Saudi Arabia Digital Printing Market: By Solution (printer(small format digital laser printers, wide-format Inkjet printers(roll-feed printers, flatbed printers, hybrid printers), others) Consumables (ink(Aqueous, Solvent, UV-curable, latex, Dye sublimation), Media/Substrate(Fabric, Paper & paperboard, plastic films/foils, metal, glass, leather, ceramics, other, cartridge, other consumables) and Services(Design & installation, training, repair & maintenance); Application(Barcoding, numbering, labelling, QR coding, variable data, marking, on-demand printing, web-to-print, other); End user(textile, packaging, advertising, cosmetic &personal care, food & beverage, electronics, automotives, healthcare, others); Region-Market size, industry dynamics, opportunity analysis and forecast for 2024-2032

- Last Updated: 05-Jun-2024 | | Report ID: AA0624844

Market Scenario

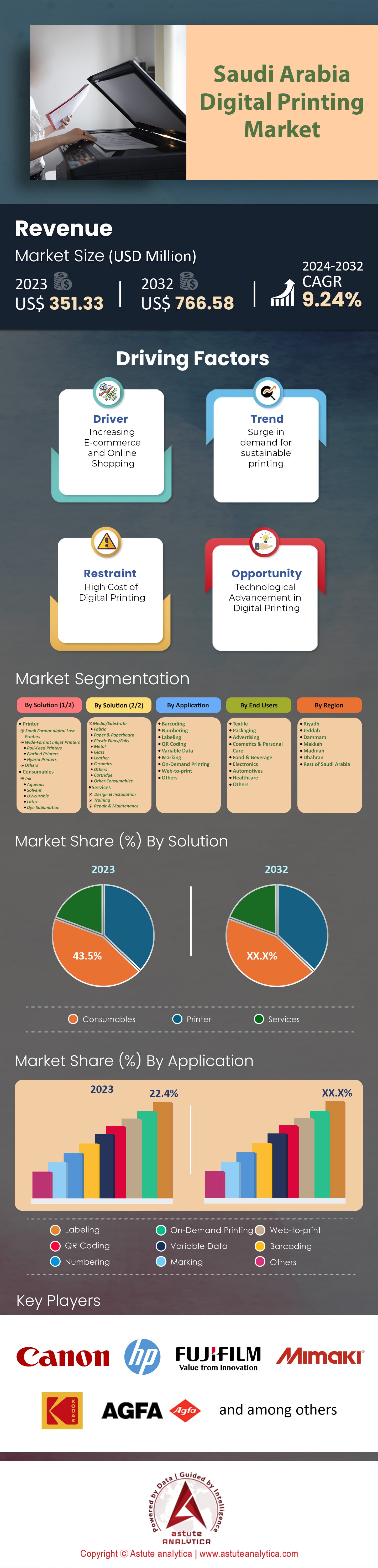

Saudi Arabia Digital Printing Market was valued at US$ 351.33 million in 2023 and projected to generate a revenue of US$ 766.58 million by 2032 at a CAGR of 9.24% during the forecast period 2024-2032.

Saudi Arabia is currently experiencing an unprecedented boom in the demand for digital printing services. There are many reasons behind this phenomenon including economic growth, technological advancement and changes in the market needs among others. The government's Vision 2030 program which seeks to move away from oil dependency as the mainstay of its economy has also played a role by opening up more sectors like printing and publishing. This has led to improved communication infrastructures, new transport routes as well as state-of-the-art industrial complexes that provide an enabling environment for growth within the digital printing industry. Non-oil GDP grew by 4.8% in 2023 according to General Authority for Statistics (GASTAT) reflecting diversification success.

Businesses across the Saudi Arabia digital printing market are attracted to digital printing technology because it offers fast turnaround times, high quality prints and can print on various materials. Zeejprint is one example of such companies that have capitalized on these advancements to offer innovative and top-notch printing services across Saudi Arabia. It was established in 2003 and provides a range of products including business cards, flyers t-shirts among others thus catering for different business needs. DC Print based in Riyadh known for premium quality prints with quick turnaround times.

