Global Primary Magnesium Market: By Form (Cryptocrystalline and Macrocrystalline); Process (Pidgeon Process and Electrolytic Reduction); Grade (99.9, 99.95,99.98); Application (Aluminum Alloying, Die Casting, Nodular Iron, Chemical Uses, Desulfurization of Steel, Metal Reduction, Others); End Users (Automotive, Healthcare, Consumer Electronics, Aerospace & Defense, Construction, Others); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: 12-Feb-2024 | | Report ID: AA1223690

Market Scenario

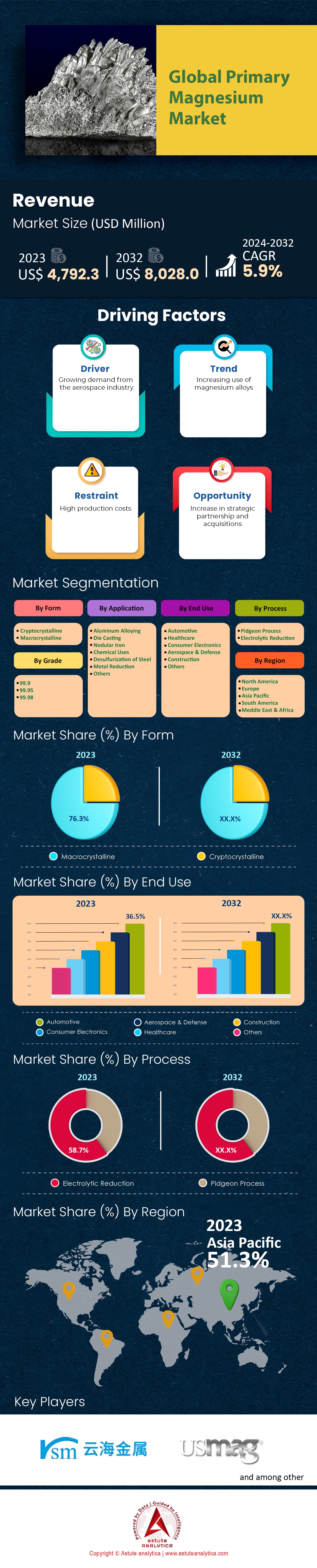

Global Primary Magnesium Market was valued at US$ 4,792.3 million in 2023 and is projected to surpass the market valuation of US$ 8,028.0 million by 2032 at a CAGR of 5.9% during the forecast period 2024–2032.

The global primary magnesium market, currently in a state of dynamic growth, is significantly influenced by its widespread applications across various sectors. In the automotive industry, magnesium is a key component in lightweight, fuel-efficient designs, especially crucial in the burgeoning electric vehicle market. Aerospace applications similarly capitalize on magnesium's lightweight yet strong characteristics for aircraft components, while the consumer electronics sector relies on magnesium for robust, lightweight casings in devices like smartphones and laptops.

However, the supply chain dynamics present a more complex picture. Dominated by China, which accounts for over 63% of the world's primary magnesium production, the market is susceptible to geopolitical risks and policy shifts. In 2022, the country produced more than 17 million tons of magnesium. This concentration poses significant challenges, as seen during the COVID-19 pandemic when disruptions in Chinese production impacted global industries reliant on magnesium. Efforts to diversify the supply chain are underway, with new mining and processing projects emerging in other regions. In response to these challenges, there is a growing interest in exploring alternative sources of magnesium production outside China. This interest is particularly strong in regions with potential magnesium reserves and those investing in more sustainable production methods. These efforts aim to create a more balanced and resilient supply chain, reducing the risk of supply disruptions and addressing environmental concerns.

The supply chain dynamics of the global primary magnesium market are thus at a pivotal point. The primary magnesium market is grappling with the dual challenges of over-reliance on a single source and the need for more sustainable production practices.

