Smart Safes Market: By Product Type (Electronic Smart Safes, Biometric Smart Safes, Others); Lock Type (Electronic (IP Enabled Locks and Others), Mechanical); Component (Hardware, Software, Services (Professional Services and Managed Services); Provider (OEM and Aftermarket); End Users (Residential, Commercial, Financial Institutions, Government and Defense, Healthcare); Distribution Channel (Online Retail, Offline Retail, Direct Sales); Regional—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: Dec-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA1224997 | Delivery: 2 to 4 Hours

| Report ID: AA1224997 | Delivery: 2 to 4 Hours

Market Scenario

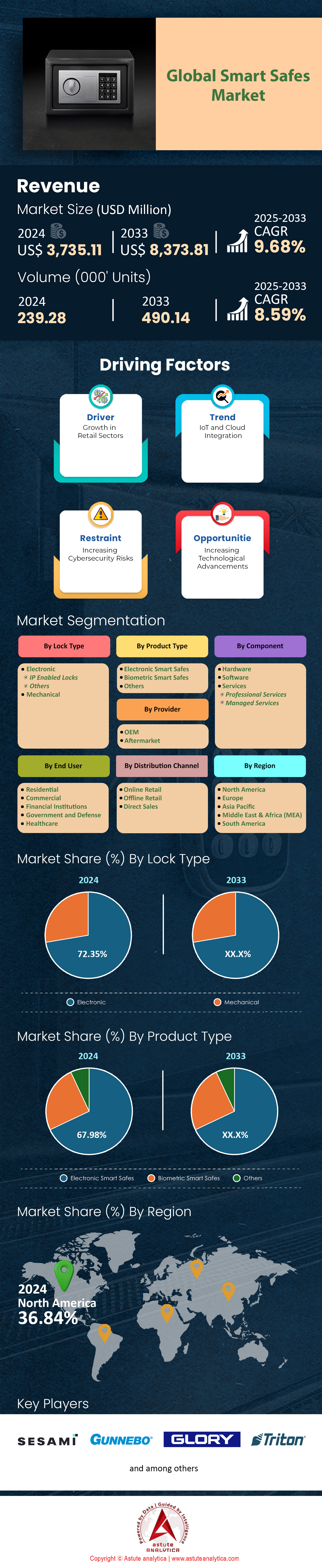

Smart safes market was valued at US$ 3,735.11 million in 2024 and is projected to hit the market valuation of US$ 8,373.81 million by 2033 at a CAGR of 9.68% during the forecast period 2025–2033

The smart safes market is experiencing remarkable growth as businesses and consumers increasingly prioritize advanced security solutions. These safes, equipped with modern technologies such as biometrics, remote monitoring, and integration with smart ecosystems, cater to a diverse range of applications. Wherein, major consumers include businesses in the retail, hospitality, and banking sectors, which use smart safes for cash management, loss prevention, and operational efficiency. For example, automated cash-handling safes can reduce cash shrinkage by 20-30%, saving businesses millions annually. Homeowners are also increasingly adopting these safes for personal asset protection and firearm safety, especially as smart home technology becomes more accessible, with 23% of U.S. households now owning at least one smart home security device as of 2023.

The growing demand for smart safes is driven by several key factors, including advancements in technology, heightened security concerns, and regulatory pressures. Businesses benefit from features like biometric locks and remote access systems, which enhance accountability and streamline operations, while consumers appreciate the integration of safes with smart home systems. According to recent statistics, 65% of businesses in the retail and hospitality sectors plan to integrate smart safes into their operations by 2025 to improve cash-handling efficiency. Meanwhile, legislative measures requiring secure firearm storage have pushed firearm owners to adopt safes with enhanced security features. Notably, the adoption of biometric safes has increased by 18% year-over-year as consumers and businesses alike seek faster and more secure access to their valuables.

