Philippines Tea Shop Market: By Product Type (Bubble/Boba Tea, White Tea, Yellow Tea, Green Tea, Black Tea, Pu-erh Tea, Oolong Tea, Others); Category (Hot and Cold); Packaging (Cups (Paper and Plastic), Cans, Bottles (Glass, PET, Others), Others); Price Range (Regular, Premium, Ultra-Premium)— Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: 21-Sep-2024 | | Report ID: AA0924927

Market Scenario

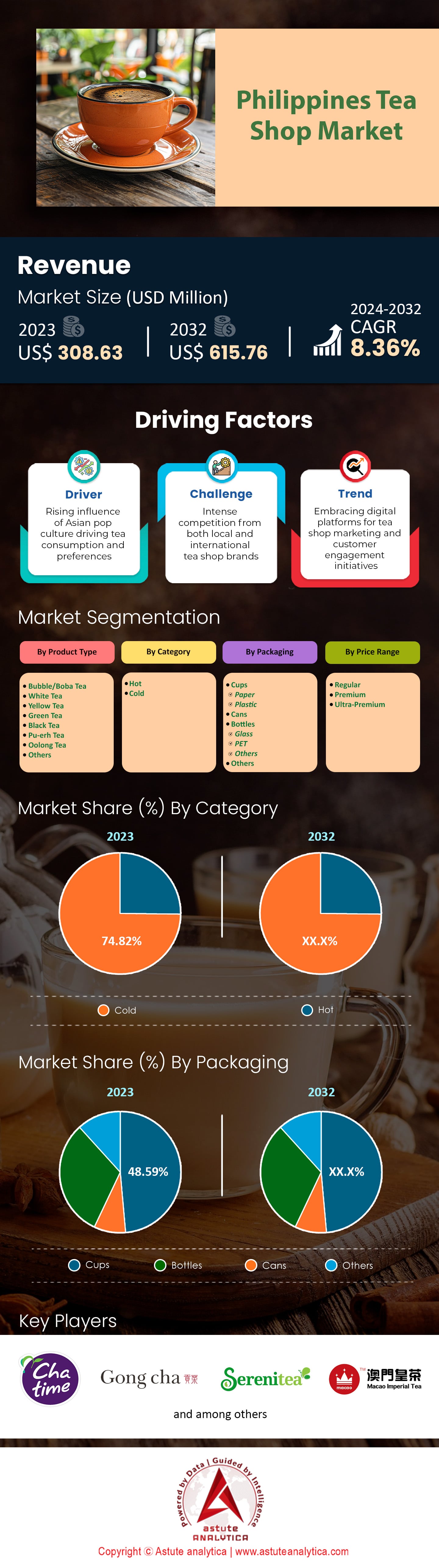

Philippines tea shop market was valued at US$ 308.63 million in 2023 and is projected to hit the market valuation of US$ 615.76 million by 2032 at a CAGR of 8.36% during the forecast period 2024–2032.

Tea consumption in the Philippines has been on a steady rise in recent years, fueled by shifting consumer preferences and a growing health consciousness among Filipinos. While traditionally a coffee-drinking nation, the Philippines has seen a significant increase in tea popularity, particularly among younger demographics. This shift is attributed to the introduction of a variety of tea flavors and the influence of international tea trends, leading to an expansion of the tea market. Ready-to-drink (RTD) teas and specialty teas have gained substantial traction, reflecting the consumers' desire for convenient yet healthy beverage options.

The distribution of tea through tea shops has played a pivotal role in growth of the tea shop market in the Philippines. As of 2023, it is estimated that there are over 2,000 tea shops nationwide, a significant increase from previous years. These establishments range from international franchises to local brands, offering a wide array of products from traditional brews to innovative bubble tea creations. Tea shops have become essential hubs for socialization, especially among the youth, contributing to approximately 35% of total tea sales in the country. The bubble tea phenomenon, in particular, has been a major driver, with milk tea sales accounting for a significant portion of the revenue in these shops.

