Saudi Arabia Property Management Software Market: By Solution (Software and Services (Professional Services and Managed Services); Deployment (Cloud and On-Premises); Application (Rental Listings Management, Tenant Management, Maintenance Activities Management, Marketing & Leasing Management, Insurance Management, Tax Management, Billing & Invoicing, Document Management, Reporting & Analytics, and Others); End Users (Residential (Apartment Buildings, Villas/Bungalows, Others), Commercial (Retail Spaces, Office Spaces, Hotels, Others), Others (Property Managers/ Agents and Property Investors); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: May-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0524836 | Delivery: 2 to 4 Hours

| Report ID: AA0524836 | Delivery: 2 to 4 Hours

Market Scenario

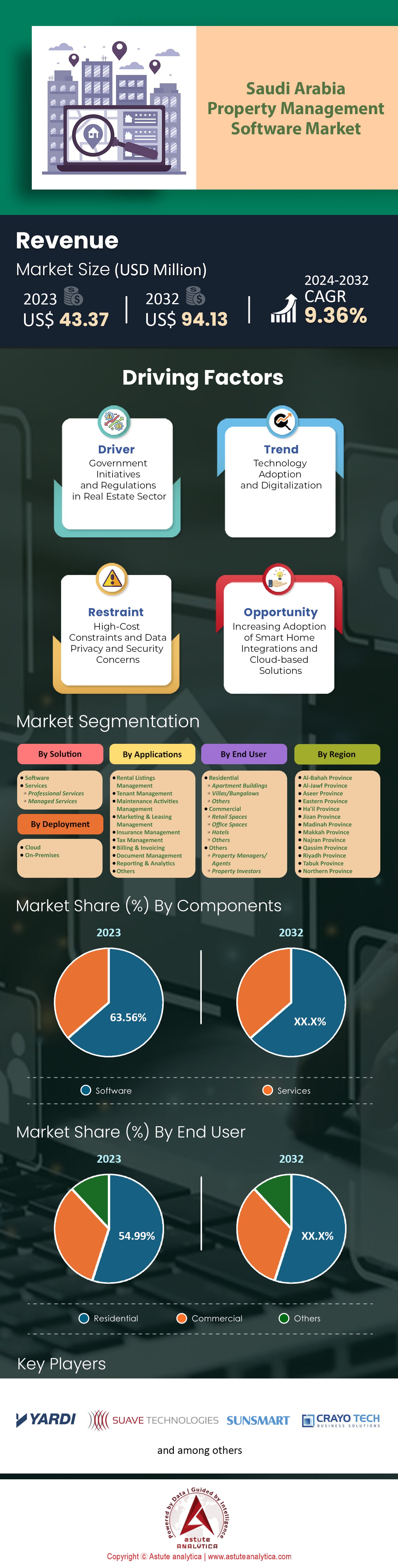

Saudi Arabia Property Management Software Market was valued at US$ 43.37 million in 2023 and is projected to hit the market valuation of US$ 94.13 million by 2032 at a CAGR of 9.36% during the forecast period 2024–2032.

The construction industry in Saudi Arabia is experiencing significant growth, driven by government initiatives, technological advancements, and increasing demand across various sectors. This growth is directly linked to the rising demand for property management software in the country. The Saudi Arabia Construction Market is estimated to be valued at USD 70.33 billion in 2024 and is expected to reach USD 91.36 billion by 2029, growing at a CAGR of 5.37% during the forecast period. As the number of residential and commercial properties increases, the need for efficient property management software market becomes more pressing. Property management software automates and streamlines various processes, such as tenant communication, rent collection, and maintenance management, making it an essential tool for property managers and owners.

This growth is fueled by technological advancements, such as the integration of artificial intelligence (AI), machine learning (ML), virtual reality (VR), and cloud-computing solutions. These innovations provide a transparent and centralized platform for storing e-documents, maintaining tenant communications, and facilitating online rent payments. Saudi Arabia's Vision 2030 projects, including the development of smart cities and mega-projects like NEOM and Qiddiya, are driving the demand for advanced property management solutions. The Ministry of Municipal and Rural Affairs of Saudi Arabia has started smart city initiatives under the Saudi Vision 2030 and the National Transformation Program 2020, further emphasizing the need for digital property management tools.

