Global Smart Mining Market: By Mine Type (Underground Mining, Surface Mining, Placer Mining, In-situ Mining, and Others); Components (Hardware (Sensors, RFID tags, Excavators, Bulldozers, Drilling Equipment, Mixer & Dump Trucks, and Others) and Software/Solutions (Data & Reporting Management Software and Safety & Security Systems); Components (Connectivity & Analytics Solutions, Fleet Management Solutions, Asset Management Solutions, Remote Management & Logistics Solutions, and Services); Application (Exploration, Mine Production, Processing and Refining, and Others); Region—Market Forecast and analysis for 2024–2032

- Last Updated: 09-May-2024 | | Report ID: AA0723542

Market Scenario

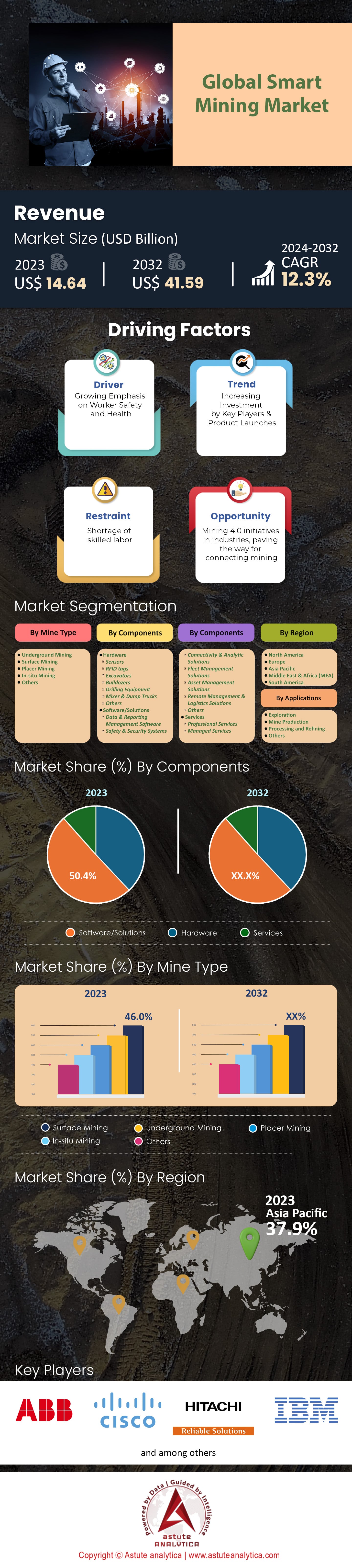

The global smart mining market is valued at US$ 14.64 billion in 2023 and is projected to generate a revenue of US$ 41.59 billion by 2032 at a CAGR of 12.3% during the forecast period 2024–2032.

The global smart mining market has emerged as a robust intersection of technological advancement and traditional industry. Historically perceived as labor-intensive and environmentally taxing, the mining sector is undergoing a transformation with the infusion of smart technologies. This modern approach uses the prowess of the Internet of Things (IoT), automation, Artificial Intelligence (AI), and data analytics to streamline mining processes, ensuring they're more efficient, safe, and environmentally considerate.

Recent years have seen significant shifts in the market. Autonomous drilling and robotic trucks, once concepts of fiction, are now realities, with industry giants like Rio Tinto and BHP leading the charge. The application of cloud computing and big data analytics has reshaped the operational core of many mining operations, presenting opportunities for cost reductions, improved safety, and operational efficiencies. The dynamism of the market can be attributed to various forces. The burgeoning demand for minerals and metals, spurred by global movements towards renewable energies and electric vehicles, has necessitated mining companies to reassess and innovate their extraction techniques.

Simultaneously, as climate change remains at the forefront of global discourse, there is mounting pressure on the mining sector to mitigate its environmental impact. Smart mining offers a viable solution, reducing the industry's ecological footprint and satisfying the increasingly eco-conscious consumer base. Today's consumers and industries demand transparency in their supply chains, prompting mining companies in the global smart mining market to adopt technologies like blockchain to ensure traceability of minerals. This traceability, coupled with real-time monitoring and predictive maintenance, is transforming the landscape of the mining industry.

Moreover, the regulatory environment has evolved in tandem with these changes. Governments worldwide are placing greater emphasis on environmental conservation and worker safety. While these regulations push companies towards smart practices, they also present challenges, particularly for smaller market players who might perceive them as additional operational burdens.

