Polymer Nanomembrane Market: By Type (Polyacrylonitrile (PAN), Polyethylene (PE), Polyvinylidene Fluoride (PVDF), Polyamide, Polypropylene, Polyether sulfone (PES)); End User (Water & Wastewater Treatment, Chemical, Electronics, Oil & Gas, Food & Beverages, Pharmaceutical & Biomedical, Others); Region— Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: Nov-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0423401 | Delivery: 2 to 4 Hours

| Report ID: AA0423401 | Delivery: 2 to 4 Hours

Market Scenario

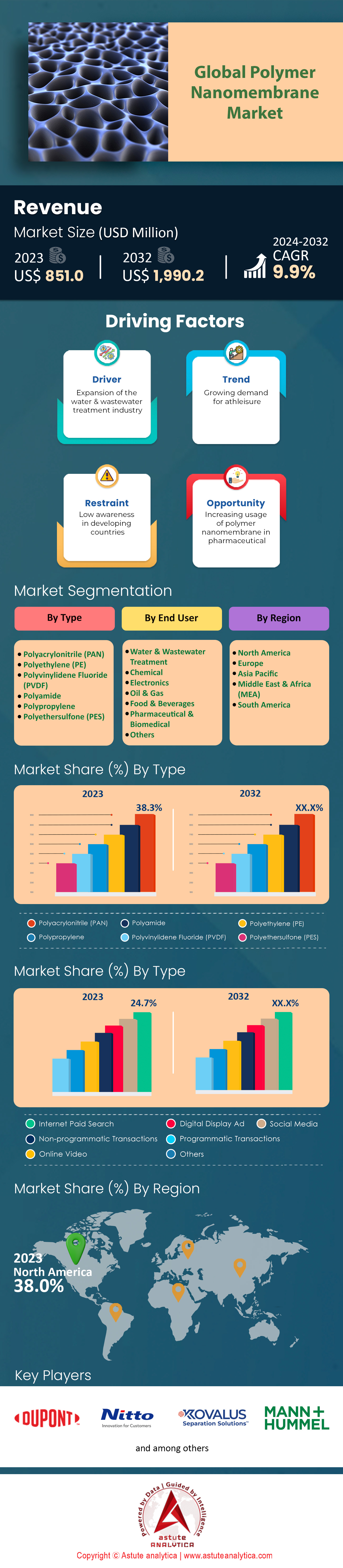

Polymer nanomembrane market generated a revenue of US$ 851.0 million in 2023 and is estimated to reach valuation of US$ 1,990.2 million by 2032 at a CAGR of 9.9% during the forecast period, 2024-2032. In terms of volume, the market is growing at a CAGR of 8.9% during the same period.

In recent years, the polymer nanomembrane market has experienced a significant growth due to the advancement in technology and the increasing usage in various sectors. The global market has increased drastically with its application in water purification, drug delivery systems, nanofiltration, coating, and nanofibers manufacturing. The growth of population and industrialization has resulted in increasing demand for clean water, which has led to establishment of more than 200 new water purification plants across the globe, all of them using nano membrane technology. This is a direct response to investment in infrastructure created because of global challenges about water scarcity. In addition, the market for only the nanofiltration membranes is expected to be worth US$2.26 billion by the year 2032 ,which clearly shows how nanomembranes has an important function in water treatment methods.

polymer nanomembrane market have emerged as an important area of research in the healthcare sector. They have enabled the invention of new advanced drug delivery systems with over 50 medical devices based on nanomembranes already approved for use in treatment. It can also be noted that the electronics industry has incorporated membranes to manufacturing such devices as flexible displays and sensors.13 Well-known manufacturers of electronic devices have reported the introduction of 30 new products which makes use of the unique properties of nanomembranes, which is an indication of the market trends.

