Saudi Arabia Wiring Devices Market: By Product (Current Devices (Electric switches (e.g., light switches, dimmer switches, fan switches), Receptacles (e.g., outlets, plugs), Wire connectors (e.g., splices, crimps), Others); Non-Current Devices (Conduit and fittings, Boxes and enclosures, Wire supports and clamps, Cable ties and connectors, Insulating tape and tubing), Circuit Protecting Devices (Plugs & power outlets, TV/TEL Sockets, Television Plates, Fuse Boxes, Circuit Breakers, and Others); Technology (Smart and Conventional); Voltage (0-100 Watts, 100-300 Watts, 300-600 Watts, Above 600 Watts); Applications (Commercial, Industrial, Residential); Sales Channel (Online (E-commerce Website and Branded Stores) and Offline (Supermarkets/Hypermarkets, Retail Stores, Specialty Stores, and Others)—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: 26-Jul-2024 | | Report ID: AA0724870

Market Scenario

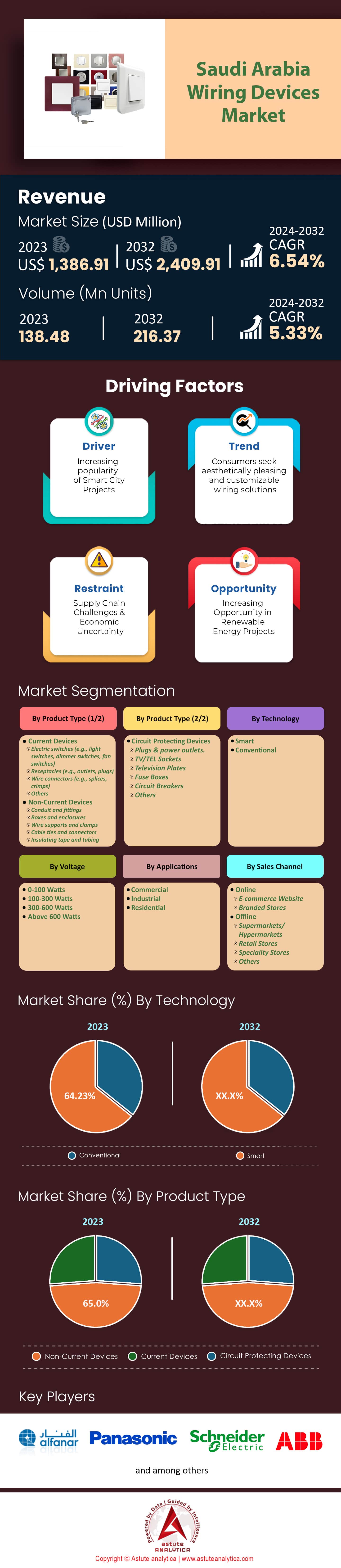

Saudi Arabia wiring devices market was valued at US$ 1,386.91 million in 2023 and is projected to hit the market valuation of US$ 2,409.91 million by 2032 at a CAGR of 6.54% during the forecast period 2024–2032.

The demand for wiring devices in Saudi Arabia is witnessing a significant uptick due to several underlying factors. The country’s electricity generation capacity hit an impressive 82.5 gigawatts in 2023, reflecting a growing need for electrical infrastructure. This rise in capacity is complemented by the Kingdom's ambitious plans to develop smart cities, with Neom alone projected to span 26,500 square kilometers. The construction sector also saw the launch of 700,000 new residential units in 2023, all requiring sophisticated wiring solutions. In the commercial sector, the Saudi government has approved 3,600 new retail licenses, further driving the demand for electrical installations.

Multiple factors are propelling the growth of the wiring devices market in Saudi Arabia. One significant driver is the surge in industrial activities, particularly in the burgeoning manufacturing sector, which now employs over 2.5 million workers. The push towards renewable energy, with the Kingdom aiming to generate 58.7 gigawatts from renewable sources by 2030, also necessitates advanced wiring systems to integrate these new energy sources. The hospitality sector, too, has seen a sharp increase, with 50 new hotels opened in 2023, each requiring extensive electrical systems. Additionally, the rise in data centers, with 30 new facilities added last year, highlights the need for robust electrical infrastructure to support digital growth.

