Respiratory Syncytial Virus Treatment Market, By Drug Type (Vaccines (Abrysvo, Arexvy, MRESVIA) Monoclonal Antibodies (Synagis, Beyfortus, Antivirals); By Dosage Form (Injectables, Orals, Antivirals); By Region(North America, Europe, Asia Pacific, South America, Middle East & Africa; Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: 01-Jun-2025 | | Report ID: AA0821085

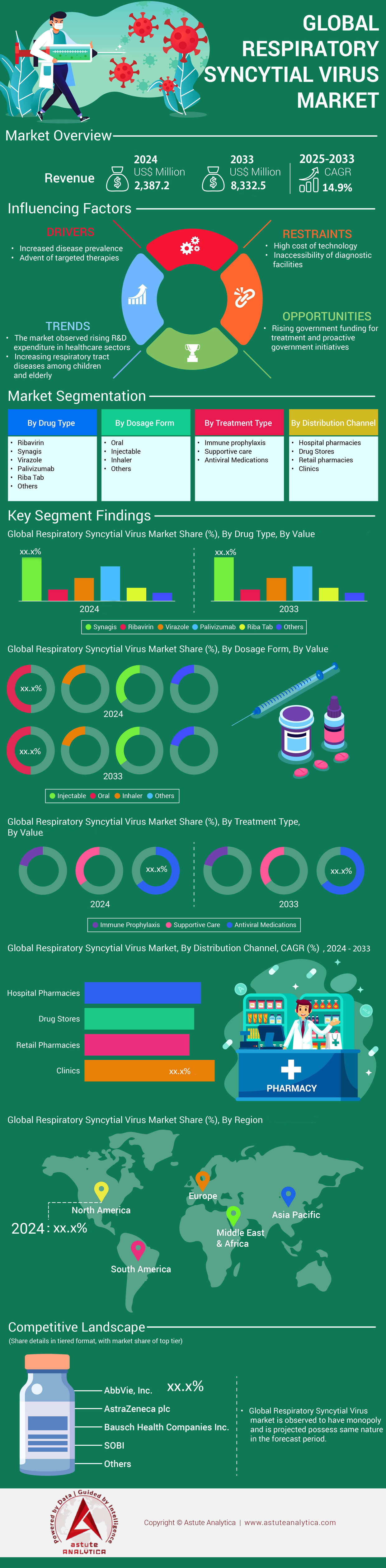

The respiratory syncytial virus (RSV) treatment market was valued at USD 2,387.2 million in 2024 and is projected to reach USD 8,332.5 million by 2033, growing at a CAGR of 14.9% over the forecast period. This growth is expected to be driven by increasing vaccine adoption, improving diagnostic infrastructure, growing awareness, and continued R&D investments by pharmaceutical & biotechnology companies.

Respiratory syncytial virus (RSV) is a single-stranded RNA virus belonging to the Paramyxoviridae family. It is a leading cause of respiratory tract infections across all age groups. The clinical presentation typically begins with mild upper respiratory symptoms, akin to the common cold, but can escalate to severe lower respiratory tract complications such as bronchiolitis and pneumonia. Such complications are commonly seen in infants, elderly population, and immunocompromised individuals. In severe cases, respiratory syncytial virus (RSV) may result in respiratory failure, apnoea, or death.

The virus is primarily transmitted via respiratory droplets and contact with contaminated surfaces. Respiratory syncytial virus (RSV) remains viable for extended periods, particularly on hard surfaces.

Epidemiology Glimpse of Respiratory Syncytial Virus (RSV)

1) By Age: Children under 5 are the major patient group

- Children under 5 years: Globally incidence of respiratory syncytial virus (RSV) related infections in this age group is over 30 million, leading to 3.2 million hospitalizations and 100,000 deaths each year

- 50% these deaths occur in infants under 6 months

- 97% of the RSV deaths occur in low and middle-income-countries (LMIC). Limited access to supportive medical care is a major reason

- Ages 5-18 years: Respiratory syncytial virus (RSV) cases are uncommon in this age group and usually result in mild symptoms

- Ages 18-64 years: Respiratory syncytial virus (RSV) infections in adults of this group are rare and typically mild. Severe cases are uncommon

