Southeast Asia Digital Advertising Market: By Platform (Mobile Ad, In-App, Mobile Web, Desktop Ad, Digital Tv, And Others); Ad Format (Digital Display Ad, Programmatic Transactions, Non-Programmatic Transactions, Internet Paid Search, Social Media, Online Video, And Others); End User (Media And Entertainment, Consumer Goods & Retail Industry, Banking, Financial Service & Insurance, Telecommunication IT Sector, Travel Industry, Healthcare Sector, Manufacturing & Supply Chain, Transportation And Logistics, Energy, Power, And Utilities, Other Industries); Country—Market Size, Industry Dynamics, Opportunity Analysis And Forecast For 2024–2032

- Last Updated: Apr-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0424808 | Delivery: 2 to 4 Hours

| Report ID: AA0424808 | Delivery: 2 to 4 Hours

Market Scenario

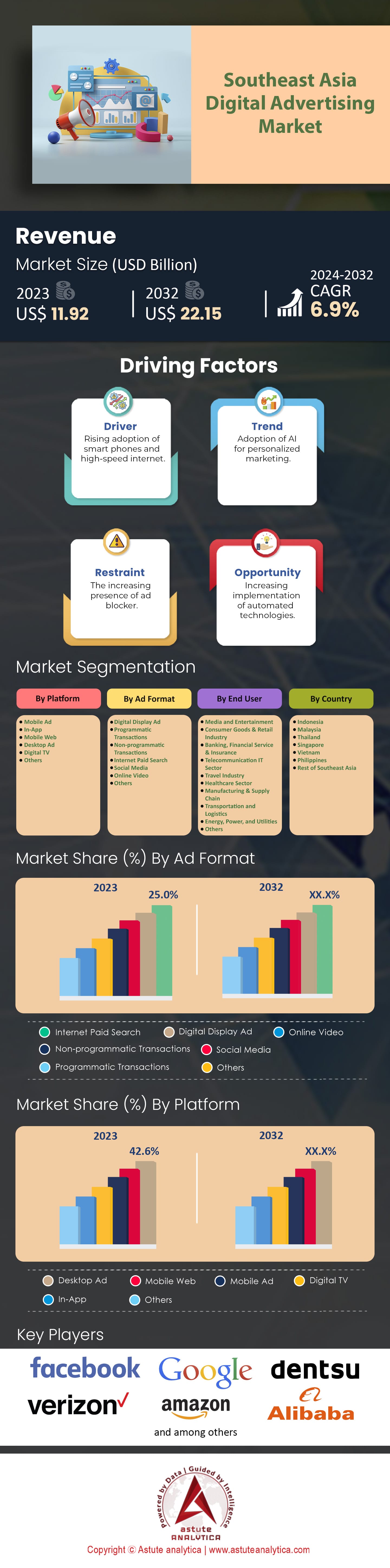

Southeast Asia Digital Advertising Market was valued at US$ 11.92 Billion in 2023 and is projected to hit the market valuation of US$ 22.15 billion by 2032 at a CAGR of 6.9% during the forecast period 2024–2032.

There are a variety of factors that have contributed to the recent growth seen in Southeast Asia’s digital advertising market. First and foremost is the rise of the middle class, which is estimated to reach around 200 million individuals across six key Southeast Asian countries by 2023. This demographic has an insatiable appetite for digital connectivity and e-commerce activities, helped along by the fact that they’re based in a region with more than 400 million internet users and a thriving digital economy. The simple fact that mobile phone adoption is becoming more prevalent further contributes to this trend, as it is projected to generate demand for 144.8 million new units by 2028. The number of smartphoneusers in Southeast Asia is also expected to surpass 326.3 million by next year—continuing its climb higher through 2026.

One of the key drivers behind the growth of the South East Asia digital advertising market growth, especially when it comes to the South East Asia digital advertising market, has been e-commerce. We all know about platforms like Lazada, Shopee, and Tokopedia—and businesses know that their customers do too. To keep up with online shoppers’ attention spans as they become increasingly focused on these platforms, advertisers have had to increase their digital ad investments accordingly. In fact, our data shows that last year alone, the e-commerce market in Southeast Asia was worth a staggering $99.5 billion dollars—not including China—and experts predict it’ll only continue growing from here.

