Printed Electronics Market: By Component (Ink (Dielectric Inks, PTC Ink, Conductive Inks, Resistive Inks, Electrode Inks, Others), Substrate (Dielectric Substrates, PET (Polyester), Polyimide, Fabrics and Paper, Stretchable Substrates, Printed Circuit Boards, Others), Services ( Professional Services (Designing, Prototyping, Manufacturing), Support Services); Printing Technique (Contact Printing (Gravure Printing, Offset Printing, Flexography, Screen Printing, Pad Printing), Non-Contact Printing (Inkjet Printing and Aerosol Printing); Application (Radio Frequency (RF) Components, Display, Thin Film Transistors, Sensors, Others); Industry (Healthcare & Pharmaceutical, Consumer Electronics, Automotive, Smart Building & Construction, Food & Beverages, Cosmetics & Personal Care, Others); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: 26-Sep-2025 | | Report ID: AA1023648

Market Snapshot

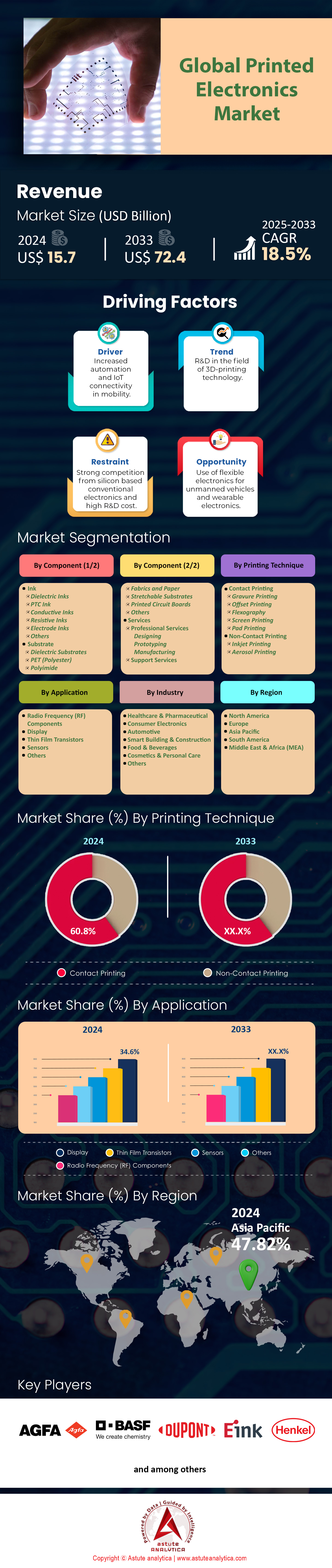

Printed electronics market was valued at US$ 15.7 billion in 2024 and is projected to attain a market valuation of US$ 72.4 billion by 2033, growing at a CAGR of 18.5% during the forecast period 2025–2033.

Key Findings in Printed Electronics Market

- By industry, the automotive segment holds a dominant position, constituting a significant 29.9% of the total market share.

- By component, the Ink segment of the printed electronics market is commanding a whopping 56.4% of the market share and is also projected to keep growing at the highest CAGR of 18.9% during the forecast period.

- Based on application, display segment accounted for over 34.6% revenue share of the market as display is the largest part of the printed electronics.

- Based on printing technique, contact printing technique firmly positions itself at the forefront with revenue share of 60.8%.

- Asia Pacific is the powerhouse of the market with over 47.82% revenue contribution to global market.

- Printed Electronics market size is set to surpass US$ 72.4 billion by 2033.

Demand in the printed electronics market is solidifying around high-volume, high-value applications. The automotive sector, for instance, is a primary driver. At least 15 new electric vehicle models launched in 2024 feature integrated printed heaters for battery conditioning and cabin comfort. In parallel, the consumer electronics landscape remains a critical demand center. Projections for 2025 show that global shipments of foldable smartphones, which rely on flexible printed circuits, will exceed 55 million units. The proliferation of Internet of Things (IoT) devices further amplifies demand, with more than 3 billion new low-power IoT nodes expected to be deployed in 2025, many requiring printed antennas and sensors.

