportsbook logs approximately 8,000 card payments on peak match days, reinforcing the system’s high processing capacity. Additionally, many casinos have begun accepting multi-currency cards to serve international guests who prefer immediate settlement without currency exchange hassles. Cardholders benefit from comprehensive fraud protection measures enforced by local financial authorities, including pin authentication for larger sums and real-time mobile alerts. Regulatory bodies also mandate regular audits on payment gateways to enforce responsible gambling protocols, such as auto-limits on daily deposits. These measures improve transparency, maintain consumer trust, and keep card transactions at the forefront of Spain’s gambling ecosystem, even in the face of emerging digital wallets and e-banking solutions.

By End Users

Dedicated gambling enthusiasts account for a 62.76% share of Spain’s gambling market revenue, often returning to the same venues multiple times per month. Surveys indicate that around three million Spaniards identify as frequent players, engaging in casino or sportsbook activities at least once per week. One leading Madrid casino reports that its loyalty program has enrolled over 25,000 active members, many of whom visit more than ten times per quarter. Some of these committed patrons can spend as much as €250 on a single visit, allocating funds to table games, slot machines, and dining. To cater to this repeat clientele, operators invest in exclusive promotions, tournaments, and events, including blackjack competitions that can attract up to 150 participants in a single night. This heightened engagement not only provides a stable revenue base but also significantly encourages operators to continually upgrade facilities, thereby improving overall visitor experiences in the Spanish gambling ecosystem.

Tourism further amplifies the influence of gambling enthusiasts, as Spain gambling market welcomes millions of visitors each year who often incorporate gaming into their travel itineraries. In Barcelona alone, certain resorts observe an influx of up to 1,500 foreign players daily during peak tourist seasons, heightening demand for tailored services. Some venues respond by offering multilingual dealers and currency exchange counters that handle an average of 200 transactions per day. Collaboration with travel agencies and hospitality brands has led to gambling-themed packages, where curated experiences include allocated betting credits, guided tours, and VIP seating at major sporting events. According to local estimates, a tourist gambler may spend an additional €100 beyond lodging and meals when engaging in casino activities. By blending leisure, entertainment, and cultural appeal, Spain effectively caters to both domestic aficionados and overseas thrill-seekers. As a result, gambling operators continue refining offerings to attract this high-value segment of the market.

To Understand More About this Research: Request A Free Sample

Top Players in Spain Gambling Market

- Bet365

- Evoke plc

- Casino Gran Madrid Torrelodones

- Casino Cirsa Valencia

- Codere Online

- SELAE

- Other Prominent Players

Market Segmentation Overview

By Type

- Sports

- Fixed Odds Sports Betting

- Pari-Mutuel Betting (Horse and Dog racing)

- In-Play/Live Betting

- Exchange Betting

- Spread Betting

- Others

- Casino

- Blackjack

- Baccarat

- Teen Patti

- Three Card Poker

- Four card poker

- Red Dog

- Others

- Lottery Games

- Scratch-offs

- Bingo

- Keno

- Electronic Gaming Machines

- Others

By Channel Type

- Offline

- Casinos

- Betting shops/halls

- Arcades

- Bookmakers

- Online

- Virtual Game

By Payment Method

- Credit and debit cards

- E-wallets

- Prepaid cards and Vouchers

- Bank Transfers

- Cryptocurrencies

- Others

By End User

- Gambling Enthusiast

- Dabblers

- Others

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA03251257 | Delivery: Immediate Access

| Report ID: AA03251257 | Delivery: Immediate Access

.svg)