Solenoid Valves Market: By Type (Direct-acting valves and Pilot-operated valves); By Function (2-Way, 3-Way, 4-Way, and 5-Way); Material (Stainless Steel, Aluminum, Plastic, and Others); Operation (Normally open, Normally closed, and Universal); Media (Air, Gas, and Water); Industry (Oil & Gas, Chemical & Petrochemical, F&B, Power Generation, Automotive, and Others); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: Dec-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0622278 | Delivery: 2 to 4 Hours

| Report ID: AA0622278 | Delivery: 2 to 4 Hours

Market Scenario

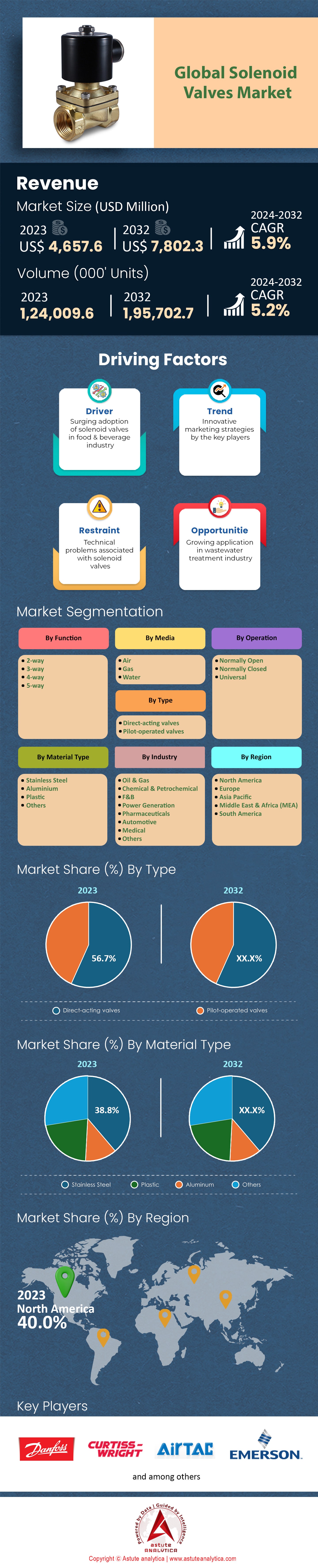

Solenoid valves market was valued at US$ 4,657.6 million in 2023 and is projected to hit the market valuation of US$ 7,802.3 million by 2032 at a CAGR of 5.9% during the forecast period 2024–2032.

Solenoid valves, electromechanically operated devices designed to control the flow of liquids or gases, are integral components in modern industrial systems. These devices use electrical energy to generate mechanical motion through a solenoid coil, enabling precise actuation of valve mechanisms. The growing demand for solenoid valves is driven by advancements in industrial automation and the increasing adoption of smart control technologies. As of 2023, solenoid valves are now being extensively integrated into advanced robotics, with over 3.5 million industrial robots in operation globally requiring precise fluid control systems. Additionally, the global rollout of hydrogen fuel cell technologies has accelerated the adoption of solenoid valves in hydrogen storage and distribution systems, ensuring safe and efficient handling of this alternative energy source. In renewable energy, solenoid valves are now a critical component in solar thermal power plants, regulating heat transfer fluids to optimize energy conversion.

Key applications of solenoid valves span industries such as oil and gas, water treatment, food and beverage, pharmaceuticals, automotive, and chemical processing. In the water and wastewater sector, solenoid valves regulate water flow within treatment plants, with over 60,000 large-scale treatment facilities worldwide relying on these devices to optimize water distribution and filtration processes. In the automotive industry, where global vehicle production reached 91 million units in 2023, solenoid valves are critical in fuel injection systems, electric vehicle battery cooling systems, and automatic transmissions, enhancing performance, safety, and energy efficiency. The pharmaceutical industry, which saw a surge in vaccine manufacturing and sterile production lines post-2020, also relies heavily on solenoid valves, particularly in applications requiring high precision, such as fluid mixing and dosing. Additionally, solenoid valves are increasingly used in the food and beverage sector, where over 300 billion liters of beverages were produced globally in 2023, requiring stringent hygiene and precision standards.

