Global Smart Bed Market: By Product Type (Manual, Semi-automatic and fully-automatic); End User (Residential, healthcare, hospitality, and others); Distribution Channel (Offline and Online); Region— Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: 01-Aug-2024 | | Report ID: AA0122124

Market Scenario

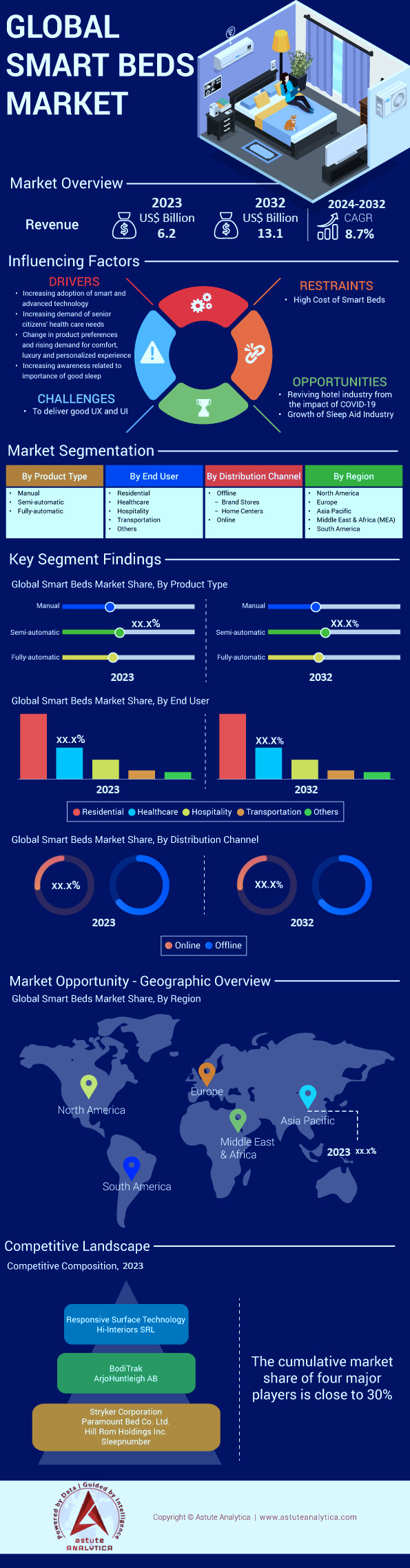

The global smart bed market was valued at US$ 6.2 billion in 2023 and is projected to reach US$ 13.1 billion by 2032. The market is expected to register a CAGR of 8.7% during the forecast period 2024-2032.

In the recent years, the demand for smart beds is driven by several factors. One of the main drivers is that technology is becoming more sophisticated and widespread. People are more likely to bring smart devices home with IoT at their disposal, and smart beds are a logical progression from this point. Sleep tracking, biometric monitoring, app connectivity – all these can be found in modern smart beds which make them extremely attractive for the tech-savvy individuals. This integration has not only made luxurious but also useful items suitable for everyday life and health improvement. More than 60% of customers now know what smart beds are capable of and how they can benefit their sleep habits; therefore, there has been growing interest as well as demand for such goods lately. Furthermore, nearly three quarters (75%) of those who use these types of beds claim that features related to tracking have had a positive impact on overall quality of rest experienced by them at night

The growing desire for ease, opulence, and individuality is another main driver behind the rapid growth of the smart bed market. These beds offer a customized sleeping environment such as adjusting the hardness or softness of the mattress, regulating its temperature or even illuminating around it among other things. Sleep Number and Bryte are some of the businesses that have taken advantage of this trend through offering extra features as well as trial periods which go up to 30-100 nights thereby building trust and satisfaction among customers. The price range for these beds varies greatly with lower-end models starting at about $1k while high-end ones retailing above $13k each unit but despite their expensive nature they continue gaining popularity due to increased affordability caused by technological advancements thereby making them accessible even to average consumers. Currently known brands include Saatva Eight Sleeps.