The growth momentum o the printed electronics market is supported by significant manufacturing advancements and investments. In the first half of 2024 alone, venture capital firms injected over $450 million into startups specializing in printed electronic components. The healthcare sector is another powerful growth catalyst. In 2024, the FDA granted clearance for more than 25 new wearable medical sensors that utilize printed, skin-conformable electrodes. For example, a new smart bandage developed in early 2025 incorporates printed sensors that can detect infection biomarkers at concentrations as low as 50 micromolar.

These trends indicate a market that is rapidly maturing. The demand is no longer just for prototypes but for millions of reliable, cost-effective units. Key material suppliers are responding; one major chemical company announced in January 2025 a production expansion that will yield 5,000 kilograms of new conductive silver ink per month. The convergence of demand from at least five major industries confirms the technology's move into the mainstream, creating a robust and expanding ecosystem for stakeholders.

To Get more Insights, Request A Free Sample

Untapped Opportunities Emerge from Sustainability and Advanced Integration Trends

An opportunity analysis of the printed electronics market reveals lucrative new avenues for growth, driven by powerful macrotrends. Stakeholders can gain a significant competitive advantage by aligning their strategies with these emerging areas of demand.

- The Rise of Green and Biodegradable Electronics. There is a rapidly growing demand for sustainable electronics. The opportunity across the printed electronics market lies in developing fully biodegradable printed circuits and sensors. In early 2025, researchers successfully developed a paper-based substrate with a water-dissolution time of less than 60 seconds. Another key development is a new carbon-based conductive ink derived from lignin, a plant-based polymer, which achieved a conductivity of 300 Siemens per centimeter in 2024 tests. Companies commercializing these green materials can tap into a market segment driven by corporate sustainability goals and increasing government regulations against electronic waste.

- The Integration of Electronics into Smart Textiles. The e-textile market is transitioning from niche applications to mainstream consumer products. A significant opportunity exists in manufacturing washable and stretchable printed electronics for smart apparel. In 2024, a new silver-based ink demonstrated consistent conductivity after 100 wash cycles. Furthermore, major athletic brands plan to release 5 new smart apparel lines in 2025 that incorporate printed sensors to monitor biometric data like muscle oxygenation and sweat composition, creating a new mass-market application.

Two Pillars Defining Next-Generation Demand in the Printed Electronics Market

Printed and Flexible Batteries Power a New Generation of Untethered Devices

The printed electronics market is witnessing a demand surge for thin, flexible power sources. These printed batteries are essential for enabling the next wave of compact IoT devices, medical wearables, and smart labels. Unlike traditional rigid batteries, their form factor allows for seamless integration into products where space and weight are critical constraints. This has created a distinct and rapidly growing sub-market focused on material innovation and high-volume production. As devices become smaller and more ubiquitous, the demand for adaptable, printed power solutions is becoming a defining feature of the market's evolution.

The demand is quantifiable through recent technological milestones and commercial activities. In 2024, Ultralife Corporation launched a new line of thin, flexible printed batteries, including a model that is just 740 micrometers thick. A key performance metric in the printed electronics market was achieved in early 2025 when a new zinc-manganese dioxide printed battery demonstrated a stable energy density of 2.5 milliampere-hours per square centimeter. Durability is also improving; a flexible battery from Molex survived over 1,000 bend cycles to a 25-millimeter radius without performance degradation. Major players are expanding capacity; one leading manufacturer announced plans in 2024 to scale production to 300 million units annually by the end of 2025. Furthermore, innovation is accelerating, with over 150 new patents for flexible battery chemistry filed in the first half of 2024 alone.

Interactive HMIs Revolutionize Smart Appliance and Industrial Control Panels

A powerful demand driver for the printed electronics market is the widespread adoption of interactive Human-Machine Interfaces (HMIs). The technology is enabling sleek, durable, and cost-effective touch controls in everything from kitchen appliances to factory equipment. By printing transparent conductive sensors onto glass or polymer surfaces, manufacturers can eliminate bulky mechanical buttons. This creates seamless, easy-to-clean interfaces that are more reliable and aesthetically pleasing. The demand is fueled by a cross-industry push for smarter, more intuitive user experiences, making printed HMIs a critical component in modern product design.