The rapid adoption of Industry 4.0 technologies continues to propel the solenoid valve market forward. Major players, such as Emerson Electric Co. and Danfoss, have developed innovative solutions like explosion-proof solenoid valves and valves capable of operating under extreme temperatures for specialized industries, including aerospace and defense. In the oil and gas sector, where global consumption reached 91 million barrels per day in 2023, solenoid valves are indispensable for managing high-pressure fluid systems and ensuring operational safety. Furthermore, with the rise of smart factories, solenoid valves integrated with IoT sensors are now enabling predictive maintenance, minimizing downtime, and improving operational efficiency across industries.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Growing Industrial Automation Demanding Precise Fluid Control Solutions

The surge in industrial automation has been a primary driver for the increased demand for solenoid valves. Industries are adopting automation technologies to enhance efficiency, reduce human error, and improve safety. Solenoid valves are integral in these automated systems, providing precise control over the flow of liquids and gases. According to the International Federation of Robotics, global sales of industrial robots reached 276,288 units in 2023, reflecting a steady rise in automation adoption. Apart from this, in manufacturing, solenoid valves are essential components in automated assembly lines, controlling pneumatic and hydraulic systems. The chemical industry utilizes them for accurate dosing and mixing of chemicals, critical for product quality and safety. The food and beverage industry relies on solenoid valves to maintain hygiene standards by ensuring precise control in processing and packaging.

Market players are developing solenoid valves that seamlessly integrate with automated systems. The introduction of programmable solenoid valves allows for more precise control and monitoring, enhancing the efficiency of automated processes. The push for Industry 4.0 and smart factories amplifies this demand, positioning solenoid valves as pivotal components in the future of industrial automation.

Trend: Integration of Solenoid Valves with IoT for Predictive Maintenance and Monitoring

The integration of solenoid valves with the Internet of Things (IoT) represents a significant trend in the industry. By equipping solenoid valves with sensors and connectivity features, operators can monitor performance in real-time and predict maintenance needs before failures occur, reducing downtime and operational costs. Astute Analytica estimated that there would be over 75 billion connected devices by 2025, illustrating the rapid expansion of IoT in industrial applications. IoT-enabled solenoid valves transmit data on parameters such as pressure, flow rate, and valve position, allowing for enhanced control and diagnostics. Manufacturers are investing in developing smart solenoid valves to meet the growing demand for connected industrial equipment. Companies like Bürkert Fluid Control Systems have introduced valves capable of communicating with centralized control systems, aligning with the move toward intelligent manufacturing.

The benefits of integrating solenoid valves with IoT include improved efficiency, reduced maintenance costs, and enhanced safety. This trend is expected to continue as industries seek to leverage data analytics and connectivity to optimize operations and respond swiftly to issues.

Challenge: Competition from Alternative Valve Technologies Limiting Market Growth Potential

A primary challenge facing the solenoid valves market is competition from alternative valve technologies. Technologies such as piezoelectric valves, motorized valves, and pneumatic actuators offer advantages like lower power consumption and faster response times, which can limit the growth potential for traditional solenoid valves. Piezoelectric valves, for instance, use piezoelectric materials to actuate the valve mechanism, offering ultra-fast response times and minimal energy consumption. These characteristics make them attractive for precision applications in sectors like medical devices and analytical instruments. Manufacturers of solenoid valves are responding by enhancing product performance, focusing on energy efficiency, response times, and durability to retain market share.

Innovation and differentiation are critical as companies strive to meet specific industry needs. While alternative technologies pose challenges, solenoid valves remain vital due to their reliability, cost-effectiveness, and versatility across a broad range of applications.

Segmental Analysis

By Type

Direct-acting solenoid valves dominate the solenoid valves market with over 56.7% market revenue due to their simple design and versatility. These valves are widely used in medical equipment, including over 2.1 million dialysis machines and ventilators manufactured globally in 2023. Their ability to operate without pressure differentials makes them essential in low-pressure systems, such as lab equipment, where over 1.5 million units required precise fluid control. In addition, direct-acting valves are integral to the automotive sector, with nearly 16 million vehicles using these valves for fuel injection systems.

The growth of direct-acting valves is closely tied to industrial automation trends. In 2023, global automation equipment sales reached $210 billion, with direct-acting valves installed in 45% of new systems. Furthermore, their ability to handle high-pressure environments has led to their adoption in 280,000 oil and gas rigs and facilities worldwide. These valves are also critical in the water treatment industry, where over 3.8 billion gallons of water are processed daily using systems incorporating direct-acting solenoids. Their reliability and lower maintenance costs save industries approximately $1.8 billion annually in downtime and repairs. The global demand is further shaped by their suitability for harsh environments, with over 680,000 chemical processing units using them for aggressive media. In the Asia-Pacific region alone, the installation of direct-acting valves grew by 120,000 units in 2023 due to infrastructure expansion, solidifying their dominance in the solenoid valve market.

