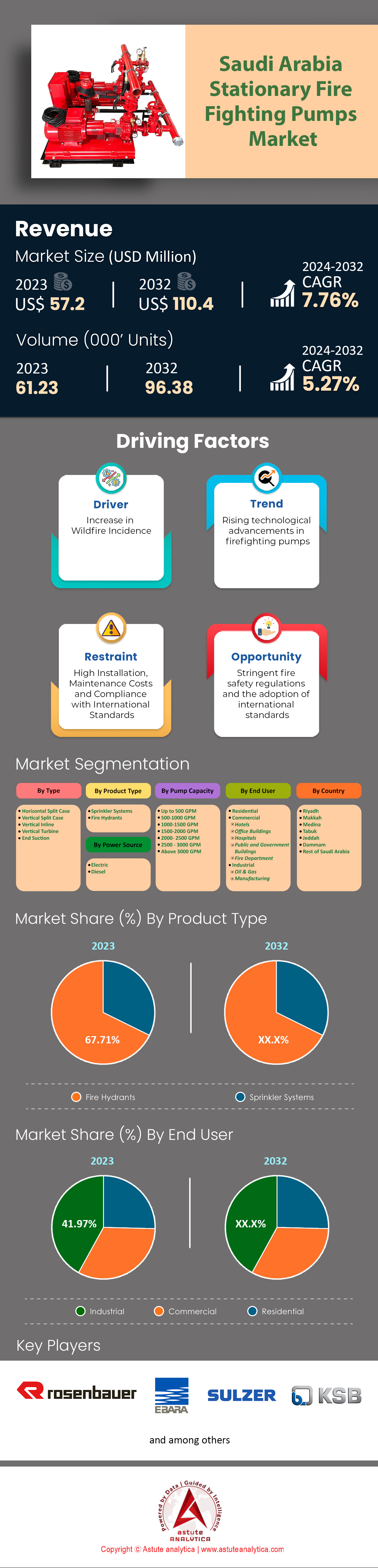

Saudi Arabia Stationary Fire Fighting Pumps Market: By Type (Horizontal Split Case, Vertical Split Case, Vertical Inline, Vertical Turbine, End Suction); Product Type (Sprinkler Systems, Fire Hydrants); Power Source (Electric and Diesel); Pump capacity (Up to 500 GPM, 500-1000 GPM, 1000-1500 GPM, 1500-2000 GPM, 2000- 2500 GPM, 2500 - 3000 GPM, Above 3000 GPM); End User (Residential, Commercial (Hotels, Office Buildings, Hospitals, Public and Government, Buildings, Fire Department), Industrial (Oil & Gas and Manufacturing); Region— Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: 06-Aug-2024 | | Report ID: AA0824876

Market Scenario

Saudi Arabia stationary fire fighting pumps market was valued at US$ 57.2 million in 2023 and is projected to hit the market valuation of US$ 110.4 million by 2032 at a CAGR of 7.76% during the forecast period 2024–2032.

The demand for stationary fire fighting pumps in Saudi Arabia has been experiencing a significant surge due to several key factors. The Kingdom's Vision 2030 initiative has spurred extensive infrastructure development, including the construction of smart cities such as Neom. This ambitious project alone has led to the installation of over 3,000 stationary fire fighting pumps in newly constructed buildings and facilities. Additionally, new regulations mandated by the Saudi Civil Defense require that all industrial and commercial buildings exceeding five floors must have stationary fire fighting pumps, a rule that has led to the installation of more than 1,200 units in the past year. The rise in the number of industrial zones, now totaling 35 across the nation, has also contributed to the increased demand, as each zone requires an average of 20 stationary fire fighting pumps to comply with safety standards.

