Saudi Arabia GRC Cladding Market: By Product Type (Sprayed GRC Cladding, Premix GRC Cladding, Hybrid GRC Cladding); Thickness (10 mm - 20 mm, 20 mm - 40 mm, 40 mm - 60 mm, 60 mm or more); Color Range (Natural White, Grey, Red, Yellow, Monochromatic, Multi-colored, Others); Surface Finish (Textured, Smooth, Patterned, Customized Designs); End Use (Residential, Commercial (Hospitality and Tourism, Retail, Healthcare, Educational Institutes, Others), Industrial, and Government); Distribution Channel (Online, Offline (Direct, Retailers, Distributors and Wholesalers, Others)— Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: 08-Apr-2024 | | Report ID: AA0923619

Market Scenario

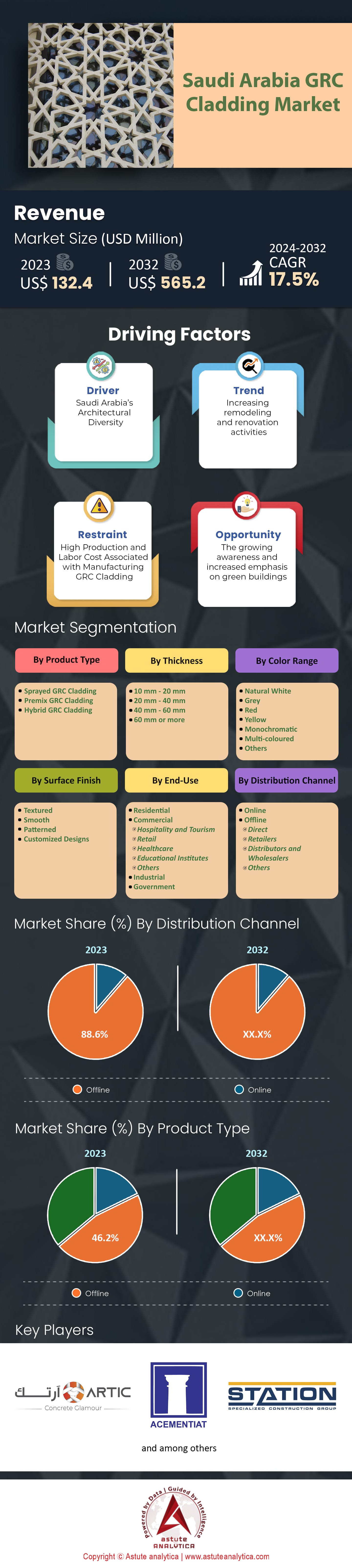

Saudi Arabia GRC Cladding Market was valued at US$ 132.4 million in 2023 and is projected to generate a revenue of US$ 565.2 million by 2032 at a CAGR of 17.5% during the forecast period 2024–2032.

Saudi Arabia’s construction landscape is undergoing a significant transformation. With an 18% increase in infrastructure investment over the past three years, the demand for modern building materials, including Glass Reinforced Concrete (GRC) cladding, is on the rise. Saudi Arabia, steered by its Vision 2030 and the Iskan programme, is on the cusp of significant property market expansion. S&P Global Ratings, a leading ratings agency, predicts an investment of $1 trillion in real estate and infrastructure in the GRC cladding market. This includes the establishment of eight new cities, mainly dotting the Red Sea coastline, aiming to offer over 1.3 million residences by 2030's close. These ambitious developments also resonate with Riyadh's aspirations to rank among the world's top ten cities. By 2030, projections hint at Riyadh's populace surpassing the 15 million markmarkssignificant leap from its 8 million in 2018.

With Riyadh's transformation, the tourism sector is poised for exponential growth in the GRC cladding market. Boosted by aviation enhancements and signature projects like the Red Sea Project—featuring opulent hotels, marinas, and an exclusive airport—the Kingdom is striving to welcome 100 million annual visitors by the end of this decade. It's noteworthy that around half of these visitors are expected in Riyadh, inclusive of 30 million for religious tourism, marking a significant rise from the current 8 million. Vision 2030 places tourism at its forefront, highlighting it as a primary non-oil sector to spur economic growth. Through its focus, the country envisions tourism's contribution to the GDP surging to 10%, a considerable jump from the present 3%. This pivot is anticipated not only to bolster the nation's economy but also to generate employment for the younger demographic. Initiatives like Neom, the Red Sea Project, and Qiddiya are emblematic of the nation's endeavors to amplify its appeal to international travelers.

