Smart Lock Market: By Lock Mechanism (Deadbolts, Lever Handles, Padlocks, Other Locks); By Technology (Keypad, Smart Card, Biometric, Wireless; By Application (Commercial, Industrial, Residential, Government Institution); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: Mar-2025 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0123344 | Delivery: 2 to 4 Hours

| Report ID: AA0123344 | Delivery: 2 to 4 Hours

Market Scenario

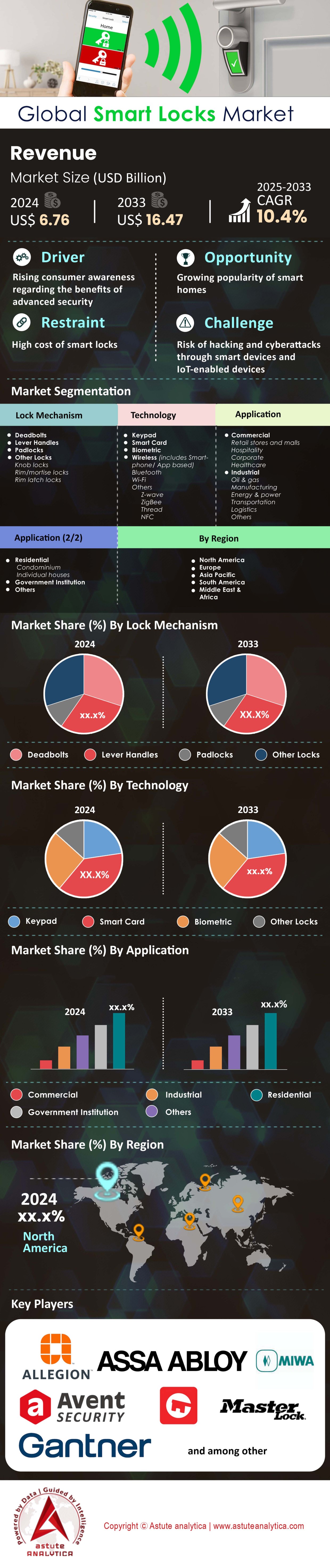

Smart lock market was valued at US$ 6.76 billion in 2024 and is projected to hit the market valuation of US$ 16.47 billion by 2033 at a CAGR of 10.4% during the forecast period 2025–2033.

The smart lock market is experiencing robust growth driven by increasing consumer awareness regarding home security, rapid adoption of smart home technologies, and rising demand for convenience and remote accessibility. Consumers are increasingly shifting from traditional mechanical locks to advanced smart locking solutions that offer enhanced security features, seamless integration with smart home ecosystems, and remote control capabilities via smartphones. The proliferation of IoT-enabled devices and the growing popularity of voice-controlled virtual assistants such as Alexa, Google Assistant, and Siri further accelerate the adoption of smart locks, as users seek integrated, user-friendly, and secure home automation solutions. According to Voicebot.ai, approximately 55% of U.S. households now utilize at least one voice-controlled device, and around 27% of adults interact with their smart devices via voice interfaces monthly, underscoring the growing demand for voice-enabled smart locks (Voicebot.ai Smart Home Consumer Adoption Report, 2023).

Technological advancements continue to significantly shape the smart lock market, with biometric authentication methods such as fingerprint scanning, facial recognition, and voice recognition gaining substantial traction. Currently, around 57% of businesses rely on fingerprint scanning as their primary biometric identification method, reflecting its reliability and popularity in commercial and residential settings (Spiceworks Ziff Davis Biometric Security Trends Report, 2023). Cloud-based smart lock management platforms are also emerging as a key trend, enabling users to remotely manage access permissions, monitor entry logs, and receive real-time security alerts. Furthermore, AI and machine learning technologies are enhancing smart lock capabilities, providing predictive analytics, anomaly detection, and proactive security measures. With nearly 78% of potential homebuyers willing to pay extra for smart home features, the integration of these advanced technologies in locks serves as a significant selling point.

