Solid-State Transformer Market: By Component (Converters, Switches, High-frequency Transformers and Others); Product Type (Distribution Solid State Transformer, Power Solid State Transformer and Traction Solid State Transformer); Application (Renewable Power Generation, Electric Vehicle Charging Stations, Power Distribution, Traction Locomotives and Others); Region—Market Size, Industry Dynamics, Opportunity Analysis, and Forecast for 2025–2033

- Last Updated: 13-Oct-2025 | | Report ID: AA0123348

Market Scenario

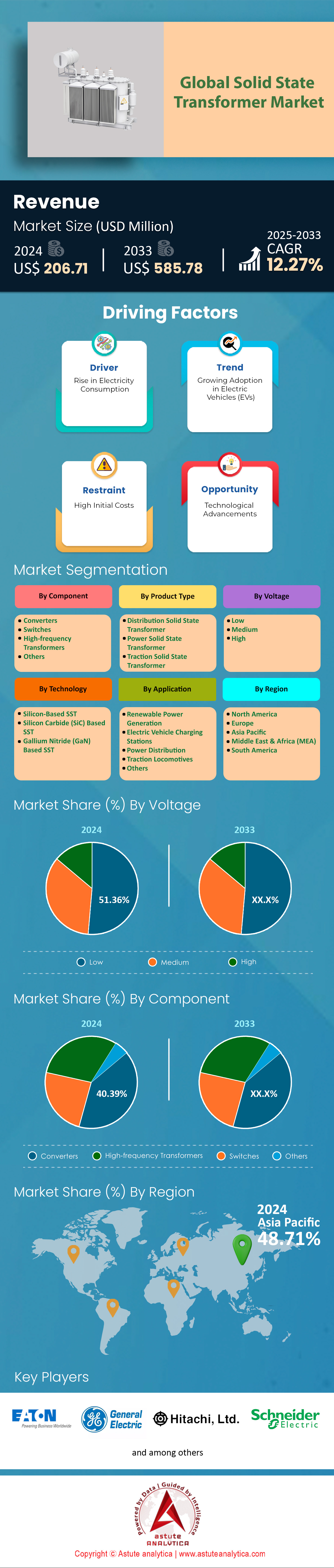

Solid-state transformer market was valued at US$ 206.71 million in 2024 and is projected to reach a valuation of US$ 585.78 million by 2033, at a CAGR of 12.27%. during the forecast period 2025-2033.

The solid-state transformer market continues to gain traction across modern power distribution networks, propelled by surging electrification in transportation, industrial automation, and renewable energy integration. Advanced designs featuring silicon carbide and gallium nitride switching devices are increasingly preferred to handle high-frequency operations, reduce transformer footprint, and optimize grid stability. According to the International Energy Agency, over twenty large-scale demonstrations of high-frequency SST solutions are running in Europe alone, while Asia-Pacific hosts more than thirty ongoing pilot programs focusing on SST-based microgrids. Leading players such as ABB, Siemens, Schneider Electric, Mitsubishi Electric, and General Electric are actively innovating multi-level converter topologies to handle dynamic load conditions in utility, transportation, and data center applications.

Utilities and electric mobility providers are among the most prominent end users in the solid-state transformer market, seeking compact solutions to integrate intermittent renewables, enhance voltage regulation, and manage peak loads. In North America, at least fifteen utility companies have reported ongoing or completed field evaluations for SST-facilitated distributed energy resource (DER) management. Meanwhile, electric vehicle infrastructure companies are testing over five operational prototypes of SST-assisted fast chargers in collaboration with research institutions. Rail operators are also eager adopters, with six European metro systems implementing pilot SST-based traction solutions aimed at achieving smoother regenerative braking and less hardware complexity.