While Shopee was able to pull away from its competitors in terms of Gross Merchandise Value (GMV) across all listed countries thanks to respective user bases between Q4 2023 and Q4 2023 (excluding China), things change quite drastically when you zero-in on individual countries like Indonesia. In this case, Lazada falls back behind Tokopedia—who claimed second place globally—when looking at GMV market share.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Strong Impact of Social Media in Southeast Asia's Digital Advertising Sphere

Social media platforms have become an everyday part of life for consumers across Southeast Asia and the surrounding region, with enormous influence over their purchasing decisions and online behaviors. With Facebook, Instagram and TikTok among the social media giants boasting staggering user bases in the region, advertisers are handed unprecedented opportunities to engage target audiences. The stats speak for themselves. In 2023, there were more than 527 million social media users in Southeast Asia digital advertising market– with a YoY growth rate of about 8%. According to reports compiled by Meta’s own research team, people in Southeast Asia spend an average of more than three hours per day on social media platforms. That highlights the amount of time that these services now account for within consumer lifestyles.

The power of influencers further extends ad campaigns’ reach and efficacy. Influencers can create genuine connections with followers that make them very effective brand ambassadors. Our research shows that more than seven in 10 consumers in Southeast Asia trust recommendations from social media influencers, underlining again how powerful this type of influencer marketing can be. Brands including Shopee, Lazada and Grab have used platforms like Facebook and Instagram to promote their products or services to great effect – using their large user base engagement potential to maximum advantage in the digital advertising market.

Micro-influencers too have risen up through the ranks. Those influencers may have fewer followers overall when compared with some big-name accounts – but they usually boast impressive levels of engagement with those they do have – which means advertisers can target niche groups with specific content. Platforms such as Instagram Shopping and Facebook Marketplace also mean that users can browse items and buy through the same app now – leaving little distinction between discovery and purchase stages.

Trend: Surging Growth of Video Advertising in Southeast Asia

Video advertising segment of the South East Asia digital advertising market has been growing at an alarming rate in Southeast Asia thanks to the rise in internet penetration, with about 70% of people having access by 2023. apart from this, the region is also witnessing a significant growth in the Smartphone adoption with Astute Analytica's analyst predicting total usage to reach 360 million by the same year. As a result, digital ad spending across all industries could exceed $2 billion within a decade’s time. Wherein, one example of video advertising’s foothold in the region is YouTube and TikTok’s success. YouTube dominates the market with more than 332.6 million users logging in every month as of February 2024: that's one hell of an audience for advertisers to capture their attention. Meanwhile, TikTok’s short-form content has become extremely popular among younger demographics, which brands have begun noticing.

But there are other platforms outside of social media that are fueling this trend further in the South East Asia digital advertising market. Over-the-top (OTT) streaming services such as Netflix, Disney+ and iFlix have gained millions of subscribers throughout Southeast Asia over the past few years — each one hungry for video content. To keep those viewership numbers at a high — and ensure they don’t skip your ad — many brands pay top dollar for native advertorial spots within well-known shows or films. By doing so they hope customers will engage with their product or service during one of these placements. As businesses begin to see just how much traction their ads receive from these different platforms — social media or otherwise — they'll be allocating more and more budget toward crafting unique and eye-catching videos: a clear sign that traditional marketing methods aren’t cutting it anymore.

Navigating Regulatory Challenges: A Key Hurdle in Southeast Asia's Digital Advertising Market"

The swift and enigmatic changes in the Southeast Asian digital advertising market are of great concern. The region’s data privacy laws keep evolving, with various countries passing their own regulations. As a result, advertisers must find a way to navigate this complex regulatory landscape if they want to succeed without breaking the bank. The Asia Internet Coalition discovered that, in some cases, businesses’ compliance costs increase by as much as 25% due to regulatory fragmentation across Southeast Asia. Despite this hardship, countries continue to work towards a more private future for consumers by passing data protection laws like Singapore’s Personal Data Protection Act (PDPA) and Thailand’s Personal Data Protection Act (PDPA). But though these efforts benefit consumers, they put advertisers at risk of noncompliance because the region’s regulatory frameworks are so diverse.

In order to deliver effective digital advertising campaigns while following the law, advertisers must take proactive measures. By staying informed about regulatory changes and implementing solid compliance strategies before things change too much, advertisers can stay ahead of costly penalties. Industry professionals and regulators must also do their part by working together to create standardized regulations which protect consumer privacy without sacrificing advertiser needs; only then can they build an environment where everyone can thrive.

Segmental Analysis

By Platform

The desktop ad segment is the market share leader in 2023, accounting for 42.6% at the time. Additionally, it will long continue to dominate Southeast Asia's digital advertising market by platform type. A primary reason this area does so well is because professionals and businesses in Southeast Asia have a preference for desktop devices. They’re especially favored when it comes to tasks that require bigger screens and more computing power. Advertisers know this and capitalize on display ads both on popular websites and search engine results pages (SERPs) to get as much exposure as possible. Furthermore, PC/laptop ownership rates show why advertisers focus here: It's 70.2% for respondents with high incomes compared to only 45.1% of those with low incomes.