Despite promising growth prospects, the smart lock market faces several challenges, including cybersecurity vulnerabilities, privacy concerns, and interoperability issues among different smart home devices and platforms. Approximately 44% of consumers experiencing technical problems with smart home products cite difficulties in device interoperability, highlighting a critical area for improvement. Moreover, 36% of consumers installing smart home devices report challenges during setup, emphasizing the need for user-friendly installation processes. Manufacturers must address cybersecurity threats, including hacking and data breaches, through robust encryption standards, transparency, and regular software updates. With nearly 97% of smart home device owners reporting satisfaction, addressing these challenges will further enhance consumer confidence and adoption rates.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Rapid Adoption of IoT and Smart Home Technologies (300 words)

The rapid adoption of Internet of Things (IoT) and smart home technologies is significantly propelling the smart lock market forward. Driven by consumers' increasing preference for interconnected devices offering convenience and security, IoT-enabled smart locks have become an essential component of modern homes. Unlike standalone solutions, IoT smart locks seamlessly integrate with broader smart home ecosystems, allowing homeowners to remotely manage access, monitor security, and automate daily routines via smartphone apps or voice-controlled assistants like Alexa and Google Assistant. According to Voicebot.ai's Smart Home Consumer Adoption Report (2023), approximately 55% of U.S. households now utilize at least one voice-controlled device, indicating significant market potential for smart locks integrated within these IoT platforms.

Moreover, as consumers increasingly embrace interconnected lifestyles, the integration of smart locks with devices such as video doorbells, home security cameras, thermostats, and lighting systems enhances overall home automation functionality. This integration provides homeowners with comprehensive security, convenience, and control. For instance, smart lock interactions can trigger lighting adjustments or thermostat changes upon entry or exit in the smart lock market. Furthermore, IoT adoption is driven by improved compatibility standards, including protocols like Matter and Thread, which are designed to facilitate seamless device interoperability across manufacturers. These standardized protocols significantly enhance consumer confidence and simplify the adoption process, further accelerating IoT-enabled smart lock adoption.

Today, it has been found that IoT-enabled smart locks are highly searched by consumers seeking integrated, user-friendly home automation solutions. Popular queries include "best IoT smart locks," "smart lock compatibility with Alexa," and "how IoT smart locks enhance home security." Effective content and marketing strategies targeting these search terms can significantly boost visibility. Therefore, manufacturers who prioritize seamless IoT integration, compatibility, and convenient user experiences will capture substantial market share in the evolving smart home landscape.

Trend: Incorporation of AI and Machine Learning for Predictive Security Analytics

Artificial Intelligence (AI) and Machine Learning (ML) are rapidly transforming smart lock capabilities through advanced predictive security analytics. By analyzing user behaviors, access patterns, and historical data, AI-powered smart locks proactively identify unusual activities or potential security threats, delivering real-time alerts and enhancing overall security. Predictive analytics enable smart locks to distinguish between authorized and suspicious behaviors effectively, significantly reducing false alarms and improving user experiences. For example, AI-enabled smart locks can recognize patterns such as frequent entries at specific hours or identify unusual attempts to access the lock during uncommon times, triggering immediate notifications to homeowners.

Additionally, machine learning algorithms in the smart lock market continuously improve their detection accuracy by analyzing large datasets collected over time, adapting to changes in user behavior and evolving security threats. This adaptive capability ensures smart locks remain effective against emerging threats, providing homeowners and businesses with peace of mind. Furthermore, AI integration allows smart locks to offer personalized user experiences, such as automatically unlocking doors when recognizing authorized users via facial recognition or voice authentication. These personalized features enhance user convenience and satisfaction, driving further adoption. Incorporating AI and ML capabilities into smart locks also represents a powerful opportunity. Consumers increasingly search for advanced security features, using queries like "AI-powered smart locks," "smart locks with predictive analytics," and "machine learning home security." In line with this, manufacturers investing in AI-driven smart locks not only differentiate their products from traditional offerings but also position themselves as forward-thinking industry leaders in home security innovation.

Challenge: Consumer Privacy Concerns and Data Protection Issues

Despite promising advancements, consumer privacy concerns and data protection issues pose significant challenges to smart lock market growth. Smart locks collect sensitive user data, including entry logs, biometric information (fingerprints, faces, voices), and location data. Consumers express heightened concerns regarding potential misuse of personal information, unauthorized access to data, and insufficient transparency regarding data handling practices. High-profile incidents involving data breaches, hacking attempts, and unauthorized data sharing by IoT device manufacturers have further elevated user concerns, underscoring the critical importance of addressing privacy and security comprehensively.

An in-depth report by Spiceworks Ziff Davis (2023) indicates that privacy concerns remain among the top barriers preventing widespread adoption of biometric and IoT-enabled security solutions. Therefore, smart lock manufacturers must prioritize transparent data collection policies, explicit consent mechanisms, and robust encryption standards to protect sensitive information. Compliance with global privacy regulations such as the European Union's General Data Protection Regulation (GDPR) and California Consumer Privacy Act (CCPA) is essential, as consumers increasingly demand clarity and accountability regarding data practices.

