Global Polymer Emulsion Market: By Technology (Dry (Isolated) and Liquid); Monomer Base (Styrene-butadienes, Pure Acrylic, Styrene- Acrylic, Vinyl Acetate Copolymers, Pure Vinyl Acetate, and Others); Application (Paints & Coatings, Adhesives & Sealant, Nonwovens, Paper, Print & Packaging, and Others); End Users (Automotive, Buildings, Retail & Ecommerce, Manufacturing, and Others); and Region—Industry Dynamics, Market Size and Opportunity Forecast Until 2031

- Last Updated: Mar-2023 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0522234 | Delivery: 2 to 4 Hours

| Report ID: AA0522234 | Delivery: 2 to 4 Hours

Market Scenario

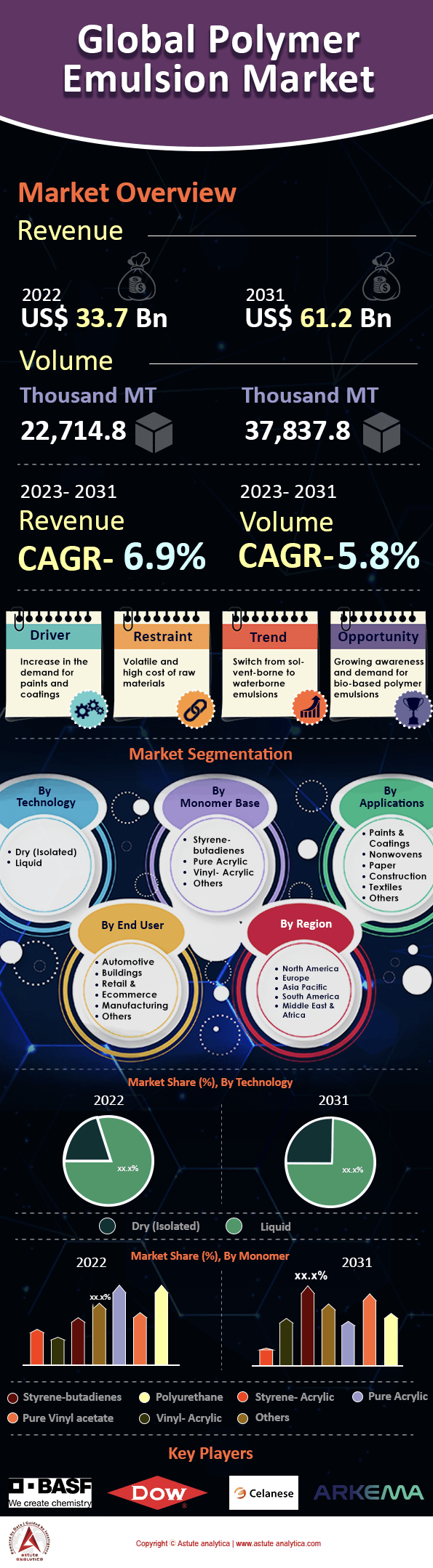

Global polymer emulsion market was valued at US$ 33.7 bn in 2022 and is projected to reach US$ 61.2 bn by 2031 at a CAGR of 6.9% over the forecast period 2023–2031. In terms of volume, the market is registering a CAGR of 5.8% during the forecast period.

The emulsion polymer market is experiencing significant growth, driven by various factors. One of the primary drivers is the increasing demand for paints and coatings. Emulsion polymers are widely used in the processing of different types of paints, including automotive OEM and refinish paints. This is due to their ability to enhance visual appeal, texture, and protect the product from external damage, thereby increasing its shelf life.

Furthermore, the market is being propelled by the growing demand for paints and coatings in various industries, such as construction, marine, automotive, and industrial, for their decorative and protective properties. The rise in the paper and paperboard market, driven by the growth of the food and beverages, cosmetics, and other industries globally, is also contributing to the growth of the emulsion polymer market. The paper industry uses various synthetic emulsion polymers, such as carboxylate styrene-butadiene latex, styrene-acrylic copolymers, acrylic polymer emulsions, and vinyl acetate.

Additionally, the governments of various countries are implementing initiatives that are influencing the growth of the emulsion polymer market. Despite the growth prospects, the market faces challenges such as the high cost and volatility of raw materials, which hinder the market growth.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Growing Demand for Green and Sustainable Products

As consumers become more environmentally conscious, there is a growing demand for products that are eco-friendly and sustainable. This has led to an increased demand for polymer emulsions that are made from renewable resources, have a lower carbon footprint, and are biodegradable. Manufacturers are increasingly focusing on developing green and sustainable products to meet this demand, which is driving the growth of the global polymer emulsion market.

