Preclinical Imaging Market: By Type (Products, Imaging Services); Product (CT Imaging, Optical Imaging, Ultrasound Imaging, MRI Imaging, PET/SPECT Imaging, Others); Application (Research and Development, Drug Discovery); End-User (Biotech Companies, Research Institutes, Pharmaceutical Companies); Distribution Channel (Online, Offline) and By Region - Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025-2033

- Last Updated: 18-Oct-2025 | | Report ID: AA0423423

Market Snapshot

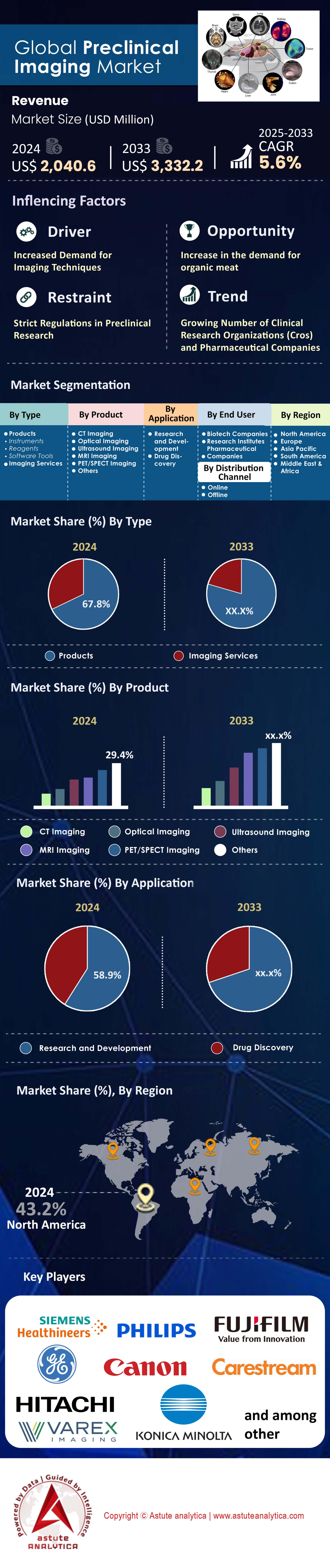

Preclinical imaging market was valued at US$ 2,040.6 million in 2024 and is projected to attain a market valuation of US$ 3,332.2 million by 2033, growing at a CAGR of 5.6% during the period 2024-2032.

Key Findings Shaping the Market

- Based on type, the market is mainly segmented into Products, Imaging Services. Wherein, products segment is projected to keep dominating the market.

- Based on product, ultrasound imaging dominates the market and capturing over 25% market share, distinguishing itself from MRI, CT, PET, and optical imaging.

- Based on application, The R&D segment of the preclinical imaging market is witnessing a robust expansion and currently accounting for 58.9% market share.

- Based on end users, biotech companies have emerged as dominant players and are holding over 45.3% revenue share in the market.

- North America to Keep leading the market in the years to come.

Preclinical imaging, which visualizes biological processes in living animal models, is an indispensable stage in drug discovery. Consequently, its demand is surging as primary consumers—pharmaceutical companies, biotechs, and CROs—seek to de-risk development pipelines. By providing early, predictive insights into a drug's efficacy and safety, these technologies help prevent costly late-stage failures.

The fundamental need for preclinical imaging is fueling a significant expansion in research pipelines, translating directly into record study volumes. For instance, the number of active preclinical programs for complex cell and gene therapies requiring in-vivo tracking surpassed 800 in 2024. Moreover, this includes 45 distinct preclinical programs using imaging to monitor CAR-T cell trafficking. As a result, the top 5 global CROs are now managing a combined total of over 10,000 active preclinical studies. This high operational tempo is supported by new efficiencies, with the average turnaround time for a standard imaging study now reduced to 21 days.

The demand is also shaped by a push for more sophisticated, non-invasive data. A new federal mandate in the U.S. preclinical imaging market now requires the reduction of 10 specific animal testing protocols by 2025, directly increasing reliance on advanced imaging. In oncology, longitudinal studies now average 6 imaging time points per study to better capture therapeutic response. This is made possible by systems that have cut total scan time for a full-body mouse PET/CT to under 10 minutes.

Furthermore, investment in enabling technologies and infrastructure remains robust across the global preclinical imaging market. The NIH's BRAIN Initiative funded over 20 new projects in 2024 involving novel neuroimaging techniques. In the UK, the Medical Research Council (MRC) allocated funds for 8 new preclinical imaging facilities. This expansion is mirrored in the private sector, where at least 6 major CROs expanded their vivarium capacity in 2024. They also hired more than 1,500 new technicians and scientists for imaging departments, while AI software reduced image processing time by up to 180 minutes per study.