The commercial segment of the property management software market is expected to grow steadily, with projects worth SAR 8 trillion (USD 2.1 trillion) in the pipeline for the next eight years. Riyadh, Jeddah, and Dammam are experiencing a steady increase in demand for office space, while Riyadh and Jeddah are leading a lifestyle shopping revolution with significant retail developments planned. This growth in commercial real estate directly contributes to the rising demand for property management software.

Demographics also play a crucial role in the demand for real estate and, consequently, property management software. As Saudi Arabia's population continues to grow, the need for housing is expected to increase, driving the demand for residential properties and property management solutions.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Smart City Initiatives and Remote Property Management Need

The rapid development of smart cities and the growing need for remote property management solutions in Saudi Arabia are key drivers of the property management software market in the country. As the Kingdom pursues its Vision 2030 goals and invests heavily in smart city projects, the demand for advanced property management tools is expected to rise significantly.

The Ministry of Municipal and Rural Affairs (MOMRA) launched the nation's first Smart Cities program in 2017, aiming to drive smart transformation in Saudi cities. This initiative, along with the Saudi government's plan to invest US$ 500 billion in modernizing the infrastructure of the existing 285 municipalities, is expected to drive the adoption of advanced property management solutions to streamline operations and enhance efficiency. Under the Saudi Vision 2030 initiative, the Kingdom plans to develop 16 smart cities by 2030, which will require sophisticated property management tools to manage the large volume of data generated through websites and mobile apps. Mega-projects like NEOM, a US$ 500 billion smart city project focusing on trade, innovation, and knowledge, will necessitate the adoption of energy-efficient systems and advanced property management solutions to minimize electricity usage and optimize functionality.

The growing urban population in Saudi Arabia has led to a rapid expansion of cities, necessitating efficient and remote property management solutions. Property management software market enables property managers and owners to efficiently manage their assets and streamline operations from anywhere, a crucial requirement in the context of smart cities. The rising demand for software-as-a-service (SaaS) models of property management, which offer flexibility, scalability, and cost-effectiveness, is driving the adoption of remote property management solutions. These solutions are particularly well-suited to the needs of smart cities, where the volume of data generated requires effective management and analysis. Furthermore, the focus on delivering customer-centric applications to drive tenant satisfaction in smart cities is encouraging the adoption of remote property management software that enhances communication between property managers and tenants, improving the overall tenant experience and contributing to the success of smart city initiatives.

Trend: Digitalization and Adoption of Property Technology (PropTech)

Major trend being witnessed in Saudi Arabia's property management software market is the increasing digitalization and adoption of Property Technology (PropTech). PropTech refers to the use of technology and software solutions to optimize and streamline property management processes, enhance tenant experiences, and improve operational efficiency. The Saudi Arabian PropTech market is expected to grow at a CAGR of 15.7% during the forecast period of 2024-2032. This growth is driven by the increasing demand for smart building solutions, the need for efficient property management, and the government's focus on digital transformation as part of its Vision 2030 initiative. In fact, the Saudi government has allocated US$ 2.1 billion for digital transformation in the real estate sector.

PropTech solutions, such as property management software, are being increasingly adopted by property managers and owners in Saudi Arabia. The market is driven by the need for remote property management, the rising demand for SaaS models, and the focus on delivering customer-centric applications. The use of artificial intelligence (AI) and machine learning (ML) in PropTech solutions is also gaining traction in Saudi Arabia property management software market. AI-powered chatbots and virtual assistants are being used to enhance tenant experiences and streamline communication between property managers and tenants.

Other PropTech trends in Saudi Arabia include the adoption of Internet of Things (IoT) devices for smart building management, the use of virtual reality (VR) and augmented reality (AR) for property showcasing, and the integration of blockchain technology for secure and transparent property transactions.

Challenge: Shortage of Skilled Property Management Professionals

One major challenge hampering the growth of the property management sector in Saudi Arabia is the shortage of skilled property management professionals. The rapid growth of the real estate sector in the country has led to an increased demand for qualified property managers, but the supply of skilled professionals has not kept pace with this demand.

According to a survey by the Saudi Real Estate Institute, 78% of real estate companies in Saudi Arabia face difficulties in finding qualified property management professionals in the property management software market. This shortage of skilled professionals can be attributed to several factors, including the lack of specialized property management courses and training programs in the country, the limited awareness about property management as a career option, and the high attrition rates in the industry.