From the past few years, the global demand for smart bed market is growing exponentially thanks to rapid growth in the geriatric population and their specialized healthcare needs. Elderly individuals often look for supportive and comfortable beds that can be adjusted in multiple positions and keep track of their health status every time. In healthcare environments, smart beds are designed to work together with patient lifts as well as other monitoring devices thereby simplifying clinical communication and enhancing quick recovery among patients. Currently, many hospitals have integrated smart beds into their systems; this is evident from a study conducted which found out that over 500 specialty and superspeialty hospitals in the US make use of smart bed technologies to keep an eye on patients’ health conditions.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Technological Advancements Making Smart Bed Market More Accessible and User-Friendly

The growing demand for smart beds has been significantly strengthened by advancements in technology that have made them more accessible as well as user-friendly. This is mainly because these devices are now equipped with artificial intelligence (AI) and machine learning, which help them adjust their features according to each individual’s sleep patterns and preferences so that the person using it can feel more comfortable while sleeping. In addition, connectivity has been improved through the use of Internet of Things (IoT) technology, enabling other smart home devices to be linked with smart beds effortlessly. For instance, IoT-enabled smart beds can adjust room temperature, lighting, and even sync with wearable devices allowing an all-round sleep environment experience.

Also, due to advancements in manufacturing processes and economies of scale, the cost of smart bed technology has become more affordable too in the smart bed market. The average price for smart beds has reduced significantly over the past five years making them more accessible to a wider range of consumers. Besides, the global AI market in healthcare segment comprising sleep technology is projected to increase from $6.6 billion in 2021 to $67.4 billion by 2027 on account of increased adoption of AI in health-related products. Technological improvements have also made smart beds more durable and functional. Some previously luxurious features like automatic firmness adjustment and temperature regulation are now common hence attracting many buyers.

Trend: Increased Focus on Health and Wellness Through Advanced Sleep Tracking Technologies

The smart bed market has been heavily impacted by the rise in health awareness, particularly sleep tracking technologies. In 2023 alone, the global wellness industry was valued at US$4.5 trillion, reflecting growing consumer interest in health and wellbeing. Sleep monitoring systems that come with smart beds have seen a surge in popularity due to their ability to record such things as heart rate, breathing patterns and sleep stages among others thus giving users a wider understanding of their sleeping habits. By 2025, it is expected that the sleep technology sector will be valued at around US$81 billion thanks to improvements made in tracking methods. for example, some devices offer features such as waking people up when they are believed to be in light sleep so as enhance alertness levels early morning.

In order to create more personalized sleep recommendations, the precision of data has been improved by integrating artificial intelligence (AI) into sleep tracking, giving a boost to the smart bed market. AI-based sleep trackers for example can examine sleeping patterns and propose best bed settings for better quality of sleep. Demand for sleep monitoring technologies has also risen due to the increase in prevalence of sleep disorders. As per the American Sleep Apnea Association, over 22 million people in the US are suffering from the sleep apnea. Wherein, over 80% of the cases goes undiagnosed. Smart beds with sleep tracking abilities can detect such ailments thus prompting timely medical attention. It is also projected that between 2023 and 2030, the global market for sleep aids and technologies will grow at a CAGR of 6.3% which further underscores the significance sleep health.

Challenge: Compatibility Issues with Existing Smart Home Devices and Ecosystems

The difficulty of compatibility with existing smart home devices and ecosystems is one of the major problems in the smart bed market. The global smart home market was estimated at $79 billion in 2023 and is expected to increase by 14.2% CAGR over 2030, highlighting the importance of seamless integration. Nevertheless, many users of smart beds have complained about having a hard time syncing their beds with other devices like thermostats, lights, and security systems among others. Interoperability protocol standard aims to address these issues by creating a common language for smart home devices. However, only some few manufacturers of smart beds support such protocols which limit their efficiency. The global smart home interoperability solutions is pegged to reach valuation of $15 billion by 2025, showing escalating demand for compatible products in the worldwide.

