Global Sodium Silicate Market (By Type - Liquid and Solid; By Grade - Neutral and Alkaline; By Form - Crystalline and Anhydrous; By Material - Sodium Oxide and Silica; By End User - Residential, Commercial, and Industrial; By Application - Detergent, Paper Bonding, Water Treatment, Construction Material, Optical Glass, Bonding Insulation Material, Wood Materials, Metal Sheets, Fabrication of Foundry Molds, Silica Gel Packets Moisture Control, Food Preservation, Passive Fire Control, Stone Consolidation, Welding Electrodes, and Others); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: 25-Nov-2024 | | Report ID: AA0822286

Market Scenario

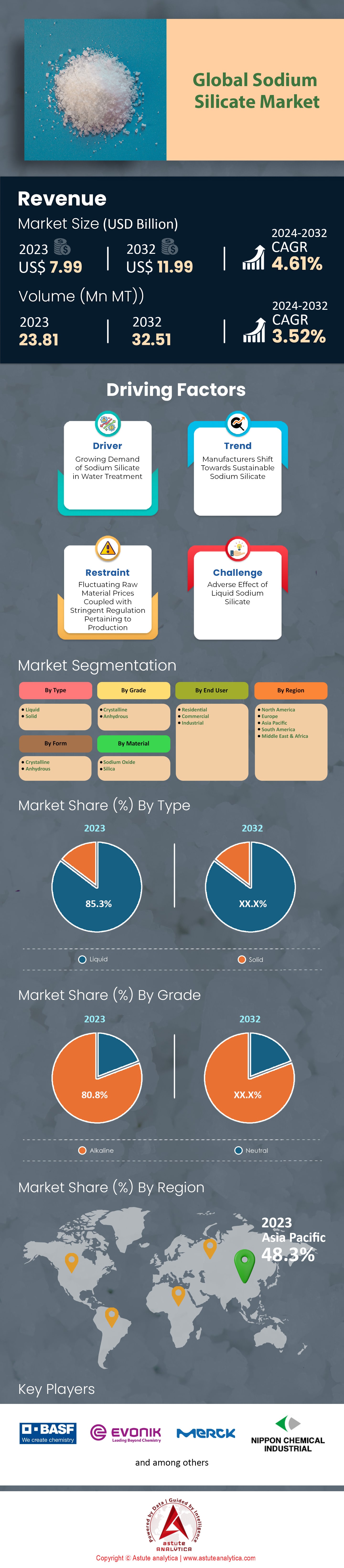

Sodium silicate market was valued at US$ 7.99 billion in 2023 and is projected to attain a valuation of US$ 11.99 billion by 2032 at a CAGR of 4.61% from 2024-2032.

Considering the annual growth rate of sodium silicate market, it’s safe to say that the market has ample competition, with water treatment, soap & detergents, and construction materials being its primary source of consumption. It gets interesting as the APAC region is the largest consumer, and China has taken a lion’s share of the global market and its production amounts to about 5 million metric tons. Today, the sodium silicate remains a non-replaceable ingredient in the formulation in the production of detergents where approximate 1.2 million tons aid in improving the mixtures in regard to cleaning and decreasing the carbon footprints [Detergent Industry Journal]. Marked as one of the largest markets with a value estimate of $120 Billion, the detergent industry has constantly fuelled the demand for sodium silicate due to the continual launch of new innovative and eco-friendly cleaning products by the manufacturers. North America alone launched over 50 new detergent brands including sodium silicate as one of its raw materials to cater the demand of the consumers in the region [North American Cleaning Institute].

In 2023, over $300 million were roughly spent by the sodium silicate market on modifying equipment and making facilities safe. Furthermore, there is also the concern of legal compliance especially in the European Union where over 400 factories are located which must meet high environmental requirements. Such regulations require ongoing funding to be allocated to both emission control systems as well as waste management systems which can be a huge financial burden. That said, because of the continual improvements in production methods and the increase in the popularity of sustainable products, the sodium silicate sector is expected to grow and company itself would be in position to play a key role in the expanding industrial arena. With industries moving towards more sustainable practices and actively seeking sustainable providers, this allows for sodium silicate to be able to have leverage among many other providers as well as the opening to expand further into the future.