The shortage of skilled property management professionals can have a significant impact on the quality of property management services in Saudi Arabia. Inadequately trained or inexperienced property managers may struggle to effectively manage properties, leading to poor maintenance, low tenant satisfaction, and increased vacancy rates. In fact, a study by the Saudi Real Estate Institute found that properties managed by untrained professionals had a 23% higher vacancy rate compared to those managed by trained professionals.

The lack of skilled professionals also hinders the adoption of advanced property management technologies and best practices in the property management software market. A survey by the Middle East Council of Shopping Centers found that only 32% of property management companies in Saudi Arabia use property management software, compared to 68% in the UAE. This low adoption rate can be partly attributed to the shortage of professionals with the necessary technical skills and knowledge.

To address this challenge, the Saudi government and private sector organizations are taking steps to develop the property management talent pool in the country. The Saudi Real Estate Institute has launched several training programs and certification courses to upskill property management professionals. Additionally, the Ministry of Housing has partnered with universities to introduce property management courses and internship programs to attract young talent to the industry.

Despite these efforts, the shortage of skilled property management professionals remains a significant challenge for the property management software market in Saudi Arabia. Addressing this challenge will require a concerted effort from the government, educational institutions, and private sector organizations to develop a robust talent pipeline and promote property management as an attractive career option.

Segmental Analysis

By Solution

Based on solution, the software segment is leading the Saudi Arabia property management software market by capturing more than 63.56% market share. The property management software in Saudi Arabia is witnessing significant growth, with several top providers gaining strong demand due to various factors. One of the primary drivers is the rising adoption of software-as-a-service (SaaS) models, which offer flexibility, scalability, and cost-effectiveness. Additionally, the need for remote property management, accelerated by the COVID-19 pandemic, has further driven the adoption of digital solutions that enable property managers to handle their tasks remotely.

The expanding construction activities in Saudi Arabia, coupled with the rise of smart city initiatives aligned with Saudi Vision 2030, are also catalyzing the demand for effective property management solutions. Moreover, the increasing digitalization and automation trends in the real estate sector are benefiting property management software providers, as these solutions help in managing activities such as payments, inventories, and tenant complaints.

Software providers in the Saudi Arabia property management software market that offer customization options and integration capabilities are gaining a competitive edge in the market. Companies like PACT provide ERP systems that can be completely customized to meet specific business requirements, while the ability to integrate with third-party applications and unify data across different systems is also a key selling point. Notable property management software providers in Saudi Arabia include PACT RevenU, nTireFM, and Cordis, each offering a range of features and tools designed to improve property performance and drive business growth in the rapidly evolving market.

By Deployment

On the basis of deployment, cloud segment is leading the Saudi Arabia property management market with over 62.40% market share and the segment is also growing at the highest CAGR of 9.64%.

The property management software market in Saudi Arabia is experiencing a surge in demand for cloud-based solutions, driven by several market dynamics and technological advancements. The market's growth is influenced by factors such as population growth, urbanization, and a focus on sustainability. Technological advancements, including AI, automation, and IoT integration, are also playing a significant role in shaping the market. The impact of COVID-19 has accelerated the need for digital and remote management capabilities, further pushing property management companies towards cloud-based solutions. These solutions offer the flexibility to manage properties from anywhere, which has become essential in the face of economic uncertainty and the changing regulatory landscape.

Cloud-based property management software market is particularly appealing due to its scalability, cost-effectiveness, and the ability to ensure security and privacy. These systems cater to a wide range of stakeholders, including real estate management companies, property owners, real estate agents, corporate occupiers, and property investors. The market spans across various regions in Saudi Arabia, including major cities like Riyadh, Jeddah, and Dammam, as well as the Eastern, Central, Western, Southern, and Northern regions. It serves different sectors such as residential, commercial, and industrial.

As of 2023, the market size of the Saudi Arabia property management market is significant, with forecasts predicting continued growth through 2030. The market is characterized by a mix of on-premises and cloud-based solutions, with a clear trend towards the latter. The cloud segment of the market has shown robust performance.

