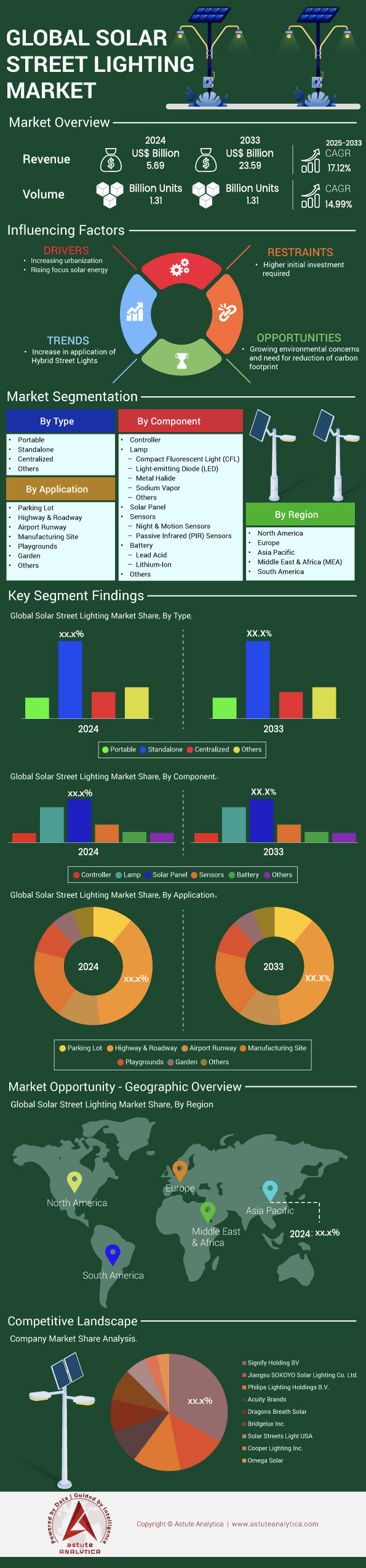

Solar Street Lighting Market: By Type (Portable, Standalone, Centralized, and Others); Component (Controller, Lamp, Solar Panel, and Others); Application (Parking Lot, Highway and Roadway, Airport Runway, and Others); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: Dec-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0222147 | Delivery: 2 to 4 Hours

| Report ID: AA0222147 | Delivery: 2 to 4 Hours

Market Scenario

Solar street lighting market is estimated to witness a major jump in revenue from US$ 5.69 billion in 2024 to US$ 23.59 billion by 2033 at a CAGR of 17.12% over the projection period 2025-2033.

Solar street lighting demand is experiencing a remarkable surge driven by multiple factors, including enhanced awareness of renewable energy’s long-term benefits and the need for reliable infrastructure in remote areas. In 2023, the global solar street lighting market is valued at around US$ 6.5 billion. By 2030, it is projected to surpass US$ 15 billion in overall worth. In the last twelve months, 28 countries have piloted national solar street lighting programs. Rural development initiatives in over 19,000 off-grid communities worldwide now routinely include solar street lamps. At least 5 million solar street lighting units were installed across Asia in 2022, underscoring the technology’s growing importance for public safety and security.

Several recent developments are fueling this upward trajectory. There has been a global investment of more than US$ 420 million in solar street lighting R&D in the last year, signifying stronger industry commitment. Over 1.1 million solar lighting systems have been deployed in Middle Eastern industrial zones, reflecting cost-efficient off-grid applications. In North America Solar street lighting market, 1.8 million new installations have gone into urban revitalization projects since 2021. Europe now has about 2.4 million operational solar street lamps along highways and municipal roads. These figures highlight how technological innovations, including improved batteries and higher-efficiency photovoltaics, are driving greater adoption while cutting long-term costs.

Governments worldwide are further accelerating demand within the solar street lighting market with large-scale implementation plans and incentives. India alone deployed 900,000 solar street lamps under centralized schemes in 2022. Officials in several African nations have connected solar lighting initiatives to broader plans for electrification and crime reduction, rolling out projects worth hundreds of millions in capital expenditure. As more regions adapt policy frameworks to encourage green infrastructure, suppliers are scaling up to meet surging orders. The synergy of supportive legislation, infrastructure funding, and public acceptance ensures a robust continued expansion of the solar street lighting sector, with modern solutions rapidly replacing older, energy-intensive lighting systems.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Strong government initiatives supporting off-grid solar solutions for widespread public illumination

