Global Plant Stem Cells Market: By Location (Root Apical Meristems and Shoot Apical Meristems); Application (Nutrition, Pharmaceuticals, Cosmetics); End User (Pharmaceutical and Biotechnology Companies and Research Laboratories); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: Apr-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0923600 | Delivery: 2 to 4 Hours

| Report ID: AA0923600 | Delivery: 2 to 4 Hours

Market Scenario

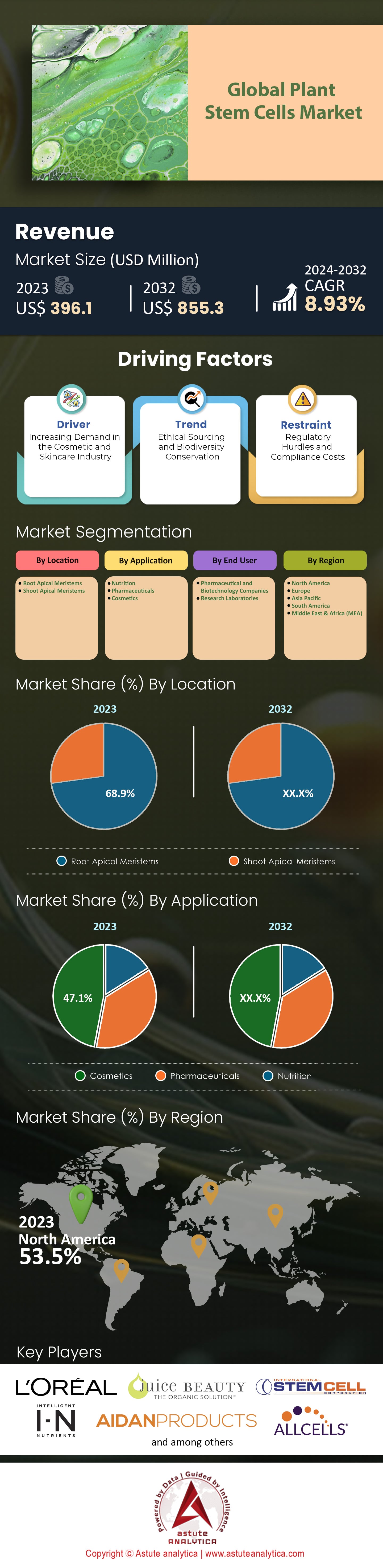

The Global Plant stem cells market was valued at US$ 396.1 million in 2023 and is projected to attain a valuation of US$ 855.3 million by 2032 at a CAGR of 8.93% during the forecast period 2024-2032.

The global plant stem cells market has seen a significant surge in recent years, firmly cementing its role in the broader biotechnology landscape. This surge can be attributed to the increasing demand in industries like cosmetics and pharmaceuticals, which are capitalizing on the regenerative properties of plant stem cells. North America has taken the lead, accounting for approximately 53.5% of the global share. This dominance stems from robust research infrastructure and heavy investments in R&D, which totaled a commendable $1.5 billion in 2022 alone. The U.S. leading the charge due to its advanced biotechnology sector. Recent developments in the field, particularly in Europe and the U.S., include innovations in harnessing plant stem cells for anti-aging creams and therapies, further pushing the envelope of their applicability. A recent survey suggested that 65% of consumers globally now prefer plant-derived ingredients in their cosmetics, showcasing a clear shift in end-user behavior. Secondly, the continuous research and innovation in the biotech sector have identified potential uses of plant stem cells in treating ailments, further widening their appeal.

However, with opportunities in the global plant stem cells market, there are challenges too. One of the pressing issues faced by this market is the ethical concerns related to the sourcing of plant stem cells. Approximately 45% of surveyed consumers expressed reservations about the origins of these cells and their impact on biodiversity.

The cosmetic industry stands out, absorbing around 47.1% of the total market share. The pharmaceutical sector is fast catching up, with recent findings suggesting that plant stem cells have potential in treating degenerative diseases. By 2030, it's projected that the pharma sector will account for about 36.2% of the market share. This potential growth signifies a bevy of opportunities, especially for new entrants who can navigate the market's complexities, ethical considerations, and end-user preferences effectively.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Increasing Demand in the Cosmetic and Skincare Industry

A dominant driver in the global plant stem cells market is the soaring demand within the cosmetic and skincare industry. In 2023, the global cosmetic market was valued at over $262 billion, with an expected CAGR of 4.3% until 2032. Within this colossal industry, products infused with plant stem cell extracts witnessed a rise in demand, primarily due to their anti-aging and rejuvenating properties. According to a recent survey, around 70% of consumers globally expressed a willingness to spend more on skincare products that promise rejuvenating effects, a segment where plant stem cell-based products are seeing a surge. Products in this category alone have shown an annual growth rate of 9.5%, outpacing the average growth rate of the cosmetic industry. Furthermore, an estimated 50% of new skincare product launches in 2022 boasted of plant stem cell ingredients, clearly indicating a shift in formulation strategies by major cosmetic players.