By Application

By application, the tenant management segment is dominating the Saudi Arabia property management software market, which captured over 25.04% market share. The Tenant Management software market in Saudi Arabia is experiencing a surge in demand, primarily due to the country's booming real estate sector. Factors such as rapid urbanization, a growing population, and government initiatives aimed at expanding the housing market are key drivers behind this trend. As the real estate landscape becomes more complex, property owners and managers are increasingly turning to technological solutions to streamline their operations, improve tenant satisfaction, and ensure regulatory compliance.

The push towards smart cities and the nation's digital transformation agenda are also significant contributors to the growing need for advanced Tenant Management software. These tools are essential for property managers who want to optimize their processes, maintain effective communication with tenants, and boost the performance of their properties. Modern Tenant Management systems offer a suite of features including lease management, automated rent collection, maintenance scheduling, and tenant communication platforms, all designed to meet the dynamic requirements of today's real estate market.

Saudi Arabia's real estate market is expected to continue its steady growth trajectory, with the residential sector at the forefront of this expansion in the property management software market. This growth is catalyzing the adoption of Tenant Management software, which is becoming increasingly vital for managing the rising number of rental properties and tenants efficiently. Leading software providers such as Yardi Systems, AppFolio, and Buildium are capitalizing on this demand, offering scalable, automated, and data-driven solutions that empower property managers in Saudi Arabia to excel in a competitive market.

By End Users

When it comes to end users, the market is mainly categorized into commercial and residential users. Wherein, the residential users are leading the pact with over 54.99% market share. The property management software market in Saudi Arabia is experiencing significant growth driven by increasing construction activities and the need for efficient property management solutions. The demand for residential property management software surpasses that of commercial property management software in Saudi Arabia due to the vast and diverse residential real estate market, encompassing single-family homes, apartments, and villas. This diversity necessitates robust property management solutions to handle tenant management, rent collection, and maintenance. The Saudi real estate market is projected to grow significantly, reaching USD 69.51 billion in 2024 and USD 101.62 billion by 2029, with a substantial portion attributed to residential properties.

The adoption of Software-as-a-Service (SaaS) models for property management market is on the rise in Saudi Arabia, offering flexibility, scalability, and cost-effectiveness, making them particularly attractive for residential property managers who may not have the resources for more complex systems. Initiatives under Saudi Vision 2030 and the National Transformation Program 2020 further drive demand for advanced property management solutions. The need for remote property management has increased, especially post-COVID-19, with residential property managers requiring tools to manage properties, communicate with tenants, and handle maintenance requests remotely. The ability to take personalized online tours and interact with high-quality 3D floor plans and drone footage enhances the appeal of residential property management software.

Residential property management software is often more affordable and accessible than commercial alternatives. Platforms like Apartments.com Rental Manager offer free tools for rent collection, tenant screening, and maintenance requests, making them budget-friendly for residential landlords in the property management software market. Examples like nTireFM and Buildium highlight the comprehensive services available to residential property managers in Saudi Arabia, further driving demand.

To Understand More About this Research: Request A Free Sample

Major Players in the Saudi Arabia Property Management Market

- CrayoTech

- In4Velocity

- Global Creative Concepts Tech Co Ltd.

- London Computer Systems

- Maisonette

- PropertyNet

- SolutionDots

- Suave Technologies

- SunSmart Global

- Yardi Systems Inc

- Other Prominent Players

Market Segmentation Overview:

By Solution

- Software

- Services

- Professional Services

- Managed Services

By Deployment

- Cloud

- On-Premises

By Applications

- Rental Listings Management

- Tenant Management

- Maintenance Activities Management

- Marketing & Leasing Management

- Insurance Management

- Tax Management

- Billing & Invoicing

- Document Management

- Reporting & Analytics

- Others

By End User

- Residential

- Apartment Buildings

- Villas/Bungalows

- Others

- Commercial

- Retail Spaces

- Office Spaces

- Hotels

- Others

- Others

- Property Managers/ Agents

- Property Investors

By Region

- Al-Bahah Province

- Al-Jawf Province

- Aseer Province

- Eastern Province

- Ha'il Province

- Jizan Province

- Madinah Province

- Makkah Province

- Najran Province

- Qassim Province

- Riyadh Province

- Tabuk Province

- Northern Province

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0524836 | Delivery: 2 to 4 Hours

| Report ID: AA0524836 | Delivery: 2 to 4 Hours

.svg)