Consumer behavior in the Philippines tea shop market shows a strong inclination towards personalized and experiential tea consumption. Around 80% of tea consumers prefer customization, selecting from various tea bases, sugar levels, and add-ons like pearls or jelly. Health trends have also influenced purchasing decisions, with a 15% increase in demand for herbal and green teas noted in recent years. Brands such as Chatime, Gong Cha, Serenitea, and Macao Imperial Tea have capitalized on these preferences, expanding their presence to over 1,500 outlets collectively. Social media remains a powerful tool, with 70% of consumers discovering new tea brands and flavors through platforms like Facebook and Instagram. Additionally, the integration of online delivery services has boosted accessibility, leading to a 25% increase in online tea sales in 2023 compared to the previous year. This dynamic market continues to evolve, driven by innovative brands and the ever-changing tastes of Filipino consumers.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Rising influence of Asian pop culture driving tea consumption and preferences

The Philippines has seen a tremendous surge in the influence of Asian pop culture, notably from countries like South Korea, Japan, and China, which has significantly impacted the tea shop market. The Korean Wave, or Hallyu, has played a pivotal role in this shift, with Korean dramas, music, and celebrities becoming household names. In 2023, the Philippines ranked as the 6th largest consumer of Korean pop music, with over 50 million views on major streaming platforms. Additionally, the popularity of Korean dramas has led to an increase in cultural curiosity, with more than 1.5 million Filipinos attending Korean culture festivals annually. This cultural fascination has extended into food and beverages, with Korean-style tea drinks gaining significant traction. The number of Korean-themed tea shops has increased by 30% in Manila alone, highlighting this growing trend. Japanese anime and manga have also been influential, with over 22 million Filipinos actively following anime series. This has led to a rise in Japanese-style tea beverages, such as matcha lattes, being offered in local tea shops. Furthermore, the influence of Asian pop culture can be seen in the 5 million Filipinos who have joined online communities dedicated to discussing Asian media and trends. With over 2,000 Asian-themed tea shops now operating in the Philippines, this driver continues to reshape the market landscape.

Trend: Embracing digital platforms for tea shop marketing and customer engagement initiatives

In recent years, the Philippine tea shop market has increasingly embraced digital platforms for marketing and customer engagement, driven by the rapid digitalization of the country. With over 89 million internet users as of 2023, the digital space offers a vast audience for tea shops to tap into. Social media platforms, particularly Facebook and Instagram, are popular marketing tools, with 74 million and 67 million users in the Philippines, respectively. Tea shops are leveraging these platforms to showcase their offerings, with over 10,000 posts tagged with #PhilippineMilkTea every day. Additionally, the rise of food delivery services has facilitated the growth of online sales, with tea shops reporting over 30 million orders through delivery apps annually. Online reviews have become crucial for businesses, as 8 out of 10 Filipino consumers check reviews before visiting a tea shop. Moreover, loyalty programs and promotions via mobile apps have gained traction, with nearly 5 million Filipinos using such apps for discounts and rewards. Virtual events and live streaming have also become popular engagement tools, with over 500 tea-related live streams hosted monthly. The digital trend has further expanded with the integration of cashless payment systems, utilized by 20 million users in the country. This trend underscores the importance of digital platforms in shaping the future of the tea shop industry in the Philippines.

Challenge: Intense competition from both local and international tea shop brands

The Philippine tea shop market faces intense competition, both from local and international brands, creating a challenging landscape for businesses. As of 2023, there are over 5,000 tea shops operating across the country, with new entrants consistently emerging. Major international brands like Gong Cha and Chatime have established a strong presence, with over 250 and 150 outlets nationwide, respectively. Meanwhile, local brands are also expanding rapidly, with Macao Imperial Tea opening its 200th store in 2023. This saturation has led to fierce competition for prime locations, particularly in urban areas like Metro Manila, where over 3,000 tea shops are concentrated. Additionally, the market has seen a diversification of offerings, with shops introducing over 100 new flavors and variants annually to attract customers. Despite the competition, the tea shop market remains lucrative, with projected revenues of 45 billion PHP in 2024. However, this growth also brings challenges, as businesses must continually innovate to retain customer interest. The entry of foreign brands has increased the pressure on local shops to maintain competitive pricing, with many offering promotions to attract the 65 million Filipino tea drinkers. Furthermore, the competitive landscape has led to increased marketing expenditures, with brands spending over 1 billion PHP on advertising annually. Navigating this intense competition is crucial for the sustainability and success of tea shops in the Philippines.

