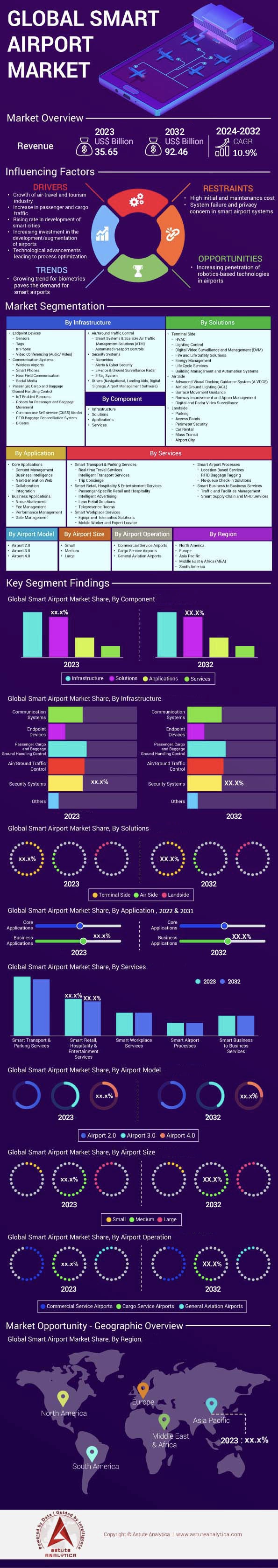

Global Smart Airport Market: By Infrastructure (Endpoint Devices, Communication System, Passenger, Cargo and Baggage Ground Handling Control, Air/Ground Traffic Control, Security System, Others (Navigational, Landing Aids, Digital Signage, Airport Management Software)); Solution (Terminal Side, Air Side, Landside); Application (Core Application, Business Applications); Services (Smart Transport & Parking Services, Smart Retail, Hospitality & Entertainment Services, Smart Workspace Services, Smart Airport Processes, Smart Business to Business Services); Airport Model (Airport 2.0, Airport 3.0, Airport 4.0); By Airport Size (Small, Medium, Larger); Airport Operation (Commercial Service Airport, Cargo Services Airport General Aviation Airports); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: 23-Aug-2024 | | Report ID: AA1121102

Market Scenario

Global smart airport market is poised to generate revenue of US$ 92.46 billion by 2032, up from US$ 35.65 billion in 2023, at a CAGR of 10.9% over the forecast period of 2024-2032.

Smart airports have become pivotal in reshaping the aviation landscape by adopting cutting-edge technology to meet the demands of modern travelers and operators. These airports incorporate IoT, AI, and data analytics to enhance efficiency and passenger satisfaction. For instance, Changi Airport in Singapore utilizes facial recognition for seamless boarding, while Incheon International Airport in South Korea has deployed autonomous robots for cleaning and passenger guidance. The global need for improved passenger experiences, increased security, and efficient operations is driving the demand for these intelligent infrastructures. The surge in global air travel, with billions of passengers flying annually, necessitates smarter airport operations. For instance, Hartsfield-Jackson Atlanta International Airport serves over 100 million passengers yearly, relying on smart tech to manage the flow. The need for robust security has led to biometric systems' widespread adoption, with over 70 airports worldwide using facial recognition to enhance safety, adding fuel to the smart airport market. Furthermore, sustainability is a driving factor, with airports like Oslo Airport integrating eco-friendly technologies, such as electric ground vehicles, to reduce environmental impact. These innovations not only streamline operations but also significantly improve passenger satisfaction by reducing wait times and providing personalized services.

Recent examples of smart airports include Beijing Daxing International Airport, leveraging AI for passenger management, and Hamad International Airport in Qatar, which features a fully automated baggage system. Notably, Heathrow Airport in London has incorporated digital twins to optimize operations, and Dallas/Fort Worth International Airport uses predictive analytics for maintenance. In terms of recent data in the smart airport market, over 50 airports have adopted automated baggage handling systems worldwide. Approximately 200 airports use advanced data analytics to forecast passenger trends, and more than 150 airports have implemented contactless check-in kiosks. The use of mobile apps for navigation and services is prevalent in over 250 airports globally. These developments underscore the transformative impact of smart technologies in modernizing airport operations and enhancing the passenger experience.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Increasing demand for air travel, need for efficient airport operations