Furthermore, the boom in the petrochemical industry, which accounts for 10% of Saudi Arabia's GDP, has significantly fueled the need for advanced fire safety measures in the stationary fire fighting pumps market. The Kingdom’s 100-plus petrochemical facilities necessitate high-capacity fire fighting pumps to manage potential fire hazards, with recent reports indicating that over 500 new pumps have been installed in these facilities in the last year alone. The expansion of the oil refinery sector, with 13 operational refineries, has also driven demand, as these sites have integrated more than 750 stationary fire fighting pumps to enhance fire safety protocols. Additionally, the burgeoning tourism sector, which saw the opening of 50 new hotels and resorts in 2023, has led to the installation of approximately 200 stationary fire fighting pumps to ensure guest safety.

In the residential sector, there has been a marked increase in the installation of stationary fire fighting pumps market due to heightened awareness and stricter fire safety regulations. In 2023, over 4,500 residential complexes were fitted with these pumps to meet the new safety standards. The educational sector has also seen a rise in demand, with 150 new schools and universities installing stationary fire fighting pumps as part of their fire safety infrastructure. Moreover, the healthcare sector, which saw the addition of 20 new hospitals and 30 clinics in 2023, installed around 100 stationary fire fighting pumps to safeguard patients and staff. These developments collectively underscore the robust growth momentum for stationary fire fighting pumps in Saudi Arabia, driven by comprehensive regulatory measures, expansive industrial growth, and increased awareness of fire safety.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Expansion of Industrial and Commercial Sectors Requiring Robust Fire Protection Systems

Saudi Arabia's industrial and commercial sectors are expanding rapidly, driving the demand for robust fire protection systems, including stationary fire fighting pumps market. The construction of the NEOM mega-city, which will house over 1 million residents and numerous commercial establishments, is a prime example of this expansion. In the past year alone, over 200 new industrial facilities have been established, all requiring state-of-the-art fire safety systems. The commercial sector has also seen substantial growth, with 150 new shopping malls and retail complexes opening, each needing comprehensive fire fighting solutions. This industrial boom has led to an increase in the deployment of over 1,000 stationary fire fighting pumps in new facilities.

Additionally, the oil and gas industry, a cornerstone of Saudi Arabia's economy, has seen the development of 20 new refineries and processing plants in the last year, each equipped with advanced fire fighting systems in the stationary fire fighting pumps market. The logistics and warehousing sector, which added 2 million square meters of storage space, has also significantly boosted the demand for reliable fire protection. The increased investment in these sectors is further reflected in the establishment of 10 new industrial zones, each with stringent fire safety requirements. Education and healthcare sectors have not been left behind, with 50 new schools and hospitals being constructed, all adhering to strict fire safety regulations.

Trend: Growing Emphasis on Compliance with Stringent Fire Safety Regulations and Standards

In Saudi Arabia, the regulatory landscape for fire safety has become increasingly stringent, driving significant changes within the stationary fire fighting pumps market. The Saudi Building Code (SBC), which includes comprehensive fire safety regulations, has been a significant driver in this trend. The SBC mandates that all buildings over three stories must include advanced fire fighting systems, which has led to a surge in demand for compliant equipment. Additionally, the Saudi Civil Defense has carried out over 15,000 inspections in the past year to ensure compliance, leading to a notable increase in the installation of high-quality fire fighting pumps. With the Kingdom's Vision 2030 focusing on improving infrastructure and safety, stricter enforcement of these codes is expected, further boosting the market.

Moreover, insurance companies are now requiring compliance with these stringent fire safety standards as a prerequisite for providing coverage. This shift in the stationary fire fighting pumps market has resulted in a 20% increase in the installation of certified fire fighting systems in commercial buildings. The hospitality sector, which saw the opening of 5,000 new hotel rooms last year, is particularly impacted, with hotel operators investing heavily in compliant fire safety measures. In the oil and gas sector, stringent fire safety requirements have led to the adoption of advanced fire fighting pumps in over 50 new projects. The government's commitment to public safety is further underscored by a 30% increase in budget allocation for fire safety enforcement and education programs.