To Get more Insights, Request A Free Sample

Emerging Frontiers Create Unprecedented Opportunities for Market Stakeholders

Untapped opportunities are rapidly emerging within the preclinical imaging market, driven by pioneering technologies and new research paradigms. Stakeholders who capitalize on these trends are positioned for significant growth.

- The Advent of Cryo-Fluorescence Tomography (CFT): A powerful new opportunity lies in the adoption of CFT. This modality uniquely bridges the gap between whole-animal optical imaging and high-resolution ex-vivo microscopy. In 2024, at least 5 major pharmaceutical companies integrated CFT platforms into their discovery workflows to improve biodistribution studies for complex biologics. The technology provides exact 3D localization of signals with resolutions down to 4 microns, an order of magnitude better than traditional optical methods. At least 10 leading academic centers established dedicated CFT core facilities in 2024, signaling its growing validation and creating a new sub-market for specialized reagents and analysis software.

- High-Throughput In Vivo Screening Platforms: The paradigm is shifting from low-volume studies to high-throughput screening directly in animal models. In 2025, new automated platforms can now handle up to 100 mice per day for bioluminescence or fluorescence imaging, a 5-fold increase over conventional systems. This enables large-scale efficacy and toxicity screening much earlier in the drug discovery process, pushing the preclinical imaging market growth further. At least 3 major CROs launched dedicated high-throughput screening services in 2024, bundling automated imaging with advanced robotics and AI-driven data analysis, and handling over 500 compounds per month for clients.

Outsourcing and Automation Drive Unprecedented CRO Sector Growth

A massive wave of outsourcing is fundamentally reshaping the preclinical imaging market, with CROs becoming central hubs of activity. Pharmaceutical and biotech companies are increasingly leveraging CRO expertise to accelerate timelines and access specialized technology. In 2024, Envigo, a leading CRO, announced an expansion that added capacity for 5,000 additional rodent models for imaging studies. Similarly, Inotiv invested over $8 million in 2024 to upgrade imaging capabilities at 3 of its key preclinical sites. This expansion is driven by a surge in demand; Labcorp reported initiating over 250 new preclinical imaging-intensive studies in the first half of 2024 alone.

The preclinical imaging market’s growth is enabled by significant investments in both personnel and technology to handle the increased volume. In 2024, Charles River Laboratories hired over 300 new staff members dedicated specifically to its in-vivo imaging departments across North America and Europe. CROs also acquired more than 60 new high-field MRI and PET/CT systems combined in 2024 to meet client demand. Efficiency gains are critical, with new workflow software reducing study setup time by an average of 8 hours. Moreover, more than 400 biotech companies signed new multi-year service agreements with CROs for preclinical imaging in 2024. The average duration of these contracts is now 3 years, while over 1,200 unique imaging protocols were validated by leading CROs in 2024. Finally, at least 15 new CRO-pharma partnerships were announced in 2024 specifically for developing novel imaging biomarkers.

Radiopharmaceutical Development Ignites a Surge in Specialized Imaging Demand

The explosion in theranostics and radiopharmaceutical therapies is creating a highly specialized and rapidly growing demand segment within the preclinical imaging market. The development of novel radioisotopes requires dedicated and advanced imaging capabilities. In 2024, the U.S. Department of Energy awarded over $15 million in funding across 4 new projects to scale up the production of Actinium-225, a key alpha-emitter for cancer therapy. The number of new PET tracers entering preclinical evaluation in 2024 surpassed 50, a new record. This pipeline includes at least 10 new tracers targeting fibroblast activation protein (FAP), a popular theranostic target.

The specialized research is driving investment in dedicated infrastructure and collaborations. At least 8 new preclinical-focused cyclotrons were installed globally in 2024 to support the development of novel short-lived isotopes. Furthermore, there were over 30 significant collaborations formed in 2024 between radiopharmaceutical startups and academic imaging centers, adding fuel to the preclinical imaging market growth. Over 200 preclinical studies were initiated in 2024 using Lutetium-177, a popular beta-emitter. The FDA also accepted at least 5 new Investigational New Drug (IND) applications for radiopharmaceuticals in 2024 based on preclinical imaging data. Finally, more than 1,000 shipments of specialized isotopes for preclinical use were recorded by major suppliers in the first half of 2025, and at least 12 new automated radiochemistry units were launched in 2024 to synthesize these imaging agents, with over 600 animal models enrolled in preclinical dosimetry studies for new radiotherapies.