- Adults 65 years and older:

In the U.S., respiratory syncytial virus (RSV) is estimated to cause up to 160,000 hospitalizations and 10,000 deaths in this age group. Severe illness is more likely to be witnessed in 65 or 65+ year of age, particularly among individuals with weakened immune systems or who have other age-related vulnerabilities

2) By Gender: Although there is a slight dominance of RSV in males, RSV has gender-neutral pattern of transmission and susceptibility

- A 2024 study published in a review paper found that, in the pre-pandemic period, respiratory syncytial virus (RSV) cases were slightly more common among males, i.e., accounting for 57.5% in males Vs 42.5% in females. During the pandemic years, this distribution showed a fluctuation, with males comprising between 52% to 61% of cases and females between 39% to 46%Currently, with no approved treatment for RSV; management is limited to supportive care including oxygen therapy, IV fluids, mechanical ventilation and non-targeted antiviral medications like ribavirin. Generally, the disease is not deadly and cause only mild symptoms, however, if left unattended can lead to hospitalisations. LMICs are greatly affected by the disease. They lack RSV management infrastructure, resulting in more than 1.8 million hospital admissions on annual basis. This indicates a need for effective prevention options in LMICs, making them untapped market with unmet needs.

Vaccines and monoclonal antibodies (mAbs) are the mainstays for respiratory syncytial virus (RSV) prevention. mAbs are administered to infants right after the birth and maternal vaccine given to pregnant women. In 2024 - a CDC survey showed that 33% of all the eligible pregnant women received a RSV vaccine. Among women who had a live birth, 45% reported that their infant received nirsevimab. Overall, 56% of infants were protected against severe RSV disease through either maternal vaccination or with nirsevimab, or both.

The respiratory syncytial virus (RSV) treatment market is also witnessing growth by novel product launches. In 2023 Arexvy, was approved as the first RSV vaccine. Being approved in more than 50 countries for older adults, Arexvy is a market leader in US and generate multi-million dollars in revenues. Such success-case-studies have catalysed further innovation in the market. The respiratory syncytial virus (RSV) treatment market landscape has a robust clinical pipeline.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Significant Disease Burden followed by RSV vaccination recommendation

Respiratory syncytial virus (RSV) is a significant global health concern, particularly affecting infants and young children. In the United States alone, RSV accounts for approximately 2.1 million outpatient visits and 58,000 to 80,000 hospitalizations each year among children under the age of 5. This considerable healthcare burden has heightened awareness among parents and caregivers, driving increased concern and demand for effective prevention and treatment strategies. Additionally, RSV vaccination is recommended under the “Adult Immunization Schedule” and “Immunization Schedule for Pregnant Individuals” by CDC.

There is also a growing focus on innovation. Current treatment efforts are aimed at protecting vulnerable young children and elderly adults who are most susceptible to the disease.

Restraint: High Cost of Respiratory Syncytial Virus Prevention Limits Access in Low- and Middle-Income Countries (LMICs)

The burden of respiratory syncytial virus disease is major health burden in low- and middle-income countries (LMICs), where it causes significant illness and death among infants and young children. Despite the urgent need, the high cost of respiratory syncytial virus prevention (RSV) is a major barrier to access in LMICs. For instance, drugs like Beyfortus cost around USD 414.75 per dose, and Abrysvo is priced at about USD 230.0 per dose, placing them out of reach for many families and healthcare systems with limited budgets.

The WHO emphasize the urgent need for affordable RSV vaccines, for use during pregnancy to pass protection to newborns, and for vaccinating young children to prevent severe illness. Without accessible and cost-effective options for these vulnerable populations, global efforts to reduce RSV-related deaths and promote health equity will continue to face major setbacks.

Opportunity: Advancing RSV Prevention Through Combination Vaccines

The rollout of respiratory syncytial virus (RSV) vaccines marks a significant milestone in respiratory disease prevention, but the next frontier could be combination vaccines. Building on the success of recent RSV launches, companies like AstraZeneca, and Moderna are now developing vaccines that combine RSV protection with immunization against diseases like Covid-19, hMPV (human metapneumovirus), and influenza. Icosavax (acquired by AstraZeneca in 2023) has a lead program exploring a combination vaccine candidate for RSV and hMPV.

