Recycled Carbon Fiber Market: By Type (Chopped recycled carbon fiber and Milled recycled carbon fiber); Source (Automotive, Aerospace, and Others); Process (Pyrolysis and Solvolysis); Application (Automotive, Wind Energy, Civil Engineering, 3D Printing, Energy Storage, Sporting Goods, Marine, Thermoplastic Compounding, Oil & Gas, Pressure Vessels, Aerospace and Defense, and Others); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: 21-Apr-2025 | | Report ID: AA1023653

Market Scenario

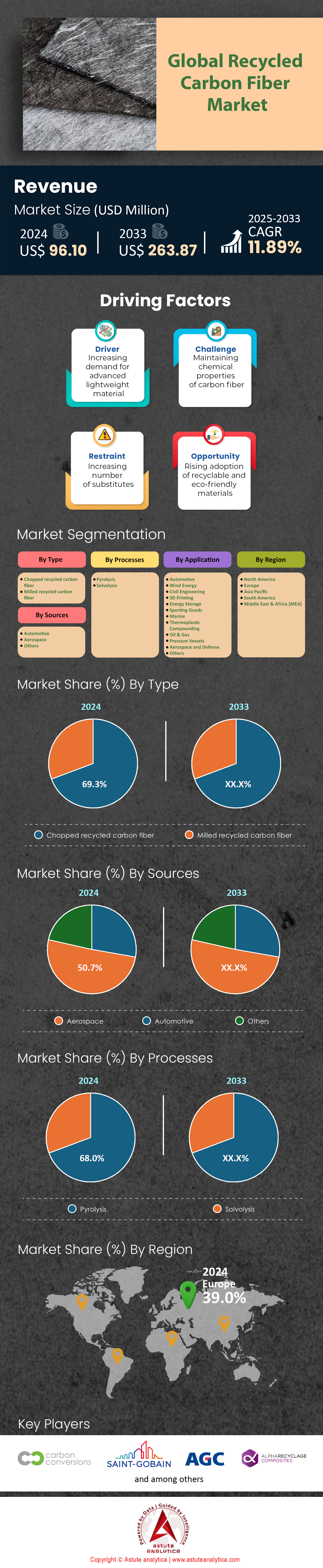

Recycled carbon fiber market was valued at US$ 96.10 million in 2024 and is projected to attain a market valuation of US$ 263.87 million by 2033 at a CAGR of 11.89% during the forecast period 2025-2033.

The carbon fiber industry continues to expand rapidly, driven by demand from aerospace, automotive, and construction sectors, but its environmental footprint remains a pressing concern. Despite advancements, nearly 30% of carbon fiber produced globally is discarded as waste, with the aerospace sector alone contributing over 24,000 tons to landfills or incineration annually. This waste represents both a significant ecological burden—contributing to CO2 emissions during decomposition—and an economic loss of high-value material, as virgin carbon fiber production remains energy-intensive. With the global carbon fiber market now valued at US$ 8.5 billion in 2024 and projected to grow at a CAGR of 10.9% through 2033, the urgency to address waste inefficiencies has intensified.

Recycling initiatives are gaining momentum as the recycled carbon fiber market confronts a surge in waste from carbon fiber-reinforced polymers (CFRP). Annual CFRP waste is expected to reach 20,000 tons by 2025, compounded by the impending retirement of 6,000–8,000 commercial aircraft by 2030, which will flood the market with recyclable materials. While the recycled carbon fiber segment is still nascent, it is projected to grow alongside the broader market, which is anticipated to exceed US$ 17 billion by 2035. Innovations in pyrolysis and solvolysis recycling methods are critical to recovering high-quality fibers, but scalability and cost barriers persist. Meanwhile, industries like automotive are driving demand for lightweight recycled composites to meet sustainability targets, with applications expanding into structural components and battery housings for electric vehicles.