By Function

The 2-way function is the most widely used solenoid valve operation mode due to its efficiency and simplicity. The 2 way function segment controlled nearly 38% revenue share of the market. In 2023, over 41 million solenoid valves sold globally incorporated the 2-way function, making it the most dominant design in the market. These valves are essential in irrigation systems, with over 220 million acres of farmland globally relying on them for water flow control. Additionally, in industrial cooling systems, 2-way solenoid valves are used in more than 1.2 million units worldwide for regulating coolant flow.

The 2-way solenoid valves’ adoption is also heavily driven by the automotive sector, where 14 million vehicles globally required these valves in 2023 for fuel and fluid transfer systems. In the oil and gas industry, approximately 350,000 installations of 2-way solenoid valves were carried out last year to regulate pipelines and ensure safe extraction. Their dominance is further evident in residential plumbing systems, with over 18 million new installations in 2023 using 2-way valves for water supply control. Key factors behind their dominance include their ability to handle high pressures, with valves in petrochemical facilities operating under 5,000 psi conditions. In the pharmaceutical industry, over 45,000 drug manufacturing units utilize 2-way valves for precise flow regulation. Additionally, wastewater treatment plants processed over 3.4 trillion gallons of water globally in 2023, with 2-way solenoid valves playing a critical role in this process. Their cost-effectiveness and minimal maintenance needs saved industries over $2.3 billion in operational costs last year, further solidifying their dominance.

By Material

Stainless steel solenoid valves are the preferred choice for manufacturers and end-users in solenoid valves market due to their superior durability and corrosion resistance. In 2023, over 47 million stainless steel solenoid valves were sold globally, driving 38.8% of the market revenue. These valves are essential in the food and beverage industry, where over 1.6 million production units depend on stainless steel valves to ensure hygiene and prevent contamination. In the chemical processing sector, over 1.2 million facilities worldwide utilize stainless steel valves to handle aggressive chemicals safely.

The material’s ability to withstand high pressures and temperatures is another reason for its dominance. For instance, in oil and gas operations, more than 320,000 rigs and facilities required stainless steel valves for harsh environments in 2023. In the marine industry, over 48,000 ships and offshore platforms utilized these valves for fluid control systems. Stainless steel is also the top choice in the pharmaceutical sector, with over 500,000 biopharmaceutical production facilities relying on these valves for sterile processing.

Key factors driving their demand include their long service life, with stainless steel valves lasting over 20 years in most applications. This reduces replacement costs by $1.5 billion annually for industries globally. In HVAC systems, over 2.6 million units installed in 2023 incorporated stainless steel valves for durability under extreme conditions. Additionally, in Asia-Pacific, over 5.4 million stainless steel valves were deployed in new industrial plants, showcasing the material’s dominance in emerging markets.

By Industry

The chemical and petrochemical industry is the largest end-user of solenoid valves with nearly 40.5% market share due to their critical role in fluid regulation and safety. In 2023, the industry accounted for nearly $1.9 billion in solenoid valve purchases, with over 4.5 million valves deployed globally in chemical facilities. These valves are essential in handling hazardous and corrosive substances, with over 1.3 million chemical reactors worldwide relying on solenoid valves for precise flow control. In the petrochemical sector, over 680,000 refining units used solenoid valves to manage processes such as distillation and cracking.

The global demand is driven by the production of plastics, where over 400 million tons were produced in 2023, requiring solenoid valves for polymerization processes. Additionally, the fertilizer industry, which produced 200 million tons of nitrogen-based fertilizers last year, relied heavily on solenoid valves to ensure precise chemical mixing. The industry's investment in automation is evident, with over 1.2 million automated systems installed in 2023 utilizing solenoid valves for efficiency and safety.

Strict safety regulations play a critical role in driving demand, as solenoid valves are necessary to prevent leaks and ensure compliance in over 10,000 chemical storage facilities globally. The valves’ ability to operate under extreme conditions, such as 500°C temperatures and pressures exceeding 3,000 psi, makes them indispensable. Furthermore, in LNG production, over 170 million tons of liquefied natural gas processed in 2023 required solenoid valves for safe transport and storage. This dominance highlights the critical role of solenoid valves in the chemical and petrochemical industry.

