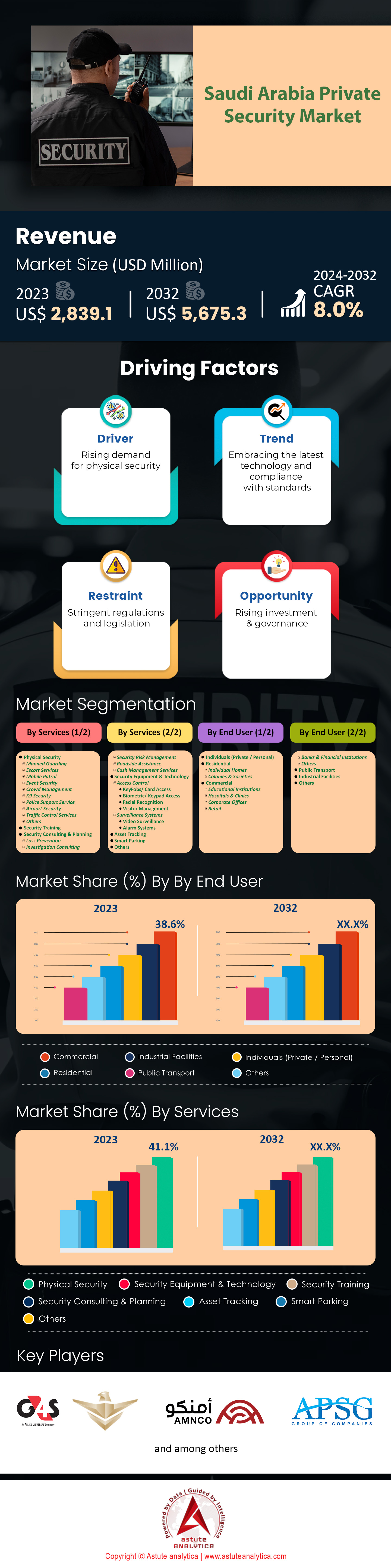

Saudi Arabia Private Security Market: By Services (Physical Security (Manned Guarding, Escort Services, Mobile Patrol, Event Security, Crowd Management, K9 Security, Police Support Service, Airport Security, Traffic Control Services, Others), Security Training, Security Consulting & Planning (Loss Prevention, Investigation Consulting, Security Risk Management, Roadside Assistance, Cash Management services), Security Equipment & Technology (Access Control (KeyFobs/ Card Access, Biometric/ Keypad Access, Facial Recognition, Visitor Management), Surveillance Systems (Video Surveillance, Alarm Systems)), Asset Tracking, Smart Parking, Others); End Users (Individuals (Private / Personal), Residential (Individual Homes and Colonies & Societies), Commercial (Educational Institutions, Hospitals & Clinics, Corporate Offices, Retail, Banks & Financial Institutions, Others), Public Transport, Industrial Facilities, Others)—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: 30-Oct-2024 | | Report ID: AA1024961

Market Scenario

Saudi Arabia private security market was valued at US$ 2,839.1 million in 2023 and is projected to hit the market valuation of US$ 5,675.3 million by 2032 at a CAGR of 8.0% during the forecast period 2024–2032.

The private security market in Saudi Arabia is experiencing significant growth in 2023, propelled by expansive economic developments and government initiatives. The market is valued at approximately $2.84 billion, reflecting the nation's heightened focus on security amid large-scale projects. There are around 300 licensed private security companies operating across the Kingdom, collectively employing over 200,000 personnel. These companies are responsible for safeguarding assets associated with mega-projects like NEOM, valued at $500 billion, and the Red Sea Project, covering 28,000 square kilometers. The demand is notably high in metropolitan areas such as Riyadh and Jeddah, where over 1,000 commercial establishments rely on private security services.