This trend is evident in both consumer and industrial sectors of the printed electronics market. In 2025, at least 12 major smart home appliance models from leading brands will feature fully integrated printed capacitive touch interfaces. The underlying technology has advanced significantly; new transparent sensors developed in 2024 feature a light transmission level of 92 percent. These sensors also boast a response time of under 15 milliseconds, ensuring a smooth user experience. In the industrial sector, printed control panels are being designed for harsh environments, with new models in 2024 rated for an operational temperature range from -30 to 85 degrees Celsius. Durability is paramount, with these industrial sensors being tested to withstand over 5 million actuation cycles without failure.

Segmental Analysis

Automotive Sector's In-Mold Electronics and EV Demands Create New Frontiers

The automotive segment's commanding 29.9% share of the printed electronics market is increasingly defined by sophisticated applications that move beyond basic circuitry. For instance, the adoption of in-mold electronics (IME) is a primary driver. It enables the seamless integration of touch-sensitive controls and ambient lighting directly into dashboards, which consequently reduces weight and assembly complexity. This trend is critical for electric vehicles (EVs), where weight reduction directly translates to improved range. Furthermore, printed heaters are gaining significant traction for optimizing EV battery performance in cold climates, a crucial factor for consumer adoption.

These developments are completely reshaping vehicle interiors and functionality. As a result, they create smart surfaces that are both aesthetic and intuitive. The complex manufacturing processes for these components are becoming more streamlined, which reduces production costs and waste, aligning with the industry's sustainability goals. The continued growth of the printed electronics market is therefore intrinsically linked to the evolution of vehicle electrification and autonomy, where its lightweight nature provides solutions that traditional electronics cannot.

- Miniaturization in electronics allows smaller sensors and LEDs to be seamlessly integrated, expanding applications in vehicle design.

- North America holds an estimated 45.6% share of the automotive IME market in 2025 due to early adoption by major auto manufacturers.

- The global market for in-mold electronics is projected to grow at a CAGR of 27.44%

Ink Segment Thrives on Material Science Breakthroughs and Niche Applications

Holding a massive 56.4% market share, the ink segment's dynamism in the printed electronics market is rooted in material innovation that caters to highly specific applications. While traditional silver flake-based inks remain dominant, particularly in photovoltaics, much of the future growth will come from emerging opportunities. For example, the development of stretchable and thermoformable inks is crucial for the expanding wearables and in-mold electronics sectors. These advanced inks can maintain conductivity even when deformed, a property essential for smart clothing. In addition, copper-based inks are gaining traction as a lower-cost alternative to silver, especially in applications like RFID antennas.

The segment's projected CAGR of 18.9% is fueled by high-value products. Nanoparticle-based and particle-free inks are enabling higher-resolution printing, opening doors for applications in high-frequency antennas. The evolution of the printed electronics market is heavily reliant on these specialized formulations. As applications become more complex, from remote health monitoring patches to smart packaging, the demand for inks with tailored properties will certainly intensify.

- Carbon/graphene inks are poised to grow at a CAGR of 5.87% through 2035, prized for their cost-effectiveness and durability.

- Explosive growth in wearable technology, including fitness trackers and e-textiles, is a primary force propelling the stretchable conductive ink market.

- Quantum dot (QD) inks are revolutionizing displays by enabling photopatternable, cadmium-free solutions for next-generation OLED technologies.

Display Segment Pushes Boundaries with Foldable and Flexible Technologies

The display segment's significant 34.6% revenue share in the printed electronics market is a direct result of consumer appetite for novel form factors, particularly flexible devices. The technology allows for displays that can be bent, curved, or rolled, making them ideal for next-generation smartphones and wearables. However, the path to dominance is complex. Manufacturing challenges, such as lower yield rates for foldable OLED panels compared to rigid displays, have kept costs high. Despite these hurdles, durability is improving, with fold cycles now exceeding 200,000 uses in lab settings, encouraging more brands to enter the space.

