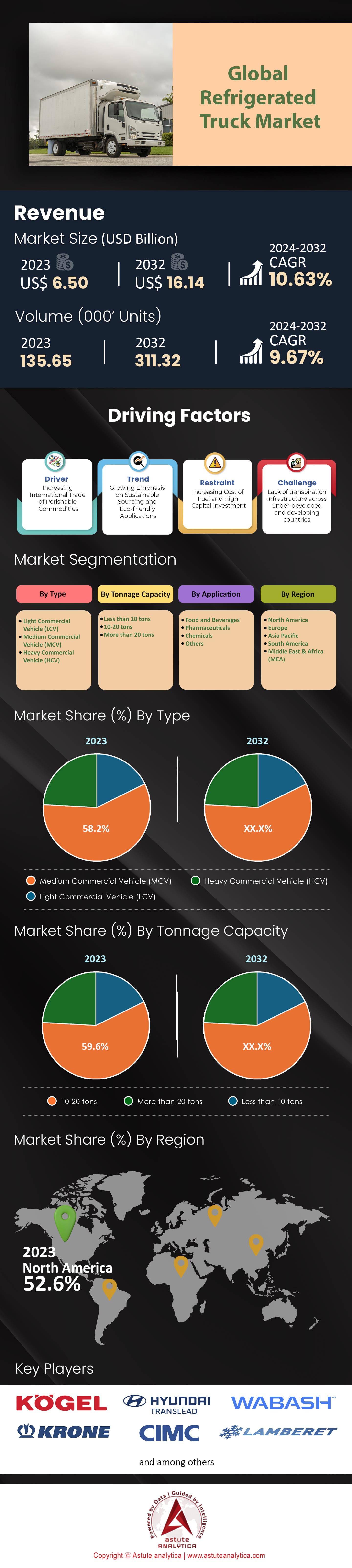

Global Refrigerated Truck Market: By Type (Light Commercial Vehicle (LCV), Medium Commercial Vehicle (MCV), Heavy Commercial Vehicle (HCV)); By Tonnage Capacity (Less than 10 tons, 10-20 tons, More than 20 tons); By Application (Food and Beverages, Pharmaceuticals, Chemicals, Others); By Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: 05-Mar-2024 | | Report ID: AA1023651

Market Scenario

Global Refrigerated Truck Market was valued at US$ 6.50 billion in 2023 and is projected to surpass the market valuation of US$ 16.14 billion by 2032 at a CAGR of 10.63% during the forecast period 2024–2032.

The global refrigerated truck market has witnessed a remarkable surge in demand, primarily driven by the increasing requirement for perishable goods transportation. The Asia-Pacific region, especially burgeoning economies like China, Vietnam, and India, emerges as the fastest growing market, which is fueled by the dual forces of rapid urbanization and the exponential growth of the food and pharmaceutical sectors in these nations. In parallel, North America, with the U.S. at its helm, continues to be a dominant player in the refrigerated truck sector. The robust American food industry, combined with the stringent food safety regulations, has cemented the region's pivotal role in the global scenario. Apart from this, pharmaceutical sector is also leaving a profound impact on the refrigerated truck market, a relationship accentuated during the COVID-19 pandemic. As the need to transport temperature-sensitive pharmaceuticals skyrocketed, so did the demand for specialized transportation. Furthermore, the e-commerce realm's meteoric rise, particularly in the domain of online grocery shopping, has further accelerated the need for efficient cold chain logistics.

Modern-day refrigerated trucks boast superior insulation properties, but advancements in refrigeration technologies also make them significantly more efficient. Reflecting the global sustainability ethos, there's a palpable shift towards electric and hybrid refrigerated vehicles, heralding a greener future. However, it's worth noting that while newer truck models are celebrated for their fuel efficiency, traditional ones often grapple with higher fuel consumption due to the additional power required for cooling units.

With the global emphasis on sustainability and food security, these vehicles in the global refrigerated truck market become indispensable in ensuring fresh produce reaches consumers. This is particularly relevant for sectors like seafood and dairy, which necessitate stringent temperature controls during transportation. Add to this the burgeoning global frozen food market, and it becomes evident why refrigerated trucks are in such high demand. However, the high operational costs associated with these vehicles, combined with looming environmental concerns, pose significant hurdles. Yet, market adaptability is evident in the rising trend of businesses leaning towards leasing or renting refrigerated trucks, giving a substantial boost to rental companies.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Rapid Urbanization and Growing Middle Class

One of the most profound drivers for the global refrigerated truck market is rapid urbanization coupled with the exponential rise of the middle class, especially in developing economies. According to the United Nations, 68% of the world's population is projected to live in urban areas by 2050, up from the 56% observed in 2018. This significant shift has multiple ramifications on various sectors, but its influence on the demand for refrigerated trucks is both direct and substantial.