Looking ahead, the demand for wiring devices market in Saudi Arabia is expected to remain strong, driven by the country's continuous infrastructure development and technological advancements. The healthcare sector, which saw the construction of 20 new hospitals in 2023, will further bolster the need for reliable electrical systems. The education sector is also expanding, with 15 new universities under construction, each demanding state-of-the-art wiring solutions. The transportation sector, with 1,200 kilometers of new railway lines planned, and new airport projects, including the Red Sea International Airport, underscore the ongoing expansion of electrical infrastructure. As Saudi Arabia progresses with its Vision 2030 initiatives, the demand for advanced wiring devices will continue to grow, fueled by continuous investments in infrastructure and modernization efforts.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Rising Electricity Demand Due to Population Growth and Urbanization

The wiring devices market in Saudi Arabia is propelled by the rising electricity demand, a direct consequence of rapid population growth and urbanization. The Kingdom's population reached 35 million in 2023, with an annual increase of approximately 500,000 residents. Urban centers like Riyadh and Jeddah are expanding rapidly, with Riyadh's population surpassing 7.5 million and Jeddah's reaching 4.5 million. This urban influx has led to a surge in residential and commercial construction, with over 100,000 new housing units built annually. Consequently, the demand for reliable and efficient electrical wiring systems has skyrocketed, necessitating the use of advanced wiring devices.

In 2023, Saudi Arabia's electricity consumption hit a record high of 300 terawatt-hours, reflecting a significant rise from previous years. The residential sector alone accounts for over 50% of this consumption in the wiring devices market, with new urban development contributing substantially. The average household electricity usage in major cities has now reached 15,000 kilowatt-hours annually. Additionally, the commercial sector, driven by the establishment of new businesses and infrastructure projects, has seen electricity usage increase to 100 terawatt-hours. The government's push for modernizing the electrical grid and reducing energy wastage has also led to the installation of 1.5 million smart meters, further driving the demand for advanced wiring solutions.

Trend: Increased Adoption of Smart Home Technologies and Automation Systems

The wiring devices market in Saudi Arabia is significantly influenced by the rising adoption of smart home technologies and automation systems. In 2023, Saudi Arabia saw the installation of over 150,000 smart home systems, with a projected increase to 200,000 by the end of 2024. This surge is driven by the growing consumer preference for convenience, energy efficiency, and security. Notably, Riyadh and Jeddah are leading the way, with over 75,000 smart homes collectively. As of mid-2024, 50% of newly constructed residential buildings integrate some form of smart technology, emphasizing the market's shift towards automation. The average household in Saudi Arabia now contains 5 smart devices, highlighting the integration of smart wiring systems and interconnected devices.

The government's Vision 2030 initiative has also played a crucial role in this trend in the wiring devices market, encouraging technological advancements and modern infrastructure. Investments in smart city projects, such as NEOM, have further boosted the demand for advanced wiring devices to support smart home applications. In NEOM alone, over 10,000 smart homes are under construction, each equipped with state-of-the-art wiring systems. The smart thermostat market has seen a sales increase of 20,000 units in the last year, while smart lighting systems have recorded over 30,000 installations in the same period. The growth of the Internet of Things (IoT) sector, with over 1 million IoT devices now operational, has necessitated advanced wiring solutions to ensure seamless connectivity and functionality.

Challenge: Ensuring Compliance with Safety and Quality Standards in Installations

One of the major challenges facing the wiring devices market in Saudi Arabia is ensuring compliance with safety and quality standards during installations. The Kingdom has witnessed over 200,000 new electrical installations annually, with a noticeable number of these failing initial safety inspections. This has raised concerns about the quality of wiring devices and the expertise of electricians. In 2023 alone, there were 5,000 reported cases of electrical fires, attributing a significant portion to faulty wiring and substandard installation practices. The Saudi Standards, Metrology and Quality Organization (SASO) has mandated stringent guidelines, yet compliance remains a critical issue, with only 60% of installations meeting the desired standards on the first inspection.

