Saudi Arabia HR Tech Market: By Application (Talent Management, Payroll Management, Performance Management, Workforce Management, recruitment, and Others); Type (Inhouse and Outsourced); End Use Industry (TTH (Travel, Transportation, and Hospitality), Public Sector, Healthcare, Information Technology, BFSI, and Others); Company Size (Less Than 1k Employees, 1k-5k Employees, Greater than 5k Employees); Country—Market Size, Industry Dynamics, Opportunity Analysis and Forecast For 2024–2032

- Last Updated: Apr-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0424818 | Delivery: 2 to 4 Hours

| Report ID: AA0424818 | Delivery: 2 to 4 Hours

Market Scenario

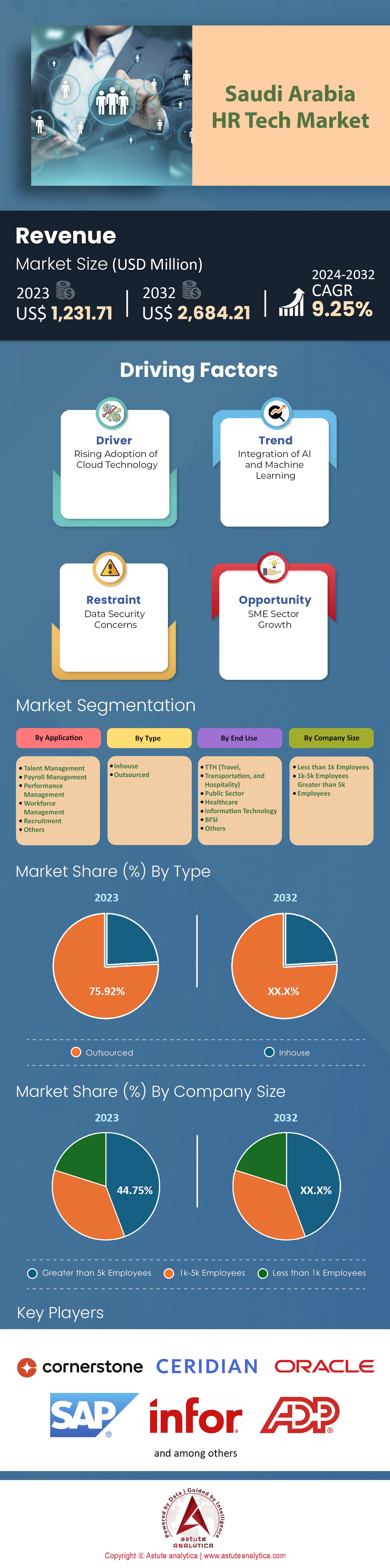

The Saudi Arabia HR Tech Market was valued at US$ 1,231.71 million in 2023 and is projected to hit the market valuation of US$ 2,684.21 million by 2032, at a CAGR of 9.25% during the forecast period 2024–2032.

The reasons the demand for HR tech is increasing in Saudi Arabia are many and can be attributed to the need for digital transformation as well as automation in managing human resources. As envisaged by its Vision 2030 plan, Saudi Arabia has been undergoing a significant economic and social change aimed at among other things diversifying the economy beyond oil, creating more private sector jobs for Saudis and modernizing different sectors of the society. This means that businesses are now under pressure to become efficient and competitive thus demanding for those HR tech solutions which will help them streamline their processes while cutting cost at the same time enhancing staff engagement. According to a survey done recently, 78% of leaders from Saudi organizations have identified HR tech as one of their top most concerns; moreover 65% revealed intentions to increase investment towards this area within next one or two years.

One of these factors driving HR tech market in Saudi Arabia is an immense increase in population size. It has grown by over half since last 10 years reaching 16.4 million people in 2023. In order to handle such large workforce with diverse skills set demands advanced human resource systems backed up by analytics.