To Get more Insights, Request A Free Sample

Driver: Rising Detergent Demand Boosts Sodium Silicate Market Through Increased Manufacturing Requirements

As a crucial component in the formulation of detergents, the global sodium silicate market has immensely benefited the detergent industry. In 2023, the market constituted a fraction of the global detergent market, which was worth around 120 billion US dollars. Furthermore, over 1.2 million tons of sodium silicate were employed in the production of detergents, indicating the material’s significance. In addition, the compound’s unique capacity to soften water, boost the effectiveness of the cleaning processes as well as prevent washers from rusting means that it is greatly valued in the manufacturing of both domestic and commercial cleaning products. Factors such as increasing urbanization and the rise in the middle-class populace in the Asia-Pacific region and Africa, which makes up about 60% of the worldwide detergent market, drive the growth of the detergent market.

There is increased need for sodium silicate market in the formulation of eco-friendly detergents, owing to innovation in detergent formulations. In the year 2023 alone, a total of upward of 300 new eco-friendly products have been incorporated into the market, many using sodium silicate because of its non-toxic biodegradable nature. Such eco-friendly products which are split up into different categories are made to meet the various EU and North American Agreement regulations, and are already in use in the two continents. As of the United States, a tally of as much as over five hundred thousand households have switched to eco-friendly products utilizing sodium silicate. It is evident that these compounds assist in diversifying the product range to that of meeting environmental sustainability targets.

Moreover, sodium silicates physical and chemical properties to perform in high temperature, pH and hydrothermal conditions has enhanced its use as a detergent in the industrial sector. The industrial cleaning industry in the sodium silicate market uses about four hundred thousand tons of sodium silicate a year because it is indispensable for getting rid of absorbed stubborn stains, grease and oil. In 2023, with respect to the US industries; more than one hundred and fifty new formulations of industrial detergents using sodium silicate for the automotive, food processing, hospital sectors were launched. All these new and expansion in the different sectors showcase detergents development in the economy, alongside that pulling up sodium silicates reflection in the economy in the growing market.

Trend: Eco-friendly product demand surges, driving sustainable sodium silicate formulation innovations

There is an increasing need for products that contain sodium silicate and are environmentally sustainable, this is because both consumers and industries are becoming more environmentally conscious. According to research, the global green cleaning product market stood at $10 billion in 2023, with sodium silicate being the inclusion in the formulation of more than 500 new products. These formulations in the sodium silicate market have also witnessed acceptance in areas such as Europe where the nature of environment laws sustains such business prospects. Interestingly, in Germany for instance, about 100,000 households embraced sodium silicate enabled eco-friendly cleaning products, a movement that reflects the changing face of consumerism which is now more sustainable and environment-friendly.

One reason why sodium silicate market has gained preference in eco-friendly products is that it is biodegradable and non-toxic. In fact, sodium silicate is in more than 200 eco-friendly detergent brands across the world due to its ability to improve the efficacy of the cleaning products with little adverse impact on the ecosystem. This trend is again evidenced by the launch of 50 new eco-friendly detergents in North America, most of which will be on the market in 2023 and contain sodium silicate. Set for consumption demand, what the compounds in those products primarily emphasize is the ultimate ease in the fulfilling its purpose – being clean. Products are set for consumption by the environmentally conscious shoppers while maintaining great functionality of the compounds, and flexibility at the same time.

The eco-friendly industry cleaning products using sodium silicate are continuously growing as the industrial sector evolves, with over 100 new formulations introduced in industrial cleaning in 2023. These products are geared towards areas such as automotive and manufacturing, where shifting focus towards sustainability is on the rise. In the cleaning products, for example, in the automotive industry sodium silicate is used in approximately 20% of the formulations. Such developments are influenced by the market forces along with regulations that encourage the use of sustainable technologies making sodium silicates an important ingredient during industrial transformation towards more greener approaches. This also indicates that for numerous industries, including automotive and others, the attractiveness of environmentally friendly products, as well as the demand for them, is steadily rising; sodium silicate helps meet those needs.