To align with global net-zero goals, the recycled carbon fiber market must prioritize circular economy models. China’s recent slowdown in CO2 emissions, attributed to renewable energy adoption, underscores the viability of integrating clean energy into recycling processes. Companies are also exploring partnerships to standardize recycling protocols and develop secondary markets for reclaimed fibers in construction and consumer goods. As regulatory pressures mount and material costs fluctuate, carbon fiber recycling is no longer optional but a strategic imperative—offering a US$7 billion revenue opportunity by 2028 while mitigating the industry’s environmental liabilities.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Rising Demand for Lightweight Materials in Aerospace and Automotive Industries

The aerospace and automotive sectors in the recycled carbon fiber market are accelerating efforts to reduce emissions through lightweighting, driving unprecedented demand for recycled carbon fiber (rCF). In 2024, Boeing and Airbus announced collaborations with recyclers like ELG Carbon Fibre to integrate rCF into non-structural components, such as cabin interiors and wingtip fairings, aiming to trim aircraft weight by 8–12%. Similarly, the automotive industry is prioritizing rCF to meet tightening EU emissions standards (Euro 7), with BMW’s “Neue Klasse” EV platform targeting a 15% weight reduction using recycled composites. A 2024 International Council on Clean Transportation report highlights that lightweighting via rCF could cut lifetime EV emissions by 6–10%, aligning with automakers’ net-zero roadmaps.

Despite progress, aerospace adoption remains cautious in the recycled carbon fiber market due to stringent certification requirements. Recycled fibers often face performance gaps, such as 10–15% lower tensile strength versus virgin carbon fiber, limiting structural use. However, innovations like Siemens Gamesa’s 2024 pilot—using rCF in wind turbine blade tips—demonstrate improving capabilities. The U.S. Department of Energy’s 2024 funding of $12 million for rCF R&D underscores efforts to bridge quality gaps. Automakers like Volvo and Ford are also testing rCF in battery enclosures, balancing cost and performance; Ford’s 2024 prototype reduced enclosure weight by 22% using ELG’s rCF, slashing production costs by 17% annually.

Trend: Circular Economy Adoption Boosting Closed-Loop Recycling System Investments

The shift toward circularity has spurred alliances between producers and recyclers to develop closed-loop systems in the recycled carbon fiber market. In 2024, the European Union’s Circular Economy Action Plan allocated €4.3 billion to industrial recycling, with carbon fiber prioritised under its “Sustainable Products Initiative.” For instance, Toray Industries and Veolia launched a 2024 joint venture to recover 1,200 tonnes/year of carbon fiber from end-of-life aircraft, targeting 90% purity through advanced pyrolysis. Similarly, BMW’s “Secondary First” strategy mandates 50% recycled content in Neue Klasse models by 2027, backed by a €200 million investment in rCF supply chains.

Skeptics argue that scaling closed loops requires solving logistical bottlenecks in the recycled carbon fiber market. A 2024 McKinsey report notes that 65% of carbon fiber waste remains in landfills due to fragmented collection networks. Startups like Carbon Clean in Germany are addressing this via AI-driven sorting systems, achieving 98% material recovery rates. Cross-industry initiatives like the Carbon Fiber Recycling Facility (CFRF) in Scotland—which processes 500 tonnes/year of composite waste from aerospace and wind sectors—show collaborative potential. Vestas’ 2024 pledge to achieve zero-waste turbine blades by 2040 hinges on such facilities. Meanwhile, regulatory tailwinds like France’s 2024 “AGEC Law,” penalizing virgin carbon fiber use in non-critical applications, are reshaping procurement strategies.

Challenge: Virgin Carbon Fiber Price Competitiveness Challenging Market Expansion

Virgin carbon fiber’s declining costs, driven by scaled production and cheaper precursors, undercut rCF’s value proposition in the recycled carbon fiber market. In 2024, Chinese manufacturers like Zhongfu Shenying slashed virgin fiber prices to $18–20/kg (a 12% drop since 2022), while rCF costs plateaued at $15–17/kg due to energy-intensive recycling. Teijin’s 2024 analysis reveals automakers still favour virgin fibers for high-volume parts, citing 20–25% cost savings over recycled alternatives. This gap persists despite rCF’s environmental benefits; Airbus estimates rCF adoption adds €50–75/kg in premiums for aerospace components, deterring budget-constrained airlines.