Moreover, manufacturers in the smart lock market are trying to educate consumers about data storage, usage, and security practices transparently, building trust through clear communication. Offering features like local data storage options, secure cloud infrastructure, and user-controlled data management settings can empower consumers, alleviating privacy concerns. Therefore, addressing consumer privacy concerns through targeted content strategies—such as blogs, whitepapers, and FAQs answering queries like "smart lock privacy risks," "how secure are smart locks," and "smart lock data protection tips"—can significantly enhance brand credibility and trust. Companies proactively addressing privacy challenges and showcasing transparent data practices will gain competitive advantages, earning consumer trust and driving sustained market adoption.

Segmental Analysis

By Lock Mechanism: Deadbolt Dominance and the Rise of Lever Handles

Deadbolts currently dominate the smart lock market, capturing over 36.6% market share, driven by their superior security features and robust resistance to forced entry. Recent tests by Consumer Reports, including rigorous assessments using a 100-pound battering ram, consistently rank smart deadbolts among the most secure lock types available today. This inherent strength, combined with advanced functionalities such as remote locking/unlocking, real-time intrusion alerts, and detailed access logs, significantly enhances consumer confidence in home security. Leading manufacturers like August Home, Yale, and Schlage have intensified their efforts to integrate deadbolt smart locks seamlessly with popular home automation platforms such as Amazon Alexa, Google Home, and Apple HomeKit. This integration provides users with a centralized, intuitive control system, further solidifying deadbolts' market dominance. Additionally, the deadbolt smart lock segment is projected to experience robust growth, with a CAGR of approximately 21.20%, reaching an estimated market valuation of USD 7,419.47 million by 2029.

Meanwhile, the lever handle segment, although currently trailing deadbolts, is rapidly gaining traction in the smart lock market, with an anticipated CAGR of 11%. Lever handles are increasingly favored in multi-family residential complexes, senior living facilities, and commercial spaces due to their ergonomic design and ease of use, particularly for elderly or disabled individuals. Companies such as Kwikset and Ultraloq are actively innovating in this segment, introducing biometric authentication (fingerprint and facial recognition) and advanced auto-locking mechanisms, significantly enhancing both security and convenience. Furthermore, the rising demand for retrofit smart lock solutions in apartment buildings and shared living spaces positions lever handles as an attractive option due to their compatibility with existing door hardware, facilitating easier and cost-effective installations.

By Technology: Smart Cards Still Strong, But Challengers Emerge

In terms of technology, smart cards continue to lead the smart lock market, accounting for 38.4% of market revenue and projected to grow at a CAGR of 10.9%. Smart cards remain prevalent in commercial and hospitality sectors due to their portability, offline operational capability, and seamless integration with existing access control systems. For instance, hotels and corporate offices widely adopt smart card-based locks from brands like Assa Abloy and Dormakaba, enabling efficient management of guest and employee access, enhancing security, and streamlining operational workflows.

However, emerging technologies are rapidly reshaping the competitive landscape of the smart lock market. Biometric authentication (fingerprint and facial recognition) is gaining significant momentum, driven by heightened security concerns and consumer preference for keyless convenience. Companies such as Samsung, Lockly, and Ultraloq have introduced biometric-enabled smart locks that offer rapid, secure, and personalized access, appealing strongly to tech-savvy residential consumers and high-security commercial environments. Additionally, Bluetooth and Wi-Fi-enabled smartphone-based solutions have become dominant in residential markets, driven by the intuitive user experience and seamless integration with smart home ecosystems. Brands like August Home and Schlage have successfully leveraged smartphone connectivity, allowing users to remotely manage access, monitor entry logs, and integrate locks with broader home automation systems. As prices for these advanced technologies continue to decline, adoption rates are expected to accelerate, further reshaping the smart lock market landscape.

By Application: Residential in the Lead, Commercial Sector Gathers Speed

The residential segment currently leads the smart lock market, holding over 36.8% market share and projected to grow at a CAGR of 11.1%. Homeowners increasingly prioritize convenience, security, and remote accessibility, driving demand for smart locks that eliminate the need for physical keys, facilitate remote guest access, and coordinate deliveries or services without requiring physical presence. Integration with home automation platforms such as Amazon Alexa, Google Home, and Apple HomeKit further enhances consumer appeal, providing centralized control and real-time security monitoring.