Segmental Analysis

Preclinical Imaging Products Dominate Market Through Continuous Innovation

The products segment, accounting for 67.8%, strongly maintains its lead within the preclinical imaging market. A primary reason is the consistent introduction of cutting-edge systems and reagents. For example, companies are actively broadening their product portfolios to satisfy demand. In a significant move, Bruker Corporation acquired Spectral Instruments Imaging LLC in February 2024 to bolster its in-vivo optical imaging solutions. Furthermore, Revvity, Inc. launched its advanced IVIS Spectrum 2 and Vega ultrasound systems in late 2023. These product launches directly fuel market growth. The critical need for such tools is highlighted by the 244 antibacterial therapeutics currently in preclinical development, all of which require sophisticated imaging. Sustained innovation ensures that direct investment in imaging products remains a top priority for research organizations over services.

Technological advancements are making powerful imaging systems more accessible, reinforcing the product segment's leadership. For instance, MH3D is set to release a compact high-resolution SPECT/CT system in 2025, expanding access for more laboratories. Additionally, the integration of artificial intelligence adds immense value; AI-powered software can now decrease image processing times by as much as 70%. The trend toward miniaturization is also notable, with portable micro-CT and micro-MRI scanners seeing wider adoption in smaller research settings. Consequently, strategic collaborations, like the one between Shanghai United Imaging Healthcare and Prepaire Labs in February 2024, are broadening the applications of the preclinical imaging market.

- PerkinElmer's Vega handheld ultrasound systems are accelerating non-invasive drug discovery processes.

- A significant market trend is the rising demand for multimodal imaging platforms that provide richer datasets.

- The development of more cost-effective imaging systems is a primary driver for equipment purchases by laboratories.

Ultrasound Imaging's to Continue Holding Market Leadership and Key Advantages

Ultrasound imaging has solidified its leading position in the preclinical imaging market, capturing a substantial market share of over 25%. A key factor for its widespread use is its capacity for real-time imaging. Some systems can capture data at an impressive 1000 frames per second. Such capability is crucial for dynamic physiological studies. Moreover, high-frequency ultrasound systems provide exceptional spatial resolution, reaching as fine as 30 µm for detailed small animal anatomy visualization. The non-invasive quality of ultrasound is another major benefit. It allows for longitudinal studies on the same animal, which in turn reduces the number of animals needed for research. Its relative affordability compared to MRI or PET/CT also makes it a popular choice.

Ongoing innovations continue to enhance the versatility of ultrasound technology in the preclinical imaging market. High-frequency micro-ultrasound systems now operate at up to 50 MHz, tailored for small animal research. Additionally, new contrast microbubbles with drug-loading capabilities are creating opportunities for targeted drug delivery studies. The integration of AI, such as Stanford's ProCUSNet tool which improved lesion detection by 44%, is greatly boosting ultrasound's diagnostic capabilities. Also, Doppler ultrasound can quantify blood flow in small animal organs, adding a critical layer of functional data. These continuous improvements secure ultrasound's dominant role in the preclinical imaging market.

- Revvity’s new Vega ultrasound system is specifically engineered for high-throughput screening applications.

- Ultrasound is effectively used to guide injections with greater precision than traditional methods.

- The technology’s non-invasive nature is ethically preferable and scientifically sound for disease progression studies.

R&D Application to Remain at the Center of Market Ascendancy

The R&D segment’s commanding 58.9% revenue of the preclinical imaging market directly reflects the intense research into complex diseases. Preclinical imaging is an essential tool in modern drug discovery. It offers vital insights into disease progression and treatment efficacy. The U.S. FDA's support for using imaging biomarkers in preclinical research highlights their importance in decision-making. Oncology remains the leading application, where imaging is used extensively to assess new cancer therapies. The scale of this research is immense, evidenced by the over USD 100 billion spent by biopharmaceutical firms on R&D in 2023. A significant portion of these funds supports preclinical studies that heavily depend on imaging.

Innovation in the R&D segment of the preclinical imaging market is constantly pushing boundaries. The development of AI-powered multimodal systems allows researchers to gather more comprehensive data faster. New PET tracers, like the Ga-68 Trivehexin planned for 2025, are improving the accuracy of early disease detection. Furthermore, the National Institutes of Health (NIH) remains a crucial funding source, providing billions in grants that fuel research activities reliant on preclinical imaging. Consequently, this strong financial backing, paired with technological progress, ensures the R&D segment will continue to lead the preclinical imaging market.

- Preclinical imaging is fundamental for translational research, connecting molecular discoveries to clinical applications.