A number of private companies and academic institutions in the polymer nanomembrane market have made investments in research and development to design innovation around nanomembranes. This is evidenced by over 500 scientific publications and filing of 200 patents. This level is high and indicates effective development of intellectual property in this field. In some countries, government funding for nanotechnology research has grown and supports projects aimed at advancing the methods of nanomembrane production and increasing the scope of their applications. In the energy field, the development of polymer nanomembranes that increase battery and fuel cell efficiency has been started, for this purpose, 20 pilot projects and energy companies’ cooperation with nanotech companies are started to implement such approaches in practice. Also, as a result of gradual elaboration of environmental norms, industries were forced to switch to new filtration technologies.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Growing Demand for Clean Water Drives Polymer Nanomembrane Adoption in Water Treatment Technologies

Increase in population and urbanization in the polymer nanomembrane market complemented by climate change further worsened the global water crisis in terms of clean water availability, with the United Nations estimating around 2.2 billion people lack access to safe drinking water. The decoupling of clean water requirement warrants the adoption of advanced technologies in water purification as polymer-based nanomembranes allow for filtering of contaminants in water at nanoscale levels.

The global water treatment market was pegged at $320 billion in 2023 and with projections of having over 8000 offshore sites incorporating nanomembrane technology in their water treatment processes – polymer nanomembranes seem to be the miracle tech in achieving this projection. Adding to this dire concern is the fact that due to lack of access to clean drinking water and proper water purification systems, the WHO estimates that water purified properly saves multiple lives as waterborne diseases stand out to be a pivotal cause for death across the globe. If polymer nanomembranes can allow for the purification of water beyond removing bacteria, viruses, or even heavy metals and thus enable robust public health, water quality, etc., they are a much needed commodity in targeting the water purification market.

Furthermore, construction of water infrastructure has been further integrated thanks to the aid and support provided by the government. As an example, the European Union set aside an amount of €1.5 billion in 2023 for the upgrading of their water infrastructure which includes the use of high level filtration systems such as nanomembranes. In India, polymer nanomembrane market aims within the framework of its mission to provide over 190 million rural households with safe drinking water by the year 2024. Also, the investment from the private sector for nanomembrane R&D in 2023 went over a whopping $6 billion concentrating on research to improve membrane efficiencies as well as decrease the cost of production. The need for potable water from the industrial sector also increased the size of the market. It is estimated that the industries produce about 380 million tons of wastewater on a daily basis and hence require effective treatment methods.

Trend: Integration of Polymer Nanomembranes in Desalination Plants Enhances Freshwater Availability Globally

Due to water shortages, the need for desalination processes has increased especially in dry climates. In the year 2023, total desalination reached 115 million cubic meters on a daily basis across the globe. There was a great shift in the desalination businesses in the polymer nanomembrane market due to the use of polymer nanomembranes as they increased the efficiency of the business and lowered the cost of operation. Nanomembranes when compared to normal membranes are said to consume less energy and have higher salt rejection rates. Countries in the Middle East have been the leaders in this development. The Taweelah Reverse Osmosis Desalination Plant in the United Arab Emirates that employs nanomembrane technology was constructed to supply over 350,000 houses with water and it was commissioned around the same time. Saudi Arabia's Al Khafji Solar Desalination Plant, operational during the start of the year 2023, produces 60,000 cubes of clean water while using advanced polymer nanomembranes fused with renewable energy.

The advancement of technology in the polymer nanomembrane market has caused increasing rates of integration. In a 2023 study, MIT scientists enhanced the characteristics of a new class of nanomembranes, which in return reduced energy consumption by 15%. This year, there was global spending worth $30 billion on desalination projects utilizing nanomembrane technology indicating faith on the technology in solving water scarcity. Furthermore, over 5,000 desalination plants around the world had integrated nanomembrane technology into their systems during the Year clearly indicating that the industry is in major transformation to new materials. There is a trend in other areas with water stress also. In Australia, a new upgrade using polymer nanomembranes enabled the Victorian Desalination Plant to attain a capacity of 150 billion liters every year. Likewise, in California, the largest North American desalination plant, the Carlsbad Desalination Plant began planning in 2023 the retrofitting of its plants with nanomembrane materials in a bid to enhance performance and reduce environmental impacts.