While such candidates are still in early to mid-stage clinical development, they hold a great potential in the respiratory syncytial virus (RSV) treatment market. Combining multiple vaccines into a single shot can reduce the number of injections required, lessening the burden on patients and healthcare systems alike and potentially increase overall vaccine uptake. For manufacturers, it's also a strategic opportunity to tap into a broader share of the respiratory vaccines market.

By Dosage Form: Injectables Dominate, Followed by Oral Forms

The respiratory syncytial virus (RSV) treatment market is segmented by dosage form into injectables and orals. Among these, injectables currently hold the largest market share of 85%+ and are projected to register the highest compound annual growth rate (CAGR) during the forecast period. Wide acceptance of vaccines and mAbs is a major reason for this. These injectable therapies have a higher clinical effectiveness Vs oral antiviral counterpart.

Injectables also tend to command premium pricing, for instance, Abrysvo, a preservative-free intramuscular vaccine administered as a 60 mcg-60 mcg powder for injection is priced at approximately $338 for a single-dose vial. Similarly, nirsevimab, a long-acting monoclonal antibody designed for infant RSV protection, is priced at $519.75 per dose for 50mg and 100mg strengths, and $1,039.50 for a 200mg dose, which is administered as two 100mg injections. Primary medical expenses for respiratory syncytial virus treatment in the U.S. exceed $700 million each year, with additional secondary costs. These costs, coupled with the substantial burden of RSV, highlight the market’s strong emphasis on effective, precise, and safe preventive measures, for high-risk groups like infants.

While injectables dominate the market, the oral treatment segment is also experiencing steady growth, fuelled by the convenience of administration and improved patient adherence. Oral medications, while generally offering less dosing accuracy and requiring limited clinical oversight, are benefitting from ongoing innovation. The development of easy-to-swallow antiviral formulations is helping to drive adoption, making oral therapies a viable alternative for broader patient populations.

By Drug Type: Vaccines lead Respiratory Syncytial Virus therapy market, while Monoclonal Bodies Gain Momentum

The respiratory syncytial virus (RSV) treatment market is divided into three main segments: vaccines, monoclonal antibodies, and antivirals. Vaccines dominate with more than 50% of the market share. Recent vaccines’ approvals and their expanding use across different age groups is a major driver for the segmental market. The vaccine segment has seen significant momentum, with multiple new entrants contributing to its growth.

- Pfizer’s Abrysvo, approved in 2023, is the only maternal RSV vaccine administered during 32 to 36 weeks of pregnancy to protect newborns during their first six months. It is also approved for unvaccinated adults aged 60 and older, generating a total revenue of USD 755 million in 2024

- GSK’s Arexvy, indicated for adults aged 60+ and high-risk individuals aged 50-59, lead the vaccine category with ~USD 797 million revenue in 2024

Together, such vaccines drive strong revenue growth and broaden the protection offered by this treatment class.

While vaccines hold the majority market share, monoclonal antibodies represent a critical segment, accounting for more than 40% of the respiratory syncytial virus (RSV) treatment market. These therapies provide passive immunity, delivering ready-made antibodies to offer immediate but temporary protection, particularly vital for high-risk paediatric populations and older patients.

- Synagis (palivizumab), approved in 1998, remains the cornerstone. In 2024, it generated approximately USD 62.1 million in revenue.

- More recently, Beyfortus (nirsevimab), approved by the FDA in 2023 and in Japan in 2024, generated ~USD 1,911 million in revenue in 2024.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

By Region: North America leads the therapy market Followed by Europe

The respiratory syncytial virus (RSV) treatment market is experiencing dynamic growth, segmented by region into North America, South America, Europe, Asia Pacific, and the Middle East. North America currently dominates the market, a position solidified by early vaccine approvals, robust insurance coverage, strong government backing, and significant R&D investments. Within North America, the US stands out as a key driver, grappling with a significant RSV burden. In 2024, CDC data revealed a substantial impact, estimating annual outpatient visits between 3.6 million to 6.5 million, with hospitalizations ranging from 190,000 to 350,000, and an estimated 10,000 to 23,000 deaths, majority of them were infants and elderly. To reduce the burden of the disease, CDC recommends vaccination, for pregnant women, infants, adults aged 75 and older, as well as high-risk individuals, further highlighting the region's proactive approach to managing and preventing RSV.

