Philippines Petroleum Market: By Form (Natural Gas, Condensate, and Crude Oil); Product (Fuel, Microcrystalline Wax, Napalm, and Others); Application (Transportation Fuels, Fuel Oils, Agriculture, Pharmaceuticals & Cosmetics, and Ohers); End User (Industrial, Residential, Commercial, and Others); Country —Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: Oct-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0222146 | Delivery: 2 to 4 Hours

| Report ID: AA0222146 | Delivery: 2 to 4 Hours

Market Scenario

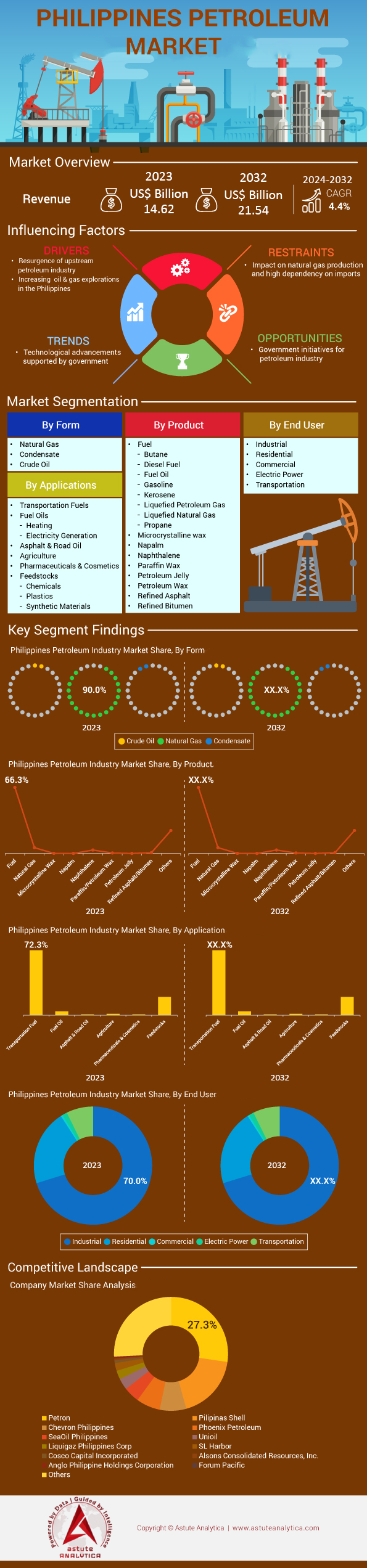

Philippines petroleum industry market revenue was valued at US$ 14.62 billion in 2023 and is estimated to reach US$ 21.54 billion by 2032 at a CAGR of 4.4% during the forecast period 2024-2032.

The Philippine petroleum industry is a crucial component of the nation's energy sector, predominantly characterized by its dependence on imported crude oil and petroleum products due to limited domestic production. The country's crude oil production in the petroleum industry market remains modest, averaging around 23,000 barrels per day, primarily from the Galoc oil field in the offshore Palawan basin. Major sites for petroleum activities include the Bataan Refinery operated by Petron Corporation, which has a refining capacity of 180,000 barrels per day, and various import terminals and storage facilities across the archipelago. Annually, the Philippines imports approximately 170 million barrels of crude oil and petroleum products to satisfy its energy requirements, with key suppliers being countries from the Middle East and neighboring Asian nations.

Demand for petroleum products across the Philippines petroleum industry market is propelled by robust economic growth, urbanization, and the expanding transportation sector. The nation's population reached about 112 million in 2023, leading to increased energy consumption. The number of registered vehicles surpassed 12 million units, significantly boosting gasoline and diesel demand. The aviation industry's recovery post-pandemic has escalated jet fuel consumption, with Ninoy Aquino International Airport handling over 47 million passengers annually. Industrial growth, infrastructure development projects, and widespread use of liquefied petroleum gas (LPG) for household cooking—utilized by over 20 million households—further fuel the demand. Key end-users include the transportation sector, industrial manufacturers, power generation facilities, and residential consumers of LPG.