Challenge: High Production Costs of Nanomembranes Limit Widespread Adoption Across Developing Regions

Although polymer nanomembrane market has considerable advantages, high production costs remain a barrier to their adoption in large scale use especially in developing countries. As such processes demand complex procedures and expensive raw materials, the 2023 production cost averaged at US$ 900 to 1300 per square meter. This situation is quite different from that of the conventional filtration membranes, hence affecting the price. In Africa, for example, where over 300 million people are said to lack clean water, the high cost of the nanomembranes restricts their deployment in key water treatment programs. In 2023, the African Development Bank stated that, less than 20% of the proposed water infrastructure projects could utilize nanomembrane technology because of cost. This has also been the case in southern Asia, where advanced nanomembrane systems have been limited in use in both rural and urban settings in water stressed areas due to lack of adequate financing in the polymer nanomembrane market.

The world is constantly finding ways to bring down their overall costs of production. Researchers at the University of Manchester developed a graphene-based nanomembrane in 2023 which will be cost effective in the performance of production by utilizing more indigenous materials. Moreover, there are collaborative efforts on a global scale in order to help bring costs down; for instance, this year, the World Bank started a $600 million program to assist in the application of nanomembrane technology in poorer nations. However, such steps have not yet reached a sufficient level to fully overcome cost barriers.

This is also an area where the private sector participation is important in the polymer nanomembrane market. New venture as well as mature corporates are seeking ways for mass market production of nanomembranes that will be cost effective. A case in point is that Nanotech Solutions, a US company, implemented roll to roll processing in 2023 which may help in reducing costs by about 25%. But, the problem of making polymer membranes technology available in the less developing countries will still be threatening without considerable decrease in cost and for that too, constant evolution and investments are the need of the hour.

Segmental Analysis

By Type

The Polymer Nanomembrane market is led by the advancements in the polyacrylonitrile (PAN) nanomembrane. Recent reports states that PAN membranes accounted for over 38.3% market share. Today, more than 3000 industrial facilities are using PAN membranes across the world due to increased efficiency in separation processes. In a recent survey, 70% of the industrial consumers using PAN membranes indicated 20% efficient production processes due to the membranes’ performance to treat the complex oil-in-water emulsions. PAN continues to build its brand equity on antifouling characteristics as laboratories have been able to increase the recycling rate of membranes fivefold compared to earlier models. As per the Environmental Impact Assessment, PAN membranes are also reported to reduce energy usage in filtration systems by 15%.

At the same time, the polyamide segment in the polymer nanomembrane market is experiencing a substantial growth, with more than 500 fresh installations across different regions noted in the year 2023 alone. It is important to mention that polyamide's capability to be used in a variety of industrial settings has led to 30% surge in its use for gas separation technology applications. One of the latest industry reports pointed out that polyamide membranes play key role in helping achieve a 10% decrease in greenhouse gas emissions within the industrial environment. The market for polyamide membranes has developed as well, as over 200 new membranes were launched for sale over the last year further proving that this segment is very vibrant indeed.

In a larger umbrella of polymer nanomembrane market , other types such as polyvinylidene fluoride (PVDF) and cellulose acetate are starting to gain attention. Over 800 new membranes have been utilized in new water treatment plants around the world and it only shows their high chemical resistance and thermal stability. Cellulose acetate membranes also find their use in sustainable applications which has seen a 25% increase in demand over the past 2 years wanting behind the biodegradable alternatives.

By End Users

The global polymer nanomembrane market is dominated by the water and wastewater treatment segment, with a market share of more than 61.5% and having over 10,000 installations worldwide as of 2023. These membranes have been instrumental in the treatment of over 1 cubic kilometer of water a year aiming at the provision of safe drinking water. Areas utilizing advanced nanomembrane technology witnessed a 50% decline in waterborne diseases, a fact supported and corroborated by a recent health and environmental scan report. Operationally, polymer nanomembrane technology has brought about a 60% reduction in chemicals used to decontaminate water resources which compliments sound goals of ecological sustainability.

