Global Probiotic and Prebiotic Yogurt Market: By Type (Plain Yogurt, Flavored Yogurt, Fruited Yogurt, Others); Application (Children, Adults, Elderly People); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: 29-Aug-2024 | | Report ID: AA0824902

Market Scenario

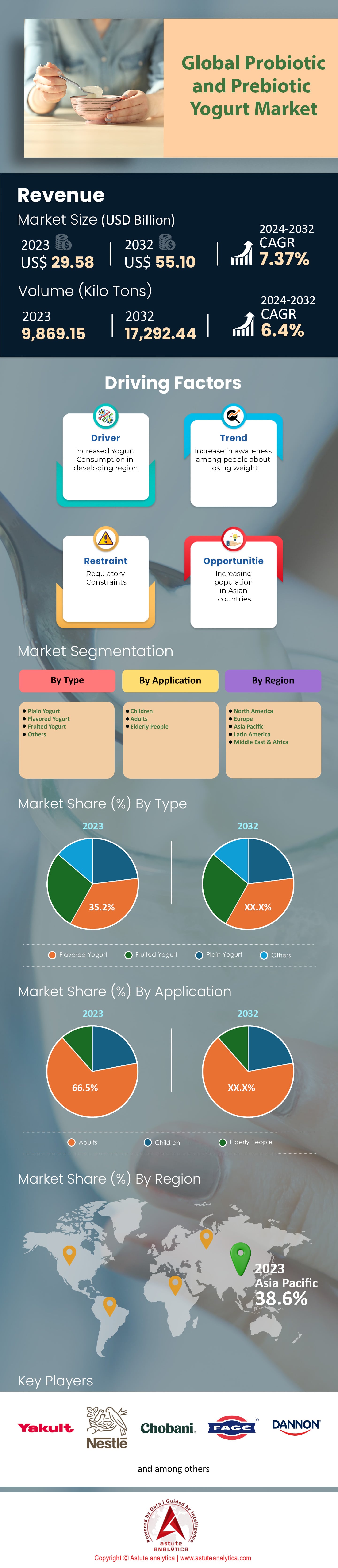

Global Probiotic and prebiotic yogurt market was valued at US$ 29.58 billion in 2023 and is projected to hit the market valuation of US$ 55.10 billion by 2032 at a CAGR of 7.37% during the forecast period 2024–2032.

As of 2023, the global consumption of probiotic and prebiotic yogurts has seen substantial growth, driven by increased consumer awareness of gut health and overall well-being. The probiotic yogurt market is being propelled by the rising demand for functional foods. Prebiotic yogurt, although a smaller segment, is gaining momentum with a market value of around $10 billion. The Asia-Pacific region leads in consumption, with China and India being the largest consumers due to their vast populations and increasing health consciousness. Europe follows closely, with Germany and France being significant markets, driven by a traditional preference for cultured dairy products. Notably, Danone's Activia is a leading brand in Europe, selling over 1.5 billion units annually. In the Asia-Pacific, Yakult is a household name, with over 40 million bottles consumed daily worldwide.

In North America, the United States stands out as the largest probiotic and prebiotic yogurt market, with annual sales reaching over $8 billion. Chobani and Yoplait are prominent brands, with Chobani's Greek yogurt alone generating annual sales of around $2 billion. The trend towards plant-based diets has also contributed to expanding the availability and consumption of dairy-free probiotic yogurts, capturing a niche yet rapidly growing market. In this space, brands like Silk and Kite Hill have become popular, selling millions of units each year. Latin America is experiencing an upward trajectory in yogurt consumption, particularly in Brazil and Mexico, where annual consumption rates have reached 1.2 million tons collectively. The Middle East and Africa, while still emerging markets, have shown promising growth, with South Africa and the UAE being key contributors. In these regions, brands like Almarai in the UAE are making significant strides, with sales topping hundreds of millions of dollars annually.