Investment opportunities in the magnesium market are evolving, driven by the need for supply chain diversification and sustainable production methods. Investors are showing increased interest in regions outside China, aiming to mitigate the risks associated with supply chain concentration. Additionally, the push towards environmentally friendly magnesium production aligns with global environmental regulations, opening avenues for innovative, sustainable practices in the industry. These shifts suggest a market ripe for strategic investments, particularly in sustainable production technologies and supply chain diversification initiatives.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Energy Storage and Stability Driving Demand in the Automotive Industry

The global primary magnesium market is experiencing substantial growth, primarily propelled by the automotive industry's shift towards magnesium for vehicle manufacturing. This change is driven by the pursuit of lighter vehicles to meet stringent emission standards. Magnesium, renowned for its strength-to-weight ratio, is becoming increasingly favored over traditional materials like steel and aluminum. Magnesium's incorporation into automotive parts, such as steering wheels, gearboxes, and seat frames, is a testament to its growing popularity. Large automotive companies are actively substituting steel and aluminum with magnesium for weight reduction. This trend is particularly pronounced in regions like the Asia Pacific, where developing countries emphasize lightweight materials to enhance performance and fuel efficiency in both the automotive and aerospace sectors.

The aerospace industry's demand in the primary magnesium market, owing to its lightweight and strong properties, further bolsters the metal's market position. The sector relies on magnesium for creating fuel-efficient and lighter aircraft components, showcasing magnesium's broad applicability across diverse market segments. This increasing reliance on magnesium in major industries underscores its critical role in driving market growth, reflecting a significant shift towards more efficient, sustainable manufacturing practices.

Trend: Advancements in Aerospace and Military Applications with Magnesium

Recent developments in the aerospace and military sectors highlight a trend towards greater efficiency, safety, and environmental sustainability, with magnesium playing a pivotal role. The aerospace industry's commitment to sustainability is driving the adoption of practices that minimize carbon footprints, including the integration of lightweight materials like magnesium. This aligns with the industry's shift towards electric propulsion systems and hybrid engines, which aim to reduce emissions and noise pollution. Furthermore, the Internet of Things (IoT) is transforming aerospace by enabling aircraft to be equipped with sensors and connected systems in the primary magnesium market. These systems gather real-time data on various parameters, crucial for predictive maintenance and enhancing operational efficiency. The incorporation of magnesium in structural components complements this technological advancement, as its lightweight property contributes to the overall safety and efficiency of the aircraft.

Artificial Intelligence (AI) is another transformative force in aerospace engineering, enhancing autonomous operations and precision in flight systems. AI's role in analyzing vast amounts of data collected during test flights and simulations is invaluable. The integration of magnesium in aircraft construction, when coupled with AI-driven systems, presents opportunities for developing more efficient and safer aircraft designs. Apart from this, additive manufacturing, or 3D printing, is revolutionizing aerospace production by allowing for the creation of intricate, lightweight components in the primary magnesium market. Magnesium's compatibility with 3D printing technologies offers potential for further reducing the weight and fuel consumption of aerospace components, accelerating design and development processes.

Challenge: Supply Chain Vulnerabilities to Stir the Growth of the Magnesium Market

The primary magnesium market faces a major challenge in the form of supply chain vulnerabilities. These issues are complex, primarily revolving around low availability, rising production costs, and environmental concerns, especially in China, which dominates magnesium production. China's magnesium industry has been grappling with increasing coal costs, leading to a sharp rise in spot prices. The significant spike in prices by 157% between September and October in a recent year has highlighted the fragile nature of the supply chain, given China's production of around 65% of the world's magnesium. This shortage had a cascading effect on other industries, such as aluminium smelters and diecasters in the West, raising alarms about the potential catastrophic impact on global metal producers.

Adding to this challenge are the stringent environmental regulations in China aimed at achieving carbon neutrality by 2060. These regulations necessitate magnesium plants to upgrade their production facilities and adopt cleaner production techniques, leading to higher production costs in the future. Although there were concerns about potential plant closures in the lead-up to China’s Winter Olympics, producers in China primary magnesium market across Shanxi and Shaanxi provinces confirmed that they would not cut output or suspend operations due to these environmental requirements. Another factor contributing to the market's instability is speculation. Market participants with significant capital resources have been stockpiling magnesium and selling it at higher prices, leading to further disruptions and price fluctuations in the market. This speculative behavior not only pushes up prices but also creates difficulties for ordinary market participants, undermining the market's stability.