Europe, too, grapples with a considerable RSV burden across age groups. Each year, around 213,000 children under five are hospitalized in the EU, UK, and Norway, many needing intensive care. Older adults are heavily affected too, with one in twenty contracting RSV annually. In response, countries are stepping up vaccination efforts. The UK launched a national program in 2024 targeting pregnant women and older adults, marking a major step toward reducing RSV’s impact across the continent.

Meanwhile, the Asia Pacific faces a significant but often overlooked RSV burden, affecting both high-income countries like China, Japan, South Korea, Singapore, and Taiwan.. China and Japan report the highest impact, but with limited data especially for older adults, makes the true scale hard to gauge. In many developing areas like India, testing is rare and diagnoses often rely on clinical judgment due to overlapping symptoms, limited lab access and financial constraints. Also, low awareness among healthcare providers and a lack of strong policies further complicates the response.

In the Middle East and Africa, data on RSV is even more limited. However, in Saudi Arabia, RSV was identified in 23.5% of paediatric patients with acute lower respiratory infections in 2021. To manage the virus, the Saudi Paediatric Pulmonology Association launched the SIBRO guidelines in 2018, establishing evidence-based national protocols to address the emerging concern within the region.

Recent Developments in Respiratory Syncytial Treatment Market:

Lower RSV cases and Hospitalization Among Infants

- On 8th may, 2025, the U.S. CDC through its Morbidity and Mortality Weekly Report, revealed the decline in RSV cases among infants aged 0-7 months during October 2024 to February 2025, compared to the 2018–2020 period.

- This reduction followed by the introduction of maternal RSV vaccines and nirsevimab monoclonal antibodies, with hospitalization rates dropping by 43% (RSV-NET) and 28% (NVSN).

Pfizer’s ABRYSVO Approved by EU for Adults with Lower Respiratory Tract Disease

- Approved on 1st April 2025 for adults aged 18-59 years with lower respiratory tract disease based on Phase 3 MONet (NCT05842967) trial results, the trial showed ABRYSVO is safe, well-tolerated, and triggers immune response

- ABRYSVO now offers the broadest RSV protection in the EU, approved for adults 18+ and for protecting infants (up to 6 months) through vaccination during pregnancy.

Clover's New RSV Vaccine Advancements

- On 23rd March 2025, Clover has received U.S. FDA clearance and has started a Phase I clinical trial for its RSV vaccine candidate, SCB-1019. This trial is specifically designed to evaluate the vaccine's ability to boost protection in older adults who have previously received GSK's RSV vaccine AREXVY.

- Clover plans a 2025 trial for a combination vaccine (RSV + hMPV ± PIV3), building on promising earlier results for SCB-1019 against a competitor's RSV vaccine.

AIM Vaccine's RSV Breakthrough

- On 10th February 2025, AIM Vaccine has submitted its mRNA RSV vaccine candidate for clinical trials to the U.S. FDA.

- Preclinical data indicates superior immune responses compared to existing international mRNA RSV vaccines.

Key Competitors:

- Moderna

- Sanofi

- GSK

- AstraZeneca

- Pfizer

- Enanta Pharmaceuticals, Inc

- Bavarian Nordic

- Novavax

- BlueWillow Biologics

- Other Prominent Players

Market Segmentation Overview

By Drug Type

- Vaccines

- Abrysvo

- Arexvy

- MRESVIA

- Monoclonal Antibodies

- Synagis

- Beyfortus

- Antivirals

By Dosage Forms

- Injectables

- Orals

- Antivirals

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2023 | US$ 2,387.2 Mn |

| Expected Revenue in 2033 | US$ 8,332.5 Mn |

| Historic Data | 2020-2023 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Unit | Value (USD Mn) |

| CAGR | 14.9% |

| Segments covered | By Drug Type, By Dosage Form, By Region |

| Key Companies | Moderna, Sanofi, GSK, AstraZeneca, Pfizer, Enanta Pharmaceuticals, Inc, Bavarian Nordic, Novavax, BlueWillow Biologics, Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)