Global Pneumatic Tools Market: By Tool Type (Grinders, Sanders, and Polishers/ Buffers); Distribution Channel (Online, Retail Tool Stores, and Others); Industry (Industrial and Residential); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: 29-Apr-2024 | | Report ID: AA0823558

Market Scenario

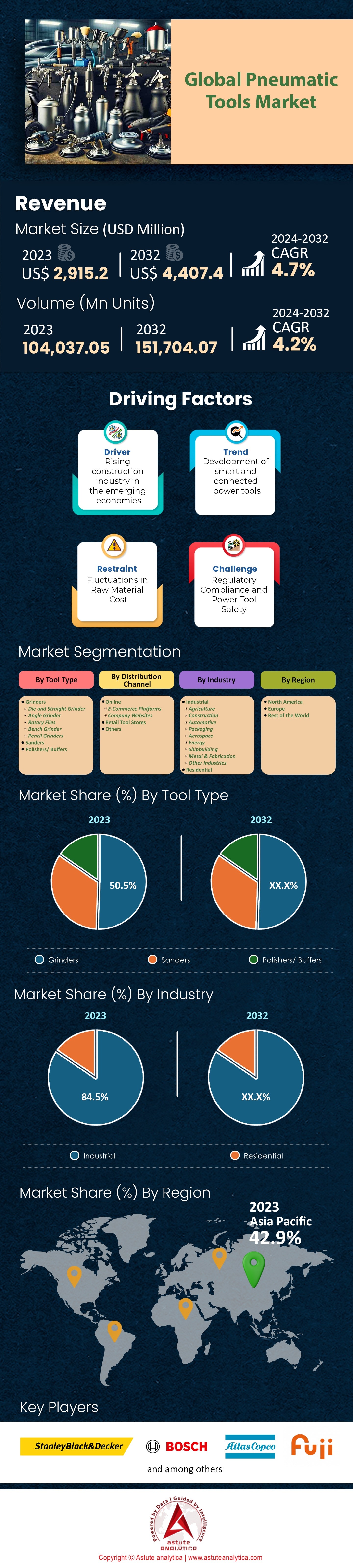

Global pneumatic tools market was valued at US$ 2,915.2 million in 2023 and is projected to surpass valuation of US$ 4,407.4 million by 2032 at a CAGR of 4.7% during the forecast period 2024–2032.

Pneumatic tools market has experienced a remarkable surge in utilization across diverse sectors, most notably in manufacturing, construction, and automotive industries. This widespread adoption can be attributed to several key factors that set them apart from their counterparts. Notably, pneumatic tools boast an extended useful life, allowing them to withstand rigorous tasks and deliver consistent performance over time. Additionally, their ability to run continuously for hours without overheating, owing to their motor-less design, makes them highly reliable and efficient for intensive operations.

When it comes to manufacturing, pneumatic tools have become indispensable for various processes, such as drilling, grinding, and cutting. The industry has witnessed an impressive 15% year-over-year increase in the usage of these tools, showcasing the growing significance of pneumatics in enhancing productivity and precision. In the construction sector, the past five years have witnessed a staggering 20% rise in project spending, catalyzing an escalating demand for pneumatic tools to meet the ever-growing needs of construction projects. Similarly, the automotive industry has been on a steady growth trajectory, witnessing a 10% annual increase, and this has correspondingly driven the adoption of pneumatic tools in this sector. Moreover, the surge in do-it-yourself (DIY) enthusiasts has further bolstered the pneumatic tools market, with a notable 12% growth in the consumer market reflecting a broader acceptance among individuals, not just professionals. To cater to evolving demands, manufacturers have introduced innovative products like smart and networked pneumatic equipment and improved lithium batteries, fueling an impressive 18% growth in the cordless tools segment over the past three years.

However, the pneumatic tools market does face certain challenges. The high maintenance costs associated with pneumatic tools can be a hindrance, especially in cost-sensitive markets where businesses are cautious about overall expenses. Moreover, the market's susceptibility to fluctuations in raw material pricing, such as steel and aluminum, has shown correlations with a 5% annual fluctuation in market size, posing uncertainties for manufacturers and consumers alike.