A major factor driving this surging adoption is the convergence of grid modernization efforts, EV expansion, and the elevated need for digital monitoring. Research labs in the United States are experimenting with no fewer than eight separate SST topologies incorporating real-time analytics for condition monitoring. In Asia solid-state transformer market, power transmission authorities have collaborated with seven-plus semiconductor foundries for next-generation wide-bandgap material development to handle major grid expansions. Industry observers highlight that more than ten specialized consortia have emerged worldwide since 2022, focusing on standardizing SST interfaces for high-density power converters. This global dynamism underscores the formidable growth potential, as microgrid operators, electric utilities, transportation authorities, and data center managers seek lighter, more flexible, and more efficient transformations than conventional transformers can provide.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Accelerated electric vehicle rollouts necessitating advanced solid-state transformer technology for robust charging networks worldwide

Electrified transportation is moving at an unprecedented pace in the solid-state transformer market, creating new power distribution complexities that conventional transformers struggle to manage. According to the International Energy Agency, the global electric car fleet surpassed twenty-six million units in 2022, with many countries forecasting double-digit millions of additional EVs within the next few years. In the United States alone, automotive manufacturers have announced plans for at least sixteen new battery-electric models by 2024, signaling broad market expansion. To cope with surging demand, utility providers in California, Norway, and China have installed more than forty demonstration sites for next-generation fast chargers employing SST modules. In Japan, four major grids are testing high-frequency transformers for near-instantaneous voltage control at public charging stations. At least nine academic research centers in Canada are experimenting with micro-inverter clusters that can seamlessly adjust to fluctuations in EV charging patterns—a task that traditional transformers address far less efficiently.

Solid-state transformer market significantly reduce size and weight, making them better suited for widespread deployment at roadside or commercial charging facilities where space is often at a premium. The Energy Department in South Korea recently documented that five out of eight pilot projects using SST-based chargers delivered improved power quality under heavy load conditions. Meanwhile, automotive-hub regions, including certain German cities, have reported ongoing tests demonstrating that high-frequency SST architectures can halve the equipment footprint relative to conventional systems. Some national laboratories in the US have cited data showing that integrating an SST with advanced software algorithms can stabilize voltage within milliseconds across more than ten different load fluctuation scenarios. Unlike classic step-down transformers, these advanced units also allow direct control over harmonic currents, saving grid operators from investing in separate filtering equipment. Consequently, grid modernization strategies can incorporate them to support both present and future EV charging requirements.

Trend: Emerging wide-bandgap semiconductor materials enabling high-frequency, multi-port architectures

Wide-bandgap semiconductors—particularly silicon carbide and gallium nitride—are revolutionizing the landscape of high-power conversion in the solid-state transformer market. Publicly available data from at least seven major semiconductor foundries indicate a consistent focus on developing more robust SiC MOSFETs usable at voltages above 3 kilovolts. This new approach paves the way for multi-port SST designs, a concept under active testing by four European power consortium labs. NASA’s research arm has also highlighted the feasibility of wide-bandgap devices for aerospace-grade power systems, suggesting potential crossover benefits for utility applications. Over a dozen universities in Asia have launched specialized programs to refine GaN transistor packaging for minimal conduction losses in SST modules. Recent pilot tests in India, involving two large distribution feeders, confirmed that wide-bandgap semiconductors can enhance switching speed by a factor of three compared to standard silicon IGBTs.

Multi-port architectures enabled by these semiconductors in the solid-state transformer market permit more flexible power routing, including the capacity to couple renewables, energy storage, and critical loads within a single converter platform. According to industry reports, at least five leading SST manufacturers are collaborating with defense organizations to adapt wide-bandgap–powered designs for mission-critical microgrid resilience. In Poland, a consortium of utility companies has demonstrated how a single SST unit can dynamically partition power among three local loads, reducing distribution losses significantly—without separate transformers for each load. In Taiwan, two new pilot studies show how multi-port SST integration can enhance the management of solar and battery systems over micro-distribution networks. Laboratory evaluations from a Swiss research institute indicate improved heat tolerance in SiC-based modules operating at temperatures above 150 degrees Celsius. As these multi-port, high-frequency architectures mature, they promise to redefine how power flows in advanced digital grids.

