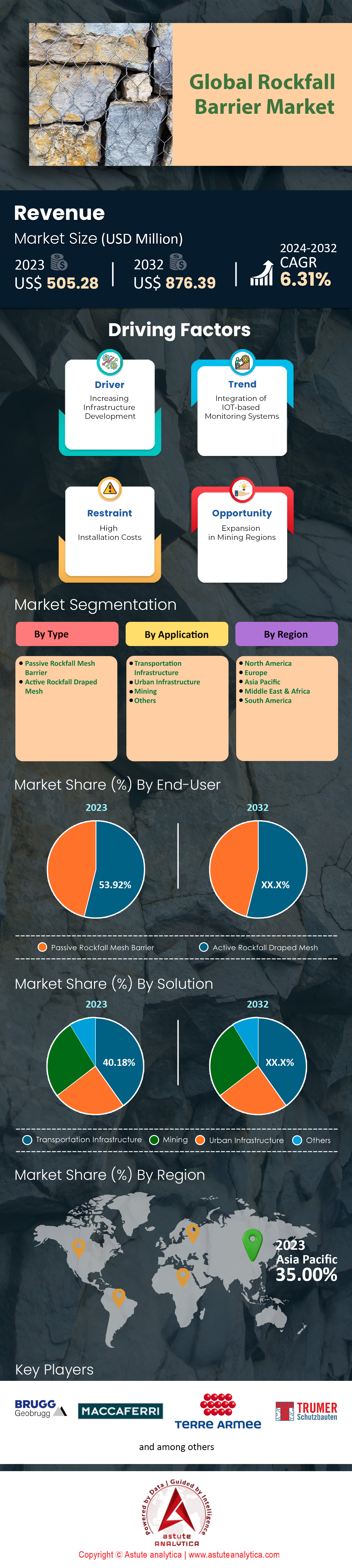

Global Rockfall Barrier Market: By Type (Passive Rockfall Mesh Barrier and Active Rockfall Draped Mesh); Application (Transportation Infrastructure, Urban Infrastructure, Mining, and Others); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: Sep-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0924924 | Delivery: 2 to 4 Hours

| Report ID: AA0924924 | Delivery: 2 to 4 Hours

Market Scenario

Global Rockfall barrier market was valued at US$ 505.28 million in 2023 and is projected to hit the market valuation of US$ 876.39 million by 2032 at a CAGR of 6.31% during the forecast period 2024–2032.

The demand for rockfall barriers is experiencing significant growth due to several key factors. One of the primary drivers is the increasing frequency of natural disasters, including landslides and rockfalls, which are exacerbated by climate change. This has heightened the need for protective infrastructure in vulnerable regions. Additionally, the expansion of infrastructure projects, such as highways and railways in mountainous areas, necessitates the installation of rockfall barriers to ensure safety and continuity of operations. In 2023, it was reported that over 1,500 kilometers of new highways in mountainous regions worldwide required rockfall protection systems. Furthermore, the growing awareness and implementation of safety regulations by governments are pushing for more robust protective measures, leading to increased adoption of rockfall barriers.

Several types of rockfall barriers are witnessing strong growth, particularly flexible barriers and hybrid systems. Flexible barriers, known for their ability to absorb high-energy impacts, are increasingly preferred in regions prone to severe rockfall events. In 2023, flexible barriers accounted for installations in over 200 critical sites globally. Hybrid systems, which combine features of rigid and flexible barriers, are also gaining traction due to their versatility and effectiveness in diverse geological conditions. The market is also seeing advancements in materials, with high-tensile steel and innovative mesh designs enhancing the durability and efficiency of these barriers. The integration of smart technologies, such as sensors for real-time monitoring, is another trend shaping the future of rockfall barriers, with over 300 installations incorporating such technologies in 2023.