Segmental Analysis

By Type

When it comes to the type of tea, bubble tea/ boba tea is making a strong prominence in the Philippines tea shop market by generating more than 36.85% market share. Bubble tea, also known as boba tea, has become a cultural phenomenon in the Philippines, driven by a combination of factors that appeal to a wide demographic. The drink's versatility in flavors and customizable options, such as varying sugar levels and tapioca pearl sizes, cater to diverse consumer preferences. Initially targeting the financially-able market, bubble tea has expanded its reach, becoming a staple among younger consumers who are drawn to its novelty and social media appeal. The drink's popularity is further fueled by its association with Asian pop culture, which is highly influential in the Philippines. As of 2023, the bubble tea market in the Philippines is characterized by a vibrant mix of local and international brands, with over 1,500 bubble tea shops operating nationwide. The average Filipino consumes bubble tea at least twice a week, and the market is projected to grow by 15% annually over the next five years.

Market players in the Philippines tea shop market are actively catering to this growing segment by innovating their offerings and expanding their presence. Major brands like Gong Cha and Chatime have introduced loyalty programs and seasonal flavors to maintain consumer interest. The affordability of bubble tea, with prices ranging from 50 to 150 PHP, makes it accessible to a broad audience. Additionally, the rise of delivery apps has made bubble tea more convenient to purchase, contributing to its widespread consumption. In 2023, the bubble tea industry in the Philippines generated approximately 45 billion PHP in revenue, with tapioca pearls being the most popular add-on, followed by pudding and jelly. The market's growth is also supported by the increasing number of health-conscious consumers opting for reduced sugar and dairy-free options. This adaptability to consumer trends ensures that bubble tea remains a dominant force in the Philippine beverage market.

By Category

Based on category, the cold tea segment is leading the Philippines' tea shop market by capturing more than 74.82% market share, which can be largely attributed to the country's tropical climate, which naturally inclines consumers toward refreshing and cooling beverages. With average daily temperatures often reaching 30°C (86°F), cold tea offers a refreshing respite from the heat. This preference is reflected in the market, where sales of cold tea have consistently outperformed hot tea offerings. In 2023, reports indicate that over 80 million liters of cold tea were consumed, a figure that dwarfs the 18 million liters of hot tea consumed in the same period. The proliferation of tea shops offering diverse flavors and customizable cold tea options has also played a significant role. There are over 1,500 tea shops across the country, with a majority offering innovative cold tea varieties that cater to local tastes, such as calamansi and pandan-infused teas.

Consumer behavior trends in the tea shop market further underscore this preference. Filipino millennials, who form a significant portion of the consumer base, are particularly drawn to cold tea due to its versatility and the ability to personalize their drinks with various toppings and flavors. In 2023, cold tea with tapioca pearls, or bubble tea, saw an impressive 150 new product launches, highlighting its popularity. Furthermore, social media has amplified trends, with over 2 million posts tagged under #ColdTeaPH, indicating the beverage's cultural penetration and appeal. The convenience factor cannot be overlooked either; with a busy urban lifestyle, ready-to-drink cold tea products have seen a sharp rise in sales, with over 30 new brands entering the market in the past year alone. This shift towards cold tea is not just a passing trend but a reflection of evolving consumer preferences that prioritize convenience, customization, and climate-appropriate choices.