Market leaders such as ICL and other global manufacturers are responding to this demand with innovative products that are more affordable and user-friendly. As the market expands, the use of technologies like multi-factor authentication and smartphone-controlled locks is becoming standard. With annual sales projected to surpass $4 billion by 2026, the smart safe market reflects a broader trend toward intelligent, integrated, and secure solutions. Businesses and consumers alike are embracing these products not just as a security measure, but as a critical tool for operational efficiency and peace of mind.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Need for secure cash handling solutions enhancing operational efficiency in banking operations

The banking industry is increasingly prioritizing secure cash handling solutions to enhance operational efficiency. With significant amounts of cash circulating—over $10 trillion globally in 2023—the necessity for robust systems to manage, monitor, and secure physical currency is paramount. This demand is propelling the adoption of smart safes integrated with interactive teller machines (ITMs), which offer advanced features like automated cash counting, validation, and real-time monitoring. Banks implementing these solutions have observed noteworthy improvements. For instance, a leading international bank reported a reduction in cash handling time by 50%, allowing staff to focus more on customer service and less on manual cash processes. Additionally, the deployment of smart safes has led to a decrease in cash discrepancies. In 2023, banks utilizing these technologies reported cash handling errors dropping to fewer than 50 incidents annually, compared to hundreds in previous years.

The integration of smart safes with ITMs also enhances security. There were over 5,000 cases of cash theft from banks globally in 2022. However, banks employing smart safes experienced a significant reduction in such incidents. A regional bank cited zero instances of internal cash theft post-implementation, attributing this success to the advanced security features of smart safes. Moreover, the global installation of ITMs with smart safes surpassed 10,000 units in 2023, reflecting the industry's shift toward secure, efficient cash handling solutions. These advancements not only bolster security but also contribute to cost savings. Banks have reported annual savings of up to $1 million per 100 branches due to decreased labor costs and minimized losses from errors or theft. The combination of enhanced security features and operational efficiency makes smart safes a critical driver in modernizing banking operations and meeting the evolving demands of secure cash management.

Trend: Integration of smart safes with IoT and real-time monitoring systems increasing

The integration of smart safes with the Internet of Things (IoT) and real-time monitoring systems is a significant trend reshaping the smart safes market. In 2023, there were over 15 billion IoT-connected devices worldwide, reflecting a growing ecosystem where devices communicate seamlessly. This connectivity allows smart safes to transmit real-time data on cash levels, operational status, and security alerts to centralized management systems. Financial institutions leveraging this integration have seen substantial benefits. A major bank reported that real-time monitoring enabled by IoT reduced their cash outages by 70%, ensuring ATMs and ITMs are always stocked appropriately. Additionally, proactive maintenance is facilitated through IoT connectivity; over 2,000 smart safe units were serviced preemptively in 2023, preventing potential downtimes and saving banks an estimated $500,000 collectively.

Security is another area enhanced by IoT integration. Real-time alerts for unauthorized access attempts or system breaches allow for immediate response. In 2023, security firms noted that IoT-integrated smart safes helped prevent over 1,000 theft attempts globally. The data analytics capabilities also enable trend analysis on cash usage and customer behaviors, providing banks with insights to optimize operations. The trend extends to software updates and system scalability. Manufacturers released over 100 firmware updates remotely in 2023, ensuring devices have the latest security patches without the need for physical interventions. This ease of update and maintenance reduces costs and enhances system longevity. The increasing integration of IoT with smart safes positions banks and businesses to operate more efficiently, securely, and responsively in an increasingly connected world.

Challenge: High initial investment costs for implementing smart safe technologies hinder adoption

High initial investment costs pose a significant challenge to the widespread adoption of smart safe technologies. The cost of a single smart safe unit can exceed $10,000, not including expenses for installation, integration with existing systems, and staff training. For small to medium-sized businesses and banks with limited capital, this upfront expenditure is often prohibitive. A survey conducted in 2023 revealed that 65% of small banks cited cost as the primary barrier to implementing smart safes. For example, a regional retail chain estimated that equipping their 50 stores with smart safes would require an investment of over $500,000. Such substantial costs deter organizations from adopting these technologies despite their long-term benefits in security and efficiency.