To Understand More About this Research: Request A Free Sample

Regional Analysis

North America's leadership with nearly 40% market share in the solenoid valves market is deeply rooted in its expansive and advanced industrial sectors that demand high-performance fluid control solutions. The United States operates over 2.6 million miles of natural gas and hazardous liquid pipelines, the most extensive network globally, which relies heavily on solenoid valves for controlling flow and ensuring safety. Additionally, the U.S. stands as the world's top oil producer as of 2023, extracting over 12 million barrels of oil per day, necessitating extensive use of solenoid valves in exploration, extraction, and distribution processes. Canada's substantial contribution comes from its significant oil sands reserves, which account for 97% of its oil reserves, driving the need for solenoid valves in heavy oil extraction and processing operations.

The manufacturing prowess of North America further cements its dominance in both the production and consumption of solenoid valves. The United States is home to over 250,000 manufacturing firms, a significant number of which operate in sectors that heavily utilize solenoid valves, such as automotive, aerospace, and chemical industries. For instance, the U.S. automotive industry produced approximately 10.6 million vehicles in 2023, with solenoid valves playing critical roles in both vehicle components and assembly lines. In the aerospace sector, the U.S. leads globally, with the industry generating over $900 billion in economic output, where solenoid valves are essential in aircraft systems for fuel management and hydraulics. Moreover, the U.S. chemical industry, comprising over 13,000 facilities, relies on solenoid valves for precise control in chemical processing and manufacturing.

North America's emphasis on technological advancement and automation significantly contributes to its forefront position in the solenoid valves market. The region boasts over 16,000 wastewater treatment facilities, many of which depend on solenoid valves for efficient fluid control in their operations. The extensive adoption of industrial automation, with the U.S. industrial automation sector featuring thousands of integrated systems, utilizes solenoid valves as key components in automated control systems. Additionally, leading global manufacturers of solenoid valves, such as Emerson Electric Co., Parker Hannifin Corp., and ASCO Valve, are headquartered in the United States, fostering innovation and reinforcing supply chains within the region. The agricultural sector also underscores this dominance; North America's widespread implementation of precision agriculture technologies incorporates solenoid valves in advanced irrigation systems to optimize water usage and enhance crop yields.

List of Key Companies Profiled:

- Airtac

- Anshan Electromagnetic Value

- ASCO Valve Inc.

- CEME S.p.A.

- Christian Bürkert GmbH & Co. KG

- CKD Corporation

- Curtiss-Wright Corporation

- Danfoss A/S

- GSR Ventiltechnik GmbH & Co. KG

- Juliang Valve

- ODE S.r.l.

- Takasago Electric Industry Co., Ltd

- YONG CHUANG

- Zhejiang Sanhua

- Zhejiang Yongjiu

- Other Prominent Players

Market Segmentation Overview:

By Type:

- Direct-acting valves

- Pilot-operated valves

By Function:

- 2-way

- 3-way

- 4-way

- 5-way

By Material:

- Stainless Steel

- Aluminum

- Plastic

- Others

By Operation:

- Normally open

- Normally closed

- Universal

By Media:

- Air

- Gas

- Water

By Industry:

- Oil & Gas

- Chemical & Petrochemical

- F&B

- Power Generation

- Pharmaceuticals

- Automotive

- Medical

- Others

By Region:

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

View Full Infographic

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2023 | US$ 4,657.6 Million |

| Expected Revenue in 2032 | US$ 7,802.3 Million |

| Historic Data | 2019-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Unit | Value (USD Mn) |

| CAGR | 5.6% |

| Segments covered | By Type, By Function, By Material, By Operation, By Media, By Industry, By Region |

| Key Companies | Airtac, Anshan Electromagnetic Value, ASCO Valve Inc., CEME S.p.A., Christian Bürkert GmbH & Co. KG, CKD Corporation, Curtiss-Wright Corporation, Danfoss A/S, GSR Ventiltechnik GmbH & Co. KG, Juliang Valve, ODE S.r.l., Takasago Electric Industry Co., Ltd, YONG CHUANG, Zhejiang Sanhua, Zhejiang Yongjiu, Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0622278 | Delivery: 2 to 4 Hours

| Report ID: AA0622278 | Delivery: 2 to 4 Hours

.svg)