By Packaging

The Philippines' tea shop market has seen a significant shift towards packaging tea in cups, a trend that has captured over 48% of the market share. This preference is driven by several key factors that align with consumer behaviors and market dynamics. Wherein, the convenience offered by cup packaging is unmatched. With urbanization on the rise, more Filipinos are seeking quick and easy options for their tea consumption. The population in urban areas has reached over 58 million, with a notable increase in the working demographic who prefer grab-and-go solutions. Additionally, the rise of delivery services, which have seen a 30% increase in usage over the past year, complements the practicality of cup-packaged tea. This packaging is also highly adaptable to the growing trend of customization, allowing consumers to easily modify their drinks with various toppings and flavors—an option now available in over 2,000 tea shops nationwide.

Moreover, environmental concerns and sustainability have become pivotal in the consumer decision-making process in the country’s tea shop market. The Philippines has been actively working towards reducing plastic waste, with several cities implementing regulations that encourage the use of biodegradable materials. The tea industry has responded by adopting eco-friendly cup options, aligning with the country's environmental goals. This shift is supported by data showing that over 70% of consumers in the Philippines now prefer products with sustainable packaging. Furthermore, the cultural infusion of tea with local flavors, such as calamansi and pandan, has increased the demand for freshly brewed tea, best served in cups to maintain flavor integrity. With the tea consumption market growing by 15% annually and over 1,500 new tea flavors introduced in the past year alone, the preference for cup packaging is not only a matter of convenience and sustainability but also a reflection of the vibrant, evolving tea culture in the Philippines.

By Price

The dominance of regular-priced teas in the Philippine tea shop market can be attributed to a combination of economic and social factors that resonate deeply with the Filipino consumer base. Economically, the affordability of these beverages aligns with the average income levels in the country. As of 2023, the average daily wage for workers in the Philippines ranges from 373 to 537, depending on the region. This wage bracket means that discretionary spending is limited for a significant portion of the population. Regular-priced teas, which typically cost around 90 to 120 per serving, fit comfortably within the budget of many consumers, making them an accessible indulgence. Additionally, the proliferation of over 2,000 milk tea shops nationwide has increased competition, keeping prices within a range that is acceptable for the masses. The steady growth of the gig economy has also seen more young professionals and students with modest incomes seeking affordable yet enjoyable dining experiences, further fueling the demand for reasonably priced tea beverages.

Social factors play a crucial role in the popularity of regular-priced teas in the tea shop market. The Filipino youth, which accounts for a substantial segment of the population—with over 30 million individuals aged between 15 and 30—are particularly drawn to tea shops as social hubs. The rise of social media platforms, where posting about food and beverage experiences is commonplace, has amplified this trend. As of 2023, the Philippines remains one of the top countries in terms of social media usage, with an average of 4 hours spent daily on these platforms. Tea shops offer aesthetically pleasing environments that cater to the desire for shareable moments. Furthermore, the introduction of localized flavors, such as ube (purple yam) and pandan, has made these beverages more appealing by resonating with Filipino tastes. The cultural emphasis on communal experiences means that affordable tea shops become ideal venues for social gatherings. Nationwide, there are over 1,500 universities and colleges where student populations frequent nearby tea shops, boosting sales of regular-priced teas. The combination of cultural relevance, affordability, and social media influence has solidified the position of regular-priced teas as a staple in the everyday lives of many Filipinos.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Top Players in Philippines Tea Shop Market

- CHA TUK CHAK

- Chatime

- CoCo Fresh Tea & Juice

- Coolblog

- Fredley Group of Companies

- George Steuarts Philippines, Inc.

- Gong cha

- Infinitea Milktea

- KOI Thé

- Sharetea

- Tealive

- The Alley

- Tiger Sugar

- Tokyo Bubble Tea

- Xing Fu Tang

- Yi Fang

- Other Prominent Players

Market Segmentation Overview:

By Product Type

- Bubble/Boba Tea

- White Tea

- Yellow Tea

- Green Tea

- Black Tea

- Pu-erh Tea

- Oolong Tea

- Others

By Category

- Hot

- Cold

By Packaging

- Cups

- Paper

- Plastic

- Cans

- Bottles

- Glass

- PET

- Others

- Others

By Price Range

- Regular

- Premium

- Ultra-Premium

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)