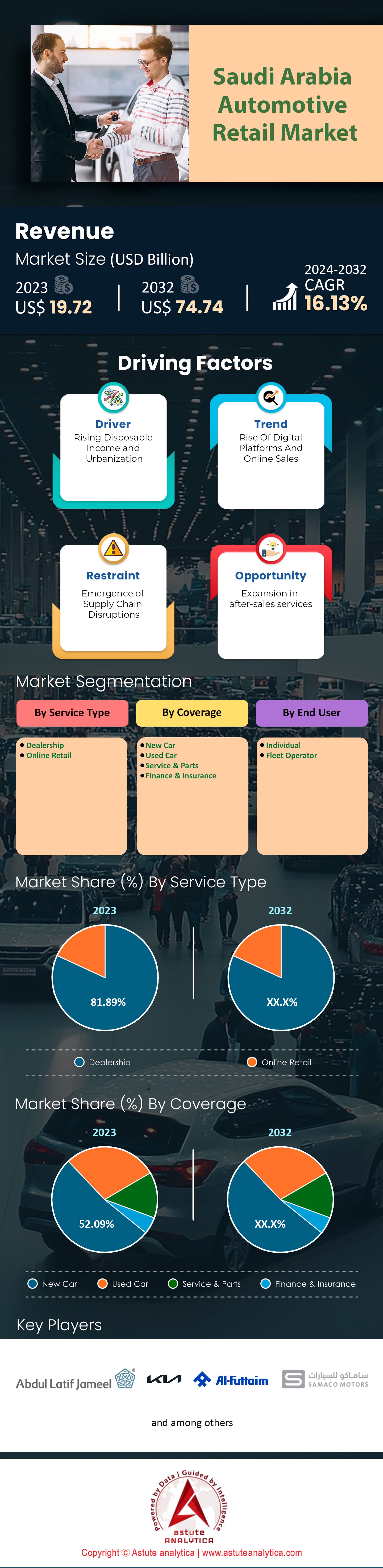

Saudi Arabia Automotive Retail Market: By Service Type (Dealership and Online Retail); Coverage (New Car, Used Car, Service & Parts, Finance & Insurance); End Users (Individual and Fleet Operator)—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: Oct-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA1024965 | Delivery: 2 to 4 Hours

| Report ID: AA1024965 | Delivery: 2 to 4 Hours

Market Scenario

Saudi Arabia automotive retail market was valued at US$ 19.72 billion in 2023 and is projected to hit the market valuation of US$ 74.74 billion by 2032 at a CAGR of 16.13% during the forecast period 2024–2032.

Saudi Arabia's automotive retail market is experiencing significant growth, solidifying its position as a leading market in the Middle East. The annual retail sales of automobiles have reached approximately 759,000 units, showcasing a robust demand in both passenger and commercial segments (Source: Saudi Automobile Association, 2023). The market value is estimated to exceed $72 billion by 2032, reflecting strong consumer purchasing power and economic stability. Vehicles witnessing strong demand include SUVs and luxury cars, aligning with consumer preferences for spacious and high-performance vehicles suitable for urban and off-road driving conditions prevalent in the region. Additionally, the electric vehicle (EV) segment is gaining traction, with sales surpassing 779 units in 2023 due to increasing environmental awareness and government incentives.

Key consumers driving the automotive retail market's growth are the young and affluent population, with Saudi Arabia's median age being around 31 years (Source: World Bank, 2023). The lifting of the female driving ban in 2018 has significantly expanded the customer base; over 200,000 women have obtained driving licenses since then, contributing to increased vehicle sales (Source: Saudi Ministry of Interior, 2023). The rise of e-commerce has led logistics and delivery companies to expand their fleets, boosting demand for light commercial vehicles, with sales exceeding 70,000 units in 2023 (Source: Gulf Business, 2023). Furthermore, religious tourism plays a pivotal role, with over 10 million pilgrims visiting annually, enhancing demand for transportation services (Source: Saudi Commission for Tourism and National Heritage, 2023).

Key factors enabling the growth of the automotive retail market include government initiatives under Vision 2030 aimed at economic diversification and reducing oil dependency. The government has invested over $5 billion in developing local automotive manufacturing, including partnerships with global manufacturers like Lucid Motors and Hyundai (Source: Saudi Ministry of Investment, 2023). Infrastructure projects totaling $400 billion have improved road networks, encouraging vehicle ownership (Source: Saudi Ministry of Finance, 2023). Current trends targeted by automotive providers include the introduction of electric and hybrid vehicles, with plans to establish local EV manufacturing facilities aiming to produce 150,000 units annually by 2026. Companies are also focusing on digitalization, enhancing online sales platforms and offering virtual showrooms to cater to tech-savvy consumers.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Government Investment in Infrastructure and Vision 2030 Initiatives Boosting Automotive Sector Growth

Saudi Arabia's Vision 2030 is a transformative plan aiming to diversify the economy and reduce oil dependency, significantly impacting the automotive retail market. The government has allocated over $400 billion for infrastructure projects, including road expansions and new urban developments like NEOM city (Source: Saudi Ministry of Finance, 2023). Improved road networks spanning 200,000 kilometers facilitate increased vehicle usage and ownership (Source: Saudi Ministry of Transport, 2023). In addition, the Public Investment Fund (PIF) invested $1 billion in Lucid Motors to establish electric vehicle manufacturing in the Kingdom, projected to produce 150,000 units annually by 2027. Agreements with automotive giants like Toyota and Hyundai are in place to explore local manufacturing opportunities.