Looking ahead, the smart mining market's trajectory is undeniably upward. The nexus of emerging technologies, including 5G, deeper AI integration, and advanced robotics, suggests an imminent wave of innovation. The alignment of the industry with global sustainable practices and an increasing consumer demand for accountability indicate vast opportunities for smart mining in the near future.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Operational Efficiency and Cost-Reduction

In a competitive global environment, the quest for higher operational efficiency and cost-reduction stands as a primary driver for the smart mining market. Traditional mining operations have always been subject to myriad inefficiencies: machinery breakdowns, worker safety incidents, and operational delays, among others. Such inefficiencies often result in significant financial and time costs. Enter smart mining—a confluence of technologies like IoT, Artificial Intelligence (AI), and big data analytics—which holds the promise of redefining the operational matrix of mining.

For instance, predictive maintenance, empowered by AI-driven algorithms, can anticipate equipment failures, scheduling preemptive repairs and thus reducing downtime. Similarly, real-time data analytics allow for the efficient allocation of resources, be it manpower, machinery, or energy, optimizing output while minimizing wastage. In an industry where even a slight enhancement in efficiency can lead to substantial savings, the allure of smart mining becomes compelling.

Trend: Rising Emphasis on Worker Safety and Health

A notable trend that has permeated the smart mining industry is the rising emphasis on worker safety and health. Historically, mining has been synonymous with hazardous working conditions—from cave-ins to long-term health implications due to exposure to harmful elements. While significant advancements have been made over the decades, the introduction of smart mining technologies promises to revolutionize worker safety standards.

Technologies like wearable sensors can monitor workers' vitals, environmental conditions, and exposure levels to harmful substances, alerting both the worker and the management to any potential threats. Drones and autonomous machinery are increasingly being employed for tasks deemed too dangerous for humans, such as deep-sea mining or working in unstable terrains. Furthermore, Virtual Reality (VR) and Augmented Reality (AR) are being utilized for training purposes, enabling workers to familiarize themselves with potential hazards in a controlled environment before they venture into the actual mines across the global smart mines market.

This trend is not just ethically driven but is also underpinned by economic rationale. Enhanced safety reduces the incidence of accidents, which in turn decreases downtime, potential lawsuits, and insurance premiums. Moreover, a commitment to worker safety can bolster a company's image, facilitating talent acquisition in an industry that often grapples with the challenge of attracting skilled manpower.

Opportunity: Environmental Conservation and Sustainable Mining

The global discourse on climate change and environmental conservation presents both a challenge and an opportunity for the mining sector. As concerns mount over the ecological footprint of industries, mining companies face increased scrutiny, given the historically detrimental impact of mining activities on the environment. This evolving sentiment provides a golden opportunity for the smart mining market.

Smart mining technologies, when deployed effectively, can significantly reduce the environmental impact of mining operations. Techniques such as precision mining ensure that only the required amount of earth is excavated, reducing wastage and minimizing landscape disruption. Water is a critical concern in many mining operations, and smart technologies offer solutions here too—sensors can monitor water quality in real-time, ensuring pollutants are kept within permissible limits.

Beyond immediate ecological concerns, there's a broader perspective on sustainability. For instance, as the world shifts towards electric vehicles and renewable energy, the demand for certain minerals and metals will spike. Smart mining can ensure that these demands are met without disproportionately amplifying the environmental cost. Moreover, with technologies like blockchain, companies can provide complete transparency about the provenance of the mined materials, ensuring ethical and sustainable sourcing.

Segmental Analysis

Regional Analysis

By Mine Type:

Surface mining has been the dominant method for mineral extraction for several decades, and its share is expected to grow further. By 2032, surface mining is projected to reach an impressive 48.6% market share. This growth can be attributed to several factors, such as the accessibility of mineral deposits, relatively lower operational costs, and fewer environmental impacts compared to underground mining methods.

Surface mining methods are particularly prevalent in mining non-metallic minerals, accounting for over 95% of their global production. These minerals include important resources such as sand, gravel, limestone, and phosphate. Additionally, surface mining contributes to more than 90% of metallic mineral production, encompassing vital elements like iron, aluminum, copper, and gold. Moreover, a significant fraction of coal, amounting to more than 60%, is also mined using surface methods.

Despite the dominance of surface mining in the global smart mining market, it is crucial to address the environmental concerns associated with this method, such as habitat disruption, soil erosion, and water pollution. Striking a balance between resource extraction and environmental preservation will be vital for sustainable mining practices in the future.

By Components:

Within the realm of smart mining, the Software/Solutions segment has emerged as the frontrunner, holding a substantial 50.4% share of the global smart mining market in 2023. As technology continues to advance, it is expected to maintain its dominance in the global smart mining market. The adoption of sophisticated software and innovative solutions has revolutionized mining operations, improving safety, efficiency, and productivity.