- Advanced AI algorithms, like JLK's stroke detection tool with 98.7% sensitivity, are revolutionizing neurological research.

- There are 244 antibacterial therapeutics in preclinical development, all requiring imaging for evaluation.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

Biotechnology Firms are the Primary End-User Driving Market Growth

Biotechnology companies have emerged as the dominant end-users in the preclinical imaging market, commanding a 45.3% revenue share. A key reason for their influence is the rapid growth of the biotech sector, especially in North America and Asia-Pacific. This expansion creates a significant demand for advanced imaging technologies. These companies are at the forefront of novel drug development. Therefore, preclinical imaging is vital for validating their candidates and securing investment. The persistent need for new therapeutics to combat infectious diseases further fuels demand from biotech and pharmaceutical companies. The continuous quest for advanced therapies solidifies their position.

The operational strategies of biotech companies also contribute to their market dominance. Many smaller firms prefer outsourcing imaging needs to contract research organizations (CROs). This approach helps them avoid the high capital costs of imaging equipment. As a result, the outsourcing trend has become a major growth driver for the entire ecosystem. The increasing complexity of clinical trials also pushes more biotech firms to rely on the specialized expertise of CROs for imaging analysis. This symbiotic relationship, combined with major R&D investments like the USD 1.6 billion from leading Indian pharma firms in 2023-24, ensures biotech companies will continue to propel the preclinical imaging market forward.

- International research collaborations requiring standardized imaging protocols grew by 9% in 2025, largely due to biotech partnerships.

- Venture capital is increasingly funding collaborations between academic institutions and biotech companies.

- Biotechs with limited in-house infrastructure frequently outsource imaging to ensure timely and accurate results.

To Understand More About this Research: Request A Free Sample

Regional Analysis

North America Spearheads Global Innovation with Unmatched Federal and Private Investment

North America commands the leading position in the preclinical imaging market, holding a 43.2% global share, driven by a powerful synergy of government funding, robust venture capital activity, and extensive pharmaceutical research. The U.S. National Institutes of Health (NIH) is a primary catalyst, awarding over 150 new grants in 2024 for projects explicitly requiring advanced in-vivo imaging. In a significant infrastructure boost, the Canadian government's CFI program funded the acquisition of 8 new high-field MRI systems for university research hubs in 2024. Furthermore, the U.S. FDA’s Animal Model Qualification Program approved 3 new imaging-based biomarkers for use in preclinical trials in 2024, streamlining drug development pathways.

The region's corporate ecosystem is equally dynamic. U.S.-based venture capital firms injected over $250 million into more than 15 imaging-focused biotech startups in the first half of 2024 alone. To meet surging demand, Charles River Laboratories initiated the construction of a new 50,000-square-foot preclinical facility in Massachusetts in 2025, designed to house over 20 advanced imaging suites. Major U.S. pharmaceutical companies in the preclinical imaging market collectively initiated over 750 new preclinical studies involving PET imaging in 2024. Furthering technological adoption, at least 40 American universities upgraded their vivariums in 2024 to support automated, high-throughput imaging workflows. In Canada, more than 30 new preclinical CROs specializing in imaging services have been established since the start of 2024. The total number of peer-reviewed publications on preclinical imaging from U.S. institutions surpassed 3,000 in 2024, and at least 10 new industry-academic partnerships were formed in the U.S. in 2025 to develop novel imaging agents.

Asia Pacific Accelerates as a Global Hub for Preclinical Research Services

The Asia Pacific preclinical imaging market is experiencing explosive growth, rapidly transforming into a global epicenter for outsourced research services and pharmaceutical R&D. China is at the forefront of this expansion; in 2024, WuXi AppTec's preclinical division managed over 2,000 concurrent in-vivo studies for global clients, a new record for the company. The Chinese government also announced subsidies for the domestic development of 5 new types of high-resolution micro-CT scanners in 2025. In India, at least 12 new GLP-certified vivariums equipped with advanced optical imaging systems were established in 2024.

The regional growth of the preclinical imaging market is further supported by significant investments and a burgeoning skilled workforce. Syngene International, a leading Indian CRO, hired over 500 new scientists for its preclinical departments in 2024. South Korea's burgeoning biotech sector saw over $100 million in private investment for companies developing novel imaging biomarkers in 2024. Furthermore, more than 40 new collaborations between Australian universities and international pharma companies for preclinical oncology imaging were initiated in 2024. Japan's regulatory agency, the PMDA, also streamlined the approval process for 8 new imaging contrast agents in 2024. The number of preclinical studies conducted in Singapore involving zebrafish models and fluorescence microscopy exceeded 500 in 2024. At least 15 Chinese CROs achieved AAALAC accreditation in 2024, and over 300 imaging systems were installed in the region during the same year.