The global air travel industry is witnessing unprecedented growth, with over four billion passengers flying annually, according to the International Air Transport Association (IATA). This surge has led to the construction of approximately 450 new airports worldwide over the next few decades, with countries like China and India leading the charge, adding fuel to the growth of the smart airport market. The average number of daily commercial flights has reached nearly 100,000, necessitating efficient airport operations to manage such volumes. Major airports like Hartsfield-Jackson Atlanta International and Beijing Capital International handle over 100 million passengers each year, pushing the boundaries of existing infrastructure. The global fleet of commercial aircraft is expected to double to around 48,000 by 2038, further amplifying the need for smarter airport operations. Meanwhile, the baggage mishandling rate has decreased significantly, with only 5.57 bags per thousand passengers being mishandled, thanks to improved systems.

To accommodate this growing demand in the smart airport market, airports are increasingly investing in technology. The global airport IT spending is projected to reach $4.63 billion, focusing on automation and digital transformation. In tandem, biometrics are being implemented in over 600 airports worldwide to streamline passenger flow. The average time spent by passengers in security checks has been reduced by 30%, owing to automated systems. Furthermore, smart baggage drop systems have been installed in over 300 airports globally, cutting average check-in times by half. As the air travel industry continues to expand, the focus on efficiency becomes paramount, driving the adoption of innovative solutions to meet passenger expectations and operational demands.

Trend: Rising focus on passenger experience

In an era defined by consumer-centric services, the aviation industry is intensifying its focus on enhancing passenger experience. The number of airports incorporating passenger experience as a key performance indicator has risen, with over 1,200 airports worldwide now actively measuring customer satisfaction. The introduction of mobile boarding passes is one such example in the smart airport market, with nearly 1.5 billion passengers opting for this digital convenience last year. Additionally, free Wi-Fi services are now available at over 80% of the world's busiest airports, addressing a critical demand from travelers. Furthermore, the proliferation of airport lounges, which now number over 1,200 globally, offers travelers a respite from the hustle and bustle of terminal environments.

Airports are also integrating advanced technologies to elevate the passenger journey. Virtual reality (VR) and augmented reality (AR) experiences are being piloted in 150 airports to guide passengers through terminals. Automated passport control kiosks, numbering over 1,500 in North America smart airport market alone, have significantly reduced wait times. There's also a notable increase in contactless payment options, available at over 90% of airport retail outlets, catering to a tech-savvy traveler demographic. Enhanced wayfinding solutions, such as interactive maps and digital signage, are now employed in more than 600 airports globally, ensuring passengers navigate with ease. As the aviation industry evolves, the focus on a seamless, enjoyable passenger experience remains a top priority, driving innovations that redefine air travel.

Challenge: High implementation costs, data security concerns, regulatory hurdles

The implementation of smart technologies in smart airport market is fraught with challenges, primarily centered around high costs, data security, and regulatory hurdles. The average cost of deploying a comprehensive smart airport solution can exceed $100 million, a significant investment for many airports. In 2023, global airport security equipment spending reached $3.2 billion, underlining the financial burden of maintaining security while adopting new technologies. Data breaches remain a critical issue, with over 500,000 cyber incidents reported across the aviation sector in the last five years. The implementation of General Data Protection Regulation (GDPR) compliance measures has added another layer of complexity, affecting over 250 airports in Europe alone.

Regulatory challenges also pose significant barriers to smart airport market growth. The process of obtaining the necessary approvals for deploying new technologies can take up to two years, stalling innovation. The International Civil Aviation Organization (ICAO) has reported that only about 60 out of 193 member states have fully implemented its recommended standards for smart airport technologies. Moreover, interoperability issues arise, with over 40% of airports facing difficulties integrating new systems with existing infrastructure. As airports navigate these challenges, the need for collaboration among stakeholders, including technology providers, regulatory bodies, and airport authorities, becomes crucial. By addressing these hurdles, the aviation industry can unlock the full potential of smart airports, ensuring they are secure, efficient, and poised for future growth.

Segmental Analysis

By Component

The infrastructure segment dominates the smart airport market with over 44.3% market share primarily due to the significant capital investment required for establishing and maintaining advanced technological frameworks. As of 2023, there are over 800 airports globally that have integrated smart infrastructure, emphasizing the widespread adoption of such technologies. The increasing demand for seamless passenger experiences has led to the deployment of over 1,500 biometric checkpoints worldwide, enhancing security while expediting the boarding process. Moreover, with over 300 airports using automated baggage handling systems, the infrastructure investments are justified by the operational efficiencies these technologies deliver, reducing baggage mishandling incidents significantly.

