Global Plastic Injection Molding Machines Market: By Machine Type (Electric, Hydraulic, Hybrid); Clamping force (0-200 Ton Force, 201-500 Ton Force, Above 500 Ton Force); Machine Structure (Vertical Injection Molding Machines and Horizontal Injection Molding Machines); Secondary process (Ultrasonic Welding, Pad Printing, Silk Screen, Job Assembly, Hot Plate Welding, and Others); Sales Channel (Direct and Distributor); Industry (Automotive, Electronics and Telecommunication, Healthcare, Packaging, Aerospace, Food & Beverage, Construction, Consumer Goods, and Others); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: 02-Apr-2024 | | Report ID: AA0424805

Market Scenario

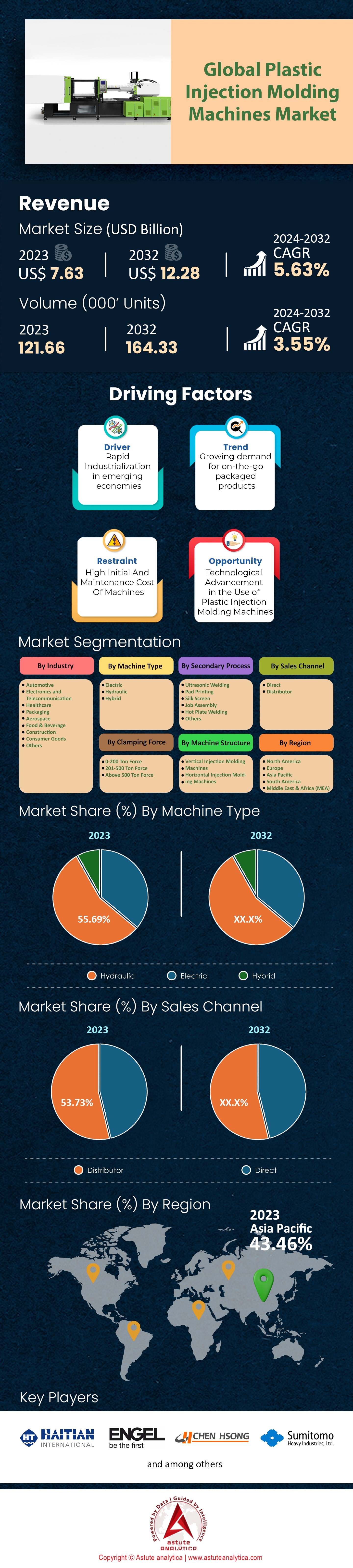

Global plastic injection molding machines market was valued at US$ 7.63 billion in 2023 and is projected to hit the market valuation of US$ 12.28 billion by 2032 at a CAGR of 5.63% during the forecast period 2024–2032.

The plastic injection molding machines market is in the midst of a booming period. Between an increased demand for these machines and rapid tech innovation, this industry is experiencing lucrative growth. Companies are finding more uses for injection molded plastics as well, especially in the automotive industry which is ditching metal for lighter components that save on fuel. A huge part of this trend are multi-material injection molding machines. These devices can inject multiple materials into one mold, making it easy to build parts that feature different properties or just have a better design overall. It sounds complicated but it really just streamlines the injection process which makes everything easier.

COVID-19 had some effects here too. A lot of companies wanted to be less reliant on foreign providers to avoid future hiccups in supply chains. To achieve this, they moved production back stateside or nearshored them to Mexico. There's also been an emphasis on sustainability recently with many companies in the plastic injection molding machines market deploying biodegradable and recyclable plastics like PLA and bio-PET. For those who care more about energy efficiency, all-electric injection molding machines are growing more popular as well. They're not only greener but also cheaper thanks to lower operating costs. These machines involve injecting melted plastic into a custom mold where it hardens into shape without sacrificing strength. These parts are also found all over the medical field where rigid plastics can create life-saving tools like implantable devices or simple disposable items like syringes.

