Global Polar Travel Market: By Type (Antarctic, Arctic, The Himalayas, Others); End Users (Millennial, Generation X, Baby Boomers, Others); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: 19-Apr-2024 | | Report ID: AA0823592

Market Scenario

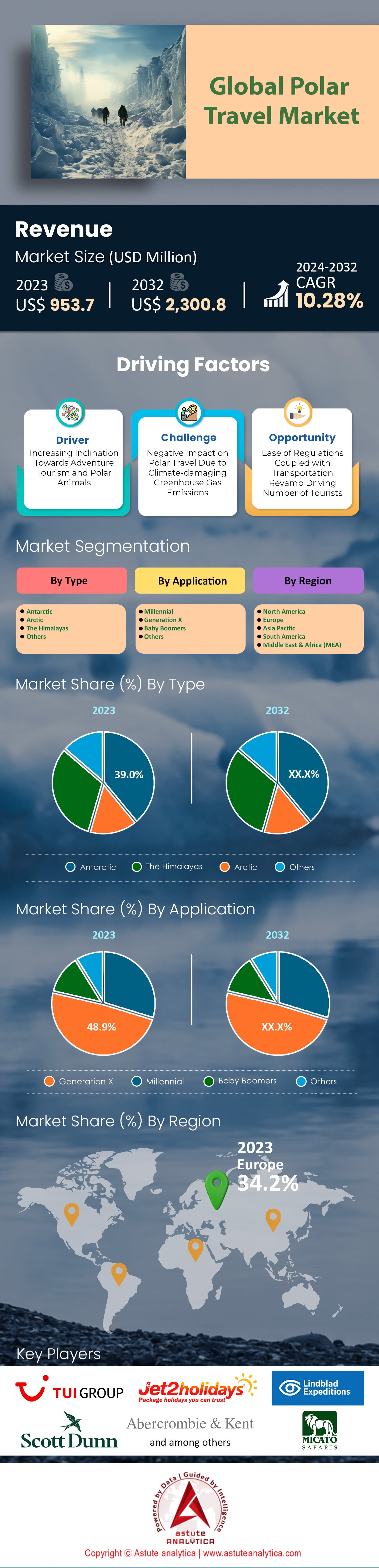

Global polar travel market was valued at US$ 953.7 million in 2023 and is projected to reach a valuation of US$ 2,300.8 million by 2032 at a CAGR of 10.28% during the forecast period 2024–2032.

Recent developments in the global polar travel market have largely been driven by technological advancements, particularly in ship design and construction. Modern vessels have stronger ice capabilities, enabling them to traverse areas previously inaccessible. During 2021 and 2022, for instance, over $1.5 billion was invested in developing advanced cruise ships suitable for polar conditions. Moreover, innovations in sustainability have been at the forefront, with many new ships utilizing hybrid technologies to minimize environmental impact. In line with this, the market dynamics are shifting constantly. Climate change, while posing challenges, has paradoxically opened up previously inaccessible regions, especially in the Arctic. As a result, there was a 15% increase in Arctic travel from 2018 to 2022. However, these shifting dynamics also carry an ethical weight; melting polar ice caps have led to debates regarding the ecological implications of such travel. Research indicates that polar tourism could influence native wildlife behavior, and over 30% of tourists now seek out companies with strong sustainability credentials when booking their trips.

The behavior of end users in the polar travel market has also been influenced by increased awareness and education about polar regions. A recent survey found that over 60% of polar travelers were primarily motivated by a desire for unique experiences and educational opportunities rather than just leisure. These travelers, typically falling within the 30-50 age bracket, are willing to spend an average of $20,000 to $25,000 on a polar expedition, showcasing the industry's high-end nature. As per our study, key consumers in the polar travel market hail from North America and Europe, representing roughly 70% of the total market share. The affluent middle class from Asian countries, especially China, has emerged as a significant demographic, with a 12% increase in Chinese travelers to the polar regions from 2021 to 2023.

Trends shaping the global polar travel market include the rise of luxury polar travel and an emphasis on immersive experiences. Companies are offering more than just a voyage; they're offering underwater exploration via submarines, heli-skiing, and more. Research from 2021 showed a 20% increase in bookings for luxury polar cruises compared to standard cruises.

To Get more Insights, Request A Free Sample

Demographic Analysis in Global Polar Travel Market

The Arctic, with its distinct environment and strategic importance, has observed an annual visitor influx of approximately 30,000. Predominantly, these tourists originate from established economies including the United States, Canada, Germany, and the UK. An emerging market dynamic to note is China's increasing representation, currently accounting for a notable 10% of Arctic tourism. Turning attention southward to the Antarctic, this remote region in the polar travel market reports an annual tourist volume of around 50,000. However, the year 2023 is projected to witness an influx of around 100,000 tourist from across the globe, over 40% higher than the pre-covid visitors. The United States is the primary contributor to this number, representing a significant 33% of the total visitor demographic. Following closely, China constitutes 16%, while Australia, the UK, and Germany contribute 12%, 10%, and 7% respectively. These figures indicate a diversified source of tourists, demonstrating Antarctica's broad appeal across different geographies.