Challenge: Complex multi-level designs demanding advanced thermal management strategies for scalable solid-state transformer production lines

The intricate, multi-level structures underpinning solid-state transformers pose considerable obstacles for mass manufacturing in the solid-state transformer market. Dozens of layered submodules, each requiring precise soldering and insulation, can multiply failure risks if not meticulously managed. According to a UK-based power electronics consortium, at least six separate manufacturing steps must be combined under strict environmental controls to ensure device reliability. In China, three high-volume production facilities have invested in customized thermal chambers to test module stability at operating temperatures above 120 degrees Celsius. A North American scale-up found that even minor lamination defects in multi-level converter stacks can lead to downtime in 25 percent of production batches, underscoring the engineering complexity. At least four leading market participants are currently optimizing 3D packaging methods for better heat dissipation, incorporating newly developed coolant paths.

Thermal runaway remains a prominent risk when hundreds of transistors and diodes operate in close proximity, prompting R&D teams to escalate research into composite materials. In Germany, a specialized institute has reported successful trials of diamond-based heat spreaders that consistently maintain operational integrity in half the time required by standard methods. Over in South Korea solid-state transformer market, two pilot production lines have collaborated with robotics experts to automate 80 percent of the assembly process for high-voltage SST modules, minimizing hot spots and mechanical strain. According to an industry white paper, five wave-soldering techniques were compared for reliability under thermal cycling, and only one consistently met the targeted performance across more than fifty sample boards. These multi-level complexities underscore why advanced thermal management is pivotal for cost-effective, scalable SST manufacturing—paving the way for the widespread availability of smaller, smarter, and more efficient power transformation devices.

Segmental Analysis

By Component

Solid-state transformer market can be categorized by their primary components, including converters, switches, and high-frequency transformers. Among these, the converter segment retains the highest market share—exceeding 40.39% in 2024—primarily because converters serve as the core power-processing stage, enabling precise control of voltage and current. This functionality is crucial for modern grid applications, where bidirectional power flow and real-time load management are increasingly essential. Converters incorporate advanced semiconductor materials and switching algorithms to achieve high efficiency, reduced harmonic distortion, and robust fault-handling capabilities. They also support variable voltage levels, making them indispensable for integrating renewable sources such as solar arrays and wind farms into the grid. In addition, ongoing energy-transition efforts worldwide necessitate more flexible distribution networks, spurring increased investments in converter-centric SST architectures. Researchers have emphasized that conventional power transformers may struggle to meet emerging grid functionalities, thereby amplifying the demand for more adaptable and intelligent converter modules.

Further fueling converter dominance in the solid-state transformer market is the uptick in electric vehicle (EV) adoption and the expansion of data-centric industries. Today, multiple pilot programs across Europe, Asia, and North America have tested novel converter designs, focusing on smaller footprints and improved thermal management. These initiatives point toward a growing trend of modular converter systems that can be scaled to different power levels with minimal redesign. In industrial environments—from manufacturing hubs to server farms—converters can regulate supply voltages swiftly to curb downtime due to grid fluctuations. This capability is essential in precision-driven sectors like semiconductor fabrication, where even minor power inconsistencies can lead to product defects. Moving forward, breakthroughs in wide-bandgap semiconductors, coupled with embedded digital control mechanisms, are expected to fortify the converter segment’s lead by enhancing power density and driving further advancements in intelligent grid infrastructure.

By Application

Solid-state transformer market find diverse applications across renewable power generation, electric vehicle charging stations, power distribution, traction locomotives, and more. Among these, power distribution stands out, holding a 41.39% market share. A key driver is the widespread need for reliable, high-quality electricity in industries such as automotive manufacturing, data centers, digital infrastructure, and beyond. Traditional transformers often lack the responsiveness and adaptability required in today’s grids, which must accommodate fluctuating renewable inputs and swiftly adjust to load changes. By contrast, SSTs with embedded power electronics can automatically regulate voltages and detect faults, making them ideal for “smart” distribution networks. Moreover, the proliferation of electric vehicles—requiring fast and efficient charging—further elevates demand for SST-based distribution systems. These systems can handle surges during peak charging times without causing extensive voltage drops or grid instability.