Governments around the globe increasingly view solar street lighting as a strategic asset for serving remote areas and reducing grid dependency. Dozens of new policy frameworks now offer tax exemptions, subsidized loans, and streamlined approval processes to promote off-grid lighting projects. In 2022, global spending on government-led solar street lighting pilots reached nearly US$ 900 million in the solar street lighting market. Over 60 national development plans incorporated dedicated budgets for off-grid illumination last year, signifying a marked shift in official priorities. At least 3 million solar street lamps were allocated to rural electrification programs across Africa in the past two years, forming a backbone for improved public safety. In South America, 500 communities approved new off-grid solar lighting installations between 2021 and 2023 to reduce reliance on expensive diesel generators.

Implementation on the ground has gathered pace as local agencies seize available funding. Municipal authorities in multiple Asian nations have sourced over 650,000 standalone solar lighting units for roads previously lacking reliable electricity. Officials confirm that these solutions lower operating costs and minimize ongoing maintenance, easing strain on public finances. Large-scale tenders, such as a Southeast Asian contract involving 400,000 solar lights, reflect a growing acceptance of these technologies as mainstream solutions. Authorities commend the swift setup times in the solar street lighting market, pointing out that installations in remote provinces can be completed in a fraction of the time required for extending power lines. A newly allocated US$ 150 million in Asia-Pacific–wide grants is poised to further accelerate off-grid solar deployments in underserved regions, underscoring a future where government initiatives remain key drivers of market expansion. Such unwavering institutional support ensures a steady flow of projects, bridging energy gaps and reinforcing the essential role of solar street lighting in modern infrastructure development.

Trend: Integration of smart lighting controls with remote monitoring and analytics tools

An emerging trend in solar street lighting market is the marriage of solar-powered LEDs with digital intelligence. Lighting arrays embedded with wireless sensors transmit information about performance, voltage, and real-time illumination levels to centralized dashboards. In 2023, major manufacturers introduced more than 20 new product lines featuring remote monitoring modules. Ten metropolitan areas worldwide announced city-wide upgrades to existing streetlights with systems that can self-diagnose faults before outages occur. These connected solutions also help streamline the maintenance cycle; in the past year, one Asian capital replaced 50,000 traditional lamps with sensor-equipped solar lighting to reduce manual inspection requirements. Operators further benefit from the ability to adjust brightness according to time-of-day usage data, leading to extended battery life and better energy allocation.

Such advanced capabilities in the solar street lighting market are reshaping how municipalities view solar street lighting. Big data analytics enhance predictive servicing, ensuring that any appliance nearing the end of its lifespan is replaced proactively. In a European pilot launched in 2022, 2,000 solar streetlights equipped with smart controls provided system-wide analytics that saved an estimated US$ 1.5 million in operational costs over one year. Another trial in the Middle East equipped 10,000 off-grid lamps with automated dimming features that responded to ambient light conditions, reducing nighttime light pollution and optimizing power usage. Dedicated research budgets are surging toward the integration of artificial intelligence algorithms with solar lighting to further refine diagnostic capabilities. As more municipalities and industrial clients integrate these smart controls, the solar street lighting market continues its steady transition from basic renewable fixtures to interactive digital platforms that align with modern urban infrastructure demands.

Challenge: Limited financing options restricting truly widespread adoption across low-income urban communities

A critical challenge confronting the solar street lighting market is the shortage of financing mechanisms for municipalities and small communities with constrained budgets. Although high-level government programs show promise, they often fail to trickle down to local administrations trying to secure funds. In the past year, more than 700 city districts worldwide could not finalize solar street lighting contracts due to limited credit availability. Small-scale lenders remain reluctant to extend capital for off-grid lighting projects, citing uncertain repayment schedules. In one African nation, 9,000 planned solar walkway installations were shelved in 2022 after sponsor banks withdrew support. Without affordable financing tools, many urban authorities resort to cheaper yet less sustainable lighting methods, curbing growth potential for solar innovation.