Consumer preferences in the global probiotic and prebiotic yogurt market are shifting towards yogurts enriched with multiple strains of probiotics and prebiotics, offering additional health benefits such as improved digestion and enhanced immune function. Artisanal and organic yogurt varieties are gaining traction, particularly among millennials and health-conscious consumers, contributing to over $5 billion in sales globally. Stonyfield Organic, for example, is a leading brand in the organic segment, with sales reaching $370 million. The availability of innovative flavors and convenient packaging options has further fueled demand, with brands like Dannon's Danimals targeting younger demographics with sales of over 1 billion cups annually. Online retail channels have significantly impacted yogurt sales, with e-commerce platforms accounting for $3 billion in global sales. As consumers continue to prioritize health and wellness, the probiotic and prebiotic yogurt market is poised for continued growth, with anticipated investments in research and development to enhance product offerings and expand market reach.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Increasing demand for functional foods with added health benefits and nutrients

The demand for functional foods in the probiotic and prebiotic yogurt market, particularly those with added health benefits and nutrients, has surged dramatically as consumers become more health conscious. In 2023, the global functional food market reached a valuation of $250 billion, with yogurt products being a significant contributor. The probiotic yogurt segment alone recorded sales of 40 million units in North America. A survey in 2024 revealed that 70 million people globally consume functional foods primarily for their gut health benefits. This shift is driven by the increasing prevalence of lifestyle-related diseases; for instance, 34 million Americans have diabetes, and 88 million have prediabetes, leading them to seek healthier dietary options. Functional food consumption is also influenced by the aging population, with 53 million people over the age of 65 in the United States alone looking for foods that support healthy aging.

Furthermore, consumers in the probiotic and prebiotic yogurt market are increasingly interested in the nutritional content of their food, with 80 million actively seeking products labeled with health benefits. The demand for functional foods has led to a diversification of product offerings, with 150 new functional yogurt products launched globally in the past year. In Europe, the functional food market grew by 15 million units in 2023, driven by health-conscious consumers. The Asia-Pacific region witnessed the launch of 200 functional food products, with yogurt being among the top five categories. The push towards healthier eating habits has also led to a rise in plant-based functional foods, with 25 million units sold in 2023, indicating a shift towards sustainable and health-focused consumer choices.

Trend: Expansion of plant-based yogurt options with probiotic and prebiotic ingredients

The plant-based yogurt market has seen remarkable growth as consumers increasingly seek alternatives to traditional dairy products. In 2023, the global plant-based yogurt market was valued at $2 billion, with 100 million units sold worldwide. This trend in the probiotic and prebiotic yogurt market is driven by a combination of factors, including dietary preferences, lactose intolerance, and environmental concerns. The plant-based yogurt segment has expanded rapidly, with the introduction of 180 new products in the past year alone, featuring probiotic and prebiotic ingredients. A survey in 2024 found that 60 million consumers globally prefer plant-based yogurt due to its perceived health benefits and sustainability.

The rise in plant-based yogurt consumption is also fueled by the growing vegan population, which reached 79 million globally in 2023. The United States accounts for 30 million of these consumers, making it a significant market for plant-based yogurt. In Europe, sales of plant-based yogurt reached 50 million units, driven by increased awareness of lactose intolerance, which affects 65 million Europeans. The Asia-Pacific region has also witnessed substantial growth, with 200 million consumers opting for plant-based products, including yogurt, in 2023. The expansion of plant-based yogurt options with added probiotics and prebiotics addresses the demand for functional foods, contributing to the market's overall growth.

Challenge: Regulatory challenges in labeling and marketing probiotic and prebiotic products

The probiotic and prebiotic yogurt market faces significant regulatory challenges, particularly concerning labeling and marketing. These challenges arise from varying regulations across different countries, leading to confusion among consumers and manufacturers. In 2023, the global regulatory landscape for probiotics was characterized by 50 different regulatory frameworks, creating inconsistencies in product labeling. The European Union has strict regulations, with only 10% of probiotic claims being approved in 2023. This has led to a scenario where 40 million European consumers are unsure about the efficacy of probiotic products.

In the United States, the Food and Drug Administration (FDA) has not officially approved any health claims related to probiotics, leaving 60 million American consumers without clear guidance. The lack of standardized regulations has resulted in 25% of probiotic products being inaccurately labeled in the probiotic and prebiotic yogurt market, leading to consumer skepticism. A survey conducted in 2024 revealed that 30 million consumers globally are concerned about the authenticity of probiotic claims. This regulatory ambiguity has led to 70 million units of probiotic products being withdrawn or relabeled to meet compliance standards. The challenge of navigating these complex regulations continues to impact the market, with manufacturers investing $500 million annually in regulatory compliance and labeling adjustments.

