Global Sintered Porous Plastic Filters Market – (By Material - Ultrahigh molecular weight polyethylene (UHMWPE), High density polyethylene (HDPE), Low-Density Polyethylene (LDPE), and others; By Application – Filter, Applicators, and others; and By Region) - Industry Dynamics, Market Size and Opportunity Forecast, 2027

- Last Updated: Jan-2023 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0122123 | Delivery: 2 to 4 Hours

| Report ID: AA0122123 | Delivery: 2 to 4 Hours

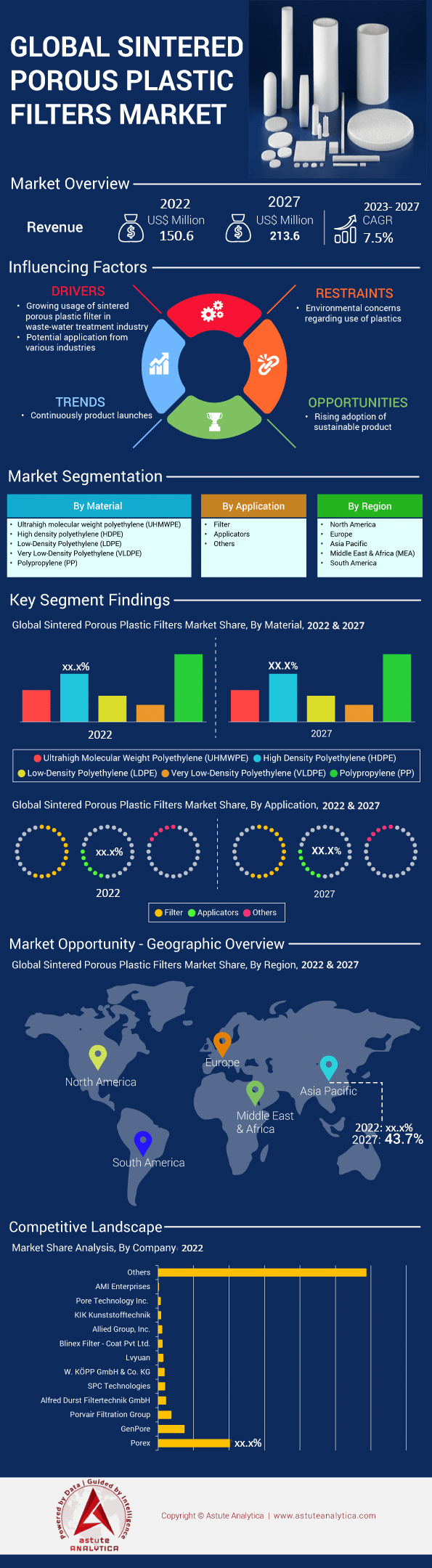

Global sintered porous plastic filters market generated a revenue of US$ 150.6 Million in 2022 and the revenue is estimated to reach US$ 213.6 Million by 2027, at a healthy CAGR of 7.5% during the projection period, 2023–2027.

The key drivers for the growth of this market are increasing demand for efficient filtration solutions in various industrial sectors such as mining, water treatment, and chemical industries, as well as rising concern about environmental impacts of conventional filters. In addition, technological advancements such as development of superior materials and reduced manufacturing costs are also contributing to the growth of this market.

To Get more Insights, Request A Free Sample

Market Dynamics

Growing Usage of Sintered Porous Plastic Filter in Wastewater Treatment

Water filtering issues are present in industrial hubs around the world with numerous manufacturing businesses headquartered in emerging nations where large quantities of wastewater from the processing industry must be treated before being discharged into water bodies. To safely discharge water into water bodies, this calls for the testing, analysis, filtration, and installation of wastewater treatment plants across businesses. The water treatment industry relies heavily on sintered porous plastic filters because they offer excellent corrosion and chemical resistance. Additionally, the wastewater/solution will be purified, and the odour will be absorbed by the carbon sintered filter.

As a result, the wastewater treatment is holding a sizable share of the global sintered porous plastic filters market. According to the 2017 Infrastructure Report, the US uses 42 billion gallons of water daily for everything from home cooking and bathing to use in workplaces like factories and offices. Due to the mixing of different contaminants in the water bodies, surface waters, which provide 80% of the country's drinking water, require considerable testing and filtering. This, in turn, give a boost the demand for the product in the region.