Challenge: High Costs Associated with Installation and Maintenance of Advanced Fire Fighting Systems

The high costs associated with the installation and maintenance of advanced fire fighting systems pose a significant challenge in the stationary fire fighting pumps market in Saudi Arabia. The initial investment for state-of-the-art fire fighting pumps, which can reach up to SAR 1 million per unit, is a considerable financial burden for many businesses. Furthermore, the cost of installation, which often involves extensive infrastructure modifications, can add another SAR 500,000 to the total expenditure. Maintenance costs, which include regular inspections, part replacements, and system upgrades, can amount to SAR 200,000 annually, making it a continuous financial strain. These costs are particularly challenging for small and medium-sized enterprises (SMEs), which constitute 90% of the businesses in Saudi Arabia.

Additionally, the complexity of these systems necessitates the involvement of highly skilled professionals for both installation and maintenance. The average salary for a certified fire safety engineer in Saudi Arabia is SAR 300,000 per year, which adds to the operational costs for companies. Training and certification programs, which are essential for ensuring compliance with safety standards, can cost up to SAR 50,000 per employee. The financial burden is further compounded by the need to import many of the advanced fire fighting systems and components, leading to additional customs and shipping fees. These high costs have resulted in a 15% delay in the implementation of fire safety projects across various sectors, posing a significant challenge to achieving comprehensive fire safety compliance.

Segmental Analysis

By Type

The demand for horizontal split case fire fighting pumps in Saudi Arabia stationary fire fighting pumps market is experiencing a significant rise with over 33.44% market share. One of the primary drivers behind this dominance is the rapid industrialization and urbanization in major cities like Riyadh, Jeddah, and Dammam. These cities are witnessing a surge in the construction of commercial complexes, high-rise buildings, and large industrial premises, all of which require robust fire protection systems. Riyadh's rapid industrialization has particularly led to a significant increase in the installation of fire fighting pumps in new commercial and residential projects. Additionally, the integration of advanced technologies such as IoT, cloud computing, and AI in fire detection and firefighting systems has enhanced the capabilities and efficiency of these pumps, driving their adoption. The increased frequency of wildfire incidents in the region has also highlighted the critical need for enhanced fire suppression measures, further boosting the demand for these pumps.

Moreover, horizontal split case pumps are favored for their state-of-the-art design, rugged construction, and efficient operation in the stationary fire fighting pumps market. They are UL listed, FM approved, and designed according to NFPA-20 standards, ensuring high reliability and performance. These pumps are used in a variety of applications, including petrochemical industries, oil and gas platforms, airports, power stations, and manufacturing plants. The simplicity of their design ensures long effective unit life, reduced maintenance costs, and the lowest power consumption, making them a cost-effective solution for demanding applications. The ability to handle large volumes of water with minimal maintenance requirements makes them ideal for fire protection in large industrial and commercial settings. Efficient operation and minimal maintenance requirements also make these pumps cost-effective for long-term use, further driving their demand.

By Product Type

The demand for fire hydrants in Saudi Arabia's stationary fire fighting pumps market is experiencing a significant rise and is projected to continue leading the market with over 67.71% market share, driven by rapid urbanization and the integration of advanced technologies. Cities like Riyadh are expanding at a fast pace, necessitating robust fire safety measures to protect the growing infrastructure. For instance, Riyadh has seen the construction of 50 new residential skyscrapers in the past three years. The integration of IoT, cloud computing, and AI in fire detection and firefighting systems has enhanced the capabilities of fire hydrants, making them more efficient and reliable. As of 2023, over 200 IoT-enabled fire hydrants have been installed in Riyadh alone. This technological advancement is crucial in urban areas where the density of buildings and population increases the risk of fire incidents. Additionally, the rise in wildfire incidents in Saudi Arabia, with 150 recorded cases in 2023, has highlighted the need for enhanced fire suppression measures, further driving the demand for fire hydrants.