The petroleum industry market's growth trajectory is ascending due to ongoing economic development and government initiatives aimed at enhancing energy security. The Department of Energy has been promoting exploration activities, resulting in the awarding of new petroleum service contracts and attracting investments exceeding $2 billion in 2023. The construction of new storage facilities increased the country's petroleum storage capacity to over 30 million barrels, improving supply chain efficiency. Anticipated infrastructure projects under the government's development agenda are expected to elevate petroleum demand further. The future outlook is cautiously optimistic, with projections estimating that petroleum demand could reach 200 million barrels annually by 2025. Efforts to explore untapped domestic reserves, particularly in the West Philippine Sea, where potential reserves are estimated at over 1 billion barrels of oil equivalent, are underway to reduce import dependence and strengthen energy security.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Economic Growth Fueling Increased Energy Demand Across Transportation and Industrial Sectors

The Philippines' robust economic expansion has significantly fueled increased energy demand, particularly within the transportation and industrial sectors. In 2023, the country's Gross Domestic Product (GDP) reached approximately $437.15 billion, indicating substantial economic activity. The industrial sector contributed around $120 billion to the GDP, reflecting heightened manufacturing and production processes that require vast energy inputs, predominantly from petroleum products, adding fuel to the petroleum industry market . The construction industry, bolstered by the government's infrastructure initiatives, accounted for over $30 billion of economic output, utilizing significant quantities of diesel and other petroleum fuels to power machinery and equipment on numerous projects nationwide.

Transportation remains a critical driver of petroleum consumption. As of 2023, there are over 12 million registered vehicles in the Philippines, including 8 million motorcycles, 3 million passenger cars, and 1 million commercial vehicles such as buses and trucks. These vehicles collectively consume over 80 million barrels of fuel annually, underscoring the sector's substantial demand for gasoline and diesel. The aviation industry's resurgence post-pandemic has further escalated energy needs in the petroleum industry market , with the Ninoy Aquino International Airport handling over 47 million passengers annually, leading to a jet fuel consumption of approximately 15 million barrels per year. The maritime sector, essential for inter-island connectivity in the archipelagic nation, uses considerable amounts of bunker fuel, with domestic shipping moving over 100 million metric tons of cargo annually.

Industrial growth has also amplified energy requirements. Key industries such as electronics manufacturing, which exported goods worth $40 billion in 2023, and the food processing sector, valued at $25 billion, rely heavily on petroleum products for both energy and as raw material inputs. The increasing number of industrial parks, totaling over 300 nationwide, houses thousands of factories and production facilities that cumulatively consume vast amounts of energy in the petroleum industry market . The agriculture sector, contributing $35 billion to the economy, utilizes petroleum products for mechanized farming equipment and transportation of goods. Overall, economic growth across these sectors has driven petroleum demand to approximately 180 million barrels annually, highlighting the critical role of the petroleum industry in supporting the nation’s development.

Trend: Expansion of Petroleum Storage Capacities Enhancing Supply Chain Efficiency and Reliability

In response to escalating energy demands and to bolster supply chain resilience, the Philippines has been actively expanding its petroleum storage capacities. As of 2023, the country increased its total storage capacity to over 52,397 thousand barrels (MB) across 181 storage facilities, distributed strategically across various regions. Notable developments in the petroleum industry market include the establishment of a new storage terminal in Subic Bay with a capacity of 5 million barrels, enhancing the import and distribution efficiency for Luzon, the nation's largest island. Petron Corporation augmented its Bataan Refinery storage by 2 million barrels, supporting its refining output of 180,000 barrels per day and ensuring a steady supply to its extensive retail network of over 2,400 service stations.

The government, cognizant of the need for energy security, allocated $500 million in 2023 for public-private partnerships aimed at constructing additional storage facilities. These investments aim to create a buffer stock equivalent to 30 days of national consumption, approximately 15 million barrels, to mitigate risks associated with supply disruptions. Shell Pilipinas expanded its Tabangao facility in Batangas by 1.5 million barrels, while Phoenix Petroleum increased its Davao storage capacity to 1 million barrels, facilitating efficient fuel distribution in the southern regions’s petroleum industry market.