Another key driver of infrastructure's prominence in the smart airport market is the growing reliance on data-driven decision-making. Airports have installed more than 5,000 sensors for real-time data collection on passenger flow, aircraft movements, and environmental conditions. This data facilitates predictive analytics, optimizing airport operations and reducing delays. Additionally, the shift towards sustainable practices has seen over 200 airports implement smart energy management systems, reducing their carbon footprint by utilizing renewable energy sources and improving energy efficiency. The infrastructure segment, therefore, represents a crucial investment not only in operational efficiency but also in sustainability.

Furthermore, the integration of Internet of Things (IoT) devices has been pivotal in transforming traditional infrastructure into smart systems. Currently, there are approximately 10,000 IoT devices deployed in airports worldwide, enabling enhanced connectivity and automation. This includes over 2,000 smart lighting systems that adjust based on natural light levels and occupancy, thereby conserving energy. The adoption of these technologies is further driven by regulatory requirements and incentives aimed at modernizing airport facilities. As a result, the infrastructure segment continues to expand, buoyed by its role in enabling smart technologies that improve airport operations and passenger experiences. With continued investment and technological advancements, smart airport infrastructure is set to remain a critical component of the market.

By Solution

On the basis of solution, terminal solutions account for the highest 60.2% market share in the smart airport market due to their critical role in enhancing passenger experience and operational efficiency. Terminals are the focal point for passenger interactions, encompassing check-in, security, boarding, and baggage handling. The integration of advanced technologies such as artificial intelligence, IoT, and automated systems in terminals significantly improves these processes, making them more efficient and user-friendly. The demand for seamless and efficient passenger experiences drives airports to invest heavily in terminal upgrades, which include smart security gates, self-service kiosks, and real-time information systems. These investments are capital-intensive due to the need for sophisticated technology and infrastructure to support the high volume of passenger traffic, which is expected to double, reaching approximately 8.2 billion travelers by 2037. Additionally, airports are increasingly deploying biometric systems, with over 60 major airports worldwide having implemented such technology, further emphasizing the focus on terminal enhancements.

Moreover, terminals are pivotal in generating non-aeronautical revenue in the smart airport market, which is crucial for airports to cover operational costs. This includes retail, dining, and other passenger services that are predominantly located within terminal areas, contributing significantly to airports' financial sustainability. For instance, non-aeronautical revenues at major global hubs like Dubai International have surpassed USD 3 billion annually. The focus on enhancing these revenue streams further justifies the significant capital allocation towards terminal solutions. The implementation of smart technologies in terminals not only improves passenger satisfaction but also boosts airport profitability, making them a priority over airside and landside developments. Furthermore, the demand for smart terminal solutions is expected to grow robustly, with over 200 airports worldwide currently undergoing significant terminal renovations or expansions.

By Services

By services, the smart transport & parking services are dominating the smart airport market with revenue share of over 34.8%, which can be attributed to their critical role in enhancing passenger convenience and operational efficiency. As airports globally face increasing passenger traffic—reaching 4.6 billion travelers in 2023—efficient transport and parking solutions have become pivotal. The integration of AI and IoT technologies in smart transport allows for real-time data analysis, reducing congestion and improving traffic flow within airport vicinities. For instance, the deployment of over 1,000 autonomous shuttles at major airports worldwide has significantly reduced wait times for passengers. Furthermore, smart parking systems, which now include over 500,000 IoT-enabled parking spaces globally, offer real-time updates on space availability, streamlining the parking process and reducing the average parking time by 40 minutes. This efficiency not only enhances the passenger experience but also increases the turnover of parking spaces, boosting revenue.

Airports are increasingly investing in these technologies as part of broader smart infrastructure initiatives, with over $12 billion allocated to smart transport and parking projects in 2023 alone. The drive for sustainability in the smart airport market has also seen a rise in electric vehicle (EV) charging stations at airports, with 20,000 new charging points installed in the past year, catering to the growing number of 14 million EVs on the road. Additionally, the rise in ride-sharing services, with airports handling over 2 million ride-share pickups daily, underscores the need for streamlined transport solutions. As airports continue to expand their capacity, with over 200 airport expansion projects currently underway globally, the need for efficient transport and parking services becomes even more vital. This not only ensures a seamless travel experience but also positions airports as modern, connected hubs capable of meeting future demands.