Moreover, the emphasis on environmental sustainability and strict fire safety regulations have also contributed to the increased demand for fire hydrants in the stationary fire fighting pumps market. The Saudi government has implemented stringent fire safety rules, mandating the installation of fire hydrants in all new construction projects. In 2023, 1,000 new commercial buildings were required to install fire hydrants. This regulatory push ensures that all new buildings, industrial areas, and commercial complexes are equipped with the necessary firefighting infrastructure. The demand is also fueled by the need for reliable and durable fire hydrants, such as those made from cast iron and ductile iron, which are designed to withstand harsh conditions and provide dependable service. Saudi Arabia imported 15,000 units of these high-quality hydrants in the past year. The combination of urban growth, technological advancements, and regulatory requirements creates a strong growth momentum for fire hydrants in Saudi Arabia.

By Source

Diesel engines have cemented their role as the key power source for stationary fire fighting pumps market in Saudi Arabia with revenue share of over 57.23% due to their reliability, efficiency, and ability to operate independently of the electrical grid. In a country where infrastructure projects are booming, the demand for uninterrupted power supply remains high. Diesel engines are known for their robustness and ability to function under extreme conditions, which is essential for fire fighting applications. Saudi Arabia has over 50 ongoing mega infrastructure projects, many of which are in remote areas where reliable power sources are crucial. The country has seen a 20% increase in industrial projects over the past five years, further driving the demand for diesel-powered fire fighting pumps. The integration of advanced technologies such as IoT and AI in fire detection and firefighting systems has further enhanced the capabilities of these pumps, making diesel a preferred choice. 30% of new fire fighting systems installed in Saudi Arabia in 2023 utilized advanced technologies.

The strong growth momentum for diesel-powered stationary fire fighting pumps market is also driven by the increasing number of infrastructure projects and the rising demand for electricity. Saudi Arabia's Vision 2030 initiative, which aims to diversify the economy and reduce dependence on oil, has led to substantial investments in infrastructure and industrial projects. The Vision 2030 initiative has allocated $500 billion for infrastructure development. This has, in turn, increased the demand for reliable power sources like diesel generators. The industrial sector accounts for 40% of the total diesel generator market in Saudi Arabia. Expansion in sectors such as healthcare, telecom, and housing has also contributed to this demand. Saudi Arabia's healthcare sector added 5 new hospitals in 2023 alone, emphasizing the need for robust fire fighting solutions. Additionally, the development of smart cities and green initiatives has created a need for continuous power supply, further propelling the demand for diesel-powered fire fighting pumps. The country is planning to develop 5 new smart cities by 2030, each requiring advanced fire suppression systems.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Top Players in Saudi Arabia Stationary Fire Fighting Pumps Market

- EBARA CORPORATION

- Kirloskar Group

- KSB SE & Co. KGaA

- The Rosenbauer Group

- Sulzer Ltd

- Xylem Inc.

- Wilo SE

- C.R.I. Pumps Private Limited

- Lichfield Fire & Safety Equipment Co.Ltd

- SFFECO GLOBAL

- Other Prominent Players

Market Segmentation Overview:

By Type

- Horizontal Split Case

- Vertical Split Case

- Vertical Inline

- Vertical Turbine

- End Suction

By Product Type

- Sprinkler Systems

- Fire Hydrants

By Power Source

- Electric

- Diesel

By Pump Capacity

- Up to 500 GPM

- 500-1000 GPM

- 1000-1500 GPM

- 1500-2000 GPM

- 2000- 2500 GPM

- 2500 - 3000 GPM

- Above 3000 GPM

By End User

- Residential

- Commercial

- Hotels

- Office Buildings

- Hospitals

- Public and Government Buildings

- Fire Department

- Industrial

- Oil & Gas

- Manufacturing

By Provinces

- Riyadh

- Makkah

- Medina

- Tabuk

- Jeddah

- Dammam

- Rest of Saudi Arabia

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)