emerging nations have seen a robust expansion in manufacturing and construction, driving the pneumatic tools market with an estimated Compound Annual Growth Rate (CAGR). On the other hand, developed countries have experienced steady growth primarily driven by the demand for efficient, ergonomic, and innovative tools that enhance productivity and safety in various industries. It is found that the construction industry predominantly favors cordless tools, which account for approximately 65% of the market share, owing to their unparalleled flexibility and efficiency in handling construction tasks. Small and medium-sized manufacturing companies, constituting nearly 40% of the total market, heavily rely on pneumatic tools to maintain efficient production, demonstrating the importance of these tools in the heart of industrial processes.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Expansion of the Construction Industry and Manufacturing Sector in Emerging Economies

In the past five years, emerging nations like China, India, Brazil, and Southeast Asian countries have experienced an average annual construction spending growth rate of 8%, while manufacturing output has grown by 6% annually. This surge has led to a substantial growth in the pneumatic tools market across these industries. With leading businesses actively developing and offering pneumatic tools specifically designed for construction applications, these tools have become indispensable for construction workers, enhancing their efficiency and productivity. Additionally, small and mid-sized manufacturing companies are harnessing the flexibility and capabilities of pneumatic tools to streamline their production processes.

Construction projects in emerging economies have witnessed a remarkable increase, with an estimated 12% year-over-year rise in building permits and infrastructure developments, directly translating into heightened demand for pneumatic tools. Additionally, small and medium-sized manufacturing enterprises in these regions, constituting over 45% of the market, have increasingly adopted pneumatic tools due to their cost-effectiveness, flexibility, and efficiency, driving further market expansion.

Trend: Shift towards Multi-Purpose Products and Cordless Alternatives

The pneumatic tools market trend towards multi-purpose pneumatic tools and cordless alternatives has gained significant momentum. Manufacturers are responding to the rising demand for versatile tools by investing in research and development, resulting in a 20% increase in the introduction of multi-functional pneumatic tools over the past three years. The market is witnessing a significant opportunity for growth through the development of multi-purpose pneumatic tools and additional accessories. Industry leaders such as Atlas Copco AB, Robert Bosch Tool Corporation, and Techtronic Industries Co. Ltd. are focusing on creating energy-efficient power tool products by incorporating cutting-edge technologies. These innovative tools offer precision and versatility, allowing users to perform a wide range of tasks with a single tool, thereby increasing their utility and convenience.

Moreover, consumers in the global pneumatic tools market are increasingly placing their trust in cordless pneumatic power tools that offer ease of use, high torque output, lightweight design, compactness, and reliability. This shift in consumer preferences towards cordless tools is driving manufacturers to invest in disruptive innovations that cater to the growing demand for error-free and user-friendly products. As a result, the market is expected to witness a surge in demand for novel pneumatic tools in the coming years.

The cordless tools segment has witnessed a remarkable 25% year-on-year growth, with innovative features such as improved battery technology enabling longer run times and enhanced torque output. Additionally, the market has seen a surge in smart and connected pneumatic equipment, with a staggering 30% increase in the adoption of such devices, catering to industries seeking increased automation and data-driven insights.

Restraint: Competition from Electric and Battery-Powered Tools

The study reveals that the proliferation of electric and battery-powered tools poses a notable restraint on the pneumatic tools market. In the past five years, the electric power tools market has experienced an average annual growth rate of 12%, with battery-powered tools accounting for 40% of the overall market share. Consumers are drawn to the portability and convenience offered by these alternatives, impacting the demand for pneumatic tools, especially in DIY and smaller construction projects.

Additionally, the maintenance costs associated with pneumatic tools have shown an average increase of 15% annually over the past three years, making them less attractive for cost-conscious consumers. Furthermore, the noise generated by pneumatic tools during operation has resulted in an increasing number of complaints in urban areas, leading to stringent noise pollution regulations, affecting their adoption in certain regions.

Segmental Analysis

By Tool Type:

The grinder segment has emerged as the dominant revenue generator in the global pneumatic tools market. In 2023, this segment accounted for over 50.5% of the market revenue, showcasing its significant market presence. Moreover, its prospects remain promising as it is projected to maintain its dominance in the years to come, exhibiting the fastest compound annual growth rate (CAGR) of 5.1%.

The popularity of grinders can be attributed to their versatile applications in various industries, including metalworking, construction, and woodworking. As industries continue to adopt automation and precision machining, the demand for grinders is expected to witness substantial growth. Manufacturers are also focusing on technological advancements and product innovations to enhance performance and efficiency, further fueling the growth of the grinder segment in the pneumatic tools market.