Looking ahead, artificial intelligence (AI) and robotics will completely revolutionize manufacturing across all industries — and plastic molds aren’t excluded from this amazing advancement! AI is expected to optimize mold designs, predict when maintenance will be needed and adjust processes based on what produces high-quality parts that last a long time. Robots are getting in on this action too. They can handle the manufacturing process from start to finish, which will make it easier to hit mass production and improve overall quality control. The plastic components that are being built into these robots also have some benefits of their own such as cost-effectiveness and lighter weight.

To Get more Insights, Request A Free Sample

Market Dynamics

Trend: The Rise of All-Electric Injection Molding Machines

The plastic injection molding machines markets is shifting toward all-electric machines at an unprecedented rate. Energy efficiency, precision, and sustainability have become the driving forces in this transition. In comparison to hydraulic machines, all-electric models boast up to 70% energy savings, lower noise levels, and better repeated reliability. This technology can maintain a repeatability of +/- 0.1mm, which translates to consistent quality across parts and less waste from scrapped materials. The global demand for all-electric machines has surged and is expected to reach $4.48 billion by 2032 at a CAGR of 57.5%. As they continue being adopted across automotive, medical and consumer goods industries.

Nypro is a key player in the global contract manufacturing and they’ve been quick to hop aboard the electric machine train in the plastic injection molding machines market. Investing heavily into these new products has paid off for them so far with claims that energy consumption dropped by half while productivity increased by 20%. Meanwhile Tessy Plastics has over one hundred electric machines installed across their New York facilities alone as of now. They cite improved preciseness, faster cycle times, reduced maintenance requirements as some benefits worth mentioning while also noting the reduced carbon footprint since adopting this technology. With more companies catching on expect these sustainable advancements to keep shaping the industry's future in plastic manufacturing.

Driver: Automotive Industry's Shift from Metal to Plastic Components

The plastic injection molding industry is rapidly growing, thanks to the help of the automotive industry. With lighter options and cheaper prices, manufacturers are replacing their metal parts with plastics. The need for better fuel efficiency, lower emissions, and a more enhanced vehicle performance has prompted this shift. A report by Astute Analytica states that the automotive plastic market will reach $96.1 billion by 2032. The demand for lighter vehicles, regulations on emissions, and advancements in technology have led the plastic injection molding machines market to some extent further. Take a look at plastic fuel tanks for instance. Plastic tanks are lighter than metal ones. They don’t rust like metal either and they’re cheaper to produce. General Motors has already adopted this new trend, using them in both Chevrolet Malibus and Cadillac CT6s. This switch alone saved weight in both cars which then improved their overall fuel efficiency.

Another example would be car interiors. Using plastic injection molding on multiple interior parts can help automakers create complex designs while still being visually appealing. BMW uses a high-performance plastic called CFRP (carbon fiber reinforced plastic) in its i3 electric vehicle to reduce weight and improve overall car performance. Lightweight materials will always be a priority in the automotive industry which means there will always be room for growth in industries such as injection molding.

Challenge: Shortage of Skilled Labor in the United States

In the United States, the plastic injection molding machines market faces a huge challenge: there aren’t enough skilled workers. As a whole, the industry has outpaced itself in growth and demand for technicians, engineers, and operators. Now, every company is struggling to find talent fast enough to keep up with production. According to a survey done by the American Mold Builders Association (AMBA), 97% of mold builders said that workforce development is their top problem right now. The survey also revealed that on average, skilled mold makers are about 50 years old—signifying an aging workforce and the lack of younger professionals entering the field.

There’s more than one reason behind this shortage of skilled labor though. There seems to be a general lack of awareness on career opportunities in the injection molding sector as well as training programs and competition from other industries altogether. A report from the Manufacturing Institute states that by 2030, the US will face a shortage of 2.1 million skilled workers in manufacturing alone. While today these companies in the plastic injection molding machines market struggle to meet their demand for skilled labors, others actually see it as an investment opportunity. RJG Inc., who provides training services for injection molding, has teamed up with several community colleges to offer specialized courses in injection molding technology. Additionally, there’s Seitz LLC—based in Illinois—who implemented an apprenticeship program not too long ago which combines classroom instruction with on-the-job training.

