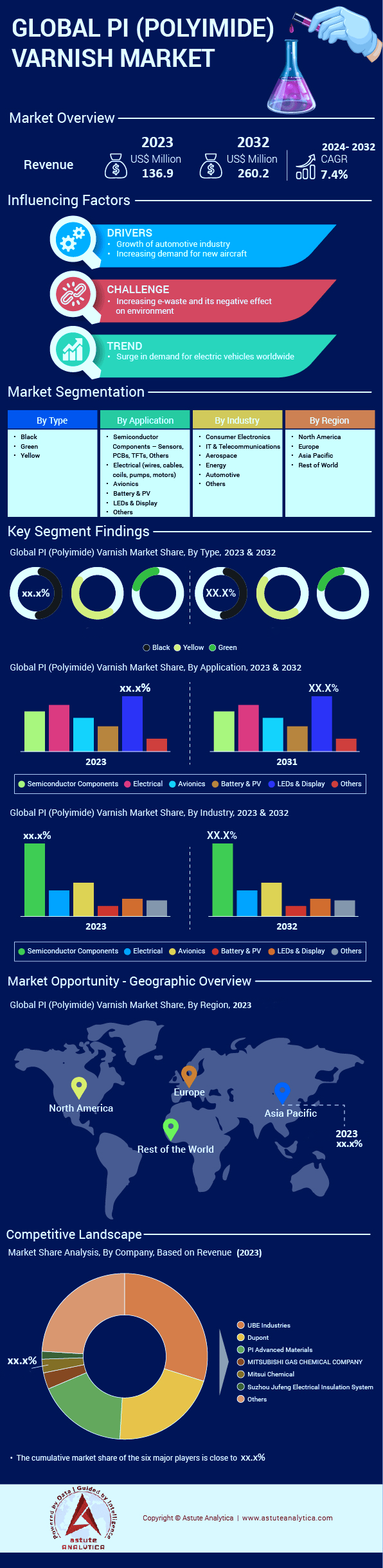

Global Polyimide (PI) Varnish Market: By Type (Black, Yellow, Green); By Application (Semiconductor Components, Electrical, Avionic, Battery & PV, LED And Display, Others); By Industry (Consumer Electronics, IT & Telecommunications, Aerospace, Energy, Automotive and Others); Region—Industry Dynamics, Market Size, And Opportunity Forecast To 2032

- Last Updated: 13-Dec-2023 | | Report ID: AA1121105

Market Scenario

Global Polyimide (PI) varnish market is projected to reach valuation of US$ 260.2 million by 2032 from US$ 136.9 million in 2023 at a CAGR of 7.4% during the forecast period 2024–2032.

Polyimide varnish, renowned for its exceptional thermal stability and electrical insulation properties, has cemented its place in various high-demand industries. As the market stands today, its undergoing rapid evolution driven by both technological advancements and market dynamics. Technological innovations, especially the integration of nanotechnology, have significantly enhanced the properties of polyimide varnish. These advancements in the Polyimide (PI) varnish market cater to the increasing requirements for high-performance materials in critical sectors like aerospace, electronics, and automotive. This evolution reflects the industry's response to the global demand for materials that offer both efficiency and durability.

As per our study, sustainability has also emerged as a pivotal factor in the industry's growth. The shift towards eco-friendly formulations with lower VOC emissions and improved recyclability is not just an environmental gesture but a strategic move aligning with global regulatory frameworks. This transition has opened new avenues in Polyimide (PI) varnish market increasingly conscious of environmental impact and sustainability. The global market for polyimide varnish is experiencing robust growth, particularly driven by the expanding electronics sector in the Asia-Pacific region. Leading this expansion are countries such as China, Japan, and South Korea, which are key players both as consumers and producers. However, the industry faces challenges such as fluctuations in raw material prices and geopolitical influences that affect market stability.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Strong Surge in Miniaturization and Microelectronics is Fueling the Polyimide Varnish Market

One pivotal driver propelling the global Polyimide (PI) varnish market is the relentless trend of miniaturization in the microelectronics industry. This movement, aimed at making electronic devices smaller, more efficient, and more powerful, is not merely a technological shift but a paradigm altering the landscape of numerous industries. At the heart of this miniaturization trend lies the demand for materials that can withstand high temperatures and provide superior electrical insulation in progressively smaller components. Polyimide varnish, with its exceptional thermal stability and excellent electrical insulating properties, emerges as an indispensable solution. It allows for the creation of thinner, yet more effective insulation layers in electronic devices, a necessity in the age of miniaturization.