In 2020, Saudi Arabia laid the foundation for the Tourism Development Fund, boasting a capital of $4 billion. The primary objective of this fund is to smoothen the path for private investors, granting them easier access to promising investment ventures through substantial project funding in the GRC cladding market. This push for privatization is also evident in the hospitality sector. Plans are underway to inaugurate 500,000 hotel accommodations by 2030, majorly positioned within these mega-projects. Furthermore, substantial commitments towards the transportation sector are expected to bolster the travel experience, drawing from a blend of public and private financial reserves.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Vision 2030’s Infrastructural Renaissance

The Kingdom of Saudi Arabia's ambitious Vision 2030 is unmistakably the primary driver for the monumental growth observed in the GRC cladding market. Vision 2030 embodies the nation’s aspirations for economic diversification, infrastructural development, and modernization. A linchpin of this vision is the strategic move towards less dependency on oil, urging sectors like construction and real estate to take center stage.

Recent statistical analyses reveal that there's been an impressive 18% increase in infrastructural investments over the past three years. Such an increment directly correlates with the rising demand for advanced, durable, and aesthetically pleasing building materials like GRC cladding. The promise to establish eight new cities, primarily along the Red Sea coast, with a target to add 1.3 million homes by 2030 further substantiates this demand in the GRC cladding market. After all, these urban developments will necessitate vast amounts of construction materials, with GRC cladding anticipated to cover a significant portion, given its benefits in terms of durability, versatility, and aesthetic appeal.

Moreover, Riyadh’s aspirations to swell its populace to a staggering 15 million by 2030, up from 8 million in 2018, further emphasize the urban expansion. This anticipated 87.5% increase in the city's population over a span of just 12 years is not just a testament to rapid urbanization but also an indicator of the colossal demand for advanced construction materials, including GRC cladding.

Trend: Eco-conscious Building Materials in Construction

As global awareness regarding sustainable construction practices grows, Saudi Arabia GRC cladding market is not lagging. Recent surveys suggest that approximately 40% of construction companies in the Kingdom now prioritize environmentally friendly building materials. In this backdrop, GRC cladding emerges as a front-runner, known for its sustainable properties, long lifespan, and reduced carbon footprint. Recent statistics from the Saudi Green Building Forum indicate a surge in the adoption of green building practices. The numbers show a commendable 35% increase in green building projects in 2022 compared to the previous year. GRC, with its eco-friendly attributes, has been a material of choice in a significant portion of these projects.

Moreover, the Saudi government's recent initiatives to incentivize projects that meet specific green building criteria further boost this trend. The Ministry of Housing’s recent report revealed that projects which incorporated sustainable materials like GRC cladding saw a 20% faster approval rate compared to others. This accelerated approval, coupled with potential financial incentives, is undeniably pushing more real estate developers and builders towards eco-friendly materials in the GRC cladding market. Also, as the Kingdom opens its doors wider for international tourism, there's a discernible push for structures that not only reflect modern architectural elegance but also resonate with global sustainability standards. With mega-projects like the Red Sea Project, which aims to attract millions, the emphasis is on creating sustainable luxury. Given the stats, it's no surprise that GRC cladding, which amalgamates sustainability with modern aesthetics, is riding the crest of this trend.

Restraint: Limited Local Expertise and Skill Shortage

In the burgeoning construction sector of Saudi Arabia, driven predominantly by Vision 2030’s vast infrastructural goals, one primary restraint emerges: the limited local expertise and skill shortage specific to advanced construction materials like Glass Reinforced Concrete (GRC) cladding. As the GRC cladding technology is relatively modern, especially in the context of the Saudi construction landscape, there exists a palpable gap between the demand for such materials and the availability of skilled workforce proficient in its application and maintenance in the GRC cladding market. While the Kingdom has witnessed an 18% surge in infrastructure investments over the past three years, the human resources required to deploy specialized materials like GRC cladding have not grown proportionately.

Moreover, the introduction of Saudization policies, which emphasize the employment of Saudi nationals over expatriate workers, adds a layer of complexity. While the policy's intent is commendable – to ensure economic benefits stay within the Kingdom and provide employment opportunities for Saudi nationals – the rapid growth of niche markets like GRC cladding market has inadvertently created a skills gap. Many expatriate workers previously filled specialized roles, and with their decreasing numbers, the market faces a dual challenge: to rapidly train the local populace while also meeting the escalating demand.

The long-term solution lies in comprehensive training programs and collaborations with international experts. However, in the short run, this skill shortage and expertise gap pose a significant restraint in the GRC cladding market, potentially affecting timely project completions and quality standards.

Segmental Analysis

By Product Type:

The Saudi Arabia GRC cladding market is experiencing a dynamic shift in terms of product types. As of now, the premix GRC cladding segment is the undisputed leader, holding a substantial market share of 46.2%. The dominance of the premix GRC segment can be attributed to its ease of production, versatility in applications, and compatibility with a wide range of architectural designs. Being a preferred choice for many developers and architects due to its tried-and-tested nature, premix GRC has found a strong foothold in numerous construction projects across the Kingdom, especially those aligned with Vision 2030's infrastructural ambitions.