Innovations are not limited to consumer electronics. Electrophoretic displays (e-paper) are expanding beyond e-readers into new applications like outdoor digital signage and electronic shelf labels. This expansion is thanks to breakthroughs enabling full color and wider operating temperature ranges. The growth of the printed electronics market is therefore being propelled by a dual-pronged advance: high-end flexible OLEDs are redefining device interaction, while energy-efficient e-paper is enabling a host of new smart-surface applications.

- After years of high growth, the foldable smartphone display market is expected to see a slight decline in 2025 before a predicted rebound.

- While Samsung has historically led the foldable display market, Chinese OLED manufacturers have been steadily increasing their market share since 2023.

- New e-paper technology features an operating temperature range between -20 and 65 °C, making it suitable for cost-effective outdoor signage.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

Contact Printing Techniques Evolve for High-Volume, Precision Manufacturing

Contact printing, with its formidable 60.8% revenue share, maintains its leadership in the printed electronics market through cost-effectiveness, especially for high-volume production. Techniques like screen printing are the workhorses of the industry, valued for their ability to deposit thick ink layers for solar cell electrodes. The process is highly scalable, with per-unit costs dropping significantly in batches over 1,000 units. Meanwhile, flexography is also gaining prominence, marrying the efficiency of traditional rotary printing with electronic fabrication to produce flexible sensors and smart packaging solutions.

While inkjet printing offers superior resolution for prototyping, contact methods are evolving. The development of roll-to-roll (R2R) gravure and screen printing processes enables high-throughput manufacturing of devices like organic photovoltaics at speeds up to 600 meters per minute. This capability for mass production of flexible electronics is vital for the continued expansion of the printed electronics market, ensuring that as demand for IoT sensors grows, manufacturing can scale efficiently to meet it.

- For production runs exceeding 1,000 units, screen printing can be 30-40% more cost-effective per unit than inkjet printing.

- Inkjet printing is the ideal method for prototypes and low-volume runs of 1-1000 boards due to its high resolution.

- Flexographic printing's ability to create lightweight circuits on flexible substrates is paving the way for advancements in wearable health monitoring.

To Understand More About this Research: Request A Free Sample

Regional Analysis

Asia Pacific Commands Global Production with Unmatched Government Backing

The Asia Pacific region solidifies its leadership in the printed electronics market with over 47.82% market share. Its dominance is not accidental but the result of a concerted industrial strategy and massive capital investment. Countries across the region are building an unparalleled manufacturing ecosystem designed for high-volume production. This is particularly evident in the display and semiconductor sectors, where governments are providing substantial financial support to secure technological sovereignty and supply chain control. Consequently, the region has become the undisputed global hub for producing the core components that power the industry, from flexible screens to advanced integrated circuits.

The strategic position in the printed electronics market is supported by staggering data. For instance, in early 2024, the South Korean government announced a private-sector investment plan of 622 trillion won to create the world's largest semiconductor cluster. Similarly, Japan's Ministry of Economy, Trade and Industry (METI) allocated 45 billion yen in 2024 to support next-generation semiconductor manufacturing research. In China, the city of Guangzhou is investing 11.1 billion yuan to establish a new flexible display production hub. Furthermore, Taiwan's semiconductor industry is projected to import over 4.2 million square centimeters of silicon wafers in 2025. In India, the government's production-linked incentive scheme for electronics manufacturing attracted 32 new applications in its 2024 cycle.

North America Drives Innovation Through Venture Capital and Advanced Research

North America's strength in the printed electronics market lies in its vibrant innovation ecosystem. The region excels at translating cutting-edge research into commercially viable products, backed by a robust venture capital landscape. Government and private consortia actively fund early-stage companies and advanced R&D, particularly in high-value sectors like aerospace, defense, and medical technology. The focus is less on commodity production and more on pioneering next-generation materials, processes, and applications that define the future of the industry.

This innovation is fueled by significant and targeted funding in the printed electronics market. For example, the U.S. CHIPS and Science Act began allocating its first 2024 grants, with a total of 39 billion dollars earmarked for manufacturing incentives. The NextFlex consortium, a key public-private partnership, announced 12 new funded projects in its 2024 cycle to advance flexible hybrid electronics. In Canada, the National Research Council provided 1.5 million Canadian dollars for a project on 3D printable electronics in early 2024. Furthermore, the U.S. Department of Energy announced a 15 million dollar funding opportunity in 2024 for advanced materials, including conductive polymers.