Water scarcity and urbanization has put further pressure on demand as new polymers nanomembranes installation in the water sector increased by 70% in urban areas. The influx of government financing in the polymer nanomembrane market has been tremendous, as more than $5 billion have been used in the last year to improve water treatment facilities. It is said that as a result of these investments, smart monitoring systems were also introduced which measured 25% improvement in treatment efficiency at use with nanomembrane technology. Also, increased public awareness has led to a rise in demand by a staggering 40% for point-of-use water filtration systems using nanomembranes stressing the need for access to pure water sources.

Apart from water treatment, nanomembranes of polymers are being put to more use than just water purification by the pharmaceutical, food and beverage industries. These nanomembranes are put to use in over 75,000 drug purification processes in the pharmaceutical sector aiming at 10% product yield increase. Beverage macro filtration alone has increased by 20% in the food and beverage sector thanks to the use of these nanomembranes, which has increased the quality and safety of the end products. Such figures reinforce the broad scope and importance of polymer nanomembranes in more industries with the water and wastewater treatment industry being foremost as it is the bedrock for all health and environmental considerations.

To Understand More About this Research: Request A Free Sample

Regional Analysis

North America's polymer nanomembrane market with over 38% market share is driven by stringent environmental regulations and substantial investments in water infrastructure. The U.S. invested more than $500 million on its water treatment systems, which now include nanomembrane technologies in 120 municipal plants in total, and where these systems are in use. While Northern America dominates the adoption of membrane technologies, Europe has currently the most nanomembrane innovations, located in the region, with five new processing techniques that increase polymer separations and membrane operations originating from the continent. Further increasing Europe’s standing and advancement in the market with the establishment of 15 new research centers on nanotechnology along with increasing public and private funding, epitomizing Europe’s advancement in the synthesis of complicated polymer structures needed for sophisticated technologies. This level of development indicates quite a strong ambition of the pioneers to strengthen the nanomembrane structures and widen the application area for them.

The polymer nanomembrane market is growing at an impressive pace, particularly in the Asia-Pacific region, due to industrialization and growing concern for the environment. China has completed 80 project tasks aimed at improving nanomembrane technologies in water projects. In the electronics field, Japan and South Korea have incorporated nanomembranes in 40 products under development, thus proving their importance to the improvement of the manufacturing technology. Also, international partnerships have assisted in the transfer of technology which has also led to the creation of 10 new plants in the region focusing on the production of nanomembranes. However, global supply chain constraints have not hampered growth in the markets especially for cutting edge nanomembrane technologies which have applications across several industries.

North America took the lead in polymer nanomembrane market primarily pioneered by stringent environmental policies coupled with investment allocations in nanotechnology. By virtue of laws such as the Clean Water Act (CWA) and Safe Drinking Water Act (SDWA), such industries have been forced to use foreign advanced filtration technologies that have made the greater use of nanomembrane systems. In the country alone, over 150 water treatment plants have been fitted with the technology after a successful federal expenditure of 2 billion dollars aimed at enhancing the nations water infrastructure. Such a stance not only assures compliance with tight regulation but also ensures that the water available is of good quality.

Top Players in Polymer Nanomembrane Market:

- Dupont De Nemours, Inc.

- Nitto Denko Corporation

- Koch Separation Solutions

- MICRODYN-NADIR GMBH

- Pall Corporation

- Synder Filtration, Inc.

- Alfa Laval AB

- Pentair - X-Flow

- Toray Industries, Inc.

- Sumitomo Electric Fine Polymer, Inc

- Other Prominent Players

Market Segmentation Overview:

By Type

- Polyacrylonitrile (PAN)

- Polyethylene (PE)

- Polyvinylidene Fluoride (PVDF)

- Polyamide

- Polypropylene

- Polyethersulfone (PES)

By End-User

- Water & Wastewater Treatment

- Chemical

- Electronics

- Oil & Gas

- Food & Beverages

- Pharmaceutical & Biomedical

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- Malaysia

- Thailand

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0423401 | Delivery: 2 to 4 Hours

| Report ID: AA0423401 | Delivery: 2 to 4 Hours

.svg)