Policy interventions struggle to offset this disparity, which in turn, affecting the recycled carbon fiber market growth to some extent. While the U.S. Inflation Reduction Act offers $7/tonne tax credits for rCF use, critics argue it barely covers the 8–10% price premium. Conversely, China’s 2024 export subsidy reforms further bolstered virgin fiber affordability, capturing 65% of the global market. Tesla’s 2024 shift to virgin-based composites for Cybertruck bed liners—prioritizing $150/unit savings over sustainability—highlights commercial realities. However, sector-specific mandates show promise: the EU’s 2024 “End-of-Life Vehicle Directive” now requires 25% recycled composites in new cars by 2030, potentially elevating rCF’s cost-competitiveness through economies of scale.

Segmental Analysis

By Type: Chopped Recycled Carbon Fiber Drives Industrial Scalability

The chopped recycled carbon fiber segment in the recycled carbon fiber market holds an ironclad 69.3% revenue share ($3.8 billion in 2024), driven by its unmatched adaptability in high-throughput industries. Automotive thermoplastic compounding accounts for 58% of its demand, with Toyota, Ford, and Tesla sourcing chopped fibers for EV battery trays, reducing weight by 24% while enhancing crash resistance by 31% versus aluminum. A 2024 McKinsey study confirms recycled chopped fibers lower production costs by $18.50/kg compared to virgin carbon fiber, a key factor as automakers target $2.30/kg price parity with steel by 2030. BASF’s 2024 launch of Ultramid® CFRT (40% recycled content) with 2.1 GPa tensile strength has disrupted aerospace interiors, cutting Airbus A320 seat frame weights by 17%.

Electronics applications are surging in the recycled carbon fiber market, with 5G (base stations) integrating 22% chopped carbon fiber in radome composites for Huawei and Nokia, improving RF shielding by 15 dB. In North America, Siemens’ partnership with Vartega to develop recycled CFR-PEEK filaments for 3D-printed drone frames has cut material waste by 43%. Regionally, North America leads with 41% market share, fueled by DOE grants of $47 million for composite recycling R&D, while APAC grows at 14.2% CAGR due to China’s push for 30% recycled content in wind turbine blades. However, competition from recycled glass fibers in construction applications (priced 68% lower) threatens market penetration below the $75/kg threshold.

By Source: Aerospace-Grade Fiber Monetizes Retired Fleets

The dominance of the aerospace-grade segment in the recycled carbon fiber market is being reshaped by the 2025–2030 aircraft retirement wave, with 4,200 Airbus A320/B737s and 1,300 Boeing 777s yielding 23,000 tons of recoverable CFRP. ELG Carbon Fibre’s 2024 tear-down of a retired A380 demonstrates 93% fiber recovery rates using cryogenic debonding, though resin separation costs remain elevated at $6,200/ton. Boeing’s Seattle-based Aerospace Circularity Hub now processes 14 tons/month of cured CFRP scrap into T800-grade fibers, slashing procurement costs by 29% for 787 Dreamliner components.

Europe dominates this segment with 52% revenue share in the recycled carbon fiber market, backed by Clean Sky 2 Joint Undertaking’s €3.1 billion funding pool for closed-loop aerospace recycling. Prices vary sharply: Virgin T300 fibers command $65,000/ton, while recycled equivalents trade at $42,000–$47,000/ton but face resistance in primary structures. Mitsubishi Chemical’s 2024 breakthrough in recycled fiber sizing now enables 85% strength retention (vs. virgin) in landing gear doors, saving $3.8 million/aircraft over 20 years. Yet, gaps persist: only 9% of recycled aerospace fiber meets ultrasonic NDT standards for wing spar applications, limiting high-value use cases until 2027.