In contrast, the commercial sector is rapidly gaining momentum, driven by operational efficiency, enhanced security requirements, and the growing trend of flexible workspaces. Smart locks in commercial environments offer significant advantages, including remote access management for employees and visitors, optimized space utilization, and detailed tracking of entry and exit points. Companies like Assa Abloy, Allegion, and Dormakaba are actively innovating in commercial smart lock solutions, providing advanced features such as audit trails, multi-factor authentication, and integration with enterprise security systems. Moreover, the increasing sophistication of commercial security infrastructure, particularly in sectors such as healthcare, finance, and technology, is expected to further accelerate smart lock adoption. For instance, shared workspaces and coworking facilities increasingly rely on smart locks to manage access efficiently, enhance security, and provide flexible, scalable solutions for tenants. As commercial enterprises continue to prioritize integrated security strategies, the commercial smart lock segment is poised for substantial growth in the coming years.

To Understand More About this Research: Request A Free Sample

Regional Analysis

North America: Technological Leadership and Extensive Consumer Adoption Propel Dominance

In 2024, North America remains the epicenter of the smart lock market with over 34.5% market share, primarily driven by the United States, which constitutes the largest consumer base regionally, followed closely by Canada. Approximately 70% of North American households are projected to adopt comprehensive smart home ecosystems by 2025, with smart locks serving as critical entry points. The region exhibits a high level of consumer awareness regarding home security, evidenced by the fact that over 60% of newly constructed residential properties now incorporate smart locks as standard installations. Market leaders like August Home, Schlage, Kwikset, and Lockly continue substantial investments in R&D, launching advanced products featuring biometric authentication, geofencing capabilities, and seamless integration with Amazon Alexa, Google Assistant, and Apple HomeKit platforms. Despite this growth, significant opportunities remain, particularly in retrofitting older residences, where demand currently outpaces supply of compatible solutions, highlighting a notable market gap manufacturers are actively addressing.

Europe: Robust Regulation and Smart City Initiatives Driving Market Expansion

Europe remains strategically positioned as the second-largest smart lock market globally in 2024, driven by robust consumer adoption in Germany, the UK, France, and the Nordic countries. The European Union’s aggressive push towards smart cities has accelerated demand, with more than 240 active smart city projects across the continent necessitating advanced access control systems. Consumer preference toward energy-efficient, secure, and integrated home solutions has significantly increased, with nearly half of European consumers prioritizing smart security solutions in residential renovations and new builds. Companies such as Assa Abloy, Dormakaba, and Nuki are capitalizing on this trend, launching GDPR-compliant, privacy-focused smart locks compatible with existing European door infrastructure. However, a significant demand-supply gap persists in retrofitting smart locks in older residential buildings, especially historic structures prevalent across Europe. This gap represents substantial untapped market potential, prompting companies to innovate retrofit-friendly solutions tailored specifically to European architectural and regulatory requirements.

Asia-Pacific: Rapid Urbanization and Rising Smartphone Adoption Fueling Accelerated Growth

Asia-Pacific is positioned as the fastest-growing regional segment within the smart lock market at a CAGR of 11.5% driven by accelerated urbanization, expanding middle-class consumer base, and widespread smartphone penetration exceeding 65% by 2026. China, India, Japan, and South Korea emerge as key markets, collectively driving regional demand due to large-scale government initiatives promoting smart city infrastructure, with over 100 ongoing projects necessitating advanced security solutions. Notably, nearly 55% of Asia-Pacific consumers express intent to incorporate smart security devices into their households within the next two years, indicating robust future demand. Regional players such as Xiaomi, Samsung SDS, Godrej, and Panasonic are responding swiftly by launching affordable, region-specific smart lock models featuring mobile app integrations, fingerprint scanners, and facial recognition tailored to local consumer preferences. Despite rapid adoption, a pronounced supply-demand gap exists, particularly in tier-2 and tier-3 cities, creating significant opportunities for manufacturers to expand distribution networks and localized product offerings.

Recent Developments Shaping the Smart Lock Market

- Acquisition of Level Home by Assa Abloy: In a significant move, Assa Abloy acquired Level Home, a prominent manufacturer of smart locks. Level Home had previously raised a total of $171 million over two funding rounds from six investors.

- IKIN Global Funding: In 2024, IKIN Global, an IoT smart lock brand, successfully raised $1 million in a pre-Series A funding round. This round was led by Unicorn India Ventures, demonstrating continued investor interest in smart lock technologies.