Segmental Analysis

By Form

The global primary magnesium market, when segmented by form, is dominated by the macrocrystalline segment, holding an impressive 76.3% share and is projected to expand at the highest CAGR of 6.2% in the coming years. Several factors contribute to this dominance and continual growth. Wherein, the macrocrystalline form of magnesium is preferred due to its superior structural integrity and purity. These properties are crucial in applications where material strength and reliability are paramount, such as in aerospace, automotive, and military applications. The high demand from these sectors, which consistently seek lightweight yet strong materials, directly contributes to the segment's growth. Additionally, macrocrystalline magnesium is extensively used in alloy production due to its compatibility and effectiveness in enhancing the properties of alloys. The rising demand for magnesium alloys in various industrial applications, including electronics and construction, further solidifies this segment's market position.

Technological advancements in the extraction and processing of macrocrystalline magnesium have also played a significant role. Improved efficiency and environmental compliance in processing have made this form more attractive to industries looking to balance performance with sustainability.

By Process

By process, the electrolytic reduction segment is dominating the global primary magnesium market by holding the largest 58.7% market share. However, it is the Pidgeon process that is anticipated to experience the most robust growth at a CAGR of 6.5% in the coming years. This contradiction between the current market share and future growth trajectories can be attributed to several key factors.

The Electrolytic Reduction process's dominance is primarily due to its established history and the high purity of magnesium it produces. This method, being one of the oldest for magnesium production, is well-integrated into various industrial ecosystems. Its widespread adoption is bolstered by the quality of magnesium it yields, which is essential for applications requiring high-grade material, like in aerospace and electronics.

Conversely, the growth of the Pidgeon process in the primary magnesium market is driven by its cost-effectiveness and scalability. Originally developed in Canada, this process has gained significant traction, especially in China, due to its lower capital and operational costs compared to electrolytic methods. The Pidgeon Process is less energy-intensive and has been optimized for mass production, making it increasingly popular in regions where cost-efficiency is a priority. Furthermore, ongoing improvements in the environmental footprint of the Pidgeon Process, such as reducing greenhouse gas emissions, are making it more appealing. As industries globally are moving towards more sustainable practices, the Pidgeon Process aligns well with this shift, contributing to its anticipated growth rate.

By Grade

Based on grade, 99.95% purity segment is leading the global primary magnesium market with 42.0% share. This segment's dominance is further solidified by its projected growth, with the highest CAGR of 6.5%. The factors driving this segment's preeminence and growth are multifaceted and rooted in the specific demands of key industries. The 99.95% grade magnesium, characterized by its high purity, is essential for applications where material quality cannot be compromised. This grade is crucial in industries such as aerospace, automotive, and electronics, where magnesium's lightweight, strength, and thermal properties are invaluable, but only if the material meets stringent quality standards. The high purity ensures minimal impurities, leading to better performance and reliability in end-use applications.

The increasing demand for high-quality magnesium in advanced manufacturing and technology sectors, particularly in precision engineering and high-performance alloy production, further boosts the market for this grade. As industries continue to innovate and require materials that offer both lightweight properties and strength, the demand for 99.95% grade magnesium is expected to rise. Moreover, advancements in extraction and processing technologies have made it more feasible to produce magnesium of this high purity at a commercial scale. These technological improvements, coupled with growing industrial demands for high-grade materials, position the 99.95% purity segment for sustained growth and market leadership.

By Application

In the segmental analysis of the global primary magnesium market by application, the aluminum alloying segment stands out prominently, accounting for 35.7% of the market share. This segment is not only dominant but is also projected to experience the most significant growth, with an estimated CAGR of 6.9% in the forthcoming years. This remarkable growth trajectory is underpinned by a combination of industrial demand and material properties. The demand for aluminum-magnesium alloys is primarily driven by the automotive and aerospace industries, where the need for lightweight yet strong materials is paramount. Magnesium, when alloyed with aluminum, significantly enhances the strength-to-weight ratio of the resulting material. This characteristic is crucial for manufacturing components that require both lightness for fuel efficiency and strength for safety and durability.