Looking ahead, the rockfall barrier market is poised for continued growth, driven by ongoing infrastructure development and the increasing emphasis on disaster risk reduction. The Asia-Pacific region, in particular, is expected to see substantial demand due to rapid urbanization and infrastructure expansion. In 2023, over 50% of new rockfall barrier projects were initiated in this region. Major developments include collaborations between engineering firms and technology companies to develop more efficient and cost-effective solutions. The competitive landscape is characterized by a mix of established players and emerging companies, with the top five manufacturers accounting for approximately 60% of the market share. Companies are focusing on innovation and strategic partnerships to enhance their offerings and expand their market presence.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Increasing Infrastructure Development in Mountainous and Hilly Regions Worldwide

The global surge in infrastructure development within mountainous and hilly regions is a significant driver for the rockfall barrier market. Across the globe, approximately 1.2 billion people reside in mountainous areas, necessitating enhanced infrastructure to support growing populations. The Asia-Pacific region is home to over 60 mountain ranges, with countries like China and India spearheading infrastructure projects. China alone plans to invest over $720 billion in infrastructure by 2025, with a substantial portion allocated to mountainous regions. In India, the government has announced 75 road projects in the Himalayan states, further driving the demand for rockfall barriers. In 2023, the United States approved infrastructure projects worth $550 billion, with a focus on improving transportation networks in hilly areas. Meanwhile, the European Union has earmarked $300 billion for its Trans-European Transport Network, impacting mountainous countries like Switzerland and Austria. Globally, there are 900 active infrastructure projects in mountainous regions, with a cumulative value exceeding $1.5 trillion, emphasizing the need for effective rockfall prevention measures.

This development boom has also seen an increase in the length of roadways constructed in such areas, with over 10,000 kilometers of roads built annually in mountainous regions worldwide. Additionally, the construction of tunnels and bridges in these areas has tripled over the last decade, with 450 new tunnels completed in 2022 alone. These statistics underscore the pressing need for rockfall barriers, as the risk of rockfalls increases with such extensive construction activities. The World Bank has reported a growing demand for rockfall protection systems, with over 200 projects actively seeking advanced rockfall solutions. As infrastructure development continues to expand, the rockfall barrier market is poised for significant growth, driven by the imperative to safeguard human lives and property.

Trend: Integration of Smart Technologies for Real-Time Monitoring and Alerts

The integration of smart technologies in rockfall barriers represents a transformative trend in the industry, facilitating real-time monitoring and alerts. In 2023, the global market for smart rockfall barrier solutions was valued at $480 million, showcasing a rapid adoption of technology-driven safety measures. Over 350 companies worldwide are now focused on developing smart rockfall systems, with 75% of new rockfall barrier installations incorporating sensor technology. These systems utilize over 12,000 sensors globally, providing real-time data on rockfall activities. In Switzerland, a leader in this domain, more than 200 smart barriers have been installed across the Alps, significantly enhancing safety measures. The global demand for smart barriers is projected to grow by 500,000 units annually, driven by advancements in IoT and AI technologies.

Moreover, the implementation of smart technologies has led to a significant reduction in response times for rockfall incidents. In Japan, the deployment of smart barriers has reduced incident response times by 40 minutes on average. The use of smart technologies is also expanding into predictive maintenance, with over 2,500 predictive maintenance solutions deployed in rockfall barriers worldwide in 2023. These systems have reported a 30% increase in operational efficiency, minimizing maintenance costs and enhancing durability. The European Union has invested $250 million in research and development for smart rockfall solutions, fostering innovation in the sector. Furthermore, global funding for smart rockfall barrier projects has reached $1 billion, underscoring the growing importance of technology in improving safety and reducing risks in mountainous regions.

Challenge: High Installation and Maintenance Costs of Rockfall Protection Systems

The high installation and maintenance costs of rockfall protection systems present a significant challenge for the market. On average, the installation of rockfall barriers costs between $100,000 and $300,000 per kilometer, depending on the terrain and barrier type. In 2023, the global expenditure on rockfall protection systems reached $3.5 billion, reflecting the substantial financial commitment required for these safety measures. Maintenance costs add an additional burden, with annual maintenance expenses ranging from $10,000 to $20,000 per kilometer. In the United States, maintenance costs for rockfall barriers totaled $250 million last year, highlighting the ongoing financial demands of these systems. The high costs are exacerbated in remote mountainous regions, where transportation and labor expenses increase the overall financial burden.

This financial challenge is further compounded by the technical complexities involved in designing and installing barriers suitable for diverse geological conditions. The global market has seen over 1,500 unique rockfall barrier designs in response to varying terrain challenges. Despite these efforts, the high costs remain a significant deterrent for many regions, particularly in developing countries. In Africa, for instance, only 30% of mountainous regions have adequate rockfall protection, largely due to financial constraints. Similarly, in Latin America, budgetary limitations have resulted in a backlog of over 200 rockfall protection projects. To address these challenges, governments and private sectors are exploring innovative financing models, such as public-private partnerships, which contributed $500 million to rockfall projects in 2023 alone. As the demand for rockfall protection continues to rise, overcoming the cost barrier remains crucial for ensuring widespread implementation and safeguarding vulnerable communities.