Advancements in storage infrastructure, incorporating state-of-the-art technology for inventory management and safety, have been a priority. Automation and real-time monitoring systems have been implemented in over 80% of the new storage facilities, enhancing operational efficiency. The expansion trend also supports compliance with international environmental and safety standards, with over $200 million invested in facility upgrades to reduce emissions and prevent spills. The increased storage capacity not only ensures a more reliable fuel supply chain but also positions the Philippines as a potential strategic energy hub in Southeast Asia, capable of handling increased trade volumes and emergency stockpiling.

Challenge: Heavy Reliance on Imported Oil Posing Supply Security and Price Volatility Risks

The Philippines' heavy reliance on imported oil remains a significant challenge to the petroleum industry market , posing risks to supply security and exposing the economy to global price volatility. In 2023, the country imported approximately 3,476 ML, equivalent to an increase of 23.7% vis-à-vis YTD June 2022 volume of 2,811 ML and finished petroleum products to meet domestic demand, spending over $15 billion on these imports. Major suppliers include Saudi Arabia, providing around 80 million barrels, and Kuwait, contributing 40 million barrels, making the Philippines susceptible to geopolitical tensions in the Middle East. The balance of imports comes from neighboring countries like Malaysia and Indonesia, supplying collectively 30 million barrels, and from Russia, with imports totaling 20 million barrels despite global market complexities.

This dependency on foreign oil subjects the Philippines to international market fluctuations. For instance, when global crude oil prices peaked at $100 per barrel in early 2023 due to supply constraints and geopolitical events, domestic fuel prices surged in the petroleum industry market , impacting transportation costs and inflation rates. The national inflation rate reached 6.5% in mid-2023, partly driven by increased fuel prices affecting consumer goods and services. The transportation sector, which consumes over 80 million barrels of fuel annually, felt the immediate impact, with public transport fares rising and logistics costs increasing for businesses.

Efforts to reduce import reliance face hurdles. Domestic crude oil production is minimal, averaging 23,000 barrels per day, primarily from the Galoc oil field in Palawan, which produced 8 million barrels in 2023. Exploration activities have been limited, with only three new petroleum service contracts awarded in 2023, attracting investments of $2 billion but facing operational challenges due to technical difficulties and territorial disputes in potential resource areas like the West Philippine Sea. Additionally, the lack of refining capacity—evident after the closure of Shell's Tabangao refinery in 2020—means the country imports significant volumes of finished petroleum products in the petroleum industry market , about 60 million barrels annually. These factors collectively underscore the challenge of supply security and the necessity for diversified energy strategies, including the development of renewable energy sources and increased energy efficiency measures to mitigate the risks associated with heavy import dependence.

Segmental Analysis

By Form

The Philippines' petroleum industry market is predominantly led by crude oil with 90.6% market share due to its significant role in powering the nation's transportation and industrial sectors. As of 2023, the country produces a modest amount of crude oil domestically, averaging around 23,000 barrels per day. This production comes primarily from the Galoc oil field, which is the largest oil-producing field in the country. However, domestic production falls short of meeting the national demand, necessitating substantial imports to bridge the gap.

In 2023, the Philippines consumes approximately 455,000 barrels of oil per day, highlighting a heavy reliance on imported crude oil to satisfy its energy needs. The country imports about 432,000 barrels of crude oil daily. Major exporters to the Philippines petroleum industry market include Saudi Arabia, which supplies around 30% of the imports, followed by Kuwait, the United Arab Emirates, and Russia. The Bataan Refinery, the largest in the country with a capacity of 180,000 barrels per day, plays a crucial role in processing these imports to produce fuels and other petroleum products.

