Procurement Software Market: By Deployment (Cloud-based and On-premise); Software (Spend Analysis, E-Sourcing, and E-Procurement); Industry (Retail, Manufacturing, Transportation & Logistics, Healthcare, and Others); and Region)—Industry Dynamics, Market Size and Opportunity Forecast for 2025–2033

- Last Updated: 30-Jan-2025 | | Report ID: AA0422193

Market Scenario

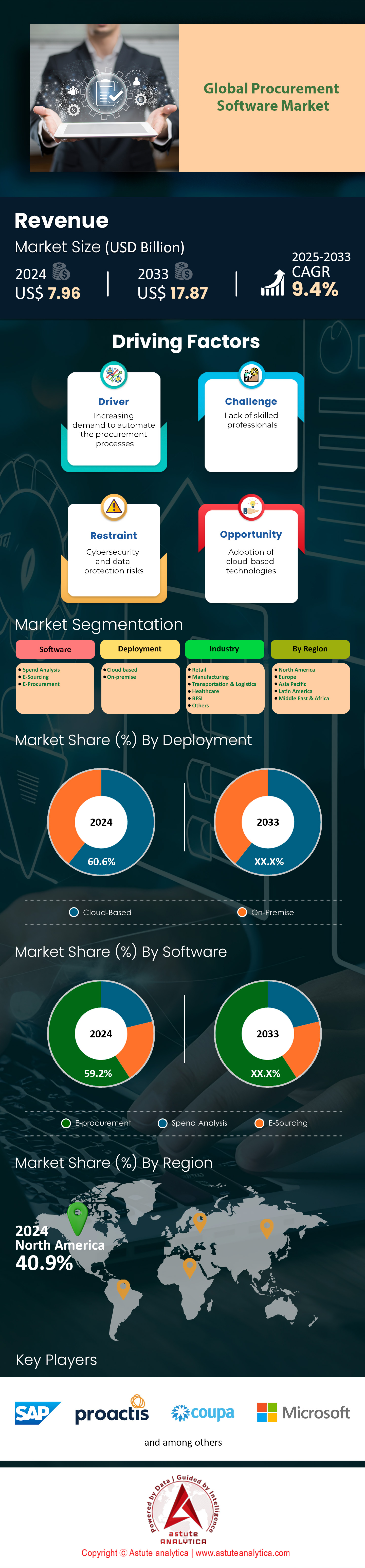

Procurement software market is expected to witness a substantial increase in revenue, projecting from US$ 7.96 billion in 2024 to US$ 17.87 billion by 2033 at a CAGR of 9.4% over the forecast period of 2025-2033.

The demand for procurement software is surging as businesses seek to streamline supply chain operations, enhance efficiency, and reduce costs. A key driver is the increasing complexity of global supply chains, with companies managing over 2.5 million suppliers worldwide. This complexity necessitates advanced tools to ensure transparency, compliance, and risk management. Additionally, the rise of remote work has pushed companies to adopt digital solutions, with 78% of procurement leaders prioritizing digital transformation. The shift towards sustainable procurement is another factor, as organizations aim to meet ESG goals by tracking over 1,200 sustainability metrics across their supply chains.

Wherein, some of the key providers in the procurement software market include SAP Ariba, Coupa, and Oracle Procurement Cloud, which dominate the market with their comprehensive, AI-driven solutions. These platforms offer features like spend analysis, supplier management, and contract lifecycle management. Leading consumers of procurement software span industries such as manufacturing, healthcare, and retail, with companies like Walmart and Pfizer leveraging these tools to optimize their procurement processes. The healthcare sector, in particular, has seen a 40% increase in procurement software adoption due to the need for efficient medical supply sourcing during recent global health crises.