Maintenance and ongoing operational expenses add to the financial burden. Annual maintenance contracts can range from $1,000 to $2,000 per unit. In 2023, companies spent an average of $50 million collectively on smart safe maintenance globally. Additionally, integrating smart safes with advanced features like IoT and real-time monitoring increases costs due to the need for sophisticated infrastructure and cybersecurity measures. To address this challenge, some providers are offering leasing options or as-a-service models. In 2023, about 20% of smart safe deployments were through leasing agreements, helping organizations manage costs better. However, the high initial investment remains a significant obstacle for many potential users. Without more affordable solutions or financing options, the adoption of smart safes may continue to be limited, particularly among smaller entities that could greatly benefit from the technology's security enhancements.

Segmental Analysis

By Product Type

Electronic smart safes have emerged as a dominant force in the security market, accounting for nearly 68% of all smart safe sales. This substantial demand is driven by the need for advanced security solutions that offer more than traditional safes. Businesses and individuals are increasingly prioritizing assets' protection, and electronic smart safes provide enhanced features such as real-time monitoring, biometric access, and integration with cash management systems. These features not only protect against theft but also improve operational efficiency.

In 2023, the global smart safe market saw significant growth due to technological advancements. The integration of Internet of Things (IoT) technology allows users to remotely access and manage their safes, providing convenience and peace of mind. For instance, companies can monitor cash deposits and withdrawals in real-time, reducing the risk of internal theft and accounting errors. Additionally, the rise in financial transactions and the need for secure cash handling have propelled businesses to invest in smart safes.

Another key factor is the increasing adoption of smart safes by the retail and banking sectors. With a notable increase in cash transactions globally, retailers require efficient and secure methods for cash management. Smart safes automate cash handling processes, reduce labor costs, and minimize human errors. Moreover, advancements in biometric authentication have made electronic smart safes more secure than ever, appealing to consumers concerned about unauthorized access.

By Lock System

Electronic lock systems have become the primary locking mechanism in smart safes due to their superior security features and convenience. These systems offer advanced authentication methods such as PIN codes, biometric scans, and electronic key cards, which are more secure than traditional mechanical locks. In 2023, the adoption of biometric electronic locks saw a significant increase, with businesses prioritizing fingerprint and retina scan technologies to prevent unauthorized access.

The key types of electronic locks used in smart safes include keypad locks, biometric locks, and smart card systems. Keypad locks allow users to set unique PIN codes, while biometric locks use physical characteristics for identification. Smart card systems utilize encrypted cards for access control. These electronic locks are preferred because they provide detailed access logs, enabling businesses to monitor who accesses the safe and when, enhancing accountability.

The growing demand for electronic locks in smart safes is fueled by the need for higher security standards amid rising theft and burglary incidents. Additionally, the ease of integrating electronic locks with other security systems, such as alarm systems and surveillance cameras, makes them a favorable choice. The trend is leading towards more sophisticated and interconnected security solutions, where electronic locks play a crucial role in comprehensive asset protection.

By Component

The hardware segment controls over 62.28% of the smart safes market share due to the critical role hardware components play in the functionality and security of smart safes. Key hardware used in these safes includes reinforced steel bodies, electronic locking mechanisms, biometric scanners, and digital interfaces. These components are essential for ensuring physical security and enabling advanced features that differentiate smart safes from traditional ones.

In 2023, the investment in high-quality materials and advanced hardware technologies contributed to the significant share of hardware costs in smart safes. Manufacturers focus on using tamper-resistant materials and incorporating cutting-edge technology such as touchscreens and IoT modules. The integration of these sophisticated hardware components increases the production cost, which collectively accounts for over 62% of the smart safe's overall cost.