Moreover, companies within KSA are currently grappling with acute shortage concerning skilled personnel where nine out every ten employers claim difficulty attracting and retaining staff members who possess particular expertise. However, application tracking systems along other recruitment platforms driven by artificial intelligence can assist enterprises sift through numerous resumes thereby ensuring that only most qualified candidates get hired faster than before. Still on another note 45% of workers feel disengaged at workplace. Employee feedback learning development programs coupled performance management tools can help create positive experiences resulting higher involvement levels as well reduced churn rates among different cadres of employees. On top this, matter leading local firms like SABIC, Saudi Aramco, and Al Rajhi Bank etc. in the HR tech market have already implemented some forms technology focused around people management functions like training administration system (TAS), which helped workforce planning hence saving both money time.

The following examples can illustrate further how organizations have adopted these innovations: For instance, STC implemented an integrated HR system which reduced recruitment time by 30%, thereby, generating $3m savings annually while Almarai screened more than 40,000 applicants using AI powered recruitment platform ultimately hiring three thousand five hundred staff members in just eighteen months.

Nala being a Riyadh based digital health startup also utilized cloud-based HR tech that enabled it cut down onboarding period from two weeks to two days. Additionally, Saudi government is actively promoting uptake of these tools through various initiatives such as Ministry Human Resources Social Development launching “HR Tech Saudi” aimed at fostering creativity investment within sector. Simultaneously, allowing some selected hi-tech start-ups operate within its regulatory framework thus giving them opportunity showcase their products/services. Furthermore, SAMA even granted licenses few startups under its fintech sandbox program.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Favorable Government Initiatives Propel Digital Transformation

The reason why the Saudi Arabian HR Tech market has been growing so fast is because of the local government’s effort in promoting digitalization across all industries.

At least one initiative that influences the use of human resource technology software is Saudi Vision 2030; a document that outlines different strategies for economic growth and diversification within the country. As a matter of fact, among other things, labor should be digitized to promote new methods which encourage invention while enhancing competition as per this vision. For example, Ministry of Human Resources and Social Development has introduced “Qiwa” platform that acts as an online interface for employers with employees under their care where they interact digitally thus making transactions clear among other things. Additionally, there have also been some legal changes aimed at updating employees’ rights and labor standards which in turn led to wider adoption of HR techs in Saudi Arabia.

Employers across the HR tech market in the country are looking into automated systems so as to meet these requirements easily especially after such programs like Wage Protection System (WPS) were implemented; this initiative ensures timely payment of salaries hence many companies need payroll processing efficiencies brought about by human resources management software. These moves can be seen from increasing number Saudi businesses using HR tech solutions today alone. There is no any industry left untouched by such platforms since banks through retail up-to healthcare sectors are investing heavily on them for recruitment optimization, talent development, performance appraisal streamlining etcetera. A good example here would be SAP SuccessFactors adopted by world largest oil producer Saudi Aramco, which used it mainly for bettering its workforce efficiency alongside simplifying HR operations.

Trend: AI-Powered Recruitment and Talent Management Solutions

The HR tech market in Saudi Arabia is changing as companies begin to use AI-powered recruitment methods. This has led to a significant increase in the efficiency and effectiveness of talent acquisition processes. Our research shows that 72% of Middle Eastern CEOs expect AI to have a major impact on their businesses within the next five years, indicating the growing importance of artificial intelligence technologies for digital transformation in this region. The results are worth it – organizations can reduce time-to-hire by up to 40% through using AI-driven recruitment tools while also enhancing employee productivity by 20%.

Leading firms in the HR tech market such as Saudi Aramco and STC have implemented applicant tracking systems which use artificial intelligence technology to analyses resumes, screen candidates and identify top performers according to predetermined criteria thereby freeing up recruiters’ time; likewise, these platforms enable accurate workforce planning and early identification skill gaps because they are driven by data generated from various sources including past job applications. SABIC predicts future talent requirements through the employment of analytics tools based on algorithms derived from machine learning models trained with historical workforce data; additionally, chatbots respond immediately giving personalized replies thus saving time on repetitive tasks like answering questions.