Another factor contributing to this segment's growth in the primary magnesium market is the ongoing innovation in alloy technology. As industries strive for more efficient and environmentally sustainable materials, aluminum-magnesium alloys are increasingly preferred for their balance of lightness, strength, and lower environmental impact compared to traditional materials. Furthermore, the increasing application of aluminum-magnesium alloys in new domains, such as electronics and construction, is expanding the market scope. Their corrosion resistance and good thermal conductivity make them suitable for a variety of applications, from electronic housings to structural elements.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

The Asia Pacific is projected to capture more than 55% revenue share of the global primary magnesium market by 2031. This growth can be attributed to a combination of regional industrial expansion, policy initiatives, and strategic investments, which contrasts with the market dynamics in North America and Europe. Wherein, the Asia Pacific region, led by China, has seen significant industrial expansion. China, in particular, has been the epicenter of primary magnesium production, contributing around 65% of the global output. This dominance is not just due to the abundance of raw materials like dolomite but also a result of government policies that have historically supported the expansion of the magnesium industry. The region's focus on developing lightweight materials for industries such as automotive and aerospace has further bolstered demand for magnesium.

Asian countries have made strategic investments in increasing production capacity. These investments in the primary magnesium market are not just limited to enhancing current production methodologies but also extend to researching and developing new, more efficient, and environmentally friendly magnesium production techniques. This approach has positioned the Asia Pacific region as a leader in magnesium production technology, further attracting global players seeking advanced magnesium solutions. The rapid increase in the Asia Pacific's market share is also a result of the declining market share in North America and Europe. The shift in automotive and aerospace industries towards lightweight materials has driven up demand for magnesium, a demand that has been primarily met by Asian producers. Moreover, the Asia Pacific's focus on developing new applications of magnesium in electronics and consumer goods has opened up new markets, further solidifying its position.

On the other hand, North America and Europe primary magnesium market, while significant players in the magnesium market, have not matched the production capacity or growth rate of the Asia Pacific. North America's magnesium market has been constrained by a combination of factors, including environmental regulations and a relatively higher cost of production. Europe faces similar challenges, compounded by stringent environmental policies and a focus on importing rather than domestic production.

By 2031, the Asia Pacific region is expected to continue its trajectory, not just maintaining but potentially increasing its market share. This growth will be supported by ongoing industrial expansion, favorable government policies, and continued innovation in magnesium production and application. In contrast, unless North America and Europe significantly invest in domestic production capabilities and adjust policies to support the magnesium industry, they are likely to see a further erosion of their market share.

Major Players in the Global Primary Magnesium Market

- China Magnesium Corporation Limited

- Dead Sea Works

- Dongguan Eontec Co" Ltd

- Nanjing Yunhai Special Metals Co., Ltd.

- Qinghai Saltlake Magnesium Industry Co. Ltd

- Shanxi Yinguang Magnesium Industry (Group) Co., Ltd

- Tateho Chemical

- US Magnesium

- Western Magnesium Corp

- Yingkou Magnesite Chemical Ind (Group) Co., Ltd

- Other Prominent Players

Market Segmentation Overview:

By Form

- Cryptocrystalline

- Macrocrystalline

By Process

- Pidgeon Process

- Electrolytic Reduction

By Grade

- 99.9

- 99.95

- 99.98

By Application

- Aluminum Alloying

- Die Casting

- Nodular Iron

- Chemical Uses

- Desulfurization of Steel

- Metal Reduction

- Others

By End-Use

- Automotive

- Healthcare

- Consumer Electronics

- Aerospace & Defense

- Construction

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2023 | US$ 4,792.3 Million |

| Expected Revenue in 2032 | US$ 8,028.0 Million |

| Historic Data | 2019-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Unit | Value (USD Mn) |

| CAGR | 5.9% |

| Segments covered | By Form, By Process, By Grade, By Application, By End-Use, By Region |

| Key Companies | China Magnesium Corporation Limited, Dead Sea Works, Dongguan Eontec Co" Ltd, Nanjing Yunhai Special Metals Co., Ltd., Qinghai Saltlake Magnesium Industry Co. Ltd, Shanxi Yinguang Magnesium Industry (Group) Co., Ltd, Tateho Chemical, US Magnesium, Western Magnesium Corp, Yingkou Magnesite Chemical Ind (Group) Co., Ltd, Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)