To address these challenges in the wiring devices market, the government has intensified its focus on training and certification programs. In 2023, over 10,000 electricians underwent additional training to meet the new regulatory standards. Furthermore, SASO has increased the number of quality checks, conducting over 20,000 inspections annually. Despite these efforts, the market still faces issues with counterfeit products, with over 50,000 substandard wiring devices seized in 2023 alone. This has led to a push for better supply chain monitoring and stricter penalties for violations. The introduction of advanced testing laboratories, which have conducted 5,000 product tests in the past year, aims to ensure that only high-quality wiring devices are used in installations, promoting safety and reliability.

Segmental Analysis

By Product Type

Based on product type, the non-current devices segment is leading the market with over 65.0% market share. The country has been experiencing significant growth in the construction sector, with over 5,000 active construction projects underway as of 2023. This surge in construction activities has increased the demand for advanced electrical systems. The Saudi government has allocated over 1 trillion SAR for infrastructure projects, further driving the need for non-current devices. Additionally, Saudi Arabia's adoption of renewable energy sources, such as the 2,060 MW solar power plant in Mecca, requires sophisticated wiring devices to manage the energy efficiently. The expansion of the electric vehicle (EV) market, with over 200,000 EVs on Saudi roads by 2024, also necessitates advanced electrical infrastructure, further boosting the demand for non-current devices.

Moreover, the emphasis on safety and reliability in electrical systems has made non-current devices more favorable. The Saudi government has implemented stringent safety regulations, such as mandatory compliance with SASO (Saudi Standards, Metrology and Quality Organization) standards, which has increased the adoption of high-quality non-current devices, giving a boost to the wiring devices market growth. The country has invested over 50 billion SAR in smart grid technology to enhance the reliability and efficiency of the electrical grid. The integration of Internet of Things (IoT) technology in buildings, with over 1,500 smart buildings in Riyadh alone, requires advanced non-current devices for seamless operation. Furthermore, the increasing number of data centers, with over 50 new data centers built in the last two years, demands reliable electrical systems, making non-current devices essential for uninterrupted power supply.

By Voltage

On the basis of voltage, the 100-300 Watts segment is leading the wiring device market with over 34.69% market share and is also expected to hold its dominant position in the years to come by growing at highest CAGR of 7.48%. The rising popularity of 100-300 watt wiring devices in Saudi Arabia can be attributed to a confluence of technological, economic, and infrastructural factors. One of the primary drivers is the rapid urbanization and construction boom within the country, leading to an increased demand for electrical devices in newly constructed residential and commercial buildings. For instance, Saudi Arabia has seen the development of over 1,200 new residential communities in the past decade. Additionally, the government's Vision 2030 initiative has led to the establishment of new smart cities like NEOM, which integrates state-of-the-art electrical infrastructure, further promoting the use of efficient wiring devices within this wattage range. The increasing average household size, currently standing at approximately 5.8 people per household, also contributes to higher energy consumption and demand for reliable electrical devices.

Furthermore, the growing emphasis on energy conservation and efficiency has spurred consumers to opt for devices in the optimal 100-300 watt range. The Saudi Energy Efficiency Center (SEEC) has been proactive in promoting energy-saving practices, resulting in the installation of over 2 million energy-efficient appliances in homes and businesses. The burgeoning middle class, with an annual disposable income exceeding $25,000 for a significant portion of the population, is increasingly investing in high-quality, energy-efficient wiring devices. Additionally, the nation’s substantial investment in renewable energy projects, with over 9.5 GW of renewable energy capacity already installed, has created a market for devices that are compatible with sustainable energy systems. With the expansion of the retail sector, marked by the opening of over 300 new electronic stores in the past five years, access to advanced electrical devices has become more widespread, contributing to the sustained growth and popularity of 100–300-watt wiring devices in Saudi Arabia.

By Technology

The dominance of conventional technology in the wiring devices market in Saudi Arabia with revenue share of 64.23% is primarily driven by the country's extensive existing infrastructure and the cost-effectiveness of traditional wiring solutions. Conventional wiring devices, such as standard switches, sockets, and connectors, are deeply entrenched in the market due to their long-standing reliability and lower upfront costs compared to smart technology alternatives. The construction sector, which is a significant driver of the Saudi economy, heavily relies on these conventional devices. In 2023, the construction industry in Saudi Arabia was valued at $37 billion, with a substantial portion of this investment directed towards traditional wiring solutions. Additionally, the residential sector, which saw the completion of over 300,000 housing units in 2023, predominantly uses conventional wiring devices due to their affordability and ease of installation.