Another factor contributing to the popularity of digital printing is its ability customize and offer on-demand services. For instance, now businesses can order personalized marketing materials designed specifically for them which gives them flexibility especially if they are small or medium enterprises trying to differentiate themselves from competitors in crowded markets according to Monsha'at SMEs constitute 99.5% of all businesses hence there lies a huge market potential here. Additionally, this customization capability comes along with cost effectiveness plus efficiency that characterizes digital printing since it is cheaper than traditional methods when dealing with short runs by doing away with plates thereby reducing set up time thus helping organizations save money while still achieving desired quality standards.

To Get more Insights, Request A Free Sample

Changing Consumer Behavior Shapes Saudi Arabia’s Digital Printing Market

Market trends coupled with consumers’ changing tastes also influence demand for digital printing services. People are increasingly looking for visually appealing printed materials that can be produced quickly and cheaply. Additionally, being a regional hub at the crossroads between North Africa and the Gulf Saudi Arabia's strategic location further strengthens its position as a major center for print production attracting businesses from neighboring countries like UAE, Bahrain etc.

Government support together with infrastructure development provides further impetus behind growth within this industry. The government has invested heavily in building up necessary infrastructure aimed at supporting various sectors including printing thereby creating an enabling business environment in the country. AlphaGraphics, for example, is able combine digital marketing and printing services effectively in the digital printing market thanks to such support thus helping companies reach out to their customers better through comprehensive service offerings targeted towards specific audiences. As of 2024, there has been a 15% rise in government spending on infrastructure projects which includes substantial investments into digital economy within Saudi Arabia.

Market Dynamics

Trend: Increasing Preference for Personalization and Customization

In Saudi Arabia and worldwide, the requirement for digital printing services has been accelerated by a tendency towards customized print materials. This means that people want products printed to reflect their particular requirements or individual tastes – motivating companies within this sector to offer an even more varied selection of services. According to Printweek’s study into consumer behavior 78% of customers are likely to deal with brands who give them personal experience. To provide a wide range of bespoke marketing materials, AlphaGraphics in Saudi Arabia use their own printing facilities. They have personalized business cards, stationery sets, brochures, posters and flyers among others so as meet clients’ unique needs. InfoTrends predicts that every year until 2025 demand for personalized printed products will grow at least by 12%.

Variable Data Printing (VDP) technology has been instrumental in driving up levels of customization even further in the Saudi Arabia digital printing market. This comes as no surprise considering how much success rate there is behind such strategies like these. Thanks to VDPs ability create highly targeted pieces based on different customer profiles using various software programs while relying upon any given printer which uses digital capabilities – all those who need something printed can get it done quickly without having lots produced at once only for most them go unused because they were irrelevant.

Personalization doesn’t just help engage customers more but also gets better responses too. Research done by The Direct Marketing Association shows that when mailings are tailored towards individuals rather than being generic there’s a five-fold increase in people replying back. They found out response rates stood at 5.1%. Personalized direct mail campaigns were revealed through the same study conducted by DMA which stated personalized versions received reply rates close to 1% while non-personalized ones got barely any replies with only about 6%. It has also been proven that personalized print can keep clients loyal as a study showed that 70% of consumers said they would stick around longer for brands providing such experiences.

Driver: Growing Integration of Digital Marketing and Printing Services Across Saudi Arabia Digital Printing Market

The integration of digital marketing and printing services is a major factor that is driving the growth of digital printing companies in Saudi Arabia. Companies are increasingly looking for holistic 360-degree marketing support that brings together digital channels with printed materials’ tangibility. Research by CMO Council discovered that 79% of marketers agree that integrating print and digital marketing strategies is vital to success. In response to this demand, digital printing companies offer various integrated services. For instance, AlphaGraphics positions itself as an international marketing company which combines printing with digital marketing as well as even digital lighting solutions so as to help businesses effectively reach their target audience. This wholesome approach enables firms create seamless branding experiences throughout multiple touchpoints.

Through integrating both mediums, businesses in the digital printing market can leverage on their respective strengths. While digital channels provide wider reach, interactivity and real-time engagement; printed materials give a tactile experience, longevity and sense of credibility according to Two Sides survey where 56 % respondents said they trusted printed marketing material more than any other form of advertising media. Campaigns that integrate both print & non-print elements have been proven to drive higher engagement rates among recipients who then respond actively towards such initiatives. According to the Direct Marketing Association study on integrated campaigns using print alongside other channels like AR or QR codes; it was found out those had 12% higher response rate compared against single channel campaigns only. In addition, new interactive possibilities came into being after association between QR codes together with augmented reality technologies plus print media.