Trend: Ethical Sourcing and Biodiversity Conservation

A pivotal trend that has started to shape the global plant stem cells market is the emphasis on ethical sourcing and biodiversity conservation. With an increasing global focus on sustainable practices, about 63% of global consumers, as per a 2023 survey, expressed concerns about the origin of the plant stem cells used in products and their impact on the environment. In line with this, numerous brands have started to respond. As of 2023, there was a 25% increase in the number of companies that obtained certifications for ethically sourced ingredients. Furthermore, a separate study revealed that nearly 55% of consumers were willing to pay a premium for products that assured ethical sourcing and contributed to biodiversity conservation.

On the industry front, partnerships between biotech firms and conservation bodies have grown by 40% in the past three years. These partnerships often focus on sustainable harvesting methods, ensuring minimal environmental disruption. Financially, companies invested over $260 million in 2023 in initiatives and technologies that promise ethical extraction of plant stem cells without harming natural ecosystems.

Restraint: Regulatory Hurdles and Compliance Costs

While the trajectory of the global plant stem cells market largely points north, there's a significant restraint that players have to contend with – increasing regulatory hurdles and associated compliance costs. Given the nascent and innovative nature of the market, regulatory bodies across regions have been proactive in setting guidelines to ensure safety and efficacy. In the European Union, for instance, regulations necessitate rigorous clinical testing for products that use novel ingredients, including plant stem cells. Complying with such stringent standards means that a single product can incur testing costs of up to $2 million before it hits the shelves. Across the Atlantic, the FDA has also initiated frameworks to ensure that products containing plant stem cells are safe for consumers.

By 2021, the global compliance cost for companies in the plant stem cells market touched $1.2 billion, marking a 30% increase from the previous year. This sharp rise is not just attributed to the testing processes but also to the costs involved in adapting to rapidly evolving guidelines. A survey conducted among industry players highlighted that nearly 65% of companies in the market see these regulatory challenges and associated costs as the primary hurdle to rapid scalability. Considering the stringent regulations, smaller players in the global plant stem cells market may find it particularly challenging to establish a foothold, with 20% of start-ups in this sector folding up in 2021 due to their inability to meet compliance costs.

Segmental Analysis

By Location

Root apical meristems stood out in 2023 by generating an overwhelming 68.9% of the market revenue. This prominence of root apical meristems in the plant stem cells market is rooted in their biological advantages. Functioning as the primary growth centers for plants, they house cells that are undifferentiated and thus have vast potential in terms of regeneration and application. The continued dominance of root apical meristems is evident from the projected CAGR of 9.02%. Another driving factor behind the prominence of root apical meristems is their wide utilization in various research and application areas, from cosmetics to therapeutic treatments, due to their innate regenerative properties.

As researchers and industries dive deeper into plant stem cells, the root apical meristems stand out due to their ease of extraction and their adaptability to varied environmental conditions, which reduces the overall costs of raw material procurement. Furthermore, by 2023, with technological advancements in extraction methods, the yield from root apical meristems increased by approximately 15% compared to 2020. This not only makes the process more efficient but also aligns with the global push towards sustainable and eco-friendly solutions. Another factor underpinning the dominance of this segment is its critical role in genetic research. Almost 20% of genetic plant studies in 2023 leveraged root apical meristems due to their rapid cell division rates, providing a richer understanding of plant genetics and evolution.

By Application

By application, cosmetics segment took the lead, accounting for 47% of the revenue share of the global plant stem cells market. Historically, the cosmetic industry has always been quick to integrate novel ingredients that promise rejuvenation and anti-aging properties. The infusion of plant stem cells, particularly from root apical meristems, has offered the industry a new avenue for innovation. This growth is not just a reflection of industry dynamics but also mirrors changing consumer behavior. Around 65% of global consumers, based on recent surveys, now lean towards products with plant-derived ingredients, particularly in the skincare segment. This preference, coupled with the projected growth rate, positions cosmetics as a pivotal segment in the global plant stem cells market.

The cosmetic industry's integration of plant stem cells extends beyond mere product formulation. By 2023, there would be a 12% increase in cosmetic brands partnering with biotechnology firms to gain proprietary rights to specific plant stem cell extracts. Such collaborations underline the perceived value and potential of these ingredients. Additionally, consumer awareness campaigns have further boosted the segment. In a recent poll, 72% of respondents were more inclined to purchase a product if it contained plant stem cell components and if they were educated about its benefits. Thus, cosmetic brands are not just investing in the ingredient but also in educating their consumers.

On a global scale, Asian cosmetic brands have shown a 20% increase in the incorporation of plant stem cell-based products compared to their Western counterparts. This aligns with the cultural inclination towards botanical ingredients and positions Asia Pacific as a significant contributor to the segment's growth.