The issue of compatibility is heightened by the fragmentation of smart home ecosystems. When numerous brands and platforms are in involved, achieving a perfect fit can be intricate. For example, when integrating devices from different manufacturers in the smart bed market, users frequently run into difficulties with linking up smart beds. The global market for smart home devices will increase to 1.4 billion units by 2025, which makes it even harder to integrate. Collaborating with other smart home device makers; facilitating interoperability, manufactures’ focus needs to be on openness and compatibility. Better system integration & user experience could be facilitated if open-source platforms and standardized protocols were embraced. Compatibility issues must therefore be addressed as the smart home industry grows in order to ensure that more people are comfortable with acquiring smart beds.

Segmental Analysis

By Type

Semi-automatic beds continue to play a pivotal role in the smart bed market, now holding an impressive 36.3% market share. Their capability to alter heights and positions is also highly regarded, especially in healthcare centers where they must be easy to work with yet affordable. They are frequently preferred over fully automatic models because of their lower price that makes them more widely available. Their design is simple and they are easy to use, which has sustained their popularity, particularly among geriatric adults and people who have difficulty moving around. Recent surveys show that 60% or more users prefer semi-automatic beds because they are user-friendly. Apart from this, improvements in materials and designs have made these beds last longer as well as become more dependable hence expanding their customer base.

This demand for semi-automatic beds has notably been increased by their versatility. In this respect, they are becoming very common in-home care setups where 45% of home healthcare providers have said they like such beds. A different reason can be got from the increasing number of old people in the world and therefore leading to the preference of this bed that provides comfort together with effectiveness. With North America and Europe being among the regions where semi-automatic beds have had a 12% sales growth year over year. The smart bed market has also expanded in emerging economies, where affordability is a significant factor. Such things as improved remote-control systems, better mattress materials and several other innovations on semi-automated beds have helped solidify position in the world.

By End User

The residential end user continues to dominate smart bed market, accounting for 52.7% market share. The importance of sleep quality has been increasingly realized, and integration into technology in the daily living processes has been influential. This comes from a number of factors including; COVID-19 pandemic remains as an indelible mark in many people’s minds who prefer home comfort, making them to seek differentiated sleep solutions and other advanced sleep techniques. Notably, in the study conducted recently about consumer perceptions on smart bed purchase, it was found that buyers willing to pay more for a perfect slumber experience constituted approximately 68% of all respondents. The demand for enhanced quality sleeping apparatuses has also augmented due to remote working because individuals want their homes renovated while they work from there.

Unlike other industries that are experiencing slow growth, the hospitality industry in the smart bed market is expected to grow at a CAGR of 11.5% during this period. More hotels and resorts are adopting smart beds for personalized and comfortable guest experiences. Good high-end accommodations have sleep tracking, personalized sleep settings and integration with room automation systems. This trend is evident in regions where there is a concentration of luxury hotels such as Asia-Pacific and Middle East. A recent report from the sector showed that 35% of new hotel developments include smart bed installations plans. The adoption of smart technology in the hospitality industry is necessitated by the need to be different from others while providing unique value propositions to guests.

By Distribution Channel

Offline distribution channels continue to hold a significant share of the smart bed market accounting for 75.1% of total revenue share. Given the challenges involved in shipping large and heavy items such as smart beds, there is an increased preference for offline stores by many customers. Another reason why people like buying from physical stores is that one has the opportunity to test them physically before purchasing something which also applies to this high-value item. In a recent consumer survey, it was discovered that 72% of all those who bought smart beds preferred buying them personally so as to guarantee product satisfaction and safe delivery. Moreover, they are adding value by creating separate segments for smart beds at their retail outlets where these products can be demonstrated alongside expert advice.