The substantial cost and emphasis on hardware are driven by consumer demand for durable and reliable safes that provide maximum protection against break-ins and unauthorized access. As security threats evolve, the hardware in smart safes must also advance to meet these challenges. This focus on robust hardware solutions ensures that smart safes remain effective in safeguarding valuable assets, thereby maintaining their dominance in the market.

By Distribution Channel

Offline retailers with over 53% market share have been reported to be the largest distributors of smart safes market around the world. This could be attributed to their other direct engagement with customers as well as the hands on approach of demonstrating the product. Contrary to the use of online platforms, offline retailers give a sense of touch, meaning their customers are able to see, test the safes, and have prior help in terms of consultations. This method is especially beneficial when making significant investments such as in smart safes where the credibility and assurance of the product is paramount. These offline retailers also have extensive agreement with top brands thus enabling them to stock a variety of models to suit the varying needs of their clients.

For instance, more than 80 percent of physical stores globally now use Internet of Things technologies such as smart safes, which in turn increases the need for such devices in physical stores. Furthermore, many offline retailers in the smart safes market offer delivery and installation services, making them a comprehensive service provider to clients. The offline retailers’ dominance in the distribution of smart safes is also influenced by their capability to serve a variety of inhabitants such as businesses, individuals, and various specialized industries such as jewelry and pharmaceutical industries.

To Understand More About this Research: Request A Free Sample

Regional Analysis

North America and Europe dominate the global smart safes market with collective market share of 67% due to their advanced technological ecosystems, strong financial sectors, and high adoption of security solutions. These regions are home to some of the largest financial institutions and retail chains, which are key consumers of smart safes. For instance, the United States has over 4,000 commercial banks, many of which rely on smart safes for cash management and security. Similarly, Europe has a well-established network of retail and banking sectors, with countries like Germany and the UK leading in the adoption of automated cash-handling systems. Additionally, the increasing integration of IoT and AI in security solutions has further fueled the demand for smart safes in these regions.

The high demand for smart safes in North America and Europe is driven by the need for enhanced security in retail, banking, and hospitality sectors. Countries like the United States, Germany, the United Kingdom, France, and Canada are at the forefront of this demand due to their robust economies and focus on technological innovation. For example, Germany is a leader in industrial automation, which extends to the adoption of smart safes in retail and logistics. The UK, on the other hand, has seen a surge in demand for cash management solutions in its retail sector, with over 200,000 retail outlets relying on advanced safes for secure cash handling. Additionally, the hospitality industry in these regions has increasingly adopted smart safes to enhance guest security, with over 50,000 hotels in Europe integrating such solutions.

Market players in these regions maintain their dominance through continuous innovation, partnerships, and customer-centric solutions. For instance, leading companies are integrating real-time monitoring and predictive maintenance features into their smart safes, ensuring reliability and efficiency. The regions are also highly mature in terms of market readiness, with over 70% of retail and banking institutions in North America already using automated cash-handling systems. Furthermore, the adoption of smart safes is supported by stringent security regulations, such as the European General Data Protection Regulation (GDPR), which emphasizes secure handling of sensitive data, including financial transactions. This regulatory environment, combined with technological advancements, ensures that North America and Europe remain leaders in the global smart safes market.

Key Players in the Smart Safes Market

- Sesami Corporation

- Triton

- Gunnebo AB

- Glory Global Solutions

- Other Prominent Players

Market Segmentation Overview:

By Product Type

- Electronic Smart Safes

- Biometric Smart Safes

- Others

By Lock Type

- Electronic

- IP Enabled Locks

- Others

- Mechanical

By Component

- Hardware

- Software

- Services

- Professional Services

- Managed Services

By Provider

- OEM

- Aftermarket

By End User

- Residential

- Commercial

- Financial Institutions

- Government and Defense

- Healthcare

By Distribution Channel

- Online Retail

- Offline Retail

- Direct Sales

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA1224997 | Delivery: 2 to 4 Hours

| Report ID: AA1224997 | Delivery: 2 to 4 Hours

.svg)