By Applications

The business application segment of the smart airport market is experiencing significant growth and is currently accounting for over 55.7% market share due to several factors that make it more capital-intensive compared to core applications. Business applications, such as real-time travel services, route switching, and valet parking, are increasingly in demand as they enhance passenger experience and operational efficiency. These applications require substantial investment in advanced technologies and infrastructure to support seamless integration and real-time data processing. The need for continuous updates and maintenance of these systems further adds to their capital intensity. The rise in self-service and automated processes, driven by passenger demand for convenience, necessitates sophisticated software and hardware solutions, contributing to higher costs. As a result, airports worldwide are prioritizing these business applications to remain competitive and meet evolving traveler expectations.

The demand outlook for business applications in smart airport market is promising, driven by global trends in air travel and technological advancements. The expansion of airport infrastructure, particularly in emerging regions like Asia Pacific, is a key driver, with governments investing billions in smart solutions to enhance capacity utilization. The international segment holds the largest market share in airport handling services, highlighting the importance of business applications in managing global passenger traffic efficiently. Despite a drop in global air connections to approximately 20,000 routes in 2021, compared to pre-pandemic levels, the industry is rapidly recovering. The number of active aircraft fleets has grown to over 25,000, further emphasizing the need for efficient airport operations. Furthermore, airport investments in digital technologies have reached nearly US$ 10 billion annually, focusing on areas like passenger flow management and baggage handling systems. As airports continue to prioritize passenger experience and operational efficiency, the demand for business applications is likely to remain strong, supported by ongoing technological innovations and infrastructure developments.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

North America continues to dominate the global smart airport market by capturing over 35% of the market share. Wherein, the United States playing a pivotal role. Recent data shows that the U.S. alone has over 60 airports actively integrating IoT and AI technologies to enhance operational efficiency and passenger experience. The Federal Aviation Administration (FAA) has earmarked $1.5 billion for smart airport initiatives, focusing on upgrading digital infrastructure and implementing AI-driven systems. Additionally, more than 70% of major U.S. airports have adopted Big Data analytics to optimize business processes and improve passenger services.

The region's commitment to innovation in the smart airport market is further evidenced by the deployment of over 200 biometric systems across airports, facilitating faster and more secure passenger processing. The U.S. is also leading in the adoption of autonomous vehicles within airport premises, with 15 airports currently testing self-driving shuttles for passenger transport. Furthermore, the integration of 5G technology is underway in 25 airports, promising enhanced connectivity and real-time data exchange capabilities. Canada is also making strides, with Toronto Pearson International Airport investing in a $500 million smart airport project aimed at reducing carbon emissions and improving energy efficiency. The airport has already installed over 1,000 energy-efficient lighting systems and is exploring the use of AI for predictive maintenance of airport facilities.

The Asia-Pacific region is experiencing rapid growth in the smart airport market, driven by increasing air passenger traffic and the need for advanced airport technologies. Recent statistics indicate that the region handled over 5 billion passengers last year, underscoring the demand for efficient airport operations. China is at the forefront, with plans to build 30 new smart airports by 2030, supported by a $20 billion investment. This initiative includes deploying 5G networks, expected to connect over 300 million devices across airports, enhancing communication and operational efficiency. Japan's Tokyo International Airport (Haneda) is advancing its Smart Airport Project, incorporating AI-powered security checks that have reduced processing times by 40%. The airport is also testing robotic assistants to aid passengers, with 50 units currently in operation. South Korea is not far behind, with Incheon International Airport investing in a $1 billion smart airport upgrade, focusing on AI-driven baggage handling systems that have decreased mishandling incidents by 25%.

India smart airport market is also witnessing an influx investment, with the government allocating $2 billion for smart airport projects across 20 airports, aiming to improve passenger experience and operational efficiency. The country has already implemented over 500 self-service kiosks for check-in and baggage drop, streamlining passenger flow. Apart from this, Australia is enhancing its airport infrastructure, with Sydney Airport investing in a $300 million project to integrate renewable energy sources, aiming to reduce its carbon footprint by 30%. The airport has installed over 2,000 solar panels and is exploring the use of AI for energy management.

Top Players in Global Smart Airport Market:

- Adelte

- Ascent Technology Inc.

- Amadeus IT Group SA

- Ansul

- Cisco System

- Collins Aerospace

- Deerns Airport System Consultants

- Daifuku Co., Ltd.