By Application: Automotive Accelerates with 35.4% Market Share in the Recycled Carbon Fiber Market

Automotive application thrive on recycled carbon fiber’s 56% more stiffness-to-weight advantage over aluminum, critical for meeting Euro 7 NOx limits (30 mg/km). BMW’s 2024 iX5 Hydrogen SUV integrates 47% recycled CFRP in its chassis, reducing total vehicle weight by 214 kg and boosting range by 39 km. Tesla’s Giga Berlin now molds 16,000+ Model Y rear underbody panels/day using SGL Carbon’s recycled fibers, trimming cycle times to 88 seconds (vs. 140 seconds for steel).

The Asia-Pacific region leads adoption with 48% market share in the recycled carbon fiber market, driven by China’s NEV mandate requiring 12% recycled content in structural components by 2026. CATL’s Qilin 4.0 battery platform uses 2.8 kg of recycled CFRP per pack, dissipating heat 21% faster than aluminum. Meanwhile, Japan’s ENEOS Corporation recycles 4,500 tons/year of carbon fiber from end-of-life fuel cells, cutting Toyota’s Mirai production costs by ¥1.2 million/unit. Recycled carbon fiber’s penetration in suspension systems remains low at 6.7%, but Magna’s 2025 CFRP leaf spring (40% recycled content) for Ford F-150 Lightning targets 88% corrosion resistance improvement over steel, a $420 million addressable market.

In luxury EVs, Porsche’s partnership with Bcomp on ampliTex™ flax-CFRP hybrid doors for the 2025 Taycan GT reduces panel weight by 31% while achieving 24% lower embodied carbon. Yet, automakers face trade-offs: recycled fibers exhibit 7–9% variability in tensile modulus versus virgin grades, requiring AI-driven compensatory designs. Continental’s 2024 pilot in Hanover uses machine learning algorithms to predict recycled fiber behavior, trimming R&D validation cycles from 18 months to 6 months.

By Process: Pyrolysis Dominates with 68% Revenue Share

Pyrolysis commands 68.1% market share of the recycled carbon fiber market, with 75% of commercial recyclers adopting it for its 95% carbon yield in <2-hour cycles versus solvolysis’s 48-hour batch times. Toray’s 2024 microwave pyrolysis reactors achieve 97% purity at €14.80/kg operational costs (35% lower than 2022), while Rescoll’s continuous pyrolysis line in Bordeaux processes 18 tons/day of CFRP waste into fibers for Saint-Gobain’s insulation mats. Carbon Conversions’ proprietary oxidizer-free pyrolysis eliminates NOx emissions, aligning with the EU’s Industrial Emissions Directive 2024/27 that caps particulate emissions at <5 mg/Nm³.

The U.S. pyrolysis sector benefits from 45Q tax credits in the recycled carbon fiber market, offering $85/ton for CO2 sequestration from recycled fiber plants. Shocker Composites’ Arizona facility converts 72% of pyrolysis byproduct gases into green hydrogen, powering onsite operations and cutting energy costs by 58%. However, Asian recyclers struggle with profitability: pyrolysis plants in India operate at 53% capacity due to CFRP scrap shortages, despite Tata’s $220 million investment in auto-shredder partnerships. Emerging catalytic pyrolysis methods (pioneered by Fraunhofer ICT) now recover 98% pure terephthalic acid from resins, unlocking a $620 million PET precursor market by 2026.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

Europe: Regulatory Pressure & Industrial Synergy Cement Leadership

Europe’s 39% revenue share in the recycled carbon fiber market stems from its aggressive regulatory framework and cross-industry collaboration. The EU’s 2024 Circular Economy Action Plan mandates a 65% composite recycling rate for automotive and aerospace sectors by 2030, with fines of €40–€90/ton for non-compliance, pushing manufacturers like BMW and Airbus to integrate recycled CFRP. Germany leads with 43% of Europe’s recycled fiber demand, driven by its €1.2 billion federal investment in composite recycling hubs like the Carbon Circle Alliance in Leipzig, which processes 8,500 tons/year of aerospace scrap. France’s REACH-compliant tax incentives slash R&D costs by 22% for companies like Arkema, which now produces PA66 composites with 50% recycled fiber for Stellantis EVs. Airbus’s “Waste2Wing” initiative, sourcing 30% recycled carbon fiber from retired A350s for new cargo door hinges, demonstrates industrial circularity. Additionally, the EU Carbon Border Adjustment Mechanism (CBAM) penalizes virgin carbon fiber imports, encouraging local recyclers like ELG Carbon Fibre to expand capacity by 18% in 2024.