Segmental Analysis

By Machine Type

The plastic injection molding machines market has three big categories: electric, hydraulic, and hybrid machines. As of 2023, hydraulic machines still have the stranglehold on the market. Their reputation for high injection pressure and cost-effectiveness has carried them this far, and will do so further in the future. With a reliable performance rate that can handle a range of materials and part sizes, it’s no wonder they hold around 55% of the global plastic injection molding machine market share. With a robust design that allows for high clamping forces and injection pressures, hydraulic machines are fit to make large, complex parts with thick walls. Take Flex Ltd., for example. They’re completely dependent on hydraulics to make automotive components, medical devices, consumer electronics and more. And according to them, it’s because these machines continuously produce quality parts at a low cost. Berry Global also uses hydraulic injection molding machines to make packaging products like bottles and jars in the plastic injection molding machines market. They say their reliability is unmatched when meeting the demands of the packaging industry.

Since electric machines are more efficient than hydraulic ones (with higher energy efficiency), many companies are beginning to integrate them in their processes - especially considering electric machine suppliers are targeting high-growth applications. Despite the dominance of hydraulic machines, electric injection molding machines are gaining ground, with a projected CAGR of 5.75% in the years to come.

By Clamping Force

The plastic injection molding machines market is segmented by clamping force, with different tonnage ranges categorizing machines. In the year 2023, the category that held more than 52.97% of the market share was pressed down on by the 201–500-ton force. It worked to serve a wide range of applications and industries. With its ability to create medium to large parts with complex geometries, it’s versatile and can be used in various areas. This clamping force range is ideal for things like manufacturing automotive components, home appliances, and medical devices. A company that uses this specific machine is Magna International which is a global automotive supplier. They use it for their bumpers, instrument panels, and door panels.

These machines provide the necessary clamping force in the plastic injection molding machines market to ensure the consistent production of high-quality parts that are dimensionally accurate. Whirlpool Corporation also employs injection molding machines in this same range (201-500 tons) to produce parts for its refrigerators, washers and dishwashers. By using these machines, they can efficiently produce large and durable parts which matters when considering how much daily wear these products go through. Additionally, Becton Dickinson and Company (BD), which operates in the medical industry, relies on 201–500-ton injection molding machines to manufacture many different medical devices such as syringes and IV catheters. The precision and consistency offered by these machines are critical in ensuring the safety and reliability of medical products.

By Machine Structure

In the dynamic world of plastic injection molding machines market, horizontal injection molding machines have solidified their spot-on top in 2023 with a whopping 75.33% market revenue contribution. These machines are now holding most of the market because of their versatility, efficiency, and ability to cater to different use cases across various industries. Horizontal injection molding machines are designed with the clamping unit and injection unit arranged in a horizontal configuration. This layout offers several advantages, including easier access to the mold area, simplified automation integration, and more efficient use of floor space. In fact, horizontal machines can save up to 50% of the floor space compared to their vertical counterparts, making them an attractive option for manufacturers with limited factory space.

One industry that has widely embraced horizontal injection molding machines across the global plastic injection molding machines market is the automotive sector. A couple examples include Toyota and Volkswagen they rely on these machines to produce a plethora of vehicle components, from bumpers and dashboards to door panels and engine covers. The high clamping force and injection speed of horizontal machines enable the production of large complex parts while still maintaining excellent surface finish and dimensional accuracy. In 2023 alone, the automotive industry accounted for over 30% global plastic injection molding machine market share. The packaging industry is also using these types of machines heavily. Companies like Amcor and Berry Global are both adopting this technology in order to manufacture a wide variety of packaging products such as bottles, jars, containers you name it! One thing that sets these two uses cases apart is how well-suited Horizontal machines are for high-volume production runs which are pretty common when dealing with packaging material production.