Challenge: Supply Chain Disruptions and Material Availability

In the past few years, digital printing companies in Saudi Arabia digital printing market have been faced with major problems due to supply chain disruptions and material availability. The worldwide distribution system has created significant disturbances within the print industry that have affected both the cost and access of components. A study from the Printing Industries of Saudi Arabia discovered that 89% printers had experienced supply chain issues in 2023. Global supply chains were shown to be brittle by this pandemic as evidenced by lockdowns, closed borders, delayed transportation leading to shortage etcetera caused because they could not handle such shocks which is attributable mainly to economic/political tensions between US-China; Russia-Ukraine; India China among others according UNCTAD report on global trade contraction rate being 3.5%.

The digital printing market in Saudi Arabia heavily relies on imported raw materials for digital printing like paper, ink and toner. However, these items are now scarce due disruptions along its supply chain thus making it difficult for enterprises engaged in this type production line meet their targets or keep up with demand levels from consumers. In addition, scarcity has also caused prices rise significantly where Bureau of Labor Statistics reports show that producer price index (PPI) increased by 9% during 2023 alone.

The interference with availability plus pricing structures was one part but there were other effects too namely production scheduling as well delivery timing problems met by local firms involved with digital printing business after materials did not arrive timeously Owings to lengthy shipping periods brought about due to global travel restrictions imposed on countries throughout world linked directly or indirectly around political/economic wrangles between major powers i.e., US Vs China-Russia-Ukraine, India-China etc. According survey findings communicated through authority called Printing Industries America, over 52% respondents who were involved in printing services said that their production processes had experienced some delays occasioned by issues related to supply chain management.

Future Outlook of the Saudi Arabia Digital Printing Market Looks Promising

- Economic Growth and Market Expansion:

Among the highest-growing economies in the G20 is expected to be Saudi Arabia, which gives priority to industrial and economic diversification. This strong growth of economy has led to increased need for cutting edge printing technology especially within the packaging, retail and logistics sectors. Corrugated, folding cartons, flexible packaging as well as labels and tags market is expected to grow at a CAGR of 4.23% from 2024-2032. These areas need advanced printing solutions that can address growing demand for quality packaging materials and labels.

- Technological Advancements:

Cutting-edge digital printing technologies are being embraced faster than ever before across the Saudi Arabia’s digital printing market. Companies are investing more into automated & digitized printing solutions so as to increase efficiency while meeting regulatory standards simultaneously. The Ministry of Industry and Mineral Resources’ 4000 factories’ digitization program is an indicative example among many others showing this shift towards automation & digitalization. Also, Canon’s Channel Partner Program will act as a game changer since it fosters collaboration with partners all over the Saudi market thereby driving further technology adoption.

Market Opportunities:

Drivers behind digital printing market include the rise of e-commerce coupled with demand for efficient supply chain management. Wide format printing together with book printing have been identified as some of the promising growth applications where by 75% regional printers recorded wide format graphics growth while 66% book printing respectively was realized. Additionally, increasing number of SMEs (which grew by 2.6% in Q2-2023) also contributes towards demand for digital print solutions because these businesses require cost effective as well scalable alternatives when it comes to their various printing needs.

Segmental Analysis

By Solution

Based on solution, the consumables segment is leading the Saudi Arabia digital printing market by capturing more than 43.4% market share and is also projected to keep dominating the market by growing at a healthy CAGR of 9.54% in the years to come. Digital printing relies on many essential consumables for the process of printing. Some of the key consumables in this regard include ink cartridges, toner cartridges, print heads, substrates, printer drums, fuser units, and specialty inks and coatings. Print heads have to be replaced regularly so as to keep up with standard printing quality. Typically, they last between one and two years. However, laser printers require replacement after 10k-50k pages for drums (printer drum) and after 100k-200k pages for fuser units respectively. Specialty inks are used for particular applications such as outdoor signage or textile printing or high-quality photo prints; examples of specialty inks include UV inks, eco-solvent inks, dye sublimation among others.

In terms of spending, consumables take up a larger portion than printers themselves and related services due to their recurring nature as well as frequency of use plus cost implications associated with having specialty types thereof too. According to Astute Analytica study findings, businesses spend about 3% their annual revenues on printing alone where majority falls under consumables category because it consumes more money than anything else i.e., volumes involved are high coupled with some being expensive – IDC estimates average office worker prints approximately 10k sheets per year.