Beyond direct industrial usage, solid-state transformer market in power distribution also stand to benefit cities and communities that are upgrading to “smart city” frameworks. Since 2023, multiple municipal utilities have initiated pilot programs incorporating SSTs into neighborhood substations, aiming to manage distributed renewable inputs and encourage real-time demand response. Implementing SSTs in these contexts can significantly reduce system losses and provide built-in analytics, allowing utility operators to identify energy bottlenecks before they escalate. Additionally, power distribution applications with SSTs support the integration of energy storage, aiding in peak shaving and off-peak load balancing. While establishing the necessary infrastructure may entail higher initial capital expenditure, the long-term operational savings—alongside improved resilience—make SST-driven distribution networks appealing to utilities and governments alike. As the global conversation around sustainable transport and urban electrification intensifies, the emphasis on advanced distribution solutions that can handle complex load scenarios is poised to drive further adoption of SSTs in this crucial application area.

By Voltage

Low-voltage segment of the solid-state transformer market secure the highest share across voltage categories, surpassing 51.36%. One reason for their prominence lies in their versatile deployment potential across commercial, industrial, and residential settings. Low-voltage SSTs combine robust power electronics with compact footprints, which proves beneficial for facilities with limited space or older electrical infrastructures. In many emerging markets, modernization projects aim to replace aging distribution equipment with advanced low-voltage solutions that offer both reduced maintenance costs and enhanced load balancing. Additionally, low-voltage SSTs can manage bidirectional energy flow, facilitating on-site renewable generation—such as rooftop solar—and enabling storage systems to feed back into the grid. This adaptability is increasingly crucial in microgrids or isolated networks that prioritize energy self-sufficiency.

Furthermore, low-voltage SST designs often require fewer raw materials compared to their medium- or high-voltage counterparts, lowering production and installation expenses over the system’s lifecycle. Recently, power electronics researchers worldwide have started refining insulated-gate bipolar transistors (IGBTs) and other semiconductor devices specifically tailored for low-voltage ranges, increasing the efficacy of SST-based solutions. These optimized components in the solid-state transformer market help reduce switching losses while providing smoother voltage control, a combination that is particularly valuable in sensitive manufacturing processes like semiconductor fabrication or pharmaceutical product lines. Pilot studies in dense urban areas have also shown that low-voltage SST nodes significantly mitigate harmonic distortion and improve overall power factor. Such findings suggest that adopting low-voltage SSTs can pave the way for “intelligent” local grids, capable of handling dynamic loads without risking widespread outages. In an era where cities are pressed to handle growing populations and expanding commercial activities, the capacity of low-voltage SSTs to harmonize distributed energy resources and critical loads makes them indispensable for modern power systems.

By Product Type

Within the solid-state transformer market, product types typically include distribution, power, and traction SSTs. Of these, the distribution segment commands over 46.29% of the market share, driven by its ability to effectively manage electricity flow across a broad spectrum of industries. Automotive assembly lines, food and beverage production facilities, textile operations, and construction sites rely heavily on stable power supply, making the adaptability and fault tolerance of distribution SSTs especially valuable. As grids become more decentralized—incorporating localized renewable sources—distribution SSTs help maintain voltage regulation and mitigate harmonics. They can also seamlessly integrate energy storage units, allowing businesses and municipalities to balance short-term peaks without overburdening the transmission network. Industry stakeholders note that distribution SSTs reduce both copper losses and transformer footprint, aligning with broader sustainability goals.