- Level Home and Baldwin Partnership: In February 2025, Level Home, known for its invisible smart lock technology, formed a strategic partnership with Baldwin, a premium architectural hardware brand. This collaboration aims to integrate Level's smart home technology with Baldwin's luxury hardware, with the first products expected to launch in late 2025.

- Swidget, Yale, and August Collaboration: In November 2024, Swidget announced a partnership with Yale and August to enhance smart home management. This collaboration allows users to control Yale and August smart locks through the Swidget app, improving property management and security for B2B users in the real estate sector.

- U-tec's Ultraloq Bolt Mission UWB+NFC Launch: In September 2024, U-tec introduced the first smart lock utilizing ultra-wideband (UWB) technology. This innovative product in the smart lock market offers precise location tracking and hands-free access, integrating with major smart home systems like Apple Home and Amazon Alexa.

- Anker Innovations' FamiLock S3 Max: Unveiled at CES 2025, Anker Innovations launched the FamiLock S3 Max, featuring advanced palm-vein reading technology for biometric security.

- Philips 4000 Series Launch: In April 2024, Philips introduced its 4000 Series deadbolt smart lock, offering three different access options and showcasing the company's commitment to versatile smart home solutions.

- Yale's Wi-Fi-Enabled Smart Lock Series: Yale launched a new series of Wi-Fi-enabled smart locks in February 2024, designed for seamless integration with existing smart home systems.

- Assa Abloy's Strategic Moves: While not a 2024 event, it's worth noting that in December 2022, Assa Abloy sold its Yale and August smart lock businesses to Fortune Brands Home & Security for $800 million. This divestiture was part of addressing antitrust concerns raised by the Department of Justice

Top Players in the Global Smart Lock Market

- Allegion plc

- ASSA ABLOY AB

- Aventsecurity

- Cansec Systems Ltd.

- GANTNER Electronic GmbH

- Haven Lock, Inc.

- Master Lock Company LLC

- MIWA Lock Co.

- Mul-T-Lock

- Okidokeys

- Onity, Inc.

- Salto Systems S.L.

- Samsung Electronics Co., Ltd.

- SDS Smart Locks

- SentriLock

- Shenzhen Vians Electric Lock Co., Ltd.

- Spectrum Brands Holdings, Inc.

- UniKey Technologies Inc.

- Weiser

- Wyze Labs, Inc.

- Other Prominent Players

Market Segmentation Overview:

By Lock Mechanism:

- Deadbolts

- Lever Handles

- Padlocks

- Other Locks

- Knob locks

- Rim/mortise locks

- Rim latch locks

By Technology:

- Keypad

- Smart Card

- Biometric

- Wireless (includes Smartphone/ App based)

- Bluetooth

- Wi-Fi

- Others

- Z-wave

- ZigBee

- Thread

- NFC

By Application:

- Commercial

- Retail stores and malls

- Hospitality

- Corporate

- Healthcare

- Industrial

- Oil & gas

- Manufacturing

- Energy & power

- Transportation

- Logistics

- Others

- Residential

- Condominium

- Individual houses

- Government Institution

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- South Korea

- Japan

- Australia & New Zealand

- ASEAN

- Malaysia

- Myanmar

- Philippines

- Singapore

- Thailand

- Vietnam

- Indonesia

- Cambodia

- Rest of ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

View Full Infographic

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2024 | US$ 6.76 Bn |

| Expected Revenue in 2033 | US$ 16.47 Bn |

| Historic Data | 2020-2023 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Unit | Value (USD Bn) |

| CAGR | 10.4% |

| Segments covered | By Lock Mechanism, By Technology, By Application, By Region |

| Key Companies | Allegion plc, ASSA ABLOY AB, Aventsecurity, Cansec Systems Ltd., GANTNER Electronic GmbH, Haven Lock, Inc., Master Lock Company LLC, MIWA Lock Co., Mul-T-Lock., Okidokeys, Onity, Inc., Salto Systems S.L., Samsung Electronics Co., Ltd., SDS Smart Locks, SentriLock, Shenzhen Vians Electric Lock Co., Ltd., Spectrum Brands Holdings, Inc., UniKey Technologies Inc., Weiser, Wyze Labs, Inc., Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0123344 | Delivery: 2 to 4 Hours

| Report ID: AA0123344 | Delivery: 2 to 4 Hours

.svg)