Apart from this, special inks and substrates in the Saudi Arabia digital printing market are more costly than common consumables because of their distinct features and uses. UV inks can be 50% more expensive than traditional ones while high-quality photo paper can be as much as ten times costlier than regular paper. Consumables such as print heads, drums and fuser units should be serviced or replaced regularly for the printer to achieve its best performance in terms of print quality. The cost of a new print head varies between $50 – $300 depending on printer model/type; many printers work better with manufacturer approved consumables which usually have higher prices compared to third party alternatives. A survey by Printerland revealed that using OEM (Original Equipment Manufacturer) consumables could amount up to 30% extra spendings than third-party options but they offer greater reliability and print quality.

By Application

Based on application, the Saudi Arabia digital printing market is led by the labelling segment. It generated over 22.4% revenue of the market in 2023 and is also expected to continue growing at the highest CAGR of 9.81% during the forecast period, 2024–2032. Several factors are driving the rapid growth of the labeling segment of the digital printing market in Saudi Arabia. These include strict statutory standards, technological advances and a dynamic business environment among others. Saudi Arabian laws require labeling and marking of different forms of products especially pharmaceuticals, medical devices and food items. The Saudi Food and Drug Authority (SFDA) insists that each human drug must bear a barcode compliant with GS1 specifications; this should contain GTINs plus Data Matrix Barcodes too. Additionally, imported goods must be labeled clearly showing their countries of origin as well as manufacturers’ details – all these call for sophisticated digital printing systems capable of producing high quality labels that meet these requirements.

Compliance with these rules has been made easier by availability advanced digital printing technology. For instance, Aflak and Zebra have various models of barcode printers suitable for use across different sectors ranging from industrial to mobile applications. Such machines support high resolution printing, variable data printing as well as system integration which makes it possible to produce approved labels fast and cheaply.

Retailing sector together with logistics industry is experiencing tremendous growth rates in Saudi Arabia where people are increasingly adopting robust labelling solutions due to e-commerce activities coupled with demand for effective supply chain management. Web-to-print services enable businesses customize orders online thereby simplifying production process while cutting costs especially for small enterprises without huge capital outlay on print infrastructure during expansion phase thus fueling demand for such offerings even further. The digital printing market is also expanding rapidly particularly in retail trade pharmaceutical logistics among other areas. For example, there has been an increase in sales volume Honeywell barcode printers because they have high memory capacity large print speed connectivity features like Bluetooth USB which shows that people are starting to appreciate faster modes of producing prints within shorter periods while maintaining quality standards.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Major Players in Saudi Arabia Digital Printing Market

- Agfa-Gevaert N.V.

- Canon, Inc.

- Epson co.

- Fujifilm Holdings Corporation

- Gulf Business Solution (GBS)

- HP Inc.

- Kodak

- Konica Minolta

- MARK21EM-IMAJE

- Mimaki Engineering Co., Ltd.

- Prolines Group

- Rabt Digital

- Ricoh Company Ltd.

- Toshiba Corporation

- Xerox Corporation

- Other Prominent Players

Market Segmentation Overview:

By Solution

- Printer

- Small Format digital Laser Printers

- Wide-Format Inkjet Printers

- Roll-Feed Printers

- Flatbed Printers

- Hybrid Printers

- Others

- Consumables

- Ink

- Aqueous

- Solvent

- UV-curable

- Latex

- Dye Sublimation

- Ink

- Media/Substrate

- Fabric

- Paper & Paperboard

- Plastic Films/Foils

- Metal

- Glass

- Leather

- Ceramics

- Others

- Cartridge

- Other Consumables

- Services

- Design & Installation

- Training

- Repair & Maintenance

By Application

- Barcoding

- Numbering

- Labeling

- QR Coding

- Variable Data

- Marking

- On-Demand Printing

- Web-to-print

- Others

By End Users

- Textile

- Packaging

- Advertising

- Cosmetics & Personal Care

- Food & Beverage

- Electronics

- Automotives

- Healthcare

- Others

By Region

- Riyadh

- Jeddah

- Dammam

- Makkah

- Madinah

- Dhahran

- Rest of Saudi Arabia

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)