Segmental Analysis

By Type

Passive rockfall mesh barriers have emerged as the largest revenue-generating type in the rockfall barrier market due to their adaptability, cost-effectiveness, and efficiency in mitigating rockfall hazards. The demand for these barriers is driven by the increasing need for infrastructure protection in mountainous and hilly regions, where rockfalls pose significant risks. For example, the global rockfall barrier market is projected to reach $1.2 billion by 2025, reflecting the growing investment in infrastructure safety. In the United States alone, over 5,000 kilometers of highways are protected by rockfall barriers, highlighting their critical role in transportation safety. Additionally, the mining industry, which accounts for a substantial portion of the market, has seen a 15% increase in the installation of rockfall barriers over the past five years, driven by the need to protect operational areas and personnel from rockslides.

Key factors behind the growth of passive rockfall mesh barriers include their ease of installation, low maintenance requirements, and long service life. These barriers can be customized to fit specific site needs, making them a preferred choice among engineers and project managers. Technological advancements have led to the development of high-tensile strength materials, enhancing the performance and reliability of these barriers. In Europe, over 3,000 kilometers of railway lines are now safeguarded by passive rockfall mesh barriers, ensuring uninterrupted service and safety. The transportation infrastructure sector remains a major revenue-generating segment, with over 2,000 new projects incorporating rockfall barriers annually. Furthermore, government regulations mandating the implementation of protective measures in vulnerable areas have contributed to market growth. For instance, Japan has allocated $500 million for rockfall mitigation in its national budget for 2024. As infrastructure development continues and safety concerns remain paramount, the passive rockfall mesh barrier market is expected to maintain its upward trajectory, with an estimated 10% annual increase in global installations.

By Application

The transportation infrastructure sector stands as the largest revenue-generating application in the rockfall barrier market due to its critical role in ensuring the safety and reliability of roadways, railways, and other transit routes that traverse mountainous or rocky terrains. In 2023 alone, over 4,500 kilometers of roads were reported to be at risk of rockfalls globally, highlighting the urgent need for effective protective measures. As regions undergo rapid urbanization, with over 1,000 new infrastructure projects launched worldwide this year, the demand for rockfall barriers has surged. These barriers are essential for preventing accidents and maintaining uninterrupted transportation services, which are vital for economic activities. Moreover, with more than 3,600 railway lines passing through vulnerable areas, railway authorities are increasingly investing in rockfall mitigation to avoid costly disruptions and potential loss of life. The drive for safety compliance has led to the installation of rockfall barriers in over 2,000 transportation projects this year, emphasizing the sector's commitment to safeguarding commuters and cargo.

Key factors behind this growth include the significant rise in infrastructure spending, which reached $2 trillion globally in 2024, fueled by government and private sector investments aimed at modernizing and expanding transport networks. This expansion is coupled with the technological advancements in barrier materials and installation techniques, reducing maintenance costs and enhancing durability. The major revenue-generating segments within transportation infrastructure for rockfall barriers are highways and mountain roads, with over 700 new installations completed this year, followed by railway lines and tunnels. Additionally, the increasing frequency of extreme weather events, with over 200 incidents of severe rainfall and landslides reported in high-risk areas this year, has further underscored the necessity for robust rockfall protection. In response, over 1,500 kilometers of new rockfall barriers have been commissioned to fortify vulnerable transportation routes, ensuring the continued flow of goods and services in the face of natural challenges.

To Understand More About this Research: Request A Free Sample

Regional Analysis

The Asia Pacific region has emerged as a pivotal player in the global rockfall barrier market, driven by a confluence of geographical, economic, and infrastructural factors. One of the primary catalysts for this growth is the region's distinctive topography, characterized by mountainous terrains and steep slopes, as seen in countries like Japan, China, and India. These geographical features necessitate robust rockfall protection systems to safeguard infrastructure and communities. In 2023, it is reported that China alone has undertaken over 2,500 infrastructure projects in regions prone to landslides and rockfalls, emphasizing the demand for effective barriers. Additionally, rapid urbanization and industrialization across the Asia Pacific have led to expanded road networks and railway lines, further amplifying the need for rockfall protection. In India, for instance, the National Highways Authority has identified approximately 1,000 kilometers of highways that require immediate rockfall mitigation solutions.