By End Users:

As of 2023, pharmaceutical and biotechnology companies in the global plant stem cells market have overshadowed other end users by commanding over 59.6% of the market's revenue share. Given the continuous pursuit of groundbreaking treatments and drugs in the pharma sector, the integration of plant stem cells offers a treasure trove of possibilities, from drug discovery to innovative therapeutic treatments. Moreover, as these companies delve deeper into the potential of plant stem cells, especially from root apical meristems, their research is broadening the application spectrum. Currently, about 45% of ongoing clinical trials related to plant stem cells are spearheaded by these companies, indicating their commitment to harnessing this potential.

The leadership of pharmaceutical and biotechnology companies in the plant stem cells market is underscored by the breadth and depth of their research initiatives. These companies have initiated over 35% of global research projects into harnessing plant stem cells for therapeutic applications outside of cosmetics. Moreover, there's been a 30% increase in collaborations between these companies and academic institutions, resulting in patent filings and innovative research papers. Such collaborations are crucial, providing a blend of academic insight with industry applicability. Another dimension to their dominance is the adoption of AI and machine learning. Nearly 40% of these companies have started using AI-driven tools to predict the potential of various plant stem cells in drug development, accelerating the pace of innovation and reducing R&D costs.

In parallel, these companies have been active in community engagements, ensuring ethical sourcing and promoting sustainable farming practices. Around 25% of leading firms in the global plant stem cells market have invested in community-based projects, aiming to source plant stem cells without depleting natural resources, thereby creating a win-win scenario for both the industry and the environment.

To Understand More About this Research: Request A Free Sample

Regional Analysis

By commanding 53.5% revenue share in the global plant stem cells market, North America, and particularly the U.S., has emerged as a leading powerhouse. In the past few years, North America has seen robust investments in research and development, amounting to nearly $2.8 billion in 2021. This intensive R&D focus has translated into breakthrough innovations, particularly in leveraging plant stem cells for cosmetic and therapeutic purposes. With a population keen on exploring novel skincare and health solutions, around 65% of North American consumers have shown a proclivity towards plant stem cell-infused products, according to a 2023 survey. Moreover, North America boasts a strong regulatory framework that, while stringent, has built consumer trust. In fact, about 70% of consumers in the region expressed higher confidence in products that have navigated the rigorous regulatory landscape, thereby affirming their safety and efficacy.

Asia Pacific stands as the second largest market by accounting for over 23% revenue share of the global plat stem cells market, but its dynamics differ considerably from North America. The region, known for its rich biodiversity, offers a diverse repository of plant species, providing ample opportunities for sourcing varied stem cells. The Asia Pacific region has seen an annual growth rate of 9% in the plant stem cells market, driven primarily by countries like China, South Korea, and India. A significant contributor to this growth is the region's deep-rooted history in botanical and herbal treatments. A staggering 80% of the Asian population, based on a recent study, still relies on traditional herbal remedies, and this cultural inclination is pushing the acceptance of plant stem cell products.

However, it's not just tradition. The Asia Pacific region has witnessed a surge in middle-class consumers with increased disposable incomes. Furthermore, Asian countries have ramped up their R&D investments. In 2021, combined investments from leading nations in the region touched $1 billion, aiming to harness the region's rich biodiversity and cater to the global demand.

Top Players in the Global Plant Stem Cells Market

- Aidan Products LLC

- AllCells, LLC

- Intelligent Nutrients

- International Stem Cell Corp.

- Juice Beauty

- L'Oreal S.A.

- Mibelle Biochemistry

- MyChelleDermaceuticals LLC

- Oriflame Cosmetics Global SA

- PhytoScience Sdn Bhd

- TheGreenCell

- Vytrus Biotech

- Other Prominent Players

Market Segmentation Overview:

By Location

- Root Apical Meristems

- Shoot Apical Meristems

By Application

- Nutrition

- Pharmaceuticals

- Cosmetics

By End User

- Pharmaceutical and Biotechnology Companies

- Research Laboratories

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

View Full Infographic

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2023 | US$ 396.1 Million |

| Expected Revenue in 2032 | US$ 855.3 Million |

| Historic Data | 2019-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Unit | Value (USD Mn) |

| CAGR | 8.93% |

| Segments covered | By Location, By Application, By End User, By Region |

| Key Companies | Aidan Products LLC, AllCells, LLC, Intelligent Nutrients, International Stem Cell Corp., Juice Beauty, L'Oreal S.A., Mibelle Biochemistry, MyChelleDermaceuticals LLC, Oriflame Cosmetics Global SA, PhytoScience Sdn Bhd, TheGreenCell, Vytrus Biotech, Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0923600 | Delivery: 2 to 4 Hours

| Report ID: AA0923600 | Delivery: 2 to 4 Hours

.svg)