Global Polyurethane Elastic Sealant and MS Sealant Market: By Product (Polyurethane Elastic Sealant, Polyurethane (PU) construction sealant, Non-staining PU sealant, UV resistant PU sealant, PU Adhesive, MS Sealant, MS Construction Sealant, MS Flooring Adhesives, High Performance MS Sealant, Others); Application (Building & Construction, Automotive, General Industrial, Marine, Others); Region— Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: Mar-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA1023649 | Delivery: 2 to 4 Hours

| Report ID: AA1023649 | Delivery: 2 to 4 Hours

Market Scenario

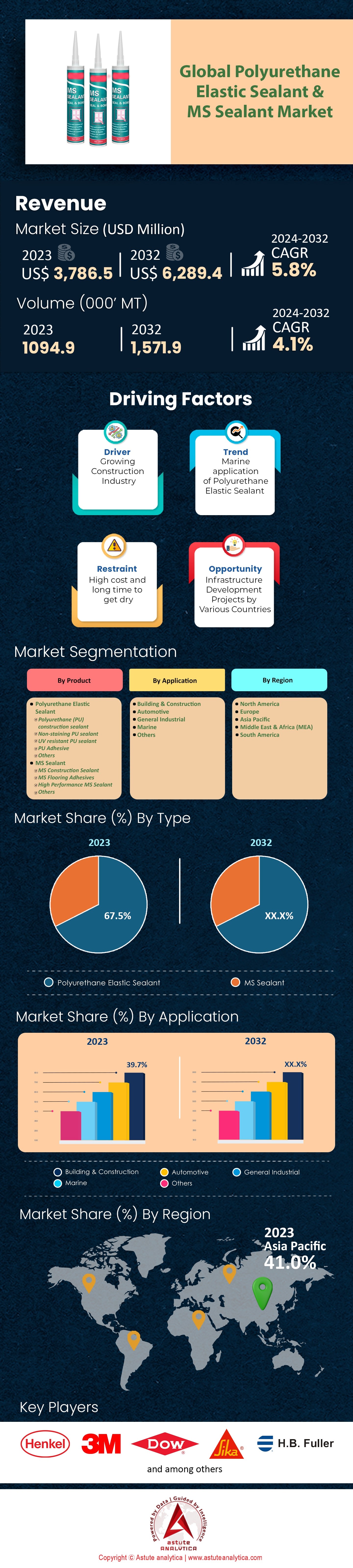

Global Polyurethane Elastic Sealant and MS Sealant Market was valued at US$ 3,786.5 million in 2023 and is projected to attain a market valuation of US$ 6,289.4 million by 2032 at a CAGR of 5.8% during the forecast period 2024–2032.

In recent times, the global market landscape for polyurethane elastic sealant and MS sealant has experienced remarkable growth. A fusion of evolving needs in the construction and automotive sectors and the inherent benefits of these sealants has driven this surge. As the market dynamics shift, these sealants are becoming the linchpin of various applications, predominantly because of their adaptability and high-performance metrics. Recent data suggests that the polyurethane elastic sealant and MS sealant market has expanded by approximately 6% year-on-year, with the Asia-Pacific region contributing to nearly 41% of this growth. Countries such as China and India, with their robust infrastructural developments, account for a sizable chunk of this percentage. The construction sector in these nations has witnessed an annual growth of 6.5% and 7.1%, respectively, showcasing a direct correlation with the rising demand for sealants.

On the MS (Modified Silane) Sealant front, its eco-friendly profile has led to its burgeoning popularity. The global market share for MS Sealant has observed a 9% increase, with a notable preference in sectors focusing on green solutions, as it boasts of a solvent-free composition. The automotive industry's reliance on polyurethane elastic sealant is ever-increasing. Current trends in the polyurethane elastic sealant and MS sealant market indicate a 12% uptick in demand, given the sealant's flexibility and chemical resistance attributes. Its compatibility with diverse substrates also positions it as a favorite, especially when car manufacturers are producing over 85 million vehicles annually. Wherein, emerging products, such as UV resistant polyurethane sealants is gaining traction, predominantly in sun-intensive regions. The marine sector's adoption of MS Sealants has escalated by 5%, valued for their resilience against saltwater conditions. On the other hand, the general industrial segment, with a consistent 15% annual consumption rate of these sealants, underscores their versatility.