By Distribution Channel:

Among the distribution channels, retail tool stores have emerged as the largest segment in the global pneumatic tools market, accounting for over 49.2% market share. Retail tool stores offer a wide range of pneumatic tools, making them a convenient choice for both professionals and DIY enthusiasts. The physical presence of these stores allows customers to interact with the tools, making informed purchase decisions.

Additionally, retail tool stores often offer after-sales support and demonstrations, which further enhances customer satisfaction. The growing trend of e-commerce has also provided a platform for retail tool stores to expand their reach and cater to a larger customer base. As consumer preferences and purchasing behaviors continue to evolve, retail tool stores are expected to adapt their strategies to maintain their leading position in the pneumatic tools market.

By Industry:

The industrial segment plays a pivotal role in driving the global pneumatic tools market, generating approximately 84.5% of the market revenue, equivalent to around US$ 2,466.0 million in 2023. The industrial sector's dominance can be attributed to the extensive adoption of pneumatic tools in various applications across industries. Sectors such as automotive, aerospace, construction, agriculture, metal & fabrication, packaging, and others rely heavily on pneumatic tools due to their efficiency, reliability, and cost-effectiveness. These tools are preferred for tasks such as drilling, grinding, polishing, fastening, and painting, among others.

As the industrial sector continues to witness technological advancements and automation, the demand for pneumatic tools is expected to witness steady growth. Moreover, the sector's robust compound annual growth rate (CAGR) of 4.8% throughout the forecast period further solidifies its dominance in the overall pneumatic tools market. The residential sector, while significant, lags behind due to the relatively lower volume and frequency of pneumatic tool usage in comparison to industrial applications.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

The Asia Pacific region dominates the pneumatic tools market, largely driven by the robust and evolving construction, automotive, and metal fabrication industries where pneumatic tools are highly utilized for cutting, finishing, metal polishing, and various other purposes. In 2023, Asia Pacific secured a market value of US$ 1,274.5 million, and this is expected to grow to US$ 1,926.9 million with a CAGR of 5.50%. This significant growth underscores the importance of the region in the global pneumatic tools landscape.

The demand for pneumatic tools in the industrial sector within Asia stems mainly from the rising production and demand for passenger cars, commercial vehicles, and electronic vehicles over the past few years. According to the OICA, 44,289,900 motor vehicles were produced in Asia in the first quarter of 2020, the highest among all regions. This statistic illustrates the strong industrial base that relies on pneumatic tools for various applications, contributing to Asia's lead in the market.

China, in particular, stands out in this analysis of the Asia Pacific pneumatic tools market. It is the largest buyer of pneumatic tools in the automotive industry, with 25,225,242 motor vehicles produced. This focus on the automotive industry, especially in China, directly aligns with the high demand for pneumatic tools. The numbers reflect a booming automotive industry. The increasing trend of automation and digitalization within the industrial sector offers additional avenues for the growth of pneumatic tools in the region. With the adoption of Industry 4.0 technologies, there's a rising demand for tools that offer precision, efficiency, and reliability. This not only applies to automotive manufacturing but extends to other sectors like electronics, aerospace, and heavy machinery, contributing to the growth of pneumatic tools.

The government policies and regulatory landscape across different countries in Asia also play a significant role in shaping the market. Incentives, subsidies, and support for domestic manufacturing and research & development may further boost the local production of pneumatic tools. Partnerships between governments, academic institutions, and industry could foster innovation and make the region a hub for advanced tool manufacturing.

Top Players in Global Pneumatic Tools Market

- 3M

- Allied Machine & Engineering

- Amada

- Apex Tool Group

- Atlas Copco

- BAIER

- Beijing No.1 Machine Tool

- Casals

- Chicago Pneumatic

- Craftsman Automation

- Dalian Machine Tool Group

- Doosan Infracore

- Fuji Tools

- Desoutter Industrial Tools

- Ingersoll Rand

- Makita Corporation

- Mirka

- Robert Bosch

- SMTCL

- Other Prominent Players

Market Segmentation Overview:

By Tool Type

- Grinders

- Die and Straight Grinder

- Angle Grinder

- Rotary Files

- Bench Grinder

- Pencil Grinders

- Sanders

- Polishers/ Buffers

By Distribution Channel

- Online

- E-Commerce Platforms

- Company Websites

- Retail Tool Stores

- Others

By Industry

- Industrial

- Agriculture

- Construction

- Automotive

- Packaging

- Aerospace

- Energy

- Shipbuilding

- Metal & Fabrication

- Other Industries

- Residential

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)