The growth momentum is shifting towards AI and machine learning integration, with platforms like Jaggaer and Ivalua embedding predictive analytics to forecast demand and mitigate risks. Blockchain is also gaining traction across the procurement software market, with over 500 companies experimenting with blockchain for procurement transparency. The leading applications of procurement software include supplier relationship management, where companies are managing over 10,000 supplier contracts, and spend analytics, which helps organizations identify savings opportunities of up to 15% of their procurement budgets. As the market evolves, the focus is on hyper-automation, with tools like Zycus and Procurify offering robotic process automation to handle repetitive tasks, freeing up procurement teams for strategic decision-making.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Digital Transformation Accelerating Procurement Efficiency

Digital transformation is fundamentally reshaping the procurement software market, offering businesses unprecedented levels of efficiency, transparency, and agility. The shift towards digital tools has been accelerated by the pandemic, with 85% of procurement teams now relying on cloud-based platforms for their operations. These platforms enable real-time data access, allowing companies to monitor supplier performance, track orders, and manage inventory with greater precision. For instance, companies using digital procurement tools have reported a 30% reduction in manual errors, significantly improving accuracy in invoice processing and order fulfillment. Moreover, the integration of IoT devices in procurement processes allows companies to track shipments in real-time, reducing delays by up to 20% and ensuring that goods arrive on schedule.

The adoption of digital procurement platforms has also enhanced supplier collaboration, with over 60% of companies using supplier portals to share real-time data on orders and inventory levels. This has led to faster order fulfilment into procurement software market, with lead times reduced by an average of 15 days. Additionally, digital transformation has enabled companies to better manage risks, with tools like Riskmethods providing real-time alerts on supplier disruptions, helping companies avoid potential losses of up to $500,000 per incident. The focus on digital transformation is not just about efficiency but also about gaining a competitive edge. Companies that adopt advanced procurement technologies report a 25% higher profitability compared to their peers. As businesses continue to navigate complex global supply chains, digital transformation will remain a critical driver of procurement efficiency, enabling companies to stay agile and responsive in an increasingly dynamic market.

Trend: AI-Powered Predictive Analytics Reshaping Procurement Strategies

AI and machine learning are revolutionizing procurement by enabling predictive analytics and smarter decision-making in the procurement software market. Platforms like Coupa and SAP Ariba are now using AI to analyze over 100,000 data points to predict demand fluctuations, helping companies optimize inventory levels and reduce stockouts by 40%. AI-driven spend analysis tools are also identifying cost-saving opportunities, with companies saving an average of $1.2 million annually through better spend visibility. Additionally, machine learning algorithms are being used to assess supplier risks, with platforms like Jaggaer providing real-time risk scores for over 50,000 suppliers globally, allowing companies to mitigate potential disruptions before they occur. This level of predictive capability is transforming procurement from a reactive function to a proactive one, enabling businesses to anticipate challenges and seize opportunities.

The use of AI in contract management is another growing trend in the procurement software market, with tools like Ivalua automating the review of complex contracts, reducing the time spent on contract negotiations by 30%. AI is also enhancing supplier relationship management, with chatbots handling over 70% of routine supplier inquiries, freeing up procurement teams to focus on strategic activities. The integration of AI into procurement processes is not just a trend but a necessity, as companies that leverage AI report a 20% improvement in procurement efficiency and a 15% reduction in operational costs. As AI technology continues to evolve, its applications in procurement are expected to expand, driving further innovation in the industry. From demand forecasting to risk management, AI is reshaping procurement strategies, enabling businesses to operate with greater precision and foresight in an increasingly complex market.

Challenge: Rising Cybersecurity Threats in Procurement Platforms

As procurement software market becomes more integrated into business operations, data security has emerged as a critical challenge. The increasing reliance on cloud-based platforms has exposed companies to cybersecurity threats, with over 1,000 data breaches reported in the procurement sector in the last year alone. These breaches have resulted in financial losses averaging $3.5 million per incident, highlighting the need for robust security measures. Additionally, the use of third-party suppliers has introduced vulnerabilities, with 60% of companies reporting unauthorized access to their procurement systems through supplier portals. This has led to concerns about the integrity of sensitive data, including supplier contracts, pricing information, and inventory details.

To combat these threats, companies are investing in advanced security solutions, such as encryption and multi-factor authentication. However, the complexity of modern supply chains, which involve over 500,000 data transactions daily, makes it difficult to ensure complete security. The lack of standardized security protocols in the procurement software market across procurement platforms further exacerbates the issue, with only 30% of companies having a comprehensive cybersecurity strategy in place. As procurement software continues to evolve, addressing these security challenges will be crucial to maintaining trust and ensuring the integrity of procurement processes. Companies must prioritize cybersecurity to protect their data and maintain the confidence of their suppliers and stakeholders in an increasingly digital and interconnected world.