However, the winds of change are blowing in the direction of the hybrid GRC cladding segment. Even though it currently holds a lesser share compared to the premix variant, it's projected to register a remarkable compound annual growth rate (CAGR) of 18.7%. This surge in demand for hybrid GRC can be traced back to its advanced properties: enhanced durability, superior aesthetic finishes, and better adaptability to modern architectural requirements. As construction in Saudi Arabia moves towards more sustainable and innovative designs, the hybrid GRC cladding segment's growth trajectory is anticipated to soar, reshaping market dynamics in the coming years.

By Color Range:

In terms of color preferences for GRC cladding in Saudi Arabia, the natural white segment is clearly in the limelight. Currently, it leads the Saudi Arabia GRC cladding market with an impressive 31.3% share. The preference for natural white in architectural and design circles stems from its ability to reflect the Kingdom's traditional architectural lineage while seamlessly blending with contemporary designs. Furthermore, the natural white shade offers a cooling effect – a crucial factor considering Saudi Arabia's scorching temperatures. This color not only aids in reducing the heat absorption of buildings, thereby promoting energy efficiency, but also provides an elegant and timeless finish to edifices.

Surprisingly, the same segment – natural white – is also projected to experience the highest growth, boasting a CAGR of 19.2%. As Saudi Arabia continues its journey of urban development and modernization, the inclination towards designs that merge tradition with modernity will only intensify. Natural white, with its minimalist and versatile appeal, perfectly aligns with this vision. As architects and developers aim to create structures that resonate with both local heritage and contemporary aesthetics, the demand for the natural white GRC cladding is poised to skyrocket, cementing its position as a market leader in the color segment.

By End-Use:

The GRC cladding market in Saudi Arabia exhibits varied dynamics when analyzed from an end-use perspective. At the forefront of the market is the government sector, grasping an imposing 39.8% market share. This substantial share can be linked directly to the numerous government-backed infrastructure projects, many of which are part and parcel of the ambitious Vision 2030. These projects, spanning from mammoth urban development plans to transportation hubs and public facilities, have been instrumental in propelling the demand for quality construction materials like GRC cladding.

However, swift growth rate is observed in the commercial segment. While currently holding a lesser share compared to the government sector, it's projected to expand at a remarkable CAGR of 18.6%. This escalating demand in the commercial arena can be accredited to the country's efforts to diversify its economy. With a surge in commercial complexes, malls, offices, and other private-sector establishments, the demand for aesthetic, durable, and efficient GRC cladding solutions will undoubtedly soar. As the Kingdom seeks to bolster its tourism, entertainment, and business avenues, the commercial segment's growth trajectory seems set on an upward climb.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

By Sales Channel:

Analyzing the Saudi Arabian GRC cladding market from a sales channel segmentation, a traditional pattern emerges. The offline sales segment holds the lion's share, accounting for a dominant 88.6%. This dominance is rooted in the long-established trust between buyers and brick-and-mortar suppliers, coupled with the nature of the product. GRC cladding often necessitates tactile assessments, which builders and architects prefer to undertake in person. Additionally, the complexities involved in shipping and handling these materials further strengthen the reliance on offline channels.

However, as digitalization is rooting in the Saudi business ecosystem, the online sales channel is emerging as a potent contender in the GRC cladding market. Despite its current smaller market share, it is projected to grow at a stellar CAGR of 18.9% in the years to come. This surge can be ascribed to a combination of factors. The younger generation of architects, builders, and decision-makers, familiar with the convenience of e-commerce, are gradually pivoting towards online procurement. Technological advancements, facilitating virtual assessments and secure logistics, are further catalyzing this shift. Moreover, as suppliers embrace digital platforms, offering competitive pricing, detailed product descriptions, and customer reviews, the online segment is poised to redefine the market's future dynamics.

Key Players in Saudi Arabia GRC Cladding Market

- Acementiat (Taktheer Comapny Ltd. Factory)

- Al-Bitar Factory Co.

- Al-Rimal Trading Company (Rimal Trading & Contracting Co. )

- Arabian Tile Company Ltd. – ARTIC

- Durraka

- GRC Touch Factory & Company

- Gulf Precast Concrete Co. LLC

- Petra GRC

- Saudi Concrete Products Co. Ltd. (SACEP & CONSTRUCT Co. Ltd.)

- Station Group

- TUNSIF GRC

- Other Prominent Players

Market Segmentation Overview:

By Product Type

- Sprayed GRC Cladding

- Premix GRC Cladding

- Hybrid GRC Cladding

By Thickness

- 10 mm - 20 mm

- 20 mm - 40 mm

- 40 mm - 60 mm

- 60 mm or more

By Color Package

- Natural White

- Grey

- Red

- Yellow

- Monochromatic

- Multi-coloured

- Others

By Surface Finish

- Textured

- Smooth

- Patterned

- Customized Designs

By End Use

- Residential

- Commercial

- Hospitality and Tourism

- Retail

- Healthcare

- Educational Institutes

- Others

- Industrial

- Government

By Distribution Channel

- Online

- Offline

- Direct

- Retailers

- Distributors and Wholesalers

- Others

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)