Restrain: Manufacturing complexities and corrosive handling require advanced safety protocols and efficient processes

To synthesize sodium silicate, it involves handling dangerous substances which are extremely corrosive hence posing a high risk towards the sodium silicate market, it is not easy. In the year 2023, there were more than 1,000 sodium silicate production plants all over the world across the different countries. Each of them faced some or the other risk when it came to working with materials such as sodium carbonate or silica sand, which are the key raw materials utilized. Such materials require specific parts and also a secure protocol to stop accidents from happening while ensuring that the workers are safe. It has been said that needless to say more than approximately 200 cases reported last year when materials were deemed corrosive and were to be handled in an industrial shift, only making it even more necessary to avail tighter rules in terms of safety.

The overall sodium silicate market poured in more than US$ 300 million securing a good amount of money, all because they wanted to the production process needs more advanced technologies for better security and efficiency. These automated systems also include precise material transfer which over 500 companies have already started using, as stated in the information brought forth. The major purpose of such technology would be to minimize any human error that could arise, along with creating a safe environment, however the financial aspect of it still is a concern for small scale manufacturers.

Additionally, regulatory compliance adds another layer of challenge during the manufacturing process. As a good example, in the European Union, more than 400 sodium silicate plants are in operation which operate under a comprehensive framework of environmental and safety standards that need, to a certain extent, per the investments aimed at compliance. These measures were put in place to reduce the harm done to the environment and to maintain safe operations and have resulted in the installation of new waste treatment and emission control facilities in more than 150 plants.

Segmental Analysis

By Type

Based on type, the liquid segment accounted for more than 85% share of the sodium silicate market in 2023. The wide application of Liquid sodium silicate is well emphasized by the fact that it consumed in over 10,000 construction works across the globe in 2023. The compound, in turn, has also helped the production of over 2 million tons of cement in the same year, which demonstrates its role in improving the quality of construction materials. In the automotive sector, around 500,000 brake linings were produced out of this silicate solution in 2023 due to its high thermal stability. Equally, the detergent industry consumed over 1.2 million tons of liquid sodium silicate, which demonstrates the importance it has towards cleaning products. Most importantly, however, due to the recent advancements in production technologies, the sector has managed to cut back on the amount of carbon emissions produced, by approximately 30,000 tons, which is a step towards attaining eco-friendliness.

The liquid sodium silicate market has grown as a major component across more than 200 product formulations and that, in turn, has driven the demand to be a part of cleaning agents across 50 nations. In addition, a progression in the technology behind sodium silicate liquid has also resulted in enhanced version being able to be used by more than 100 industrial applications. Both of these moves show that there is a trend towards greater efficiency and greener industrial solutions where the use of liquid sodium silicate has been critical. Silicate’s market is projected to grow at a global scale, with expectations of usage growing to 15 million tons by the year 2024. Such growth is as a direct result of the demand posed by the construction industry, especially in developing countries where urbanization is on the rise. In the water treatment sector, liquid sodium silicate is utilized in approximately 1500 institutions across the globe, making it useful in ecological solutions.

By Grade

The alkaline sodium silicate market remains strong and is poised to keep dominating the market with over 80.8% market share during the forecast period as its nearly 3 million tons of output annually finds usage in detergents, adhesives and silica gel as an input. It is particularly interesting to note that the detergent industry alone accounts for the consumption of approximately 1.5 million tons, which highlights its importance in the radical increase of cleaning. In terms of the construction industry as a whole, more than 5,000 projects employ alkaline sodium silicate for soil stabilization or as a sealant that increases the durability of the building materials. Also, it has been estimated that over 20 million tires have been produced in which alkaline sodium silicate was used and its adhesion characteristics were of great demand. These statistics are evidence of the numerous possibilities as well as importance of the compound in the contemporary technological advancement.