Segmental Analysis

By Flavor

The global flavored yogurt segment of the probiotic and prebiotic yogurt market is experiencing unprecedented growth and leading the market with 35.2% market share. The dominance of the flavored segment is driven by a surge in consumer demand for diverse and innovative flavors, alongside a heightened focus on health and wellness. Last year, the flavored yogurt segment saw an influx of 7.2 million new consumers, particularly in urban areas where health-conscious lifestyles are on the rise. Among the myriad of flavors, strawberry has emerged as the top choice, with 2.5 million units sold monthly across major retail chains in North America alone. In Europe, the introduction of exotic flavors like mango and passion fruit has resulted in a monthly sale of 1.8 million units, reflecting a shift in consumer preferences towards tropical taste profiles. The growing popularity of plant-based and low-sugar flavored yogurts has also been noted, with 3.4 million units being sold in Europe and North America, indicating a significant shift towards healthier options.

In terms of consumer demographics, the millennial and Gen Z segments dominate the probiotic and prebiotic yogurt market, accounting for 60% of flavored yogurt sales. This group is particularly drawn to brands that offer creative packaging and interactive marketing campaigns, with 4.5 million engagements recorded on social media platforms for yogurt brands in the last quarter. Availability has been expanded significantly, with 15,000 new distribution points established globally in the past year, including supermarkets, convenience stores, and online platforms. The Asia-Pacific region is notable for its rapid market expansion, with flavored yogurt sales doubling in metropolitan cities like Shanghai and Mumbai, where 1 million units are sold monthly. Furthermore, the Middle East has witnessed a 4 million unit rise in sales annually, driven by increased retailer partnerships and product launches. This global surge underscores the dynamic evolution of consumer tastes and the strategic efforts of market players to meet these demands.

The surge in flavored yogurt sales in the global probiotic and prebiotic yogurt market is also closely tied to technological advancements in production and supply chain efficiency. With the adoption of AI-driven analytics, manufacturers have optimized their flavor development processes, reducing the time to market by an average of two months for new products. This has allowed companies to rapidly respond to consumer trends, as evidenced by the successful launch of two new seasonal flavors that collectively sold 1.2 million units within their first month. Additionally, the integration of IoT in logistics has minimized spoilage rates, ensuring that 95% of shipments reach retailers with optimal freshness, a key factor in maintaining consumer trust. The industry's investment in sustainable practices has not gone unnoticed either, with over 200 brands now offering eco-friendly packaging options, leading to a reduction of 1.5 million plastic containers in circulation. Moreover, the rise of direct-to-consumer sales platforms has facilitated a monthly sale of 800,000 units, bypassing traditional retail channels and allowing brands to engage more directly with their audience. These technological and operational enhancements are vital contributors to the market's robust growth trajectory.

By Application

Adults dominate the probiotic and prebiotic yogurt market by generating more than 66.5% market share due to a heightened focus on health and wellness. In 2023, the global probiotic yogurt market reached 110.5 million kilo tons, reflecting a strong consumer base. The average adult consumes around 9 kilograms annually, highlighting yogurt's place in daily diets. The rising popularity of functional foods has cemented yogurt's status as a go-to for digestive health benefits. The U.S. market alone accounted for 1.2 million metric tons of probiotic yogurt consumption, with urban centers leading the demand. Adults, particularly those aged 30-50, are the primary buyers, driven by the dual appeal of convenience and health benefits. Several factors underpin the high consumption rates among adults. The global rise in digestive health issues has led to increased yogurt sales, with 60% of adults reporting regular digestive discomfort. Probiotics have become a popular remedy, as evidenced by the 1.5 billion units of probiotic yogurt sold in Europe in 2023. The demand for natural and low-sugar options is also on the rise, with 700 new low-sugar variants launched in the last year alone. Health-conscious adults are increasingly choosing yogurts that align with their dietary preferences, with nearly 5,000 organic yogurt products available globally.