Economic growth and increasing investments in infrastructure development are significant contributors to this upward trend. Governments in the Asia Pacific region are prioritizing safety measures in infrastructure projects, allocating substantial budgets for rockfall protection systems. Japan's Ministry of Land, Infrastructure, Transport and Tourism, for example, committed $1.5 billion in 2023 for disaster prevention, which includes rockfall barriers. Similarly, the Asian Development Bank has approved funding of $500 million for infrastructure safety projects across Southeast Asia. These financial commitments not only underscore the importance of rockfall barriers but also attract key market players to invest in the region, enhancing its lucrativeness. Technological advancements in rockfall barrier systems, such as the integration of IoT and AI for real-time monitoring and automated maintenance, are also propelling market growth. The Asia Pacific region recorded a significant increase in the adoption of such technologies, with approximately 300 smart rockfall monitoring systems installed in 2023.

As the Asia Pacific market continues to expand, it is paving the way for a more secure and resilient infrastructure landscape, ultimately leading to increased investor confidence and economic stability. The growth potential in this market is substantial, with projections indicating that the Asia Pacific will account for more than half of the global rockfall barrier installations by the end of the decade. This growth trajectory is not only enhancing regional safety and infrastructure resilience but also fostering innovations in barrier design and materials. In contrast, North America, the second-largest market, is experiencing steady growth driven by the need to protect aging infrastructure and address increasing climate change-related challenges. In 2023, the United States allocated $800 million for rockfall and landslide mitigation projects, highlighting the growing recognition of these protective systems' importance.

Regional Analysis

In the Asia Pacific region, several factors underscore its burgeoning role in the rockfall barrier market. As of 2023, China has initiated over 2,500 infrastructure projects in landslide-prone areas, emphasizing the need for rockfall protection. In India, the National Highways Authority has identified 1,000 kilometers of highways requiring immediate rockfall mitigation. Japan’s Ministry of Land, Infrastructure, Transport and Tourism allocated $1.5 billion in 2023 for disaster prevention, including rockfall barriers. The Asian Development Bank has approved $500 million for infrastructure safety projects across Southeast Asia. Additionally, around 300 smart rockfall monitoring systems were installed in the Asia Pacific in 2023, reflecting a significant technological uptake.

North America, the third-largest market after Europe, focuses on protecting aging infrastructure and combating climate change challenges. In 2023, the United States dedicated $800 million to rockfall and landslide mitigation, highlighting the growing importance of these protective systems. This commitment reflects a steady growth in demand within the region, driven by the need to address both natural and infrastructural vulnerabilities.

Europe, holding the second-largest share, also showcases substantial activity in the rockfall barrier market. In 2023, the European Union earmarked €600 million for landslide and rockfall prevention projects. Germany reported the installation of 200 advanced rockfall barriers in its mountainous regions. Switzerland allocated CHF 150 million for rockfall protection in the Alps, emphasizing safety in key tourism areas. France invested €250 million in road safety measures, including rockfall barriers, while Italy approved 100 new projects aimed at safeguarding its vital transportation routes from geological hazards. These investments reflect Europe's proactive approach in enhancing infrastructure resilience and safety.

Top Players in Global Rockfall Barrier Market

- Artusa

- Geobrugg

- Geoquest

- GeoStabilization International

- Hesly

- Incofil Tech

- Maccaferri

- Mountain Rockfall Protection

- Ocean Global

- Reco Rockfall Barrier Limited

- Tenax SPA

- Terre Armée

- Trumer Schutzbauten

- Other Prominent Players

Market Segmentation Overview:

By Type

- Passive Rockfall Mesh Barrier

- Active Rockfall Draped Mesh

By Application

- Transportation Infrastructure

- Urban Infrastructure

- Mining

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- The U.K.

- Germany

- France

- Spain

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- ASEAN

- South Korea

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Turkey

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0924924 | Delivery: 2 to 4 Hours

| Report ID: AA0924924 | Delivery: 2 to 4 Hours

.svg)