Several key factors drive the higher demand for crude oil over other petroleum products in the petroleum industry market like natural gas and condensate. The transportation sector is a primary consumer, with over 12 million registered vehicles as of 2023 requiring gasoline and diesel derived from crude oil. Additionally, the industrial sector relies on crude oil for manufacturing processes and electricity generation, with oil-fired power plants contributing to the energy mix. The lack of extensive natural gas infrastructure limits the use of alternative energy sources. Moreover, the established distribution network of over 1,200 fuel retail stations facilitates easy access to crude oil products, reinforcing their dominance in the market. The continuous economic growth, projected to push the GDP beyond $400 billion in 2023, further escalates the demand for energy, predominantly met by crude oil.

By Application

When it comes to the application of petroleum products in the Philippines' petroleum industry market, transportation fuel stands as the most significant and dominant aspect with over 72.3% market share. The transportation sector is integral to the archipelagic nation's economy, facilitating commerce, trade, and the movement of people across its more than 7,600 islands. As of 2023, the number of registered motor vehicles in the Philippines surpassed 12 million, reflecting a steady increase in vehicle ownership driven by economic growth and urbanization. The expansion of public transportation systems, including buses and jeepneys, and the rise of app-based ride-hailing services have further amplified fuel consumption. Additionally, domestic tourism has boomed—with over 120 million domestic tourists reported in 2023—escalating the demand for transportation fuel, particularly gasoline and diesel.

Infrastructure development is another significant driver of transportation fuel dominance in the petroleum industry market . The Philippine government's "Build, Build, Build" program, with an allocation exceeding ₱5 trillion from 2017 to 2023, has led to the construction of roads, bridges, and airports, stimulating vehicular traffic and fuel usage. The aviation industry has also seen substantial growth, with the Ninoy Aquino International Airport handling over 55 million passengers in 2023, necessitating higher consumption of aviation fuel. The maritime sector remains vital, with more than 25 million metric tons of goods transported via domestic shipping routes annually, relying heavily on marine fuel oil. Moreover, the public utility vehicle modernization program aims to replace over 200,000 old jeepneys with more efficient models, impacting fuel dynamics.

The country's reliance on imported petroleum products to meet its energy needs underscores transportation fuel's dominance in the petroleum industry market . In 2023, the Philippines imported approximately 170 million barrels of crude oil and refined petroleum products to satisfy domestic demand. The energy sector's focus on supporting transportation aligns with government policies aimed at economic development and poverty reduction. The proliferation of logistics and delivery services, particularly amidst the e-commerce boom—with the industry valued at over $14 billion in 2023—has led to increased fuel consumption. Additionally, the adoption of hybrid vehicles is on the rise, with over 10,000 units sold in 2023, slightly altering fuel consumption patterns but still contributing to overall demand. Collectively, these factors cement transportation fuel's role as the most significant aspect of the Philippine petroleum market.

By Products

The Philippines petroleum industry market is predominantly led by fuel products such as gasoline, diesel, and liquefied petroleum gas (LPG). In 2023, the fuel segment held over 66.3% market share. This dominance is attributed to the country's growing transportation sector, industrialization, and increasing energy needs of a rising population. As of 2023, the Philippines consumes approximately 500,000 barrels of oil per day, making it one of the largest oil consumers in Southeast Asia. The demand for gasoline and diesel is particularly high, with the transport sector consuming around 44.7 million barrels of gasoline and an equal amount of diesel annually. The country's limited domestic oil production, which stands at about 25,000 barrels per day, necessitates the importation of significant quantities of crude oil and refined petroleum products to meet its energy requirements.

Fuel production in the Philippines is primarily focused on refining imported crude oil through its existing refineries, such as the Petron Bataan Refinery, which has a capacity of 180,000 barrels per day. Despite this, local production cannot keep pace with consumption. In 2023, the country imported over 150 million barrels of crude oil and finished petroleum products to bridge the supply-demand gap. Natural gas consumption has also increased, especially for power generation, with the Malampaya gas field supplying about 400 million cubic feet per day. However, the depletion of this field in the petroleum industry market has raised concerns, leading to increased interest in importing liquefied natural gas (LNG) to supplement domestic supply.