Europe Champions Collaborative Research and Next-Generation Theranostic Development in the Preclinical Imaging Market

Europe solidifies its strong market position through highly integrated, cross-border research consortiums and a pioneering role in the development of radiopharmaceuticals. The Innovative Health Initiative (IHI), a partnership between the EU and industry, launched 6 new large-scale projects in 2024 with a combined budget exceeding €150 million, all featuring significant preclinical imaging components. Germany continues to be a leader, with the Max Planck Society acquiring 10 new multiphoton microscopes in 2024 for advanced neuroscience imaging. In France, the new Saclay biomedical hub is now home to over 40 biotech startups actively using its shared preclinical imaging core.

The region's expertise in radiopharmaceuticals is a key differentiator. The Netherlands produced over 500 batches of novel research-grade isotopes for preclinical use in 2024. The UK's Medical Research Council (MRC) also funded 4 new research hubs in 2025 specifically focused on developing and validating new PET tracers. Furthermore, at least 20 European CROs expanded their services in 2024 to include specialized dosimetry and biodistribution studies for radionuclide therapies. Swiss pharmaceutical companies in the preclinical imaging market were granted over 30 new patents for imaging agents in 2024. The European Medicines Agency (EMA) qualified 2 new imaging biomarkers for neurodegenerative diseases in 2024. More than 700 European research papers on preclinical molecular imaging were published in 2024, and over 15 EU-wide workshops on imaging best practices were held.

Recent Developments in Preclinical Imaging Market

- Calvert Labs Receives Growth Investment (2024): M2S Capital announced a strategic growth investment in Calvert Labs, a CRO providing comprehensive preclinical services, to help expand its specialized capabilities, including advanced imaging.

- Verisix Launches with Pre-Seed Funding (2024): A new preclinical imaging CRO, Verisix, was launched in Paris with the backing of pre-seed funding from the Adbio partners fund, establishing new MRI and optical imaging platforms.

- Bruker Acquires Spectral Instruments Imaging (2024): Bruker Corporation completed its acquisition of Spectral Instruments Imaging, a developer and manufacturer of preclinical optical imaging systems, for approximately $37.5 million.

- Sonio Raises $14 Million for AI Imaging Platform (2024): Sonio, a company developing AI-powered software for imaging diagnostics, secured $14 million in Series A funding to enhance its platform, with applications relevant to both clinical and preclinical image analysis.

- Vico Therapeutics Secures €54 Million (2024): Vico Therapeutics raised €54 million in a Series B financing round to advance its antisense oligonucleotide therapies, with preclinical development heavily reliant on in-vivo imaging for efficacy and biodistribution studies.

- NIH Funds New Hyperpolarization Unit (2024): The National Institutes of Health provided significant grant funding for the creation of a new GE Spinlab Hyperpolarization Unit for preclinical imaging at a major U.S. university to advance metabolic imaging research.

List of Key Companies Profiled:

- Agilent Technologies

- Bruker Corporation

- Canon

- Fujifilm Corporation

- General Electric (GE)

- Hitachi,

- Hologic

- Konica Minolta, Inc.

- Koninklijke Philips

- Mediso Limited

- MILabs B.V.

- Molecubes

- MR Solutions

- PerkinElmer, Incorporated

- Siemens Healthineers

- TriFoil Imaging

- Varex Imaging

- Other Prominent Players

Market Segmentation Overview:

By Type

- Products

- Instruments

- Reagents

- Software Tools

- Imaging Services

By Product

- CT Imaging

- Optical Imaging

- Ultrasound Imaging

- MRI Imaging

- PET/SPECT Imaging

- Others

By Application

- Research and Development

- Drug Discovery

By End User

- Biotech Companies

- Research Institutes

- Pharmaceutical Companies

By Distribution Channel

- Online

- Offline

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2024 | US$ 2,040.6 Million |

| Expected Revenue in 2033 | US$ 3,332.2 Million |

| Historic Data | 2020-2023 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Unit | Value (USD Mn) |

| CAGR | 5.6% |

| Segments covered | By Type, By Product, By Application, By End User, By Distribution Channel, By Region |

| Key Companies | Agilent Technologies, Bruker Corporation, Canon, Fujifilm Corporation, General Electric (GE), Hitachi, Ltd., Hologic, Konica Minolta, Inc., Koninklijke Philips, Mediso Limited, MILabs B.V., Molecubes, MR Solutions, PerkinElmer, Incorporated, Siemens Healthineers, TriFoil Imaging, Varex Imaging, Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)