- Sensec Solution AS (Initially DSG Systems)

- FB Technology

- Honeywell International, Inc.

- Huawei Technologies Co., Ltd.

- IBM Corporation

- Indra

- SITA

- Lufthansa Systems GmbH & Co. KG.

- QinetiQ

- RESA

- S.A.S.

- Sabre Corporation

- Selex ES

- Siemens AG

- T-Systems

- Thales Group

- Vanderlande Industries

- Vision-Box

- Wipro Limited

- Zensors

- Other Prominent Players

Market Segmental Overview:

By Component

- Infrastructure

- Solutions

- Applications

- Services

By Infrastructure

- Endpoint Devices

- Sensors

- Tags

- IP Phone

- Video Conferencing (Audio/ Video)

- Communication Systems

- Wireless Airports

- Smartphones

- Near Field Communication

- Social Media

- Passenger, Cargo and Baggage Ground Handling Control

- IoT Enabled Beacons

- Robots for Passenger and Baggage Movement

- Common-use Self-service (CUSS) Kiosks

- RFID Baggage Reconciliation System

- E-Gates

- Air/Ground Traffic Control

- Smart Systems & Scalable Air Traffic Management Solutions (ATM)

- Automated Passport Controls

- Security Systems

- Biometrics

- Alerts & Cybersecurity

- E-Fence & Ground Surveillance Radar

- E-Tag System

- Others (Navigational, Landing Aids, Digital Signage, Airport Management Software)

By Solutions

- Terminal Side

- HVAC

- Lighting Control

- Digital Video Surveillance and

- Management (DVM)

- Fire and Life Safety Solutions

- Energy Management

- Life Cycle Services

- Building Management and Automation Systems

- Air Side

- Advanced Visual Docking Guidance System (A-VDGS)

- Airfield Ground Lighting (AGL)

- Surface Movement Guidance

- Runway Improvement and Apron Management

- Digital and Radar Video Surveillance

- Landside

- Parking

- Access Roads

- Perimeter Security

- Car Rental

- Mass Transit

- Airport City

By Application

- Core Applications

- Content Management

- Business Intelligence

- Next-Generation Web

- Collaboration

- Integration

- Business Applications

- Noise Abatement

- Fee Management

- Performance Management

- Gate Management

By Services

- Smart Transport & Parking Services

- Real-time Travel Services

- Intelligent Transport Services

- Trip Concierge

- Smart Retail, Hospitality & Entertainment Services

- Passenger-Specific Retail and Hospitality

- Intelligent Advertising

- Lean Retail Solutions

- Telepresence Rooms

- Smart Workplace Services

- Equipment Telematics Solutions

- Mobile Worker and Expert Locator

- Smart Airport Processes

- Location-Based Services

- RFID Baggage Tagging

- No-queue Check-in Solutions

- Smart Business to Business Services

- Traffic and Facilities Management

- Smart Supply-Chain and MRO Services

By Airport Model

- Airport 2.0

- Airport 3.0

- Airport 4.0

By Airport Size

- Small

- Medium

- Large

By Airport Operation

- Commercial Service Airports

- Cargo Service Airports

- General Aviation Airports

By Region

- North America

- US

- Canada

- Mexico

- South America

- Argentina

- Brazil

- Rest of South America

- Europe

- The U.K.

- Germany

- France

- Spain

- Italy

- Russia

- Poland

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia & New Zealand

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa

- U.A.E.

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2022 | US$ 35.65 Bn |

| Expected Revenue in 2031 | US$ 92.46 Bn |

| Historic Data | 2019-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Unit | Value (USD Bn) |

| CAGR | 10.9% |

| Segments covered | By Component, By Infrastructure, By Solutions, By Application, By Services, By Airport Model, By Airport Size, By Airport Operation, By Region |

| Key Companies | Adelte, Ascent Technology Inc., Amadeus IT Group SA, Ansul, Cisco System, Collins Aerospace, Deerns Airport System Consultants, Daifuku Co., Ltd., Sensec Solution AS (Initially DSG Systems), FB Technology, Honeywell International, Inc., Huawei Technologies Co., Ltd., IBM Corporation, Indra, SITA, Lufthansa Systems GmbH & Co. KG., QinetiQ, RESA, S.A.S., Sabre Corporation, Selex ES, Siemens AG, T-Systems, Thales Group, Vanderlande Industries, Vision-Box, Wipro Limited, Zensors, Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)