Europe Champions Collaborative Research and Sustainable Electronics Development

Europe carves out its distinct position in the printed electronics market through a unique, collaborative model. The region leverages extensive cross-border research programs and public-private partnerships to advance the industry. A strong emphasis is placed on sustainability and circular economy principles, driving innovation in green and biodegradable electronic materials. European research institutes are global leaders in developing processes for high-performance applications, especially within the automotive and industrial sectors, creating a market defined by quality and ecological responsibility.

The region's commitment is evident through its funding mechanisms and research output. The EU's Horizon Europe program has a total budget of 95.5 billion euros through 2027, with numerous 2024 calls targeting printed electronics. Germany's Fraunhofer-Gesellschaft, a key research organization, operated with an annual research budget exceeding 3.0 billion euros in 2024. In the United Kingdom, the Centre for Process Innovation (CPI) launched 3 new collaborative projects in 2024 to scale up printed sensor manufacturing. Meanwhile, Belgium-based research hub imec reported a revenue of 940 million euros in 2024, dedicating significant resources to advanced electronics.

Top 6 Developments in Printed Electronics Market

- Dutch startup TracXon raised €4.75 million in seed funding to scale its hybrid printed electronics (HPE) technology industrialization (September 2025).

- Gallus Rotascreen launched a new rotary screen printing unit for narrow-web machines, enhancing production capabilities in printed electronics (May 2025).

- Electroninks formed a strategic collaboration with North America distributor Insulectro to expand metal organic decomposition (MOD) inks in printed electronics (August 2025).

- Panasonic launched BEYOLEX™, a new thermoset film substrate designed to advance soft printed electronics with flexible and stretchable properties (2025).

- Henkel highlighted innovations in printed electronics materials for smart surfaces, healthcare, and connectivity, showcasing its expanding portfolio and sustainability focus (February 2025).

- Nano Dimension completed its merger with Desktop Metal, aiming to expand its digital manufacturing solutions for aerospace, automotive, electronics, and medical sectors (March 2025).

Top Players in the Global Printed Electronics Market

- Agfa-Gevaert N.V.

- Applied Materials, Inc.

- BASF SE

- Brewer Science, Inc.

- DuPont de Nemours, Inc.,

- E Ink Holdings Inc.

- Ensurge Micropower ASA

- Henkel

- Molex LLC

- Nissha Co., Ltd.

- NovaCentrix

- PRINTED ELECTRONICS LTD

- Xeikon N.V.

- Other Prominent Players

Market Segmentation Overview:

By Component

- Ink

- Dielectric Inks

- PTC Ink

- Conductive Inks

- Resistive Inks

- Electrode Inks

- Others

- Substrate

- Dielectric Substrates

- PET (Polyester)

- Polyimide

- Fabrics and Paper

- Stretchable Substrates

- Printed Circuit Boards

- Others

- Services

- Professional Services

- Designing

- Prototyping

- Manufacturing

- Support Services

- Professional Services

By Printing Technique

- Contact Printing

- Gravure Printing

- Offset Printing

- Flexography

- Screen Printing

- Pad Printing

- Non-Contact Printing

- Inkjet Printing

- Aerosol Printing

By Application

- Radio Frequency (RF) Components

- Display

- Thin Film Transistors

- Sensors

- Others

By Industry

- Healthcare & Pharmaceutical

- Consumer Electronics

- Automotive

- Smart Building & Construction

- Food & Beverages

- Cosmetics & Personal Care

- Others

By Region

- North America

- The US

- Canada

- Mexico

- Europe

- The UK

- Germany

- France

- Italy

- Russia

- Spain

- Poland

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Taiwan

- South Korea

- Australia & New Zealand

- ASEAN

- Rest of Asia Pacific

- South America

- Argentina

- Brazil

- Rest of South America

- Middle East & Africa (MEA)

- UEA

- Saudi Arabia

- South Africa

- Rest of MEA

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)