Several factors drive the high demand for fuel in the Philippines. The transportation sector is rapidly expanding, with over 12 million registered vehicles on the road in 2023, including around 7 million motorcycles and 3 million passenger cars. The booming automotive industry and inadequate public transportation infrastructure have led to a reliance on personal vehicles, thereby increasing fuel consumption. Industrial growth has also contributed, with manufacturing sectors requiring diesel for machinery and generators. Additionally, the growing middle class and urbanization have led to higher energy consumption for household and commercial activities, increasing the demand for LPG for cooking and heating purposes.

By End Users

The transportation sector in the Philippines petroleum industry market is the primary consumer of petroleum products, accounting for more than 70.4% of the market share. This dominance is driven by the country's rapid urbanization and economic growth. As of 2023, the Philippines has over 12 million registered vehicles, and this number continues to grow annually. The extensive use of motorcycles is notable, with over 7 million units on the roads, reflecting the reliance on personal transport due to inadequate public transportation infrastructure.

The public transportation system heavily depends on petroleum products. There are approximately 200,000 jeepneys—the iconic Filipino mode of transport—that consume significant amounts of diesel daily. Buses also play a crucial role, with around 35,000 units operating nationwide to cater to the commuting needs of millions. The burgeoning ride-hailing industry contributes to petroleum consumption as well, with companies like Grab and Angkas facilitating over 2 million trips each day. Maritime and aviation sectors further amplify the transportation sector's petroleum demand in the petroleum industry market . The country has over 10,000 registered sea vessels, including ferries and cargo ships, which are vital for inter-island connectivity and trade. The aviation industry is expanding, with major airlines like Philippine Airlines and Cebu Pacific operating a combined fleet of over 150 aircraft, requiring substantial quantities of jet fuel. Additionally, the logistics and delivery services sector has seen a surge, especially with the growth of e-commerce; over 5,000 delivery trucks and countless smaller vehicles are operational to meet consumer demand.

The agricultural sector also indirectly influences petroleum consumption in transportation. With over 5 million hectares of agricultural land, the movement of agricultural goods relies heavily on fuel-powered vehicles. The continued dependence on road transport for freight movement underscores the transportation sector's pivotal role in petroleum consumption. Collectively, these factors contribute to the sector's leading position in the Philippine petroleum industry market.

To Understand More About this Research: Request A Free Sample

Top Companies in Philippines Petroleum Market:

- Alcorn (Production) Philippines, Inc.

- Alsons Consolidated Resources, Inc

- Altisima Energy, Inc

- Anglo-Philippine Oil & Mining Corporation

- Coplex Resources Nl

- Forum Exploration, Inc.

- Nido Petroleum Philippines Pty. Ltd.

- Novus Petroleum Limited

Market Segmentation Overview:

By Form:

- Natural Gas

- Condensate

- Crude Oil

By Product:

- Fuel

- Butane

- Diesel fuel

- Fuel oil

- Gasoline

- Kerosene

- Liquefied petroleum gas

- Liquefied natural gas

- Propane

- Microcrystalline wax

- Napalm

- Naphthalene

- Paraffin wax

- Petroleum jelly

- Petroleum wax

- Refined asphalt

- Refined bitumen

By Application:

- Transportation fuels

- Fuel oils

- Heating

- Electricity generation

- Asphalt and road oil

- Agriculture

- Pharmaceuticals and Cosmetics

- Feedstocks

- Chemicals

- Plastics

- Synthetic materials

By End User:

- Industrial

- Residential

- Commercial

- Electric Power

- Transportation

View Full Infographic

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2023 | US$ 24.62 Bn |

| Expected Revenue in 2032 | US$ 21.54 Bn |

| Historic Data | 2019-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Unit | Value (USD Bn) |

| CAGR | 4.4% |

| Segments covered | By Type, Application, and Region |

| Key Companies | Cosco Capital Incorporated, Forum Pacific, Inc., Novus Petroleum Ltd., Conoco Phillips, and other prominent players. |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0222146 | Delivery: 2 to 4 Hours

| Report ID: AA0222146 | Delivery: 2 to 4 Hours

.svg)