Market Trends

Frequent Launch of New Products

Sintered porous plastic filters market has been rapidly gaining ground in recent years for a variety of industrial uses, including those in the chemical, medical, wastewater management, textile, food, and other sectors. To foster variety and draw in customers, businesses are adopting cutting-edge marketing & positioning techniques that are anticipated to rise in the future. To obtain a competitive edge, the market's players have consistently embraced ground-breaking marketing techniques.

For instance, to meet the filtration needs of its customers and create new solutions for the markets, Porvair filtration group launched a wide selection of its filtration catalogue.

As a result, most of the leading players in the global sintered porous plastic filters market are investing heavily to develop and launch advanced products. In addition to this, they are paying a significant attention to improve their overall manufacturing capacities.

Restraints

Environmental Concerns Regarding Use of Plastics

Diverse industry manufacturers are concentrating on the introduction of organic and natural materials that are extraordinarily durable and reusable for both personal and business needs. In the past 50 years, there has been a dramatic increase in the manufacturing of plastic, which has resulted in the widespread usage of cheap throwaway goods that are seriously harming the environment.

Today, major companies are under pressure to reduce the flow of plastic-based rods, filers, and other items that are polluting the world's rivers as the environmental impact of that flood of plastic becomes an increasingly important political issue.

The use of plastic is prohibited worldwide by regulatory and governmental entities for this reason. as an example. The government of France and other countries passed a bill in 2019 banning the use of single-use plastic packaging and products beyond 2040.

As a result, the global sintered porous plastic filters market is expected to be hampered by restrictions on the use of plastic filters and other materials in the manufacturing sector.

Segmental Analysis

Material Analysis

By material, polypropylene is projected to hold around 37% share of the global sintered porous plastic filters in the years to come. In 2020, the segment generated a revenue of around US$ 50.33 million and is anticipated to exceed the valuation of US$ 76.55 million by 2027 at a CAGR of 6.6% thanks to its resistance to chemicals and solvents.

Whereas, the ultrahigh molecular weight polyethylene (UHMWPE) category during the anticipated period is anticipated to grow at the highest CAGR of 10.5% due to its high strength, low density, low friction coefficient, and higher fracture toughness.

Application Analysis

Based on application, the sintered porous plastic filters market is dominated by the filter segment by generating over 52.5% of global revenue. By 2027, the segment is anticipated to reach valuation of US$ 107.64 million at a CAGR of 6.5%. The product is majorly used across particulate filtration, gas diffusion or venting, and wicking applications.

Whereas the applicators segment in global sintered porous plastic filters is anticipated to grow at the quickest CAGR of 7.9%. The segment is estimated to generate a revenue of over US$61.74 million by the end of the forecast period on account of growing application the segment in make-up, ink, fragrance, antiperspirant and deodorant applicator heads, and cleaning goods.

To Understand More About this Research: Request A Free Sample

Competitive Landscape:

Top six key players in the global sintered porous plastic filter market held almost 32% share in 2022. Porex, GenPore, Porvair Filtration Group, Alfred Durst Filtertechnik GmbH, SPC Technologies are some of the top players in the market.

The key to success in the SPP industry is developing innovative products that can meet customer needs. To do this, companies must have a good understanding of their target markets and how they want to be perceived by them. They also need to have a strong manufacturing capability and an effective marketing strategy.

Manufacturing processes play an important role in the competitiveness of companies in the sintered porous plastic filter market. Some firms focus on producing high-quality materials at low cost, while others focus on improving processing technologies so that materials can be produced more quickly and at lower costs.

List of Key Companies Profiled:

- Allied Group, Inc.

- AMI Enterprises

- Beltran Technologies, Inc.

- Blinex Filter - Coat Pvt Ltd.

- China Rainbow Porous Filters & Parts

- GenPore

- Industrial Specialties Mfg., Inc.

- International Polymer Engineering

- Lvyuan

- Marian, Inc.

- Pore Technology Inc.

- Porex

- POROYAL

- Porvair Filtration Group

- Saint-Gobain Performance Plastics

- Other Prominent Players

Regional Analysis

By revenue, Asia Pacific held 40% share of the global sintered porous plastic filters market in 2022. Our study also suggests that the region is projected to enjoy growth at the fastest CAGR of 8.9% throughout the projected period. The region generated around US$ 60.9 million in 2022, which is anticipated to grow to US$ 93.4 million by the end of 2027.