By Industry

The automotive industry has taken the lead in the plastic injection molding machines market by contributing more than 28.21% revenue share. This is largely due to the growing demand for plastic components in vehicles, which are way lighter than their metal counterparts. A 10% reduction in vehicle weight can improve fuel economy between 6-8%, meaning a lot of cash saved on gas. So, it’s no wonder that automakers have chosen to tap into that potential. Plus, its versatility means it can be used to create intricate parts with high precision and consistency, two things which are always important when it comes to making cars. Automotive manufacturers also prefer them due to how much time and money they save on assembly costs by using this process. On average, modern cars contain around 30,000 parts. And roughly half of a vehicle’s total volume is made up of plastic. Combined with the ability to consolidate multiple parts into a single component and make more lightweight parts, this speeds up production considerably.

The electrifying trend towards self-driving cars has been accelerated in the past few years and moving away from fossil fuels requires light materials in to get car as far as possible without needing another charge or top off from gas. This adds more demand for these machines.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

The global plastic injection molding machines market is growing rapidly, with Asia Pacific leading the way. The region already accounts for over 43% of the world's plastic injection molding machine revenue and it's still growing. A number of factors have contributed to its success: its manufacturing sector is expanding quickly; foreign firms are flocking to the area and there’s a rising demand for plastic products across many industries. China alone has been responsible for much of Asia Pacific's growth – in 2023 its injection molding machine market was valued at $3.2bn. The country’s automotive, electronics and packaging sectors have all driven this demand. The Chinese government is also pushing hard with its "Made in China 2025" strategy, which has only increased adoption further.

ther countries in Asia Pacific are also seeing significant development within their own markets – India's is expected to grow at a CAGR of 6.5% from 2024 to 2032 as consumers become more reliant on plastic components in cars, healthcare products and consumer goods. Japan has long been associated with innovation, so it comes as little surprise that the country has spearheaded development when it comes to injection molding solutions.

Europe and North America are also major plastic injection molding machines market; they may be smaller than their Asian counterpart but they’re still significant players in the space — Europe is known for its commitment to sustainability and circular economy principles, so it’s adopted electric machinery that uses less energy and reduces carbon emissions as a result. Additionally, the region has strict regulations on waste management so manufacturers have started developing bio-based polymers that will biodegrade instead of clogging up landfill sites.

The North American market (and specifically the US) is fueled by the desire for lightweight plastics; companies want high-performance materials that won't weight them down when added to products like automobiles or healthcare devices. The US already possesses advanced manufacturing capabilities though many firms have sought overseas manufacturers due to the lower costs. However, a rising trend in the US has seen companies return their operations home to reduce risk and improve productivity.

Top Players in Global Plastic Injection Molding Machines Market

- Arburg GmbH & Co. KG

- Borche North America Inc.

- Chen Hsong Holdings Limited

- Dongshin Hydraulic Co. Ltd.

- Dr. Boy GmbH & Co. KG

- Engel Austria GmbH

- Fu Chun Shin Machinery Manufacture Co. Ltd.

- Haitian International Holdings Limited

- Hillenbrabd, Inc.

- Husky Injection Molding Systems

- Krauss Maffei Group

- Shibaura Machine Co Ltd.

- Sumitomo Heavy Industries

- The Japan Steel Works

- Ube Industries, Ltd.

- Other Prominent players

Market Segmentation Overview:

By Machine Type

- Electric

- Hydraulic

- Hybrid

By Clamping Type

- 0-200 Ton Force

- 201-500 Ton Force

- Above 500 Ton Force

By Machine Structure

- Vertical Injection Molding Machines

- Horizontal Injection Molding Machines

By Secondary Process

- Ultrasonic Welding

- Pad Printing

- Silk Screen

- Job Assembly

- Hot Plate Welding

- Others

By Sales Channel

- Direct

- Distributor

By Industry

- Automotive

- Electronics and Telecommunication

- Healthcare

- Packaging

- Aerospace

- Food & Beverage

- Construction

- Consumer Goods

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)