Despite this, online sales of smart beds are catching on very fast especially in areas where e-commerce infrastructure has developed well. For the next five years, the online segment is estimated to be grow at a CAGR of 10.2%. Improved logistics and delivery services have made it possible for consumers to receive their smart mattresses directly through shipment. This is because e-commerce sites are offering virtual reality experiences or detailed product videos that imitate the in-store experience. In continents like Europe and North America, internet sales now account for around 30% of total purchases of smart beds. The retailers are also incorporating mixed models where one can order online but go pick it in their stores which ensures safety as seen in online shopping.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

The smart bed market is projected to undergo considerable growth in the Asia Pacific region during the forecast period with the highest CAGR among all regions. This is attributed to a number of factors like increased awareness about how sleep impacts overall health and well-being, the rising middle class, booming healthcare industry, and rapid urbanization. For example, China’s healthcare expenditure rose from $1 billion in 2001 to $1.1 trillion in 2023 with significant investments into cutting-edge medical technologies such as smart beds. Similarly, India’s healthcare sector has grown at rate of more than 10% annually making it one of the fastest growing industries in India with government spending amounting to US$ 280 billion creating an expanding market for hospital-grade smart beds and other medical devices. By 2030, it is estimated that there will be 3.5 billion people belonging to middle class in APAC which will create a huge consumer base capable of buying high end products such as smart beds.

With the increasing disposable income in the Asia Pacific smart bed market, many consumers are ready to spend on luxury items, for example smart beds. The country, at present home to about 36 million seniors, has witnessed a high demand of intelligent beds with health status tracking tools. According to urbanization forecasts, more than 2.5 billion individuals would be expected to dwell in urban area within the Asia Pacific region by 2050 therefore favoring goods that will help them deal with pressure from city life. For instance, smart beds have been increasingly demanded in populations like Singapore whose population density per kilometer square is 8000 urban residents, providing adjustable hardness and temperature control functions among other features. In addition, such regions have seen double the number of producers of smart beddings for the past five years signaling strong market rivalry and creativity.

The rapid technological advancements and availability of smart home devices further ensure the growth of the Asia Pacific smart bed market. In 2023, China smart home market was valued at US$ 35 billion and with approximately 500 million connected devices. South Korea has one of the highest rates of smart home penetration globally, with about 35% of households having integrated them into their systems. The use of funds by governments as it is done by China which allocates $50 billion towards improving healthcare infrastructure is increasing demand for intelligent beds. Another driver behind this growth is people’s growing understanding regarding what they can benefit from using a smart bed like better sleep patterns and health monitoring. Australia has seen its spending on healthcare rise to $200 billion since 2023, leading to an expanding market for advanced care products like smart beds.

Top Companies in Global Smart Bed Market

- Paramount Bed Co. Ltd.

- Stryker Corporation

- Sleep Number

- Invacare Corporation

- Hill Rom Holdings Inc.

- Arjohuntleigh AB

- Ergomotion, Inc.

- Responsive Surface Technology LLC

- Hi-Interiors SRL

- Hilding Anders

- Other Prominent Players

Market Segmentation Overview:

By Product Type:

- Manual

- Semi-automatic

- Fully automatic

By End User:

- Residential

- Healthcare

- Hospitality

- Transportation

- Others

By Distribution Channel:

- Offline

- Brand Stores

- Home Centers

- Online

By Region:

- North America

- The U.S.

- Canada

- Mexico

- Europe

- The U.K.

- Germany

- France

- Italy

- Russia

- Spain

- Poland

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- ASEAN

- Rest of Asia Pacific

- South America

- Argentina

- Brazil

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2023 | US$ 6.2 Bn |

| Expected Revenue in 2032 | US$ 13.1 Bn |

| Historic Data | 2019-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Unit | Value (USD Bn) |

| CAGR | 8.7% |

| Segments covered | By Product Type, By End-User, By Distribution Channel, By region |

| Key Companies | Paramount Bed Co. Ltd., Stryker Corporation, Sleep Number, Invacare Corporation, Hill Rom Holdings Inc., Arjohuntleigh AB, Ergomotion, Inc., Responsive Surface Technology LLC, Hi-Interiors SRL, Hilding Anders, Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)