As more people migrate to cities, there's an evident surge in demand for fresh produce and perishable goods. Urban areas require more sophisticated logistics due to the density of the population and infrastructure challenges. With an estimated 1.7 billion people joining the global middle class by 2025, dietary preferences are undergoing a massive transformation. This demographic now has more disposable income to spend on high-quality food, especially perishable products that need refrigerated transport. Furthermore, a report from the Brookings Institution predicted that by 2030, the global middle class would spend $29 trillion more than they were in 2015. This economic power directly translates to higher consumption rates of goods that necessitate refrigerated transportation, like meat, dairy, and certain pharmaceuticals driving growth of the refrigerated truck market.

In countries like India and China, where urban populations have been increasing at rates of 2.3% and 2.8% annually, respectively, the cold chain logistics industry has witnessed growth rates surpassing 15% annually in the past decade. Infrastructure development in these urban locales, from supermarkets to healthcare facilities, necessitates the frequent movement of temperature-sensitive goods, further propelling the demand for refrigerated trucks.

Trend: Technological Integration in Refrigerated Trucks

In an age of digital transformation, even industries that seem traditionally bound to their old ways, like transportation, are not immune to the wave of technological integration. The refrigerated truck industry is a prime example, showcasing an accelerated adoption of innovative technologies in recent years. A significant trend in this arena is the integration of the Internet of Things (IoT) into these trucks. Our research on the global refrigerated truck market suggests that by 2025, the global IoT in the logistics market will surpass $65 billion, and refrigerated transportation stands as a significant beneficiary. IoT devices allow real-time temperature monitoring, ensuring the safe transit of perishable goods. This not only reduces wastage but also ensures compliance with stringent global food safety standards.

Another notable number is the predicted 20% reduction in operational costs through IoT integrations by 2030, as these devices can help optimize routes, reduce fuel consumption, and predict maintenance needs. Additionally, artificial intelligence (AI) and machine learning (ML) are beginning to find their footing in this sector. Predictive analytics, powered by AI, can forecast demand, helping logistics providers to better plan their fleets and reduce idle times. A report from McKinsey predicted that the transportation sector could unlock $500 billion in value by 2030 through the adoption of AI, and refrigerated trucking is a significant chunk of this potential. Given the current market circumstances, we are expecting a 30% increase in the efficiency of supply chain operations with the integration of AI and ML in the next decade. This heightened efficiency will directly translate to reduced costs, quicker deliveries, and overall improved service quality in the refrigerated truck market.

Challenge: Operational Costs and Fuel Efficiency Dilemma

Refrigerated trucks, by design, have an added layer of complexity compared to standard freight trucks. The refrigeration unit, crucial for maintaining temperature integrity, requires additional power, often sourced from the vehicle's main engine. This additional power draw invariably leads to increased fuel consumption. To put the challenge in numbers, traditional refrigerated trucks can consume up to 20% more fuel than their non-refrigerated counterparts. With global diesel prices having seen fluctuations, with averages ranging from $0.90 to $1.20 per liter in major markets over the past decade, this 20% increase in consumption can translate to substantial additional operational costs in the refrigerated truck market. For a truck traveling 100,000 miles annually, this can mean extra costs ranging from $3,000 to $4,500, depending on regional fuel prices. Furthermore, the global push towards sustainability and reducing carbon footprints brings the fuel efficiency challenge into sharper focus. The transportation sector contributes nearly 24% of global CO2 emissions from fuel combustion, and inefficient refrigerated trucks only add to this tally.

Compounding the issue is the fact that upgrading to more fuel-efficient models or transitioning to alternative power sources for refrigeration requires significant capital investment. For many operators, especially smaller businesses, such upfront costs can be prohibitive.

Segmental Analysis

By Type:

Based on the type of refrigerated trucks market, medium commercial trucks emerge as the undisputed leaders. Holding a colossal market share of over 58%, this segment showcases both the current dominance and a promising future in the refrigerated truck market. Several factors can be attributed to this dominant position. Medium commercial trucks offer a balance between size and efficiency, making them suitable for a wide range of applications, from urban deliveries to long-haul transportation.

The robustness of this segment is further accentuated by its growth prospects. With projections indicating a CAGR of a staggering 10.82%, the highest among all types, the momentum of medium commercial trucks is set to remain unyielding in the foreseeable future. This growth can be attributed to their versatility, adaptability to various terrains, and the growing demand for medium-scale cold storage transportation solutions in emerging markets. Businesses, recognizing their operational advantages, are increasingly leaning towards medium commercial trucks, ensuring that this segment continues its upward trajectory.

By Storage Capacity:

Based on storage capacity, the 10-20 tons segment stands out prominently in the refrigerated truck market. Capturing an impressive market share of more than 59%, it's evident that this storage capacity aligns perfectly with the global demands of the refrigerated truck market. These trucks, with their 10-20 tons capacity, strike an optimal balance, making them the preferred choice for a myriad of businesses. They offer adequate storage for most logistical operations without the challenges that come with maneuvering larger vehicles, especially in urban settings.