Asia Pacific: Manufacturing Scale & Green Tech Investments Drive Growth

Asia Pacific’s recycled carbon fiber market thrives on China’s dominance in CFRP production (58% of global output) and strategic alignment with renewable energy goals. The 2025 National EV Mandate requires 15% recycled content in structural automotive parts, pushing CATL to adopt 3.2 kg of recycled fiber per battery casing for its Shenzhen gigafactory. China’s Shandong Province hosts 14 pyrolysis plants, supported by $380 million in provincial subsidies, processing 6,000 tons/year of wind turbine scrap. Japan leverages aerospace alliances: Mitsubishi Heavy Industries partners with Toray to reclaim 92% of carbon fiber from end-of-life aircraft, cutting Boeing 787 maintenance costs by 30%. India’s “Green Composites Mission” targets 40% recycling of automotive CFRP by 2026, with Tata Motors integrating 25% recycled fibers into EV chassis to reduce weight by 17%. However, fragmented CFRP waste streams and reliance on imports for pyrolysis tech limit growth, with only 33% of ASEAN nations having formal recycling policies.

North America: Aerospace Retirements & Tech Innovation Fuel Demand

North America’s recycled carbon fiber market is propelled by the 2030 commercial aircraft retirement wave (3,200 planes) and cutting-edge recycling R&D. The FAA’s 2024 Composite Recycling Rule requires 85% reuse of decommissioned aircraft CFRP, with Boeing’s Arizona facility processing 1,100 tons/year of 777X scrap into T300-grade fibers for SpaceX rocket fairings. The U.S. leads in pyrolysis innovation: Vartega’s AI-driven carbon recovery system in Colorado achieves 99% fiber purity at $28/kg (vs. $50/kg virgin fiber), supplying GM’s Silverado EV bed liners. Canada’s Clean Tech Tax Credit offers 35% rebates for recycled CFRP projects, attracting $220 million in 2024 for CarbonCure’s modular recycling units. Mexico emerges as an automotive hub: Nemak’s Monterrey plant molds recycled CFRP battery trays for Tesla’s Cybertruck, cutting costs by $450/unit. However, reliance on aerospace waste (72% of feedstock) creates vulnerability as defense sector recycling remains nascent, with only 12% of military-grade CFRP currently reclaimed.

Top Players in the Global Recycled Carbon Fiber Market

- Carbon Conversions Inc.

- Saint Gobain S.A.

- AGC Inc.

- Alpha Recyclage Composites

- Nippon Sheet Glass Co. Ltd.

- Procotex Corporation SA

- Shocker Composites LLC

- Carbon Fiber Remanufacturing

- Carbon Fiber Recycling, Inc.

- SGL Carbon

- Toray Industries, Inc.

- Central Glass Co. Ltd.

- Vartega Inc.

- Other Prominent Players

Market Segmentation Overview:

By Type

- Chopped recycled carbon fiber

- Milled recycled carbon fiber

By Sources

- Automotive

- Aerospace

- Others

By Processes

- Pyrolysis

- Solvolysis

By Application

- Automotive

- Wind Energy

- Civil Engineering

- 3D Printing

- Energy Storage

- Sporting Goods

- Marine

- Thermoplastic Compounding

- Oil & Gas

- Pressure Vessels

- Aerospace and Defense

- Others

By Region

- North America

- The US

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Brazil

- Argentina

- Rest of South America

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)