Meanwhile, traction solid-state transformers, also part of this product-type categorization, are on an accelerated growth curve due to their application in high-speed railway systems, commuter lines, and tram networks. As of 2024, several major rail operators in Asia and Europe solid-state transformer market have been testing traction SSTs to improve energy efficiency and enhance onboard power quality. The digital control features within traction SSTs further reduce maintenance intervals, a critical factor when minimizing operational disruptions in busy transit corridors. Additional benefits include optimized braking energy recovery and reduced weight compared to traditional transformers—both of which contribute to lower overall energy consumption. The ongoing shift toward green mobility policies worldwide also favors traction SST adoption, as modern rolling stock increasingly incorporates advanced power electronics. Together, the steady expansion of distribution SSTs in commercial and industrial settings, coupled with the rising prominence of traction SSTs in public transportation networks, underscores the broadening appeal and transformative potential of solid-state transformer technologies.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

The Asia Pacific region, holding 48.71% of the solid-state transformer market share in 2024, emerges as a dominant force due to large-scale initiatives aimed at modernizing power grids in nations like India and China. Industrial expansions, along with urban growth, necessitate enhanced power quality and efficiency, areas where SSTs excel by providing real-time voltage regulation and improved fault isolation. Many Chinese provinces, for instance, have rolled out programs to pilot SST deployments in quickly developing urban centers. Such projects address immediate concerns—such as voltage fluctuations and aging grid components—and align with longer-term sustainability plans that heavily feature renewables. Researchers emphasize that the ongoing global energy transition compels nations to explore transformers that can offer higher flexibility and efficiency, confirming a vital role for SSTs in Asia’s evolving grids.

Beyond China’s leading position in the region’s solid-state transformer market, countries like South Korea, Japan, and India are also championing SST integration. As of 2023, multiple government-backed research collaborations focus on refining semiconductor materials and advanced converter designs. These improvements aim to cut energy losses and augment system resilience, ensuring that upgraded distribution networks can handle higher loads from e-mobility infrastructures and industrial automation. Rapid industrialization and the surge in digital services across Asia Pacific further amplify the importance of stable power supply. Factories, data centers, and commercial facilities require robust solutions to cope with sensitive computing equipment and fluctuating operational cycles. The region’s elevated demand for consumer electronics, textiles, and heavy machinery in the solid-state transformer market is matched by a parallel push for more sustainable production methods—emphasizing efficient resource utilization. Alongside indigenous manufacturing of transformers and power modules, Asia Pacific is progressively attracting international technology collaborations, solidifying its status as a global epicenter for the strategic deployment of solid-state transformer technology.

Top Companies in Solid State Transformer Market:

- Alstom SA

- Eaton Corporation PLC

- ERMCO

- General Electric

- Hitachi, Ltd.

- Kirloskar Electric Company

- Maschinenfabrik Reinhausen GmbH

- Mitsubishi Electric Corporation

- Prolec GE

- Schneider Electric SE

- Siemens AG

- Synergy Transformers

- Other Prominent Players

Market Segmentation Overview:

By Component

- Converters

- Switches

- High-frequency Transformers

- Others

By Product Type

- Distribution Solid State Transformer

- Power Solid State Transformer

- Traction Solid State Transformer

By Voltage

- Low

- Medium

- High

By Technology

- Silicon-Based SST

- Silicon Carbide (SiC) Based SST

- Gallium Nitride (GaN) Based SST

By Application

- Renewable Power Generation

- Electric Vehicle Charging Stations

- Power Distribution

- Traction Locomotives

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2024 | US$ 206.71 Million |

| Expected Revenue in 2033 | US$ 585.78 Million |

| Historic Data | 2020-2023 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Unit | Value (USD Mn) |

| CAGR | 12.72 |

| Segments covered | By Component, By Product Type, By Voltage, By Technology, By Application, By Region |

| Key Companies | Alstom SA, Eaton Corporation PLC, ERMCO, General Electric, Hitachi, Ltd., Kirloskar Electric Company, Maschinenfabrik Reinhausen GmbH, Mitsubishi Electric Corporation, Prolec GE, Schneider Electric SE, Siemens AG, Synergy Transformers, Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)