By 2025, three quarters (75%) of all applications will be made via machines like those used at Al Rajhi Bank or airlines where chatbots entertain candidates during lengthy processes by keeping them engaged until selection process ends or promotions become available hence providing more information about themselves which enhances overall candidate experience since FAQs are answered accurately while application status updates are given promptly so one does not need to keep checking if there any changes were made on his/her position.

Organizations in the HR tech market adopt AI-supported recruitment methods because they rely heavily upon facts instead guesses when making decisions concerning people employed this is line with kingdom’s vision for a digital future which aims at data-driven insights leading automation across sectors especially HR that involve large numbers of staff whose performance affects success third-wave economies like KSA.

Challenge

Lack of skilled local talent and reliance on foreign workers

The HR tech market in Saudi Arabia struggles with a lack of qualified native professionals in technical and specialized fields. A survey from the Saudi Ministry of Labor and Social Development found that 67% of private companies see few qualifiable applicants as their number one roadblock to fulfilling Saudization requirements. The information technology industry, including the HR tech sector, is being hit hardest by this shortage. Because of this, many organizations are still heavily dependent on foreign employees for key positions.

However, visa restrictions and quotas tied to recruitment imposed by an increasingly nationalistic government have made it harder than ever for businesses operating within the Kingdom to attract or retain talent from abroad. For example; due to Nitaqat program implementation which mandates certain levels of Saudization based on industry type and company size, there has been decline in work visas given out this year compared with last year—over two hundred fifty thousand less workers came into private companies alone during 2020.

Even now skilled local talent remains scarce across all sectors within Saudi Arabia’s HR tech market. According to estimates put forward by The Saudi Information Technology Association (SITA), Riyadh needs at least 37,000 more IT experts just to meet current demand–this figure is expected rise sixty thousand over next three years up until 2023. Not only does such skills gap hinder growth in domestic e-commerce but also threatens broad-based digital transformation across nation too.

Segmental Analysis

By Application

Saudi Arabia’s HR tech market has talent management as its segment with the highest share, accounting for 56.02%. This is mainly because of several reasons; one being the digital transformation which the Kingdom is undergoing in line with its Vision 2030 strategy where companies are adopting more and more innovative technologies to streamline their talent management processes so as not to be left behind by this changing business environment. Among other things, what prompts growth in talent management segments is increasing cloud-based platforms and mobile personnel management systems penetration rate. HR professionals use Software-as-a-Service (SaaS) solutions to automate scouting, identifying and recruiting new talents from pools of available candidates besides keeping track on those already employed.

Another key driver for growth within HR tech market can be attributed towards integration of such things like artificial intelligence (AI) and machine learning (ML) into talent management systems which have been designed around large enterprises. These technologies drive organizations into making data-driven decisions thereby improving upon candidate assessment accuracy while at the same time enhancing overall efficiency within an organization’s talent acquisition process.

Apart from this, employee well-being along with retention focus also contributes significantly towards burgeoning demand levels for services offered under Talent Management. In a survey done, it was found that availability of key skills among staffs ranks number five out of seven concerns faced by CEOs worldwide when they think about organizational health hence many firms are now coming up with all rounded packages that cater for mental health support as well physical wellness programs among their workforce especially during these times when everyone needs love most inclusive work cultures remains vital.

By Type

The outsourced segment holds a dominant share of 75.92% in the Saudi Arabia HR tech market for several key reasons. Outsourcing HR functions saves money and increases efficiency which is especially useful for small businesses. Usually outsourcing fees are monthly, and they are cheaper than what it would take to keep an in-house department thus leaving organizations with enough funds that can be redirected to their core activities. More so, it provides expertise and technology; where competent professionals have current skills on laws and regulations plus more modern tools that can be modified to meet specific customer needs but most importantly ensures quick accurate payroll processing without costing too much. In addition, it helps with compliance and risk management by making sure that both national as well regional labor legislations are adhered to in Dubai or any other state within UAE where such services may be required. They also give analytics for decision-making purposes while at the same time helping companies deal with legal risks. Flexibility is another advantage of these firms since they allow organizations adjust their human resource service levels fast when there is a need brought about by rapid expansion or downsizing without going through recruitment drives or sacking employees. Hence, providing additional support on demand across various areas of personnel administration thereby improving overall business agility.