Even when funding programs exist, the application process often requires extensive documentation or matching investments that smaller local governments cannot afford. Recent data shows that 15 philanthropic foundations collectively contributed US$ 250 million to global solar streetlighting initiatives over the last two years, but these contributions are still dwarfed by overall infrastructure costs in heavily urbanized settings. Such financial bottlenecks in the solar street lighting market slow project implementation and create disparities between wealthier regions and those that could benefit most from cleaner, off-grid lighting solutions. Some emerging schemes, like community-backed microfinance projects, are beginning to show promise; a pilot in Southeast Asia financed 3,500 solar streetlights through local cooperatives in 2023. However, for true market expansion, bridging this funding gap remains paramount. To meet the needs of diverse communities, stakeholders must develop more innovative financing structures, guarantee lower interest rates, and open up long-term repayment options tailored to low-income areas, ultimately enabling scalable, equitable adoption of solar street lighting.

Segmental Analysis

By Application

Highways and roadways have emerged as priority areas for solar street lighting market because of the urgent need for consistent nighttime visibility and reduced operational costs. In line with this, the segment is controlling over 37.0% market share. As of 2023, more than 15,000 kilometers of roads worldwide are lit exclusively by solar-powered fixtures, underscoring the technology’s growing acceptance among transport authorities. Prominent government initiatives in regions such as the Middle East and Southeast Asia have expanded installations along major highways, mitigating grid reliance and promoting sustainable infrastructure. Large-scale endeavors, including a 600-kilometer highway retrofit in South Africa, exemplify the cost savings and reliability offered by solar lighting, especially in areas prone to power shortages.

Several factors contribute to this trend. High traffic volumes and elevated accident risks demand robust, energy-efficient lighting, a hurdle overcome by modern LED-based solar solutions. Next, the low-maintenance nature of solar lamps—some operating for nearly ten years without major servicing—further enhances their appeal in the solar street lighting market. Technologically, sophisticated sensors and remote monitoring systems ensure these lights work efficiently, adjusting brightness based on real-time conditions. Notably, about 900 municipalities globally have mandated renewable-oriented street lighting for new highway projects, signaling a broader shift toward green infrastructure. Budgets have collectively allocated around USD 2 billion in 2023 for solar street lighting along highways, reflecting significant investment in sustainable transit solutions. Together, these elements make highways and roadways the leading segment in global solar street lighting.

By Type

Standalone solar street lighting systems have garnered widespread attention in the solar street lighting market with over 49.0% market share because they operate independently of conventional power grids, integrating panels, batteries, and controllers in one unit. These systems particularly benefit remote or semi-urban locales that lack stable electricity infrastructure. As of 2023, global deployments of standalone solar street lights have surpassed 10 million units, showing the market’s robust shift toward off-grid solutions. Their plug-and-play setup often enables installation in under a day, crucial for communities with limited resources. Moreover, many modern designs incorporate LEDs with lifespans extending beyond 50,000 hours, significantly reducing operating expenses over time.

A key reason standalone systems dominate the solar street lighting market is their ability to store energy and function through fluctuations in sunlight or on-grid supply. In adverse climates, newer models with IP65-rated enclosures demonstrate resilience under extreme weather conditions. Joint efforts from nonprofits, local governments, and private companies have produced over 800 rural electrification initiatives in 2023 alone, hastening adoption of standalone solar street lights. These systems also benefit from wireless connectivity, easing remote maintenance and allowing for data-driven adjustments to conserve energy. As decentralized energy models gain traction globally and hardware costs continue to fall, standalone solar street lights are poised to maintain their leading position in market share and overall demand.

By Component

Solar panels have emerged as the most significant revenue-generating component in solar street lighting market with over 34.0% market share, owing to their indispensable function of converting sunlight into electrical power. With photovoltaic technology advancing at a rapid pace, many panels available today deliver power outputs exceeding 200 watts, suitable for large-scale street illumination. As of 2023, global installations of solar street lighting panels have exceeded 28 million units, pointing to a worldwide surge in clean, renewable energy adoption. Multiple manufacturers now offer monocrystalline and polycrystalline panel designs, maximizing efficiency and resilience in harsh climates. Modern panels also boast lifespans surpassing 20 years, minimizing long-term operational costs for cities and developers.

Key factors fueling the dominance of solar panels in the solar street lighting market include falling prices of raw materials, expanded manufacturing capacities, and strong governmental incentives for renewable energy. The flexibility of customization also allows panels to adapt to diverse environments, ensuring compatibility in both urban and rural settings. During 2023 alone, more than 50 countries have stepped up procurement of cutting-edge panels to fortify public lighting projects. Meanwhile, the solar street lighting sector has seen over 500 patents issued for panel innovations, underscoring robust R&D activities. Upgraded functionalities such as IoT-based data monitoring further enhance performance, offering insights into energy consumption and system reliability. With a growing emphasis on reducing carbon footprints worldwide, the preference for solar panels in urban infrastructure is set to accelerate, securing their position as the top revenue contributor in the solar street lighting segment.