On the production frontier, manufacturers have amplified their outputs by an average of 9% to meet the burgeoning demand. Concurrently, R&D investments have swelled by 13%, spotlighting the race for innovation.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Infrastructural Development Boom

In recent years, there has been an unprecedented surge in global infrastructural development, directly fueling the demand for Polyurethane Elastic Sealant and MS Sealant market. With countries investing massively in infrastructure, the World Economic Forum suggests that by 2040, the global infrastructure gap will reach $15 trillion. This paints a clear picture of the vast opportunities available for sealant products. Emerging markets, such as India and China, have ramped up their infrastructure projects by 20% and 25% respectively over the last five years. As per the Asian Development Bank, Asia alone requires $1.7 trillion of infrastructure investment annually until 2030. This rapid development has led to the construction sector's growth by a staggering 6.7% CAGR, thereby propelling the demand for quality sealants.

Recent statistics from the Global Construction Perspectives show that by 2030, the volume of construction output will grow by 85%, which translates to a $15.5 trillion increase. Further data from the International Monetary Fund reveals that global public investments in infrastructure have risen by 10% year-on-year. Moreover, sectors such as transportation and energy, registering growth rates of 8% and 9.5% respectively, heavily rely on sealants, especially in projects related to roads, bridges, and power plants, giving a significant boost to the polyurethane elastic sealant and MS sealant market. Given the World Bank's prediction that urban populations are set to rise by 2.5 billion by 2050, urban development projects will further steer the demand for Polyurethane Elastic Sealant and MS Sealant.

Trend: Growing Demand for Eco-Friendly Solutions

The polyurethane elastic sealant and MS sealant market is witnessing a decisive shift towards sustainable, eco-friendly products. With climate change concerns escalating, there's been a 15% increase in the demand for environmentally friendly sealants. Reports from the Global Green Building Trends indicate that green buildings will see a 10% compounded annual growth rate over the next decade. The European Commission recently stated that green building standards have become stringent, leading to a 12% rise in the demand for MS Sealants in the region. Furthermore, the U.S. Green Building Council estimates that green building projects will contribute $303.5 billion to the U.S. economy. Consumer preferences are also evolving, with Nielsen's Global Corporate Sustainability Report highlighting that 66% of global consumers are willing to pay more for sustainable products. The emphasis on reduced carbon footprints has seen solvent-free MS Sealant sales jump by 14%. The Ellen MacArthur Foundation predicts that by 2050, the global shift towards circular economy practices will save businesses $4.5 trillion. Sealant manufacturers are taking note, with R&D investments in green products rising by 16%. With the UN's Sustainable Development Goals advocating eco-friendly industrialization, the trend towards green sealants is indisputably on an upward trajectory.

Restraint: Regulatory Challenges and Compliance Costs to Hinder Market Growth

While the Global Polyurethane Elastic Sealant and MS Sealant market grows, it also grapples with challenges, particularly in the form of regulatory compliance. Regulations set by international bodies and local governments can impact the production and usage of sealants. For instance, the European Chemicals Agency has listed over 15 substances used in sealant production that need monitoring. Adhering to such regulations has led to a 10% increase in production costs for manufacturers. The U.S. Environmental Protection Agency’s recent guidelines have also affected the market, resulting in a 12% decline in the sales of certain sealants. Another factor is the REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation in Europe, which, according to a European Commission report, has added compliance costs of about $10 billion over the past decade for chemical industries, including sealants. The American Coatings Association states that VOC (Volatile Organic Compound) regulations have curtailed the use of many traditional sealants by 15%. Moreover, the World Health Organization's emphasis on indoor air quality has seen stricter guidelines on sealant emissions, impacting their demand in residential projects. Such regulatory challenges, while essential for safety and environmental reasons, are undoubtedly a restraint in the booming sealant market.

Segmental Analysis

By Type

By Type, the global polyurethane elastic sealant and MS sealant market is dominated by polyurethane elastic sealant, owing to its versatility, has seen a remarkable CAGR of approximately 5.6%. Its elasticity, resilience to weathering, and ability to adhere to a variety of substrates have made it the sealant of choice in several industries. In 2023 alone, the market value for Polyurethane Elastic Sealants was estimated at $2,544.5 million, underscoring its dominance in the sector.