Advanced software applications enable real-time monitoring and data analysis, allowing mining companies to optimize their processes, detect potential hazards, and make informed decisions. Artificial Intelligence (AI) and Internet of Things (IoT) technologies have also made significant contributions to the growth of smart mining solutions, making operations more streamlined and automated.

The continued dominance of the Software/Solutions segment indicates the industry's increasing reliance on data-driven decision-making and automation, which will likely lead to further advancements in mining practices and safety protocols.

By Application:

In terms of applications, the exploration segment holds the largest share, accounting for approximately 37.8% of the global smart mining market. Exploration is a critical phase in mining operations, where geological surveys and assessments are conducted to identify potential mineral deposits. Smart mining technologies have significantly enhanced the efficiency and accuracy of exploration activities. Integration of AI and data analytics has improved the ability to process vast amounts of geological data, enabling geologists and mining engineers to pinpoint promising areas for further investigation. These technological advancements have led to cost reductions and a more targeted approach to exploration, minimizing the environmental impact.

Moreover, the utilization of unmanned aerial vehicles (UAVs) or drones for aerial surveys and remote sensing has further revolutionized the exploration process in the smart mining market. Drones equipped with advanced sensors can quickly and comprehensively survey large areas, providing valuable geological insights and reducing the need for manual labor in challenging terrains.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

The Asia Pacific region is poised to be the driving force behind the growth of the global smart mining market, boasting the highest Compound Annual Growth Rate (CAGR) and occupying the largest share in the industry. This dynamic growth can be attributed to the region's abundant mineral resources, increasing industrialization, and the adoption of advanced mining technologies. APEC member economies stand out as major players in the mining sector, with an astounding 70% of the world's mining output being produced and consumed within the region. This includes a significant portion of essential minerals such as bauxite, copper, iron, nickel, silver, tin, and zinc, making the Asia Pacific region an indispensable contributor to the global supply chain.

China, India, and Japan, three prominent economies in the region, are leading the way in deploying advanced and smart technologies in the mining industry. These technologies range from data-driven decision-making and automation to the implementation of Artificial Intelligence (AI) and the Internet of Things (IoT). Such innovations are revolutionizing mining operations, enhancing safety, and optimizing efficiency, ultimately contributing to increased productivity. The importance of the mining, mineral, and metal industries within the APEC region is further highlighted by the fact that approximately 75% of all global mining trade and investment occurs within its boundaries. This interdependence underscores the significant role the Asia Pacific countries play in shaping the global mining landscape.

In South America, Chile stands as a prominent player in the smart mining industry, particularly in copper production. Chile hosted Mining Week in 2019, a platform that emphasized the active participation of small and medium enterprises (SMEs) in the mining sector. This focus on inclusivity and collaboration aims to foster sustainable economic development while promoting advancements in mining equipment, technology, and services.

Europe, the second-largest shareholder in the global smart mining market, holds a unique position. The European industry accounts for approximately 20% of the world's mineral consumption, but only 3% of the minerals are produced within the continent. This disparity necessitates cutting-edge technologies to identify and explore mineral deposits efficiently.

To meet the demand for metals and minerals, European countries are embracing newly developed eco-friendly and cost-efficient exploration techniques. Sustainable mining practices have become a priority, driven by environmental concerns and the need to optimize resource utilization. European stakeholders are investing in research and development to implement innovative technologies that minimize environmental impact while ensuring a stable supply of essential minerals.

Top Players in the Global Smart Mining Market

- ABB Ltd

- Cisco Systems Inc.

- Hitachi Construction Machinery Co. Ltd.

- IBM Corporation

- Komatsu Mining Corporation

- Rockwell Automation Inc.

- SAP SE

- Symboticware Inc.

- Trimble Inc.

- Wenco International Mining Systems Ltd

- Other Prominent Players

Market Segmentation Overview:

By Mine Type

- Underground Mining

- Surface Mining

- Placer Mining

- In-situ Mining

- Others

By Components

- Hardware

- Sensors

- RFID tags

- Excavators

- Bulldozers

- Drilling Equipment

- Mixer & Dump Trucks

- Others

- Software/Solutions

- Data & Reporting Management Software

- Safety & Security Systems

- Connectivity & Analytics Solutions

- Fleet Management Solutions

- Asset Management Solutions

- Remote Management & Logistics Solutions

- Others

- Services

- Professional Services

- Managed Services

By Applications

- Exploration

- Mine Production

- Processing and Refining

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Brazil

- Argentina

- Rest of South America

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)