The segment's dominance is projected to grow at a CAGR of 10.80. This growth is buoyed by the rising demand for mid-sized refrigerated transportation, especially in sectors like fresh produce, dairy, and pharmaceuticals. As industries expand and urbanization continues its march forward, the requirements for efficient, mid-sized refrigerated logistics solutions will soar, cementing the 10-20 tons segment's position at the helm of the refrigerated truck market.

By Application

Based on application, global refrigerated truck market is dominated by the food & beverage segment by commanding an impressive revenue share exceeding 42%. The global demand for fresh produce, dairy, meats, and other perishables has been on a perpetual rise, especially with the burgeoning middle class in emerging economies and their evolving dietary preferences. Furthermore, the intricate web of the global supply chain, from farms to supermarkets and restaurants, necessitates the need for robust cold-chain logistics. The emphasis on food safety standards, both at regional and global levels, further escalates the demand for efficient refrigerated transportation, ensuring the Food and beverage segment retains its top spot.

Following closely, the pharmaceutical segment is holding the second position in terms of revenue in the global refrigerated truck market and is also projected to keep growing at the fastest CAGR of 10.89% in the upcoming years. This can be attributed to the rapidly expanding, pharmaceutical industry driven by continuous research, development of new drugs, and a pressing need for vaccines, especially in light of recent global health challenges. The inherent nature of many pharmaceutical products requires stringent temperature control throughout their storage and transportation. Be it vaccines, biologics, or other temperature-sensitive drugs, any deviation from the required temperature range can compromise their efficacy. This critical need for precise temperature control during transit amplifies the demand for specialized refrigerated trucks, propelling the growth of the pharmaceutical segment.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

North America stands as a titan in the global refrigerated truck market, holding a commanding market share of 36%. This supremacy can largely be attributed to the U.S., which alone accounts for over 80% of the region's demand. Supported by an annual growth rate that has consistently ranged between 8-10% in recent years, the North American market showcases a harmonious blend of robust infrastructure and technological prowess. Moreover, the meteoric rise in online grocery shopping, with projections hinting at the U.S. e-commerce market nearing the $1 trillion mark by 2022, has significantly bolstered the demand for refrigerated trucks. Furthermore, the North American pharmaceutical market, valued at over $550 billion, necessitates an intricate web of temperature-controlled logistics, providing a stable platform for growth.

Regulations, too, play a pivotal role. The FDA's standards, particularly the Food Safety Modernization Act (FSMA), have set high benchmarks for cold-chain transportation. Yet, it's not just about regulations or demand. The market also witnesses a palpable shift towards sustainability, with rising sales of electric and hybrid refrigerated trucks, resonating with global environmental concerns. Companies, recognizing the fluidity of demand, are increasingly leaning towards renting refrigerated trucks, as evidenced by industry leaders like Ryder. Moreover, with the combined dairy and meat market in the region surpassing $350 billion, the future looks promising for the North American refrigerated truck market.

Europe, holding over 24% of the global revenue share, emerges as a formidable player in the refrigerated truck market. Key countries like Germany, France, and the UK serve as the linchpins, jointly contributing to over 60% of Europe's demand. With an annual growth rate hovering around 3-4%, Europe's market dynamics are shaped by a mix of regulatory landscapes, consumer behavior, and technological advancements. The pharmaceutical market in Europe, boasting a valuation of over $280 billion, underscores the imperative for efficient cold-chain logistics. Meanwhile, as the European e-commerce sector is poised to touch $1 trillion by 2028, the ripple effects on refrigerated logistics are undeniable. Stringent EU food safety regulations further amplify the need for top-tier refrigerated transportation.

European manufacturers, with giants like Schmitz Cargobull and Lamberet at the forefront, are setting global trends and shaping regional preferences. The movement of fresh produce, especially across the length and breadth of Europe, is another cornerstone for the market. On the technological front, digital platforms are being seamlessly integrated for fleet management, pushing the envelope for efficiency. As meat consumption rates soar, surpassing 90 kg per capita annually, the demand for refrigerated transportation follows suit. With cold chain logistics investments crossing the $5 billion threshold annually, Europe's refrigerated truck market offers a landscape of opportunity and growth.

Top Players in the Global Refrigerated Truck Market

- Kgel Trailer GmbH & Co.KG .

- Hyundai Translead. Inc.

- Wabash National

- Fahrzeugwert Bernard Krone Gmbh & Co.KG

- China International Marine Containers (Group) Ltd.

- GRW Tankers and Trailers (US)

- Lamberet SAS

- Great Dane LLC

- Chereau

- Schmitz Cargobull AG

- Other Prominent Players

Market Segmentation Overview:

By Type

- Light Commercial Vehicle (LCV)

- Medium Commercial Vehicle (MCV)

- Heavy Commercial Vehicle (HCV)

By Tonnage Capacity

- Less than 10 tons

- 10-20 tons

- More than 20 tons

By Application

- Food and Beverages

- Pharmaceuticals

- Chemicals

- Others

By Region

- North America

- The US

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)