The expansion of the customer base is evident with over 200,000 women obtaining driving licenses since the lifting of the female driving ban (Source: Saudi Ministry of Interior, 2023). Vehicle loans in the automotive retail market have surged, with over $10 billion in auto loans issued in 2023 (Source: Saudi Arabian Monetary Authority, 2023). Economic cities like Jazan Economic City offer incentives, fostering a favorable business environment (Source: Saudi Economic Cities Authority, 2023). Vehicle ownership is expected to rise from 250 to 300 cars per 1,000 people by 2025 (Source: World Bank, 2023), emphasizing the growth potential driven by governmental support.

Trend: Growing Interest in Electric Vehicles with Government Support for EV Adoption and Manufacturing

The shift towards electric vehicles (EVs) is a significant trend in Saudi Arabia's automotive retail market. The government aims for 30% of vehicles in Riyadh to be electric by 2030 (Source: Saudi Green Initiative, 2023). Investments of $3.4 billion in EV infrastructure, including charging stations and manufacturing facilities, underline this commitment. The partnership between the Public Investment Fund and Lucid Motors includes plans to produce 150,000 EVs annually by 2027, creating over 4,000 jobs. Import tariffs on electric vehicles have been reduced, increasing the availability of models from Tesla, BYD, and Nissan (Source: Saudi Customs Authority, 2023). As of 2023, there are over 5,000 electric vehicles registered, a substantial rise from previous years (Source: Saudi Automobile Association, 2023).

Over 500 EV charging stations have been installed, with plans to reach 5,000 stations by 2025. The transportation sector's role in reducing carbon emissions by 130 million tons by 2030 is crucial. A survey revealed that 60% of citizens are willing to consider purchasing an EV. Automotive retailers are expanding EV offerings, with companies like Abdul Latif Jameel Motors partnering with EV manufacturers.

Challenge: Fluctuating Oil Prices Influencing Consumer Spending and Economic Stability in the Automotive Market

The dependency on oil makes Saudi Arabia's economy susceptible to fluctuating oil prices, presenting challenges to the automotive retail market. A drop in oil prices from $70 to $50 per barrel can lead to a budget deficit exceeding $50 billion (Source: Saudi Ministry of Finance, 2023). Such deficits may result in austerity measures, including increased Value Added Tax (VAT), which rose from 5% to 15% in 2020. Economic contraction affects consumer purchasing power, leading to decreased spending on vehicles. Auto loans decreased to $9 billion in 2023 from $10 billion the previous year (Source: Saudi Arabian Monetary Authority, 2023). Some dealerships reported a decline of 10,000 units in annual sales during periods of low oil prices (Source: Gulf Business, 2023). Currency fluctuations tied to oil revenues impact import costs, increasing vehicle prices.

Manufacturers and retailers in the automotive retail market face challenges like adjusting inventory levels and offering promotions to maintain sales. The automotive market remains sensitive to changes in oil prices, and while the government works towards economic diversification, the immediate impacts of oil price volatility necessitate strategic planning within the industry.

Segmental Analysis

By Dealership

Based on services, the dealership segment captured over 81.89% The dealership segment's leadership in Saudi Arabia's automotive retail market is attributed to a combination of consumer preferences, cultural factors, and the robustness of the dealership infrastructure. As of 2023, Saudi Arabia boasts over 1,500 automotive dealerships, a network that facilitates strong customer relationships and after-sales services. This extensive network provides consumers with a personalized buying experience that online platforms struggle to replicate. Dealerships offer immediate physical access to vehicles and the ability to engage in negotiations, which resonates well with Saudi consumers who value face-to-face interactions and tangible assurances before making significant purchases.

Cultural preferences play a significant role in the dominance of dealerships. In Saudi Arabia automotive retail market, the automotive purchase is often a family affair, with multiple members participating in the decision-making process. This dynamic is better catered to in a dealership setting where buyers can physically inspect vehicles and discuss options with knowledgeable sales representatives. Additionally, dealerships in Saudi Arabia are increasingly integrating advanced technologies such as virtual reality showrooms and digital financing solutions, blending traditional and modern retail elements. In 2023, approximately 80% of new car sales transactions in Saudi Arabia were facilitated through dealerships, highlighting their continued prevalence.