Alkaline sodium silicate market has found extensive use as a fireproofing agent in over 10 million square regards of construction space, thereby adding to the safety norms of construction activities. The cost savings of around 200 million dollars a year due to using it as a binding agent in several building materials significantly reduced the construction expenditure. Thanks to the use of alkaline sodium silicate by the automotive industry in the production of tires, there has been a growth of 10 percent in tire performance, which is a plus for millions of vehicles across the globe. Indeed, these various usages highlight the importance of the compound in industrial practices and the possibility of penetrating more unexplored markets in the future.

By Form

Based on form, the sodium silicate market is led by the crystalline segment with over 75% market share. Consuming, selling, buying, and even marketing crystalline sodium silicate has accelerated to new heights in recent times as in 2023, their production was recorded to be a staggering 2 million tons! Reports suggest that out of these millions of tons produced, 800,000 tons are utilized to create detergents which then results in the cleaning products market utilizing more than 30,000 different compositions! Not stopping there, sodium silicate has been in high demand in the construction sector, with over 2 million fireproofing materials being made that significantly improve building’s Defensive features. With the number of sodium silicate constructions and materials increasing, it is evident how integral and useful this particular compound is.

But that's not all, because crystalline sodium silicate is useful for more than just cleaning products as it can be found in more than 1,200 different construction projects within the United States alone! Additionally, around 500,000 square meters of waterproof surfaces have been created due to sodium silicate being utilized as a sealant. Furthermore, crystallizing sodium silicate has established itself in the paper and pulp industry as there are over a hundred production facilities that employ this compound for bleaching and producing high-value paper goods. It is evident that this particular compound is integral in today’s modern industrial standards and practices!

On a supply and demand basis, crystalline sodium silicate market has the desired potential in the Asia-Pacific region, with over 1 million tons yearly consumption across various sectors. This is particularly the case of India and China which have led to increased demand. In North America and Europe, approximately 700,000 tons are consumed, focusing on innovation and sustainability mostly. The introduction of more than 200 products using crystalline sodium silicate attest to the fact that this compound is versatile and its applications are increasing. This trend of a more worldwide distribution of consumption emphasizes the universality of crystalline sodium silicate and its diverse applications across the industries.

By Material

When it comes to the production, the raw material that tops the list no doubt is silica, with its annual consumption exceeding 3 million tons. In line with this, segment is capturing over 75.5% market share of the sodium silicate market. This category encompasses quartz, sand, and precipitated silica. Of the figure, unattached silica contributes about 500,000 tons while silica is most effective in sodium silicate when enhanced purity level and controlled particle size characteristics are possessed in sodium silicate to use it in detergents and adhesives. Such a general practice of the use of these compounds in various industries points their great importance as to the development of sodium silicate.

According to recently emerged patterns, there is an increasing tendency to use more self-sufficient materials, and this in response has prompted the search for other sources of silica in the sodium silicate market. More than 100 projects worldwide are being undertaken in relation to alternative sources approaching rice husk ash that can account for more than 200 million tons of silica. These activities are consistent with the aspirations of the international community towards achieving sustainable development as well as the direction the industry is taking towards green production models. The widespread consumption of compounds based on silica in the construction industry for more advanced material led to the output of more than a million tons of high-strength crushed stone concrete every year, which shows that the silica is a factor of great importance for the advancement of industries.