On the contrary, Saudi Arabia’s in-house HR tech market segment will record a CAGR of 9.65% during forecast period as predicted by Technavio's analysts. This projection comes against a backdrop where larger corporations along with government departments continue adopting this kind of systems due primarily out concerns over privacy protection especially after experiencing data breaches before now which might have led them opting for localized solutions instead. Those who choose custom options do so because these integrations work seamlessly well even better than off-the shelf alternatives while serving different purposes at once create value for money spent on buying it.

By End Use Industry

The information technology segment holds a high share of 22.08% of the Saudi Arabia HR tech market and is growing at a high CAGR of 9.68% during the forecast period. The IT industry in the Kingdom, which is worth more than $40.9bn and accounts for 4.6% of GDP, is also the biggest and fastest growing in the Middle East and North Africa region (MENA). Saudi Arabia’s Vision 2030 economic diversification blueprint places a strong emphasis on technology and innovation, with the government aiming to spend 2.5% of GDP on R&D annually by 2040. Meanwhile, projects such as NEOM are driving widespread use of IT systems, while e-commerce is booming. In addition, increasing attention towards data analytics & artificial intelligence within HR management will further push adoption rates for advanced HR tech solutions within the IT sector.

Saudi Arabia wants to become one of the world’s most technologically advanced countries and has launched a range of initiatives to support this ambition, including national transformation programs and digital infrastructure schemes such as the Saudi Vision Cable and Alibaba Cloud. These efforts will continue contributing to high growth levels across Saudi Arabia’s information technology (IT) sector over future years due to an increasing demand for automation in human resources processes coupled with rising investments made by firms engaged into development or deployment-related activities associated with these type solutions.

By Company Size

The Saudi Arabia HR Tech market is experiencing significant growth, with the greater than 5k employees segment holding a high market share of 44.75% in 2023 and projected to grow at the highest CAGR of 9.45% during the forecast period. As technology advances, HR software solutions have become increasingly important for larger companies to effectively manage their workforce. These companies are using cloud deployments and automation in HR processes to simplify tasks and enhance employee involvement. The market is growing due to the digitization trend and adoption of analytics-based HRM software that allows companies to utilize data-driven insights and align HR strategies with wider organizational objectives.

The cost of implementing such systems can be prohibitive especially for SMEs however benefits from centralizing functions and automating them are becoming clearer with time. Therefore, it is expected that the Greater than 5k employee segment will continue dominating the Saudi Arabia HR Tech market over next few years as well registering highest growth rate.

To Understand More About this Research: Request A Free Sample

Recent Developments

- In April 2024, Saudi Arabia’s HR tech secures $30 million in funding with plans for expansion on the horizon.

- In October 2023, the KSA-Based HR Tech Platform Jisr raises $30 million, marking the Middle East's largest Series A round for a SaaS firm.

- In July 2023, HR startup Alfii received $2.5 million in pre-seed funding for the development of HR management software as reported by WAYA Staff.

- In August 2022, KABI completed the acquisition of HR tech startup BLOOVO.

Key Players in Saudi Arabia HR Tech Market

- SAP SE

- Oracle Corporation

- Automatic Data Processing (ADP), Inc

- Cornerstone OnDemand, Inc.

- Ceridian HCM Holding Inc.

- Infor, Inc.

- Cegid Group

- The Access Group

- Other Prominent Players

Market Segmentation Overview:

By Application

- Talent Management

- Payroll Management

- Performance Management

- Workforce Management

- Recruitment

- Others

By Type

- Inhouse

- Outsourced

By End Use

- TTH (Travel, Transportation, and Hospitality)

- Public Sector

- Healthcare

- Information Technology

- BFSI

- Others

By Company Size

- Less than 1k Employees

- 1k-5k Employees

- Greater than 5k Employees

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0424818 | Delivery: 2 to 4 Hours

| Report ID: AA0424818 | Delivery: 2 to 4 Hours

.svg)