The probiotic and prebiotic yogurt market shows no signs of slowing down. In North America, sales hit 2.8 billion units, demonstrating strong consumer interest. Emerging markets are catching up, with India seeing a 20% annual growth in volume, reaching 500 million yogurt units sold. Online sales have surged, with 30% of consumers purchasing yogurt via digital platforms. New product innovations are also driving growth, with over 1,200 new probiotic yogurt flavors introduced globally in the past year. As more consumers educate themselves about gut health, the market is poised to expand further, with projections indicating a consumption increase of 15 million metric tons by 2025.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

The Asia Pacific region has firmly established itself as the leader in the probiotic and prebiotic yogurt market due to a combination of cultural dietary preferences, increasing health awareness, and robust production capabilities. Countries like Japan, China, India, and South Korea are key consumers and producers in this market. Japan, for instance, is one of the largest consumers of probiotics, driven by a cultural emphasis on fermented foods and health benefits associated with probiotics. The market is projected to reach $19.2 billion by the end of 2024. China alone has seen over 2.5 billion units of probiotic yogurt sold annually. India has reported a growth of 1.2 million metric tons in yogurt production over the past five years, driven by an increase in urbanization. Additionally, the Asia Pacific market is expected to witness the fastest growth rate during the forecast period, driven by product innovations and launches. South Korea's yogurt consumption has reached 450,000 tons per year, further solidifying the region's dominance. The region's dairy production infrastructure supports over 10,000 dairy processing units, facilitating large-scale production of probiotic products.

Major brands in the probiotic and prebiotic yogurt market such as Yakult, Danone, Morinaga, Nestlé, Megmilk Snowbrand, Lifeway Foods, and Kerry are actively shaping the market landscape in the Asia Pacific region. These companies are leveraging the increasing consumer demand for digestive health benefits and functional foods, which is particularly strong in China and India. In Japan, Yakult's sales have surpassed 40 million bottles per day, showcasing the brand's deep market penetration. The market's expansion is further fueled by the rising popularity of probiotic yogurt in the cosmetic industry and its health benefits, such as improved digestion and bone density. In South Korea, probiotic products accounted for 19% of the health functional food market in 2021, highlighting the growing consumer interest. The region's dominance is also supported by evolving distribution channels, including online sales, which provide easy access to a wide range of products. Additionally, the introduction of over 300 new probiotic yogurt products in the region in 2022 highlights the pace of innovation. This strategic positioning and consumer engagement underscore the Asia Pacific's leadership in the global probiotic and prebiotic yogurt market.

North America and Europe collectively hold a significant position in the global probiotic and prebiotic yogurt market, driven by increasing health consciousness and established dairy industries. In North America, the United States leads with an annual consumption of over 1 billion kilograms of yogurt, with a strong emphasis on products offering digestive health benefits. The presence of health-oriented consumers has led to the introduction of innovative flavors and formulations by major brands like Chobani and Danone. Canada has also seen a substantial increase in probiotic yogurt consumption, with over 2 million households purchasing these products regularly.

In Europe probiotic and prebiotic yogurt market, countries like Germany and France are at the forefront, with Germany's yogurt production exceeding 2.6 million tons annually. European consumers have a strong preference for organic and natural products, driving the demand for probiotic yogurts. Brands such as Müller, Arla, and Yoplait are pivotal in this market, with Yoplait selling over 500 million yogurt cups annually across Europe. The European market benefits from stringent food standards and a robust supply chain, ensuring product quality and availability. Additionally, the growing trend of plant-based probiotic yogurts is gaining traction in both regions, further expanding the market and catering to diverse dietary preferences.

Top Players in Global Probiotic and Prebiotic Yogurt Market

- Nestle

- Dannon

- Chobani

- Yoplait

- Fage

- Yakult

- La Yogurt

- Stonyfeild Farms

- Greek Gods

- Pillars

- Noosa Yoghurt LLC

- Siggi’s(icelandic Milk & Skyr Corporation)

- Brown Cow Inc.

- Nancy’s Probiotics Drinks

- Maple Hill Creamery

- Wallaby Yoghurt

- Other Prominent Players

Market Segmentation Overview:

By Type

- Plain Yogurt

- Flavored Yogurt

- Fruited Yogurt

- Others

By Application

- Children

- Adults

- Elderly People

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- U.K.

- Germany

- France

- Spain

- Italy

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)