Key services offered by private security firms include manned guarding, cash-in-transit, electronic security systems, and cybersecurity solutions. Manned guarding dominates the Saudi Arabia private security market, with more than 150,000 security guards deployed nationwide. The installation of electronic security systems has surged, with an estimated 500,000 CCTV cameras in operation. The rise in cyber threats has led to the growth of cybersecurity firms, numbering over 1,000, catering to the protection of digital assets. Cash handling services have expanded in response to the increase in ATMs, which now total over 18,000 units across Saudi Arabia.

The demand for services in the private security market is driven by factors such as the government's Vision 2030 initiatives, urbanization, and the amplification of the tourism sector, which aims to attract 100 million visitors annually by 2030. End users predominantly include commercial entities, financial institutions, oil and gas facilities, government buildings, and residential complexes. Leading providers in the market feature international companies like Securitas and Allied Universal, alongside prominent local firms such as the Saudi Security and Safety Company (SSSC). The private security industry is strategically positioned to support the Kingdom's growth, with projections indicating the creation of an additional 50,000 jobs in the next five years.

To Get more Insights, Request A Free Sample

Driver: Government's Vision 2030 Initiatives Fueling Infrastructure and Security Investments

Saudi Arabia's Vision 2030 is a transformative blueprint that significantly impacts the private security market. The plan includes over $1 trillion in projects aimed at diversifying the economy. Mega-projects like NEOM, a $500 billion smart city, and the Red Sea Project, covering 28,000 square kilometers, necessitate substantial security measures. The infrastructure expansion involves constructing over 5,000 kilometers of new roads and 2,000 kilometers of railways, increasing the need for security services in transportation. In 2023, the government allocated approximately $50 billion to infrastructure development, including security enhancements.

The number of industrial cities in the private security market has grown to 35, housing over 3,500 factories, all requiring security solutions. The private security workforce is expected to expand by 25,000 personnel to meet project demands. An increase in shopping malls, now totaling over 150, boosts demand for manned guarding and surveillance. The King Abdullah Economic City, spanning 181 square kilometers, incurs annual security costs exceeding $100 million. With over 10 million pilgrims visiting annually, investments ensure safe experiences. Expansion of 27 airports adds to security responsibilities, while the energy sector requires advanced security for over 120 facilities contributing $200 billion to GDP. These initiatives are a significant driver, creating an expansive market for private security services. The sector is poised to safeguard burgeoning assets and support the nation's ambitious growth plans, with projections indicating continued demand escalation.

Trend: Integration of Advanced Technologies like AI and IoT in Security Solutions

The Saudi Arabian private security market is increasingly adopting technologies like Artificial Intelligence (AI) and the Internet of Things (IoT). In 2023, AI-powered security systems are estimated at $500 million. Over 2,000 companies offer IoT-based devices, signifying technological shifts. Smart surveillance cameras have surpassed 1 million units, many with facial recognition. Government initiatives, such as the National Data Management Office, invest over $2 billion in digital infrastructure, promoting data-driven security.

Cybersecurity firms in the Saudi Arabia private security market utilizing AI number over 500, protecting digital assets for more than 10,000 organizations. AI in access control has led to over 5,000 biometric scanners in high-security areas. IoT devices connected to security networks have increased to over 3 million, facilitating real-time monitoring. Smart city projects like NEOM aim for 100% utilization of these technologies upon completion. Drone technology is incorporated with over 1,000 security drones operational. AI analytics software processes data from over 2 million security sensors nationwide, supported by 10,000 5G towers erected. This trend reshapes the security landscape, offering innovative solutions to emerging challenges and enhancing the effectiveness of security operations across various sectors.

Challenge: Shortage of Skilled Security Personnel Affecting Service Quality Delivery

A pressing challenge in Saudi Arabia's private security market is the shortage of skilled personnel, impacting service quality. The sector employs over 200,000 security guards, yet there's a gap of approximately 30,000 trained professionals needed to meet demand. Only about 40% of personnel hold advanced training certifications, leading to competency issues. High turnover rates see over 15,000 personnel leaving annually due to low wages and limited career advancement. The average security guard earns around $800 per month, lower than the $1,200 average in other Gulf Cooperation Council countries. There are just 25 government-accredited training institutions, collectively training approximately 5,000 individuals per year—insufficient to close the deficit. Expatriate workers constitute over 60% of the workforce, introducing language and cultural challenges. Saudization policies require firms to employ at least 30% local staff, but only 18% compliance was reported in 2023.