Economic factors also support the dealership model's dominance in the automotive retail market. The Kingdom's Vision 2030 initiative has spurred economic growth, increasing disposable incomes and encouraging consumer spending on new vehicles. Dealerships, with their established financial services and partnerships with banks, provide attractive financing options that are less accessible through online platforms. Furthermore, the Saudi government has invested in expanding infrastructure, leading to a surge in automotive demand and, consequently, dealership sales. In 2023, the automotive market in Saudi Arabia recorded sales of 759,000 new vehicles, with dealerships contributing a significant portion. This trend underscores the enduring appeal and strategic advantages of the dealership model over online retail in the country.

By Coverage

The new car segment is leading the Saudi Arabia's automotive retail market with over 52.09% market share and is driven by several factors, including high consumer demand for the latest models, technological advancements, and government initiatives promoting economic growth. In 2023, Saudi Arabia's new car sales reached approximately 759,000 units, reflecting a burgeoning demand for modern vehicles. The Kingdom's youthful population, with a median age of 32, demonstrates a strong preference for state-of-the-art features, advanced safety systems, and fuel efficiency, all of which are more prevalent in new cars. This consumer inclination is bolstered by the country's rapidly growing middle class, which increasingly views new vehicles as status symbols.

Economic incentives and favorable financing options further propel the new car segment's dominance in the automotive retail market. The Saudi Arabian Monetary Authority (SAMA) has encouraged banks to offer competitive auto loans, making new cars more accessible to a wider audience. Additionally, government policies aimed at diversifying the economy under Vision 2030 have increased consumer confidence, resulting in higher spending on new automobiles. The introduction of hybrid and electric vehicles in the Saudi market has also spurred interest, with sales of such models reaching 15,000 units in 2023, indicating a shift towards sustainable mobility solutions.

Looking ahead, the future of the new car segment in Saudi Arabia appears promising. The government's commitment to infrastructure development, including the expansion of road networks and investment in electric vehicle charging stations, is expected to further stimulate demand for new cars. Moreover, the anticipated influx of international automotive brands into the Saudi market will likely enhance competition and innovation, benefiting consumers. By 2030, it is projected that the annual revenue of the Saudi Arabia market could approach US$ 74.74 billion by 2032, driven by continued economic growth and evolving consumer preferences. This sustained demand for new vehicles underscores the segment's potential for long-term dominance in the automotive retail landscape.

By End Users

Individual consumers dominate the Saudi Arabian automotive retail market due to cultural preferences, economic factors, and the increasing accessibility of personal vehicles. In 2023, individual buyers accounted for approximately 84.90% of the total automotive sales in the country, translating to around 644,391 vehicles. This prevalence is largely driven by the high value placed on personal transportation in Saudi society, where owning a vehicle is often associated with social status and independence. The country's expansive geography and limited public transportation options further incentivize personal vehicle ownership, making it a necessity for many residents.

Economic growth and favorable financing options have also contributed to the dominance of individual buyers. With the Saudi economy experiencing steady growth, individuals have greater disposable income to invest in personal vehicles. Banks and financial institutions offer attractive loan packages tailored to individual buyers, facilitating easier access to new and used cars. In 2023, financial institutions across Saudi Arabia automotive retail market approved over 300,000 auto loans for individual buyers, underscoring the significance of financing in vehicle acquisition. Additionally, government initiatives aimed at enhancing consumer protection and transparency in automotive transactions have boosted buyer confidence, encouraging more individuals to invest in personal vehicles.

Fleet operators, on the other hand, face challenges that deter large-scale vehicle acquisitions. The high cost of fleet maintenance and the complexities associated with managing large vehicle inventories can be daunting. Moreover, recent regulatory changes, such as stricter emissions standards and vehicle safety requirements, have increased the operational costs for fleet operators. These factors, coupled with the rising popularity of ride-sharing services, which reduce the need for large fleets, contribute to the dominance of individual buyers in the market. As Saudi Arabia continues to develop its transportation infrastructure and promote economic diversification, the demand for personal vehicles is expected to remain robust, ensuring the continued prominence of individual consumers in the automotive retail sector.

To Understand More About this Research: Request A Free Sample

Top Players in Saudi Arabia Automotive Retail Market

- Abdul Latif Jameel IPR Company Limited

- Al Habtoor Motors

- Al Futtaim Motors

- SAMACO

- Aljomaih Automotive

- Kia Al jabr

- Mohamed Yousuf Naghi Motors Co.

- Other Prominent Players

Market Segmentation Overview:

By Service Type

- Dealership

- Online Retail

By Coverage

- New Car

- Used Car

- Service & Parts

- Finance & Insurance

By End User

- Individual

- Fleet Operator

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA1024965 | Delivery: 2 to 4 Hours

| Report ID: AA1024965 | Delivery: 2 to 4 Hours

.svg)