One of the main reasons for the region's large production in the global sintered porous plastic filters market is the country's long-standing chemical sector. Wherein, China held a 47.6% market share in 2022. On the other hand, Japan is expected to grow at tge fastest CAGR of 9.8% over the forecast period in the region.

Segmentation Overview

Global Sintered Porous Plastic Filters Market is Sub-segmented into:

By Material

- Ultrahigh molecular weight polyethylene (UHMWPE)

- High density polyethylene (HDPE)

- Low-Density Polyethylene (LDPE)

- Very Low-Density Polyethylene (VLDPE)

- Polypropylene (PP)

By Application

- Filter

- Applicators

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia & New Zealand

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Brazil

- Argentina

- Rest of South America

View Full Infographic

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2022 | US$ 150.6 Mn |

| Expected Revenue in 2027 | US$ 213.6 Mn |

| Historic Data | 2017-2021 |

| Base Year | 2022 |

| Forecast Period | 2023-2027 |

| Unit | Value (USD Mn) |

| CAGR | 7.5% |

| Segments covered | By Material, By Application, By Region |

| Key Companies | Allied Group, Inc., AMI Enterprises, Beltran Technologies, Inc., Blinex Filter - Coat Pvt Ltd., China Rainbow Porous Filters & Parts, GenPore, Industrial Specialties Mfg., Inc., International Polymer Engineering, Lvyuan, Marian, Inc., Pore Technology Inc., Porex, POROYAL, Porvair Filtration Group, Saint-Gobain Performance Plastics, Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

FREQUENTLY ASKED QUESTIONS

Sintered Porous Plastic Filters are made using a process in which porous materials are fused, but not to the extent to which it liquefies. These filters are mostly made up of polyethylene or polypropylene.

Sintered filters are made of bronze, stainless steel, nickel alloy, HDPE Powder material and various other alloys.

The end user industries of the sintered plastic filters are chemical industry, medical industry, automotive industry, textile, food & beverage, waste-water treatment plant and others.

Industrial centers across the world with large number of manufacturing industries are facing water filtration challenges. Sintered porous plastic filter plays a vital role in water treatment industry as it provides high corrosion and chemical resistance. Further, with the use of carbon sintered filter, the filter will absorb the odor and purify the waste-water.

Manufacturing and processing industries are reliably dependent on sintered porous plastic filters for insulating material and heating solutions for many of its applications and processes. Thus, sintered porous plastic filters have wide scope in chemical, pharmaceutical, textile, light, food, machinery, petroleum, and other industries.

Availability of alternative (such as porous aluminum) and environmental concern regarding the use of plastic presents significant challenges for the sintered porous plastic filter market.

During the inception of the COVID-19 pandemic, the global demand for the sintered porous plastic filter market was significantly reduced due to the reduced investments by government and private companies in plastic filter manufacturing, which led to cutbacks in such business lines. However, the end-users of such filters worldwide are also preparing for a post-pandemic scenario, and thus companies are likely to gain significant traction in the upcoming years.

The Global Sintered Porous Plastic Filter Market is segmented into material, application, and region; and the study period of Global Sintered Porous Plastic Filter Market is 2017-2027.

The polypropylene segment is estimated to have the highest market share of 37.0% in 2022. The polypropylene-based sintered porous plastic filters market was valued at US$ 52.1 Mn in 2022.

Based on application, the filter segment contributed the major share of 52.5% in the global sintered porous plastic filters market in 2022. The range of applications of filter in sintered porous plastic filters includes filtering particulate, diffusing, or venting gases or wicking applications, and this is leading to the high share of the segment.

Asia Pacific is projecting the fastest CAGR of 8.9% during the forecast period. The presence of well-established chemical industry in Japan is one of the leading factors for the high manufacturing of sintered porous plastic filters in the region.

The key market players are Porex, GenPore, Porvair Filtration Group, Alfred Durst Filtertechnik GmbH, SPC Technologies, Saint-Gobain, and Blinex Filter - Coat Pvt Ltd. among others.

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0122123 | Delivery: 2 to 4 Hours

| Report ID: AA0122123 | Delivery: 2 to 4 Hours

.svg)