Mobile ads are projected to grow at the highest CAGR of about 8.2%, in the digital advertising market thanks to Southeast Asians adopting smartphones left and right while internet penetration rates skyrocket across the region as a whole. With more than 90% of internet users relying on their phones to surf the web, advertisers would be foolish not to take advantage of mobile advertising opportunities moving forward — especially as they grow in number too! Social media platforms like Facebook, Instagram and TikTok all see massive trends in ad spending since they have such large mobile user bases who can be targeted for campaigns. Additionally, Lazada has proved to be one of Southeast Asia’s fastest rising e-commerce platforms — making it’s mobile-first nature quite telling about how much farther mobile ads can go in the region yet.

By Ad Format

As of 2023, the internet paid search ad format held over 25% revenue share of the South East Asia digital advertising market and will continue to do so. It’s expected that it will grow at a CAGR of 7.5% during the forecast period. South East Asia’s number of internet users grew from 260 million in 2015 to 400 million in 2023, with an additional 40 million added in just one year due to COVID-19 lockdowns and economic shifts. This catalyzed growth has positively impacted various sectors such as e-commerce, online media and paid search advertising. Paid search ads are favored by customers because they are efficient and helpful when finding products/services online, with two-thirds of respondents stating they use paid search ads to avoid exposure outside during the pandemic. One-third said they used them because it is easier to find what they're looking for on Google.

Over 71% of Southeast Asians use the Internet as of 2023, with social media being the most popular category among all age groups. On average, people spend more than half an hour longer on social media every day than users around the world (65 minutes vs. global average), giving a significant boost to the Southeast Asia digital advertising market. The top choice for young people aged between16–24 is Facebook (26%). However, this demographic also uses Instagram (20%), WhatsApp (17%), TikTok (13%) actively on average every month, therefore indicating that there is considerable audience overlap across channels. The use of seven different platforms monthly speaks to this generation’s multitasking habits across multiple platforms while conducting everyday activities such as shopping or interacting with content creators or friends. Social commerce has been growing rapidly in the Asia-Pacific region since social media is becoming a significant force in product discovery and e-commerce practices.

Notably, Taiwan digital advertising market has a very high penetration rate of Facebook usage where over 94%of its population can be found using Facebook often.Google holds a commanding lead in Asia's search engine market, generating over 90% of the region's 5+ billion monthly search page views. Southeast Asia’s internet economy was valued at $194 billion in 2022, with e-commerce making up $131 billion of it.

By End Users

The consumer goods and retail industry has accounted for 25.1% of the revenue share of South East Asia’s digital advertising market, according to End Users. The region’s digital economy is booming, with its internet economy reaching $194 billion in 2022. E-commerce makes up the lion's share, valued at $131 billion and projected to surpass $250 billion by 2025. Sixty million new users have adopted digital services during the pandemic, speeding up this shift. Rising digitisation and changing consumer preferences are revolutionising the region's retail landscape, as shopping behaviour undergoes significant change. In 2023 alone, 76% of Southeast Asian consumers changed their buying habits from the previous year. Despite growing incomes, many shoppers remain price-sensitive and actively hunt for deals and promotions. Return rates in e-commerce are higher (15-20%) than traditional sales; especially true for apparel and electronics.

Digital ad spending outpaces traditional formats in Southeast Asia digital advertising market thanks to video, banner, social media and search ads driven by soaring social media usage and online shopping. Major players include Google, Facebook, Microsoft, Amazon etc. Retail channels across Southeast Asia are modernising quickly as e-commerce continues to gain shares in total retail sales figures; to keep up with this tide 80% of SE Asian consumer brands have adopted some degree of digital transformation already. As social media turns into a discovery portal for products purchased on site, social commerce is surging in APAC countries. Consumer goods companies are injecting a lot of money into building strong digital capabilities to better understand and engage customers with their products or services across these platforms. With mobile-first internet usage being highly popular within the area; mobile devices drive most e-commerce traffic and sales across SEA too - not surprisingly then that consumer goods & retail also dominate digital ad spendings across Southeast Asia too.

To Understand More About this Research: Request A Free Sample

Country Analysis

Digital advertising market is a well-established in the South East Asia. It's surpassed traditional advertising and now claims over half of total ad spending globally. Southeast Asia has had the fastest growth in digital ad spend among all other regions, with Indonesia coming out on top as the highest-grossing market in the area (raking in a whopping 30.3% of regional market revenue.) They're not stopping there though: by 2028, the country is projected to likely to spend over 53% of their total ad spend on digital ads, and 87% of their ads will be programmatic.