Driver: Growing Construction Industry

The construction industry is a major consumer of polymer emulsions, as they are used in various applications such as paints, coatings, adhesives, and sealants. The growth of the construction industry, particularly in emerging economies such as China and India, is driving the demand for polymer emulsions. As these countries continue to urbanize and industrialize, the demand for construction materials is expected to increase, which will further boost the demand for polymer emulsions.

Restraint: Volatility in Raw Material Prices

The cost of raw materials used to manufacture polymer emulsions, such as acrylic monomers and styrene, can be highly volatile. This makes it difficult for manufacturers to predict and control their production costs, which can impact their profitability. Moreover, the fluctuating prices of raw materials can also affect the prices of finished products, making them less competitive in the market.

Challenge: Intense Competition from Alternative Technologies

Polymer emulsions face intense competition from alternative technologies, such as solvent-based formulations and powder coatings. These technologies offer advantages such as faster drying times and better adhesion, which can make them more attractive to certain consumers. In order to remain competitive, manufacturers of polymer emulsions need to continually innovate and improve their products to meet the changing needs of consumers and stay ahead of the competition.

Segmental Analysis of Global Polymer Emulsion Market Report

By Technology:

The liquid segment of the polymer emulsion market is expected to grow significantly over the forecast period due to the advantages offered by liquid emulsions, such as better stability and ease of use. Inverse emulsion polymerization is a widely used technology for producing high-performance liquid thickeners, which are widely used in the paints & coatings and adhesives & sealants industries. Companies such as Seppic are investing in research and development to create new liquid and powder polymers that offer better performance and ease of use.

By Monomer Base:

The styrene-butadiene segment has been the dominant segment of the polymer emulsion market for several years, as it is widely used in paper coatings, carpet backing adhesives, and other industrial applications. However, the pure acrylic segment is expected to grow at a faster rate due to the increasing demand for acrylic emulsions as additives in paints and varnishes. Acrylic emulsions offer better abrasion resistance, washability, and resistance to fungi and algae, making them a preferred choice for high-performance paints and coatings.

By Application:

The paints and coatings segment is the largest application segment of the polymer emulsion market, driven by the increasing demand for better visual appeal, texture, and protection in the decorative, marine, automotive, construction, and industrial applications. Polymer emulsions are used for painting and coating fast food bags, wrappers, and paper plates to make the paper oil and grease-resistant. The adhesives and sealants segment is expected to grow rapidly due to the vast chemistries of polymer emulsions, which provide low cost, low emissions, zero VOC, good shelf-life, and potential sustainability in many adhesive formulations.

By End User:

The buildings segment is the largest end-user segment of the polymer emulsion market due to the extensive use of polymer emulsions in waterproofing and anti-seepage work on roofs, washrooms, basements, and other areas. Polymer emulsion-based paints and coatings are applied to the exterior of houses to protect them from environmental damage and provide a fresh look that does not fade, peel away, or crack.

The automotive segment is expected to grow significantly due to the increasing use of polymer emulsions in automotive OEM and refinish paints, as they offer better durability, scratch resistance, and weatherability compared to conventional paints. The packaging segment is also expected to grow rapidly due to the increasing demand for polymer emulsions in the production of food packaging, cosmetics packaging, and other types of packaging. Polymer emulsions are used to make the packaging materials more resistant to grease, oil, and moisture, which helps to extend the shelf life of the packaged products.

To Understand More About this Research: Request A Free Sample

Regional Analysis

Asia Pacific dominates the global polymer emulsion market and held the highest market share in 2022. The region is expected to maintain its dominance and register the highest growth rate over the projection period. The growth of the polymer emulsion market in Asia Pacific is primarily attributed to the growing industrial and automotive sectors in countries such as China, India, Japan, and South Korea.

China is the largest consumer of polymer emulsion in the Asia Pacific region, driven by the rapidly expanding construction and automotive industries. According to the National Bureau of Statistics of China, the country's automotive industry sales increased by 11.7% in 2020, despite the COVID-19 pandemic. This growth in the automotive industry is expected to continue over the forecast period, driving the demand for polymer emulsions in the region.