In the midst of these polar destinations, the Himalayas stand as a formidable magnet for high-altitude enthusiasts. Specifically, the Nepal sector, characterized by popular routes such as the Everest Base Camp trek, records approximately 30,000 trekkers annually. Broadening the assessment to include all trekking pathways in Nepal, the number rises sharply to over 200,000 foreign trekkers each year. Key markets for Himalayan tourism are India, followed by China, the United States, the UK, and several European countries.

Market Dynamics

Driver: Rapid Economic Growth in Emerging Markets

As globalization continues its advance, coupled with infrastructural developments in various regions of the world, one of the prime movers of the polar travel market remains the accelerating economic expansion of emerging markets. For instance, the World Bank's 2023 assessment highlighted an encouraging global GDP growth of around 2.7%. However, drilling deeper into these numbers, it's emerging markets and developing economies that outpaced this growth, clocking in at approximately 4.1%. Among these markets, countries like China, India, and Brazil have seen rapid urbanization, technological adoption, and a burgeoning middle class.

China, in particular, offers an illustrative case study. With a middle class surpassing 400 million individuals, its citizens are beginning to exhibit a pronounced shift in their consumer behavior. An appetite for novel, exotic experiences is increasingly evident. The International Association of Antarctica Tour Operators (IAATO) has chronicled this trend, revealing that Chinese tourists to Antarctica surged from a modest 2,000 in the 2010-2011 season to a striking 8,000 by 2018-2019. This represents a fourfold increase in less than a decade. Given the premium price point of polar expeditions—often exceeding $10,000—it’s clear that these once-in-a-lifetime journeys are seen as both attainable and desirable by the new affluent segments of these societies.

Trend: Emphasis on Sustainable and Responsible Tourism

The conscious traveler of today is vastly different from the tourist of a decade ago. This evolution is mirrored in the changing dynamics of the polar travel market. The once passive holidaymaker, content with clicking photographs and hopping from one landmark to another, is now evolving into an informed, responsible traveler. They seek deeper engagements, educative experiences, and are acutely aware of their ecological footprint. Supporting this observation, Booking.com's 2021 survey illuminated the collective consciousness of global travelers. A significant 55% of respondents signaled a firmer resolve to make sustainable travel choices compared to the previous year. This sentiment isn't just confined to opting for eco-friendly accommodations or reducing plastic usage. It permeates the fabric of the entire travel experience.

Reflecting this aspect, the polar travel industry has made considerable strides. IAATO members, recognizing the fragility of the regions they operate in, have collaboratively adopted rigorous, eco-conscious guidelines for their expeditions. A commitment to reduce carbon emissions has seen operators like Quark Expeditions advancing toward ambitious targets like achieving a 100% carbon-neutral operational model. Furthermore, recognizing the increasing demand for sustainable lodging without compromising luxury, accommodations such as White Desert’s “Whichaway Camp” in Antarctica have been designed from the ground up with environmental conservation at their core.

Challenge: Environmental Impact and Fragility of Polar Ecosystems

There's no denying the majestic allure of polar regions—their pristine landscapes, unique ecosystems, and the sheer sense of adventure they evoke. However, the increasing human footprint in these areas brings with it a plethora of environmental challenges in the global polar travel industry. Recent research published in the journal “Nature Climate Change” offers sobering insights into the rapid climatic shifts occurring in the polar areas. With temperatures in these regions escalating at nearly double the global average rate, their ecosystems teeter on the brink of profound change. The mounting tourist influx—now exceeding 50,000 annually in Antarctica alone—aggravates these environmental concerns.

The repercussions of such footfalls are multifaceted. There's a tangible risk of introducing non-native species, inadvertently or otherwise across the global polar travel industry. Waste, even if managed responsibly, poses significant threats. Then there are the more intangible effects—the potential behavioral changes in native wildlife due to increased human interaction. Addressing these challenges, regulatory bodies like the Antarctic Treaty System have introduced stringent guidelines, such as limiting the number of visitors at landing sites. However, as the demand for polar experiences grows, reconciling the dichotomy of conservation versus accessibility becomes an intricate challenge, necessitating continuous review and adaptive strategies.

Segmental Analysis

By Type

By type, antarctica segment is holding over 39% revenue share of the global polar travel market, often referred to as the last great wilderness on Earth, offers an untouched and otherworldly experience. Its appeal largely stems from its sheer remoteness and the exotic allure of its icy landscapes and unique wildlife. In 2023, the number of tourists visiting Antarctica had swelled to approximately 50,000 and is likely to reach 100,000 by the end of 2023. This marked a significant increase from just 6,700 in the early 1990s, indicating the growing interest in this icy continent. While ship-based tourism accounted for about 95% of all visitor activities, this didn't mean all these travelers were landing on the continent. Given the regulations set by the ATCM, only a fraction of these tourists would set foot on Antarctica, while the rest would merely cruise the surrounding waters, taking in the mesmerizing views.