Segmental Analysis

By Deployment

Cloud-based deployment stands at a notable 61% market share in the procurement software market, a clear indicator of its unmatched flexibility, cost efficiency, and reduced implementation timelines. Many mid-sized enterprises that switch to this model have reported a US$2 million decrease in hardware and maintenance expenses over a three-year period, illustrating how a shift away from on-premise resources can substantially impact operating budgets. Beyond capital savings, cloud solutions can often be deployed within six weeks, which stands in stark contrast to the traditional 18-week schedule required for on-premise setups. Providers also note that some platforms process 50,000 procurement transactions daily, showcasing the scalability required to accommodate rapid business growth. In a marketplace where speed is critical, the capacity to handle such high volumes puts cloud solutions at the forefront for global retail giants, pharmaceutical companies, and other industries that prioritize streamlined procurement cycles.

Another compelling factor driving this deployment model in the procurement software market is the simplified approach to compliance and security. Certain providers in the procurement software market offer up to 20 distinct modules that include automated audit trails, vendor risk assessment, and real-time reporting, ensuring that companies can meet ever-evolving regulatory standards. For heavily regulated sectors like healthcare, such capabilities provide a critical layer of assurance without the undue complexity of managing disparate systems. Cloud-based platforms also benefit from robust encryption measures, with some vendors incorporating as many as five independent layers of data protection. This ensures that while procurement data remains easily accessible from multiple locations, it is safeguarded against any unauthorized intrusion.

By Software

E-procurement software commands a sizable 60% market share of the procurement software market, chiefly because of its capacity to automate and centralize purchase-related workflows. Many organizations that implement e-procurement report managing up to 80,000 purchase orders monthly, underscoring the platform’s ability to handle large transaction volumes without compromising accuracy. This heightened efficiency arises from intelligent matching engines that reconcile invoices with purchase orders in mere minutes, a process that once took entire teams hours to complete. The financial impact is equally significant, with some companies citing annual savings of US$1.5 million thanks to the elimination of paper-based processes and the reduction of manual errors. Even routine tasks, such as generating a purchase request, can be performed in three seconds or less, a rapid pace that enables businesses to maintain smooth coordination with multiple suppliers in fast-changing market conditions.

In addition to speed, e-procurement stands out for its seamless integration with vital enterprise resource planning systems in the procurement software market. Several vendors offer 15 or more modules within a single e-procurement suite, covering areas such as supplier selection, tactical sourcing, and automated invoice matching. By consolidating these functions, organizations gain real-time visibility into their supply chain, making it easier to isolate cost drivers and reallocate budgets effectively. In fact, advanced analytics can execute 100 separate data queries in one dashboard, giving executives an unparalleled view of purchasing trends and compliance. Moreover, a single instance of e-procurement software can bring on board as many as 500 suppliers to a unified portal, simplifying vendor onboarding while adhering to each industry’s unique regulatory requirements. This robust feature set solidifies e-procurement as a dominant force in the market, reflecting a direct response to companies’ growing need for speed, cost control, and enhanced supplier relationships.

By Industry

Holding a 24.9% share of the procurement software market, the BFSI (Banking, Financial Services, and Insurance) industry emerges as a key driver of product evolution and vendor innovation. Financial institutions often juggle thousands of supplier relationships concurrently, with some global banks managing over 2,000 active contracts at any moment. Such complexity demands high-volume invoice handling, and many BFSI systems can process 10,000 invoices per day while maintaining an unbroken audit trail. The sector also dedicates substantial resources to fraud prevention through procurement software, with certain institutions investing as much as US$5 million annually in compliance infrastructure. This investment covers a range of specialized features, from multi-layer authorization to intricate risk scoring models that guard against any compromise of sensitive data. As regulatory frameworks tighten worldwide, BFSI firms increasingly view procurement software as indispensable to safeguarding financial transactions and meeting operational benchmarks.