India is another major market for polymer emulsions in the Asia Pacific region. The Indian government's initiatives such as 'Make in India' and 'Smart Cities Mission' are expected to drive the demand for construction and infrastructure development, thus fueling the growth of the polymer emulsion market in the country. Additionally, the increasing adoption of eco-friendly and sustainable products in India is further expected to boost the demand for polymer emulsions.

Japan is also a significant market for polymer emulsions in the Asia Pacific region. The Japanese automotive industry is one of the largest in the world, and the country is home to some of the major automotive manufacturers such as Toyota, Honda, and Nissan. The growth of the automotive industry in Japan is expected to drive the demand for polymer emulsions in the region.

Several companies such as Arkema Group, Synthomer Plc, and Celanese Corporation are using their technical capabilities to create differentiated solutions for their customers in Asia. These companies are investing in research and development to develop innovative products that meet the evolving needs of their customers in the region. Furthermore, the increasing focus on sustainable and eco-friendly products is driving companies to develop green and sustainable polymer emulsions, which are expected to boost the growth of the market in Asia Pacific.

List of Key Companies Profiled:

- Arkema Group

- Asahi Kasei Corporation

- BASF SE

- Celanese Corporation

- DIC Corporation

- Dow Chemical Company

- Synthomer Plc

- Nippon Paper Industries Co., Ltd.

- Toyobo Co., Ltd.

- The Lubrizol Corporation

- Trinseo

- Wacker Chemie AG

- Other Prominent Players

Segmentation Overview

The following are the various segments of the Global Polymer Emulsion Market:

The following are the various segments of the Global Polymer Emulsion Market:

By Technology:

- Dry (Isolated)

- Liquid

By Monomer Base:

- Styrene-butadienes

- Pure Acrylic

- Styrene- Acrylic

- Vinyl Acetate Copolymers

- Pure Vinyl acetate

- Vinyl- Acrylic

- Others

By Applications:

- Paints & Coatings

- Adhesives & Sealant

- Nonwovens

- Paper

- Print & Packaging

- Construction

- Textiles

- Others

By End User:

- Automotive

- Buildings

- Retail & Ecommerce

- Manufacturing

- Others

By Region:

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

View Full Infographic

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2022 | US$ 33.7 Billion |

| Expected Revenue in 2031 | US$ 61.7 Billion |

| Historic Data | 2018-2021 |

| Base Year | 2022 |

| Forecast Period | 2023-2031 |

| Unit | Value (USD Bn) |

| CAGR | 6.9% |

| Segments covered | By Technology, By Monomer Base, By Application, By End-User, By Region |

| Key Companies | Arkema Group, Asahi Kasei Corporation, BASF SE, Celanese Corporation, DIC Corporation, Dow Chemical Company, Synthomer Plc, Nippon Paper Industries Co., Ltd., Toyobo Co., Ltd., The Lubrizol Corporation, Trinseo, Wacker Chemie AG, Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

FREQUENTLY ASKED QUESTIONS

The Global Polymer Emulsion Market was valued at US$ 33.7 Bn in 2022.

The various monomers which contribute to the majority of the bulk polymer material of all emulsion polymers are styrene-butadiene, pure acrylic, styrene- acrylic, vinyl acetate copolymers, and pure vinyl acetate, among others.

The various applications of polymer emulsions are paints & coatings, adhesives & sealant, nonwovens, paper, pint & packaging, and others.

The end users in the polymer emulsion market are automotive, buildings, retail & e-commerce, manufacturing, and others.

The Global Polymer Emulsion Market is estimated to expand at a CAGR of 6.9% over the projection period.

The market is majorly driven by factors such as an increase in demand for paints & coatings and a rapid rise in the paper and paperboards market.

The volatile and high cost of raw materials is hindering market growth.

Growing awareness and demand for bio-based polymer emulsions are creating a lucrative opportunity for market expansion.

The liquid technology type dominates the Global Polymer Emulsion Market in 2022.

The styrene-butadiene segment holds the highest market share in 2022.

Paints & coatings are the highest application segment in the Global Polymer Emulsion Market in 2022.

The key players in the Global Polymer Emulsion Market are BASF SE, Dow Chemical Company, Celanese Corporation, and Arkema Group, among others.

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0522234 | Delivery: 2 to 4 Hours

| Report ID: AA0522234 | Delivery: 2 to 4 Hours

.svg)