The application of Polyimide (PI) varnish market in microelectronics extends beyond traditional sectors. It’s pivotal in developing advanced technologies like flexible electronics, where its ability to maintain integrity and performance under flexing stress is unmatched. This feature is particularly crucial as the world moves towards more adaptable and wearable technology. Moreover, the global shift towards sustainability further accentuates the importance of polyimide varnish. As industries seek materials that contribute to longer product lifespans and reduced e-waste, polyimide varnish's durability and thermal stability make it an eco-friendlier choice. This aspect not only aligns with environmental goals but also meets the increasing regulatory demands for sustainable materials in technology manufacturing.

Trend: Rise of Green Polyimide Varnish

A significant trend shaping the global Polyimide (PI) varnish market is the burgeoning emphasis on eco-innovation, particularly the development of environmentally friendly polyimide varnishes. This trend is not just a nod to growing environmental awareness but a strategic response to the increasing regulatory and consumer demands for sustainable products.

In the polyimide varnishes, eco-innovation manifests in the development of formulations that minimize harmful environmental impacts. Traditional PI varnishes, while effective, often contain solvents and other components that can be detrimental to the environment. The industry's pivot towards 'green' polyimide varnishes involves reducing volatile organic compound (VOC) emissions and enhancing recyclability. This shift is crucial in an era where environmental regulations are becoming more stringent across the globe, especially in key markets like the European Union, North America, and parts of Asia.

The drive for sustainability is not solely regulatory-driven in the global Polyimide (PI) varnish market. There's a growing consumer and industrial preference for environmentally friendly materials, reflecting in procurement policies and corporate social responsibility agendas. Companies are increasingly aligning with materials that not only perform efficiently but also demonstrate a commitment to environmental stewardship. This trend towards eco-friendly polyimide varnishes also opens up new market opportunities. Innovations in green chemistry are leading to the development of bio-based polyimide varnishes, a segment that holds significant potential. These varnishes, derived from renewable resources, offer a compelling combination of performance and sustainability, appealing to a broader range of industries, including automotive, aerospace, and consumer electronics.

Challenge: Navigating Raw Material Price Volatility

A critical challenge facing the global Polyimide (PI) varnish market is the volatility in raw material prices and availability. This issue is not merely a matter of fluctuating costs but a complex web of factors that directly impacts production, pricing, and market stability. Polyimide varnishes are composed of specialized chemicals and polymers, the supply and pricing of which are subject to various global factors. These include geopolitical tensions, trade policies, and economic fluctuations that can lead to unpredictable changes in raw material availability and cost. For instance, the polyimide market is heavily reliant on petrochemicals, making it susceptible to the oscillations in the oil and gas industry. Additionally, rare earth elements, crucial in some advanced polyimide formulations, are often subject to geopolitical influences and export restrictions, particularly from countries that dominate their supply.

This volatility poses a significant challenge for manufacturers in the Polyimide (PI) varnish market. It impacts their ability to forecast costs and maintain consistent pricing, essential for long-term business planning and customer relations. Furthermore, sudden spikes in raw material costs can compress profit margins, especially for manufacturers who cannot pass these increases onto customers due to competitive market pressures or long-term contracts. In addition, this challenge is compounded by the increasing demand for specialized, high-performance polyimide varnishes. As industries like electronics, aerospace, and automotive continually seek advanced materials, the pressure on raw material supply chains intensifies, leading to further instability.

Segmental Analysis

By Type

The black varnish segment in the Polyimide (PI) varnish market commands a significant presence, holding approximately 50% of the market share. This dominance is anchored in its superior mechanical properties and exceptional long-term heat resistance, making it a material of choice for applications that demand high durability and stability under thermal stress. Black PI varnish is particularly valued in industries where materials are subjected to extreme temperatures and harsh conditions, such as in aerospace and automotive manufacturing. Its ability to maintain structural integrity in challenging environments is crucial for the reliability and longevity of components in these sectors.

The black varnish's robustness against chemical and physical degradation also contributes to its widespread usage in the global Polyimide (PI) varnish market. Its resistance to wear and abrasion, along with its ability to withstand exposure to oils, fuels, and various chemicals, makes it an ideal coating in a range of industrial applications.

Contrasting with the market position of black varnish, the yellow varnish segment, although currently smaller in market share, is projected to grow at the highest CAGR of 7.6%. This growth trajectory can be attributed to its unique set of properties that cater to specific application needs. Yellow PI varnish is renowned for its optical clarity in addition to its insulating capabilities, making it highly suitable for applications where transparency is required alongside electrical insulation. This segment's growth is closely tied to advancements in electronics and optoelectronics, where yellow varnish is used in applications ranging from flexible displays to insulating layers in various electronic components.