Silica consumption within the sodium silicate segment is estimated to reach 4 million tons by 2025 and this growth will largely be dependent on the increasing amounts of silica that are being extracted and processed thus leading to a drop of roughly US$ 50 million cut in production costs in the silicate sector. The addition of other new silica sources such as volcanic ashes has the possibility of augmenting the market by an additional 500,000 tons and eventually broaden its range of applications. Such moves demonstrate the movement in the market and the opportunities that lie for future growth and creativity so that it remains applicable in the larger sodium silicate industry.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

Sodium silicate market is consistently strong within the Asia-Pacific region with an annual use of more than 5 million tons in industrial applications and is currently capturing over 48% market share. Given the rapid pace of urbanization and industrial development, especially over the past decades in China and India. On the other hand, European companies are becoming more and more committed to the use of green products based on alkaline sodium silicate, more than a thousand enterprises have begun to use eco-friendly alternatives. North America has also witnessed a growth with the increase in various technological applications in the alkaline sodium silicate industry enabling over 500 new technologies to emerge. These regional trends underline the international character of the market and its responsiveness to the various industrial applications.’’ They consider data obtained from OOC studies as a valuable contribution in helping to predict responses in humans. Another advantage of the use of OOC in the drug development process as mentioned earlier such as shorter time frame as well as reduction of animal studies has made companies to take the necessary steps and progress towards meeting the expectations of the pharmaceutical market.

In terms of revenue share and sodium silicate consumption, North America is the second most dominant sodium silicate market owing to strong industrial applications and powerful manufacturing capabilities. In 2023, the US alone formed more than 81% of the sodium silicate revenue in this region. This region has an annual production ability of around 1,400 kilotons of glass-grade sodium silicate which caters to sundry needs in the construction and manufacturing sectors. The region is home to several major firms that are engaged in sodium silicate production, thereby strengthening the market. The construction sector that utilizes a large quantity of sodium silicate in cement and sealants has been able to utilize more than 500,000 tons on such infrastructure projects every year. Also, the market for industrial sodium silicate is expected to grow in Mexico because the paper and pulp saw. The detergent industry continues to hold a large percentage of use which was moved by the high North American use of sodium silicate containing liquid laundry detergents due to their cleaning properties. Sodium silicate uses are expected to experience tremendous growth in the regions due to strong technological changes and market compliance ensuring the area is economically adaptive even after the regional markets sentiments were said to be bearish early in 2023.

Top Companies in Sodium Silicate Market:

- BASF

- CIECH S.A.

- EVONIK INDUSTRIES AG

- GLASSVEN C.A.

- KIRAN GLOBAL CHEM LIMITED

- MERCK MILLIPORE LIMITED

- NIPPON CHEMICAL INDUSTRIAL CO., LTD.

- OCCIDENTAL PETROLEUM CORPORATION

- PQ GROUP HOLDINGS INC.

- SINCHEM SILICA GEL CO. LTD.

- TOKUYAMA CORPORATION

- Other Prominent Players

Market Segmentation Overview:

By Type

- Solid

- Liquid

By Grade

- Neutral

- Alkaline

By Form

- Crystalline

- Anhydrous

By Material

- Sodium Oxide

- Silica

By End User

- Residential

- Commercial

- Industrial

By Application

- Detergent

- Paper Bonding

- Water Treatment

- Construction Material

- Optical Glass

- Bonding Insulation Material

- Wood Materials

- Metal Sheets

- Fabrication of Foundry Molds

- Silica Gel Packets Moisture Control

- Food Preservation

- Passive Fire Control

- Stone Consolidation

- Welding Electrodes

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia & New Zealand

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2023 | US$ 7.99 Billion |

| Expected Revenue in 2032 | US$ 11.99 Billion |

| Historic Data | 2019-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Unit | Value (USD Bn) |

| CAGR | 4.61% |

| Segments covered | By Type, By Grade, By Form, By Material, By End-User, By Application, By Region |

| Key Companies | BASF, CIECH S.A., EVONIK INDUSTRIES AG, GLASSVEN C.A., KIRAN GLOBAL CHEM LIMITED, MERCK MILLIPORE LIMITED, NIPPON CHEMICAL INDUSTRIAL CO., LTD., OCCIDENTAL PETROLEUM CORPORATION, PQ GROUP HOLDINGS INC., SINCHEM SILICA GEL CO. LTD., TOKUYAMA CORPORATION |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)