Beyond compliance, the BFSI sector’s procurement needs are shaped by its diversified portfolio of services in the procurement software market. Large banks frequently maintain 10 or more internal procurement teams, each devoted to a particular category—IT, facility management, or professional services—and their software must integrate these subunits into a cohesive network. A centralized platform provides insight into contract statuses, vendor performance, and renewal timelines, minimizing bottlenecks that can derail critical financial projects. One multinational conglomerate cited a savings of US$7 million following its transition to a unified procurement solution, highlighting how technology investments translate directly into stronger financial standing. The BFSI industry’s rigorous standards for security, record-keeping, and multi-level approvals have spurred procurement software vendors to develop specialized modules tailored for intricate risk management. This synergy ensures that both small-scale insurance firms and major investment banks see a substantial return on their technology outlays, reinforcing BFSI’s commanding presence as the largest procurement software consumer.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

North America’s procurement software market claims a formidable 40.9% share worldwide, backed by deep-rooted investments in robust digital infrastructure and a corporate culture predisposed to technological innovation. Among the region’s numerous competitive advantages is a willingness among Fortune 500 firms to allocate over US$10 million per year toward transforming procurement operations, a figure that underscores the strategic importance placed on streamlining supplier management. In the United States alone, industry reports indicate that more than 2,500 sizable enterprises have replaced their legacy systems with current-generation procurement suites designed to orchestrate as many as 25,000 purchase transactions each day. Over 40 specialized vendors offer solutions across the continent, creating a vibrant ecosystem that continuously refines software capabilities. This environment nurtures new features such as real-time analytics dashboards, AI-driven sourcing algorithms, and chat-based user interfaces, all of which cater to demand for agile and transparent purchasing cycles. Ultimately, North America remains a hotbed for early adopters and established leaders alike, each seeking to maximize the business advantages derived from automating spend oversight, auditing, and supplier collaboration.

Beyond corporate readiness, the region’s macro-level environment further strengthens its leadership in procurement software market. Data centers in key tech hubs maintain redundancy capacities of up to 2,000 megawatts, ensuring that these mission-critical systems stay online even under heavy loads or unexpected disruptions. While major cities like New York and San Francisco are best known for bringing high-tech innovations into play, mid-tier markets across the U.S. and Canada are also steadily ramping up their investment. Many organizations in these areas report annual budgets of US$3 million for upgrading procurement platforms, recognizing that efficient supplier management forms the backbone of operational excellence. Government-led modernization efforts, particularly in public sector procurement, have injected new impetus into private-sector research and development. As thousands of tech professionals gravitate toward procurement-centric roles, the offerings coming out of North America exemplify state-of-the-art functionalities that help businesses reduce errors, mitigate risk, and adapt to future market shifts. Looking ahead, experts anticipate that this combination of fiscal resources, innovation, and infrastructural reliability will sustain the region’s pivotal role in shaping global procurement software trends.

Top Companies in the Procurement Software Market:

- SAP SE

- Proactis Holdings PLC

- Coupa Software Inc.

- Microsoft Corporation

- Oracle Corporation

- Epicor Software Corporation

- Ginesys

- Zycus, Inc.

- Ivalua Inc.

- Infor Inc.

- Jaggaer

- Tangoe, Inc.

- Other Prominent Players

Market Segmentation Overview:

By Deployment:

- Cloud-based

- On-premise

By Software:

- Spend Analysis

- E-Sourcing

- E-Procurement

By Industry:

- Retail

- Manufacturing

- Transportation & Logistics

- Healthcare

- BFSI

- Others

By Region:

- North America

- The U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Rest of Asia Pacific

- Latin America

- Mexico

- Brazil

- Rest of LA

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Rest of the MEA

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2024 | US$ 7.96 Bn |

| Expected Revenue in 2033 | US$ 17.87 Bn |

| Historic Data | 2020-2023 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Unit | Value (USD Bn) |

| CAGR | 9.4% |

| Segments covered | By Deployment, By Software, By Industry, By Region |

| Leading players | SAP SE, Proactis Holdings PLC, Coupa Software Inc., Microsoft Corporation, Oracle Corporation, Epicor Software Corporation, Ginesys, Zycus, Inc., Ivalua Inc., Infor Inc., Jaggaer, Tangoe, Inc., Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)