To address the skills gap, the government plans to invest $100 million in new training centers capable of training an additional 10,000 personnel annually. Until these measures take effect, the shortage remains a concern, potentially compromising security effectiveness across critical infrastructure and commercial sectors.

Segmental Analysis

By Service

Physical security services—including manned guarding, escort services, mobile patrols, event security, crowd management, K9 security, police support services, airport security, and traffic control—are leading the private security market in Saudi Arabia due to several critical factors. One significant reason is the government's investment in megaprojects under Vision 2030, such as NEOM, a $500 billion smart city project covering 26,500 square kilometers. These massive developments require extensive physical security measures to protect assets and ensure the safety of personnel and visitors. Additionally, the geopolitical climate in the Middle East and the need to safeguard vital oil and gas infrastructure have heightened the demand for comprehensive physical security services.

As of 2023, the physical security sector held over 38% market share and employed approximately 200,000 personnel across Saudi Arabia. This substantial workforce is necessary to meet the security needs of a growing number of high-profile events and infrastructural expansions. For instance, the country hosted the G20 Summit and regularly holds international sporting events like the Formula E races and the Dakar Rally, all requiring sophisticated event security and crowd management. Moreover, the expansion of airports—Saudi Arabia has over 35 airports, including the busy King Abdulaziz International Airport serving more than 30 million passengers annually—drives the need for airport security services.

The demand for physical security is being met through the proliferation of licensed private security companies, which numbered over 1,500 in 2023. These companies are investing in advanced training programs and security technologies to enhance service delivery. The market is also fueled by regulatory requirements mandating stringent security protocols across various sectors. The Saudi private security market's value reached an estimated SAR 15 billion in 2023, reflecting significant investment in physical security infrastructure and services. This dominance is expected to continue as the nation progresses with its ambitious development plans, necessitating robust security solutions to protect its growing assets and population.

By End Users

Commercial end users—including educational institutions, hospitals and clinics, corporate offices, retail establishments, and banks and financial institutions—lead the Saudi Arabia private security market by capturing over 38.6% market share. Thid dominance is attributed to their substantial need for comprehensive security solutions. As of 2023, Saudi Arabia hosts over 30 public universities and numerous private colleges, collectively educating more than 1.5 million students. These institutions prioritize campus security to protect students and staff, driving the demand for access control systems and surveillance. Hospitals and clinics, exceeding 500 facilities nationwide, require stringent security measures to safeguard patient data and ensure the safety of approximately 100,000 healthcare professionals.

Key factors behind this dominance in the private security market include the rapid expansion of commercial activities and the increasing sophistication of security threats. The retail sector boasts over 35,000 retail outlets and more than 200 shopping malls, such as the Kingdom Centre in Riyadh, which necessitate advanced security to prevent theft and ensure shopper safety. The banking sector, with over 30 banks operating more than 2,000 branches, invests heavily in security protocols to protect financial assets and comply with regulations set by the Saudi Central Bank (SAMA). Additionally, the surge in e-commerce, with the market valued at SAR 30 billion in 2023, compels businesses to enhance both physical and cybersecurity measures.