The Philippines is another standout digital advertising market in Southeast Asia. In 2023, its' online media was valued at $3 billion (the same as Singapore and Malaysia.). These high numbers aren't all sunshine and rainbows; however, Indonesia also faced some incredibly high brand risk levels worldwide when it came to desktop and mobile web display. Several strong factors contribute to this surge of business throughout Southeast Asia: Its digital economy is predicted to multiply by threefold by 2029, ultimately reaching $240 billion. Mobile and internet usage rates have skyrocketed too; mobile subscriptions totalled at 133% of the population, while internet usage increased by over 30% between years (with mobile adoption being the biggest contributor.) With almost half (47%) of Southeast Asia's population using social media these days, it's no surprise that influencer marketing is so popular here too.

Influencer ads are also gaining a significant momentum: Spending on them within SEA alone is expected to total $977 million by 2027 -that’s more than a 50% increase from just two years ago where it sat at $638 million. Country-specific insights also show other interesting statistics about consumer behavior across different parts of southeastern Asia; Vietnam has an incredibly active gaming population that totals around four million individuals aged between eighteen and thirty; Singapore owns one of the lowest brand risk levels in this region (3.5%); Japan, however, saw its' brand risk levels increase significantly from 2.4% to 5.6%.

Key Players in the Southeast Asia Digital Advertising Market

- Alibaba Group Holding Limited

- Amazon

- Apple Inc.

- Applovin Corporation

- Baidu

- Dentsu Inc.

- Facebook Inc.

- FLEISHMANHILLARD

- Google, Inc.

- Grey Group

- Havas SA

- Invoke Malaysia

- Microsoft Corporation

- MiQ Digital

- Mirum India

- Nokia Corporation

- Sina

- Smaato, Inc.

- Tencent

- The Interpublic Group of Companies, Inc.

- Twitter Inc.

- Verizon Communications Inc.

- Yahoo! Inc

- Other Prominent Players

Recent Developments in Southeast Asia Digital Advertising Market

- In April 2024, Sentosa Development Corporation retains GOVT Singapore as creative and digital agency partner

- In February 2024, Accenture (NYSE: ACN) has completed the acquisition of the business of media and marketing technology company Jixie. Jixie’s intelligent digital marketing platform and team will be integrated into Accenture to strengthen its marketing transformation capabilities and resources through Accenture

- In November, 2023, Accenture has agreed to acquire Rabbit’s Tale, a Bangkok-based creative and digital experience agency. The move will significantly strengthen the regional creative, brand and data capabilities of Accenture Song—the world’s largest tech-powered creative group.

- In August 2022, Accenture (NYSE: ACN) has agreed to acquire Romp, a brand and experience agency in Indonesia renowned for its creative talent and innovative services across branding, creative and performance marketing. The move will strengthen Accenture Song’s (formerly Accenture Interactive) ability to deliver creative and tech-driven brand experiences for clients across Southeast Asia.

Market Segmentation Overview:

By Platform

- Mobile Ad

- In-App

- Mobile Web

- Desktop Ad

- Digital TV

- Others

By Ad Format

- Digital Display Ad

- Programmatic Transactions

- Non-programmatic Transactions

- Internet Paid Search

- Social Media

- Online Video

- Others

By End User

- Media and Entertainment

- Consumer Goods & Retail Industry

- Banking, Financial Service & Insurance

- Telecommunication IT Sector

- Travel Industry

- Healthcare Sector

- Manufacturing & Supply Chain

- Transportation and Logistics

- Energy, Power, and Utilities

- Others

By Country

- Indonesia

- Malaysia

- Thailand

- Singapore

- Vietnam

- Philippines

- Rest of Southeast Asia

View Full Infographic

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2023 | US$ 11.92 Bn |

| Expected Revenue in 2032 | US$ 22.15 Bn |

| Historic Data | 2019-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Unit | Value (USD Bn) |

| CAGR | 6.9% |

| Segments covered | By Platform, By Ad Format, By End User, By Country |

| Key Companies | Alibaba Group Holding Limited, Amazon, Apple Inc., Applovin Corporation, Baidu, Dentsu Inc., Facebook Inc., FLEISHMANHILLARD, Google, Inc., Grey Group, Havas SA, Invoke Malaysia, Microsoft Corporation, MiQ Digital, Mirum India, Nokia Corporation, Sina, Smaato, Inc., Tencent, The Interpublic Group of Companies, Inc., Twitter Inc., Verizon Communications Inc., Yahoo! Inc, Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0424808 | Delivery: 2 to 4 Hours

| Report ID: AA0424808 | Delivery: 2 to 4 Hours

.svg)