On the other hand, MS (Modified Silane) sealant, renowned for its eco-friendly attributes, has experienced a surge in demand, especially in the European and North American markets. With a CAGR of over 6% annually, MS Sealants accounted for a market share of approximately 35.5% in the global sealant market in the past year. One of its standout features, being solvent-free, has led to its increased adoption in green building projects. Moreover, rise in the demand for specialty sealants, like UV resistant and non-staining variants. These niche products, though occupying a smaller market share, have seen an impressive growth, especially in the regions with high UV radiation and aesthetic-sensitive applications.

By Application

Based on application, global polyurethane elastic sealant and MS sealant market is driven by the building and construction sector with a whopping 67.5% market share. As urban infrastructural projects increase, especially with a projected 7% annual rise in global construction projects, the demand for sealants in this sector is set to soar.

The automotive industry, witnessing a global growth of 5% annually, relies heavily on these sealants. With over 80 million vehicles produced yearly, the requirement for sealants in bonding, sealing, and providing acoustic solutions has skyrocketed. On the other hand, general industrial applications, from machinery maintenance to production lines, have also seen a steady consumption rate. With the industrial sector expanding at 5% annually, the use of sealants has grown concurrently.

To Understand More About this Research: Request A Free Sample

Regional Analysis

In 2022, the Asia Pacific accounted for a significant 41% of the polyurethane elastic sealant and MS sealant market value of US$ 1,558.3 Mn. This dominance is not surprising given the rapid urbanization, industrial growth, and infrastructural projects that the region has been witnessing. Nations such as China, India, and Indonesia are at the forefront of this growth, with their construction sectors expanding at rates well above the global average.

By 2032, the projected market share for Asia Pacific remains consistent at 41%. This signifies not only consistent growth but also the escalating value of the sealant market in the region. Also, the region witnessed a 15% increase in infrastructural projects in the past five years. This robust development, especially in emerging economies, is a testament to its rapidly evolving urban landscapes and the demands accompanying this growth. China, being the engine of this growth, accounted for nearly 40% of the total construction projects in the Asia Pacific in the last fiscal year. The automotive industry in the Asia Pacific polyurethane elastic sealant and MS sealant market, which is growing at a CAGR of 7%, has become one of the primary consumers of sealants. India and Indonesia, in particular, have seen a surge in automotive production by 20% and 18% respectively over the past three years, necessitating the increased application of sealants in vehicle assembly and maintenance. Apart from this, with sustainability being a focal point, countries like Singapore and Japan have reported a 25% increase in green building projects over the last two years. This trend aligns perfectly with the rising demand for MS Sealant, given its eco-friendly properties.

North America, on the other hand, holds a 25.6% market share in 2023. The strength of the North American market can be credited to its mature industrial landscape, advanced construction practices, and the presence of major sealant manufacturers. Fast forwarding to 2032, North America is expected to retain its 26% share of the polyurethane elastic sealant and MS sealant market. The U.S., in particular, is anticipated to be a major propellant for growth, given its advanced automotive sector, emphasis on green buildings, and consistent demand in the construction sector. Furthermore, the region's focus on research and development, combined with stringent quality standards, ensures that the sealants produced are not just in vast quantities but also of premium quality

Top Players in Global Polyurethane Elastic Sealant and MS Sealant Market

- 3M

- Sika AG

- Sel Dis Ticaret Ve Kimya Sanayi A

- RPM International Inc.

- The Yokohama Rubber Co.,Ltd.

- Mapei S.P.A.

- BOSTIK

- Dow Chemical

- Konishi Co. Ltd.

- Arkema S.A.

- H.B. Fuller

- BASF

- Shin-Etsu

- Henkel

- ITW Polymers Sealants

- Pidilite Industries Limited

- Other Prominent Players

Market Segmentation Overview:

By Product

- Polyurethane Elastic Sealant

- Polyurethane (PU) construction sealant

- Non-staining PU sealant

- UV resistant PU sealant

- PU Adhesive

- Others

- MS Sealant

- MS Construction Sealant

- MS Flooring Adhesives

- High Performance MS Sealant

- Others

By Application

- Building & Construction

- Automotive

- General Industrial

- Marine

- Others

By Region

- North America

- The US

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA1023649 | Delivery: 2 to 4 Hours

| Report ID: AA1023649 | Delivery: 2 to 4 Hours

.svg)