By Application

In the application segment, LED displays and electricals hold a commanding position in the Polyimide (PI) varnish market, accounting for around 40% of the revenue share. This dominant stance is primarily driven by the escalating demand for PI varnish in the rapidly growing field of portable devices. PI varnish is crucial in these applications for its excellent insulating properties, which are essential in protecting electronic components from thermal and environmental stress. The rising trend of mobile and wearable technology has made LEDs and displays integral to everyday devices, increasing the reliance on materials that can enhance durability and performance.

The use of PI varnish in LED displays and electrical components also extends beyond mere insulation in the Polyimide (PI) varnish market. It plays a critical role in enhancing the longevity and reliability of these devices, which are often subject to frequent use and varying environmental conditions. The ability of PI varnish to maintain its insulating properties over a wide range of temperatures and its resistance to degradation under UV exposure are key factors in its widespread application in the LED and electricals sector.

By Industry

In 2023, the Polyimide (PI) varnish market is predominantly led by the consumer electronics sector, accounting for 51.5%. This dominance reflects the rapid growth and widespread presence of consumer electronic products in today's world. PI varnish's diverse applications in this industry, from smartphones to advanced home appliances, highlight its vital role. Its thermal stability, electrical insulation, and mechanical strength make it a key component in various consumer electronic devices, contributing to their performance and durability.

The demand in the consumer electronics sector is fueled by the continuous innovation and launch of new products, each requiring more advanced and reliable materials. The role of PI varnish in enhancing the durability and performance of these devices, especially in the context of increasing consumer expectations for quality and longevity, solidifies its market position.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

In the global landscape of the Polyimide (PI) varnish market, the Asia-Pacific region stands as a dominant force, contributing significantly more than 40% of the market's revenue. This dominance is largely spearheaded by China, which alone accounts for over 34% of the region's production. Such figures not only highlight the region's market leadership but also underscore the intricate dynamics that drive this sector. China's central role in the PI varnish market is a calculated outcome of its extensive industrial growth and strategic investments. The nation's expansive manufacturing sector, particularly in areas such as electronics, automotive, and aerospace, demands a substantial supply of high-performance materials like PI varnish. Furthermore, China's advancement in technological capabilities and its emphasis on research and development have established it as a global epicenter for polyimide varnish production.

The Asia-Pacific region's dominance in the Polyimide (PI) varnish market is further bolstered by several critical factors. The rapidly expanding electronics industry, especially in technologically advanced nations like South Korea and Japan, relies heavily on polyimide varnish for its essential thermal and electrical insulating properties. The region's growth in consumer electronics, coupled with strides in microelectronics and semiconductors, significantly amplifies the demand for PI varnish. Additionally, the electric vehicle (EV) sector, which is witnessing a remarkable surge in countries such as China, Japan, and South Korea, is also a key market driver. Given the crucial role of PI varnish in EV manufacturing, particularly for its insulation properties in battery and motor applications, this sector's growth directly impacts the demand for polyimide varnish.

However, the Asia-Pacific region's leadership in the PI varnish market is not without its challenges. Supply chain disruptions, often influenced by geopolitical tensions or global economic shifts, can adversely affect the availability of raw materials, thus impacting production efficiency and pricing stability. Furthermore, stringent environmental regulations in countries like Japan and South Korea pose a challenge to manufacturers, pushing them towards developing more environmentally friendly PI varnish formulations.

Top Players in the Global Polyimide (PI) Varnish Market

- Daxin Materials Corporation

- Dongbeak Fine-Chem

- Hubei Dinglong

- Industrial Summit Technology (IST)

- Lumtec

- Mitsui Chemical

- PI Advanced Materials

- PICOMAX

- SKC Kolon

- UBE Industries

- Wuhan Imide New Materials Technology

- Other Prominent Players

Market Segmentation Overview:

By Type

- Black

- Green

- Yellow

By Application

- Semiconductor Components

- Electricals

- Avionics

- Battery & Photovoltaics (PV)

- LED & Display

- Others

By Industry

- Consumer Electronics

- IT and Telecommunication

- Aerospace

- Automotive

- Energy

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- The UK

- Germany

- France

- Italy

- Spain

- Russia

- Poland

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- ASEAN

- Rest of Asia Pacific

- Rest of the World

- South America

- Middle East & Africa

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2023 | US$ 136.9 Mn |

| Expected Revenue in 2032 | US$ 260.2 Mn |

| Historic Data | 2019-2022 |

| Base Year | 2023 |

| Forecast Period | 2023-2032 |

| Unit | Value (USD Mn) |

| CAGR | 7.4% |

| Segments covered | By Type, By Application, By Industry, and Region |

| Key Companies | Daxin Materials Corporation, Dongbeak Fine-Chem, Hubei Dinglong, Industrial Summit Technology (IST), Lumtec, Mitsui Chemical, PI Advanced Materials, PICOMAX, SKC Kolon, UBE Industries, Wuhan Imide New Materials Technology, Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)