Financially, Antarctic tourism has been on the rise as well. By early 2023, the average cost of a 10–15-day expedition cruise to Antarctica ranged from $10,000 to $30,000. Luxury experiences, with state-of-the-art amenities and private excursions, could even exceed $100,000. This lucrative segment plays a substantial role in driving the revenues for the polar travel industry. Moreover, as global awareness about climate change and environmental conservation grew, there was a noticeable surge in 'educational tourism' to Antarctica. Universities, research institutions, and NGOs started organizing expeditions, aiming to educate participants about the region's ecology, the effects of global warming, and the significance of its conservation.

By Application

Generation X, which holds over 48.9% of the global polar travel market share, showcases specific patterns and preferences that significantly shape the polar travel industry. This generation, now in their 40s to late 50s, has a particular affinity for unique, enriching experiences. According to a 2022 survey, over 65% of Gen X travelers expressed that they preferred destinations that were "off the beaten path" and provided a blend of adventure and learning. When questioned about their spending habits, around 70% of this cohort indicated that they're willing to spend more on travel experiences that are unique, enriching, and offer deeper insights into the environment and culture of a region. Furthermore, their digital literacy plays a crucial role. Approximately 80% of Gen X travelers in Europe and North America, as of a 2023 report, relied heavily on online platforms for researching, planning, and booking their trips. This indicates a vast potential for digital marketing strategies specifically targeted at this segment.

While Gen X dominates the market share, other demographic segments, like the eco-conscious millennials and the affluent baby boomers, also contribute to the growth and diversification of the polar travel market. By 2023, millennials, motivated by sustainable travel options and immersive experiences, accounted for almost 30% of Antarctic travelers, whereas baby boomers, driven by luxury offerings, made up around 10%.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

The global polar travel market has witnessed shifts and changes with regions varying in their contributions to the industry's growth and revenues. As we delve into the intricacies of the regional dynamics, particularly those of Europe and North America, there's a plethora of data-driven insights and nuances to consider. In 2023, Europe emerged as a frontrunner in the polar travel industry, accounting for a staggering 34.2% of the market revenue. The reasons for such dominance are manifold such as, Europe's proximity to the Arctic region makes polar voyages more accessible and logistically convenient. Cities such as Oslo and Tromsø serve as pivotal launchpads for many Arctic expeditions. This geographical advantage amplifies Europe's position in the market. The demographics also play a pivotal role. Europe, with its aging population and a median age hovering around 42.5 years in 2022, has a significant proportion of individuals in the higher income bracket. This demographic segment, coupled with a tradition of long-haul vacations and an appetite for experiential travel, finds polar expeditions especially appealing. Furthermore, research from Eurostat indicated that by 2022, over 60% of Europeans had undertaken at least one international holiday, further emphasizing the region's penchant for travel.

In terms of investments in the polar travel industry, European travel companies and venture capitalists have shown increased enthusiasm for the polar travel market. In 2021 alone, European investment in sustainable polar travel ventures crossed the €250 million mark, a growth of 18% compared to the previous year. This is reflective of both the region's commitment to sustainable tourism and the anticipation of continued growth in the sector. Analyzing key consumers, it's noteworthy that European travelers, especially from countries like Germany, the UK, and France, display a heightened interest in eco-tourism and sustainable travel, driving demand for polar trips that prioritize environmental conservation. Moreover, the European market's penchant for luxury travel experiences has prompted polar tour operators to introduce high-end packages, further driving revenue.

Meanwhile, North America, primarily led by the U.S. and Canada, is not far behind, cementing its position with a 31.9% revenue share. Given the vast coastline that both these countries share with the Arctic, there's a natural inclination towards polar travel. North America's demographics, characterized by a median age of around 38 years in 2022 and a considerable segment of the population with disposable incomes exceeding $75,000 annually, contribute to this trend.

In terms of the polar travel industry growth, North America witnessed a 7% year-on-year growth in polar travel bookings in 2022. Investment-wise, North American companies have been at the forefront of technological integration, pumping in over $200 million in 2022 towards enhancing the polar travel experience through virtual reality and augmented reality. Key consumers in North America, especially the millennial and Gen X segments, have demonstrated an increasing interest in immersive and educational travel experiences. This aligns perfectly with the polar travel proposition, which offers both adventure and an educational insight into pressing global issues like climate change.

Top Players in the Global Polar Travel Market

- Abercrombie & Kent Ltd.

- Cox & Kings Ltd

- Jet2 Holidays

- Lindblad Expeditions

- Micato Safaris

- Scott Dunn

- Tauck

- Thomas Cook Group

- TUI Group

- Other Prominent Players

Market Segmentation Overview:

By Type

- Antarctic

- Arctic

- The Himalayas

- Others

By Application

- Millennial

- Generation X

- Baby Boomers

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)