This growth is driven by increased foreign investment and the establishment of over 500 international companies setting up operations in Saudi Arabia as part of Vision 2030. These entities bring global standards for security, further elevating the demand for high-quality private security services. Commercial end users are leading the market by investing an estimated SAR 5 billion in security infrastructure and services in 2023. They are adopting integrated security solutions that combine physical presence with advanced technologies like AI-powered surveillance and biometric access controls. These key factors collectively position commercial end users at the forefront of the private security market's growth in Saudi Arabia.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Fortifying Saudi Arabia's Key Cities: Unveiling the Surging Private Security Demand and Need

As Saudi Arabia propels forward with its ambitious Vision 2030, the nation's top four cities—Riyadh, Jeddah, Mecca, and Dammam—are experiencing significant urban expansion and economic development. Riyadh, the capital, is evolving into a global metropolis with projects like the King Abdullah Financial District, spanning over 1.6 million square meters of development that require comprehensive security infrastructure. Jeddah's skyline is transforming with developments like the Jeddah Economic City, which includes the towering Jeddah Tower, projected to exceed 1,000 meters in height and necessitating advanced security systems for its occupants. Mecca welcomes over 2 million pilgrims annually during Hajj, demanding extensive security coordination to ensure the safety of visitors. Meanwhile, Dammam, a pivotal hub for the oil and gas industry, has witnessed infrastructure investments surpassing $50 billion, amplifying the need for robust asset protection.

The burgeoning economic activities have catalyzed an increased demand for private security services across these urban centers. The Saudi private security market is signaling substantial growth potential. Over 1,200 licensed private security companies employ more than 150,000 security personnel nationwide, reflecting the sector's significant workforce. The number of CCTV cameras installed in public and private spaces has exceeded 500,000 units, underlining a heightened emphasis on surveillance. Investment in security technology solutions has surged, with the government allocating considerable funds towards integrating advanced systems in urban projects. The security equipment market, encompassing access control and surveillance systems, is projected to grow to $3.5 billion by 2025. Additionally, international security exhibitions, such as the Intersec Saudi Arabia held in Jeddah, attract over 10,000 industry professionals, highlighting the growing interest and investment in security solutions.

Looking ahead, the construction of NEOM—a futuristic city spanning over 26,500 square kilometers, equivalent to the size of Massachusetts—underscores the monumental scale of forthcoming requirements for private security market. The anticipated influx of international tourists, projected to reach 100 million annually by 2030, further accentuates the need for enhanced security measures. With over 60% of the population under the age of 30, urbanization trends are accelerating, increasing pressure on city security infrastructures. Hosting global events like the Formula E Championship in Diriyah necessitates high-level security arrangements, spotlighting the crucial role of private security firms. Collectively, these factors delineate a robust and expanding market for private security services in Saudi Arabia's major cities, underscoring a significant opportunity for investment and innovation in the sector.

Top Players in Saudi Arabia Private Security Market

- Al Qiada

- Annasban Security

- APSG Group

- The Arab Security and Safety Services Company (AMNCO)

- Ewan Jeddah

- ETH Security Solutions

- G4S Limited

- Garda World

- Herasat Al-Jazirah For security

- Initial Saudi Group

- Matco Security Services

- National Security Services (SAFE)

- Securitas AB

- Security & Safety Company

- Other Prominent Players

Market Segmentation Overview:

By Service

- Physical Security

- Manned Guarding

- Escort Services

- Mobile Patrol

- Event Security

- Crowd Management

- K9 Security

- Police Support Service

- Airport Security

- Traffic Control Services

- Others

- Security Training

- Security Consulting & Planning

- Loss Prevention

- Investigation Consulting

- Security Risk Management

- Roadside Assistance

- Cash Management Services

- Security Equipment & Technology

- Access Control

- KeyFobs/ Card Access

- Biometric/ Keypad Access

- Facial Recognition

- Visitor Management

- Surveillance Systems

- Video Surveillance

- Alarm Systems

- Access Control

- Asset Tracking

- Smart Parking

- Others

By End User

- Individuals (Private / Personal)

- Residential

- Individual Homes

- Colonies & Societies

- Commercial

- Educational Institutions

- Hospitals & Clinics

- Corporate Offices

- Retail

- Banks & Financial Institutions

- Others

- Public Transport

- Industrial Facilities

- Others

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)