Another factor contributing to the dominance of conventional technology is the slower adoption rate of smart technologies among the general population. Despite the government's push towards digital transformation, many consumers and businesses remain hesitant to switch to smart wiring devices due to concerns over compatibility, complexity, and cybersecurity. For instance, while Saudi Arabia ranks second in the Middle East for cybersecurity, the perceived risks associated with smart devices still deter widespread adoption. Furthermore, the average monthly salary for Saudis working in the private sector is SR9600, which influences purchasing decisions towards more cost-effective conventional wiring solutions. The HVAC market, which generated $2,810.2 million in 2023, also predominantly uses conventional wiring devices due to their proven efficiency and lower maintenance costs. These factors collectively ensure that conventional technology continues to hold the highest revenue share in the wiring devices market in Saudi Arabia.

By Application

By application, commercial segment is dominating the market by generating more than 45.62% market revenue. The dominance of commercial applications in the wiring devices market in Saudi Arabia can be attributed to several key factors. One major driver is the rapid expansion of the commercial sector, particularly in the realms of retail, hospitality, and office spaces. For instance, the construction of new shopping malls, such as the 1.2 million square meter Mall of Saudi, and the development of luxury hotels, including the 10,000-room Abraj Kudai, significantly boost the demand for advanced wiring devices tailored to complex commercial needs. Moreover, the rise of smart buildings and the integration of IoT (Internet of Things) in commercial infrastructures necessitate sophisticated wiring solutions. The Saudi Vision 2030 initiative, which aims to diversify the economy and reduce dependence on oil, has also spurred investments in commercial real estate, further driving the market. Additionally, projects like the King Abdullah Financial District, spanning over 1.6 million square meters, highlight the substantial investments in commercial properties, fueling the wiring devices market.

Another critical factor is the increasing emphasis on energy efficiency and sustainability within commercial spaces. As businesses strive to meet international standards and reduce operational costs, there is a growing demand for energy-efficient wiring devices. For example, the implementation of LEED-certified projects, such as the 500,000 square meter King Abdullah Petroleum Studies and Research Center, underscores the need for state-of-the-art wiring solutions. Furthermore, Saudi Arabia's push towards becoming a digital hub, with initiatives like the NEOM smart city project covering 26,500 square kilometers, necessitates the deployment of advanced wiring infrastructure. The commercial sector's need for enhanced security systems, high-speed internet connectivity, and automated building management systems also contributes to the predominance of commercial applications in the wiring devices market. These factors collectively underscore the commercial sector's significant impact on the wiring devices market in Saudi Arabia, driving higher revenue generation compared to industrial and residential applications.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Top Players in Saudi Arabia Wiring Devices Market

- ABB Ltd.

- Acuity Brand Lighting

- Alfanar Group

- Bahra Electric

- Eaton

- GE Lighting

- Gedac Electric

- Hager Group

- Honeywell

- Hubbell

- Legrand

- Leviton

- Lutron

- Panasonic Corporation

- Schneider Electric

- Signify

- Other Prominent Players

Local Manufacturers

- Al Manara

- Optimal Light

- HAWA MEAF

- ISTCO

- Dari International Company

- Alrouf Electrical

- Energya Cables Saudi Arabia

Market Segmentation Overview:

By Product

- Current Devices

- Electric switches (e.g., light switches, dimmer switches, fan switches)

- Receptacles (e.g., outlets, plugs)

- Wire connectors (e.g., splices, crimps)

- Others

- Non-Current Devices

- Conduit and fittings

- Boxes and enclosures

- Wire supports and clamps

- Cable ties and connectors

- Insulating tape and tubing

- Circuit Protecting Devices

- Plugs & power outlets.

- TV/TEL Sockets

- Television Plates

- Fuse Boxes

- Circuit Breakers

- Others

By Technology

- Smart

- Conventional

By Voltage

- 0-100 Watts

- 100-300 Watts

- 300-600 Watts

- Above 600 Watts

By Applications

- Commercial

- Industrial

- Residential

By Sales Channel

- Online

- E-commerce Website

- Branded Stores

- Offline

- Supermarkets/Hypermarkets

- Retail Stores

- Speciality Stores

- Others

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)