To Understand More About this Research: Request A Free Sample

Regional Analysis

Asia Pacific has positioned itself as the largest producer and consumer of solar street lighting market for a variety of compelling reasons. In 2022, the region boasted manufacturing facilities capable of rolling out 5 million solar street lighting units annually. Over 20 major solar panel suppliers maintain plants in East and Southeast Asia, ensuring a steady supply chain of photovoltaic components. China alone exported solar lighting products worth over US$ 2.1 billion last year. India has invested the equivalent of US$ 450 million in local solar street lighting incentives, leading to rapid installations across multiple states. In Malaysia, 30 newly established manufacturing lines have emerged since 2021, focusing on advanced battery and controller technologies.

The current need for solar street lighting market in Asia Pacific is driven by urbanization and efforts to electrify remote settlements. Roughly 12,000 off-grid villages in the region gained their first solar streetlights between 2021 and 2023, highlighting the pressing requirement for reliable nighttime visibility. Broad swaths of infrastructure corridors, including newly built highways, continue to rely on off-grid illumination solutions due to challenging terrain and the high expense of extending grid services. Large-scale government grants, amounting to US$ 150 million in the last fiscal year, further stimulate solar streetlight infrastructure projects for both urban and rural contexts. With significant throughput in manufacturing and growing domestic demand, the region’s market influence continues to expand.

Several countries lead this dominance of the Asia Pacific solar street lighting market. Wherein, China’s prolific industrial capacity coupled with supportive national policies makes it a leader in global supply. India’s robust push for renewable energy, demonstrated by installing more than 900,000 solar streetlights in its urban zones in 2022, has further cemented its status in the market. Japan’s technological expertise and South Korea’s electronics stronghold contribute innovative research capabilities. Local producers, such as top-tier Chinese and Indian firms, remain competitive by offering cost-optimized, durable fixtures that performed reliably in pilot tests conducted across 500 municipalities. These solutions are steadily replacing conventional lighting systems, evident from rising exports of LED-based solar fixtures throughout the region, reinforcing Asia Pacific’s position as a global frontrunner.

Key Solar Street Lighting Market Companies:

- Acuity Brands, Inc.

- Bajaj Electricals Ltd.

- Bridgelux Inc.

- Cooper Lighting,

- Dragons Breath Solar

- Jiangsu SOKOYO Solar Lighting Co., Ltd.

- Omega Solar

- Philips Lighting Holding B.V.

- Signify Holding BV

- Sol Inc.

- Solar Street Lights USA

- Solektra International LLC

- Sunna Design

- Urja Global Ltd.

- VerySol Inc.

- Other Prominent Players

Market Segmentation Overview:

By Type:

- Portable

- Standalone

- Centralized

- Others

By Component:

- Controller

- Lamp

- Compact fluorescent light (CFL)

- Light-emitting diode (LED)

- Metal halide

- Sodium vapor

- Others

- Solar Panel

- Sensors

- Night & Motion Sensors

- Passive Infrared (PIR) Sensors

- Battery

- Lead-acid

- Lithium-Ion

- Others

By Application:

- Parking Lot

- Highway and Roadway

- Airport Runway

- Manufacturing Site

- Playgrounds

- Garden

- Others

By Region:

- North America

- The U.S.

- Canada

- Mexico

- Europe

- The UK

- Germany

- France

- Italy

- Spain

- Poland

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

View Full Infographic

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2024 | US$ 5.69 Bn |

| Expected Revenue in 2033 | US$ 23.59 Bn |

| Historic Data | 2020-2023 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Unit | Value (USD Bn) |

| CAGR | 17.12% |

| Segments covered | By Type, By Component, By Application, By Region |

| Key Companies | Acuity Brands, Inc., Bajaj Electricals Ltd., Bridgelux Inc., Cooper Lighting, LLC, Dragons Breath Solar, Jiangsu SOKOYO Solar Lighting Co., Ltd., Omega Solar, Philips Lighting Holding B.V., Signify Holding BV, Sol Inc., Solar Street Lights USA, Solektra International LLC, Sunna Design, Urja Global Ltd., VerySol Inc., Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0222147 | Delivery: 2 to 4 Hours

| Report ID: AA0222147 | Delivery: 2 to 4 Hours

.svg)