Philippines Chain Restaurant Market: Product (Beverages (Tea and Others) and Food); Restaurants Type (QSRs, Fine Dining, Others)— Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: 21-Sep-2024 | | Report ID: AA0924929

Market Scenario

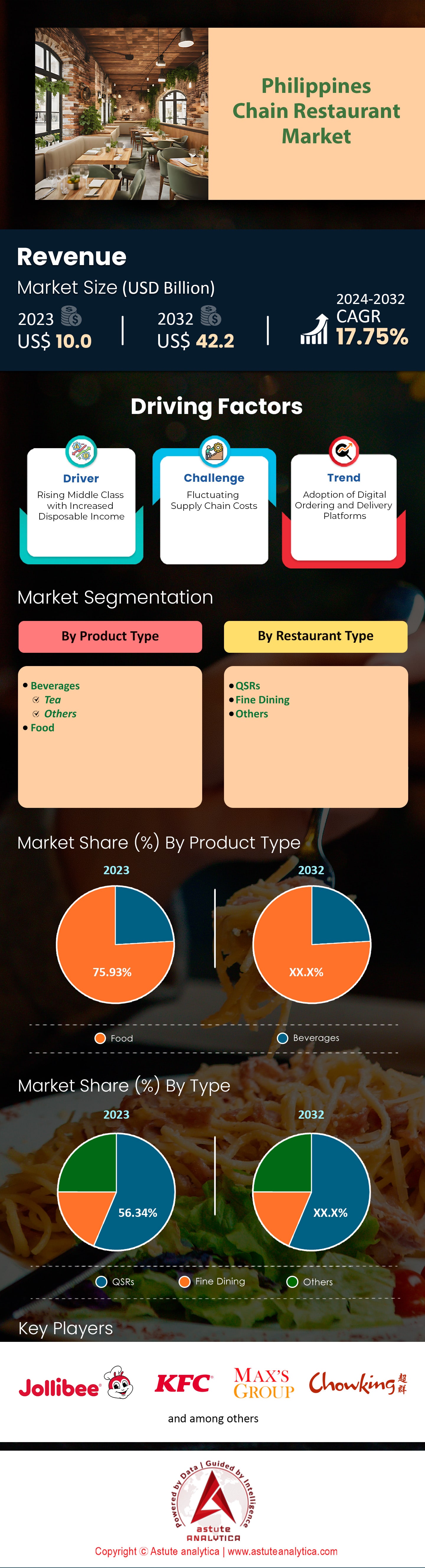

Philippines chain restaurant market was valued at US$ 10.0 billion in 2023 and is projected to hit the market valuation of US$ 42.2 billion by 2032 at a CAGR of 17.75% during the forecast period 2024–2032.

The chain restaurant market in the Philippines is experiencing significant growth in 2023, bolstered by a robust economy and increasing consumer spending on dining out. The industry has seen a notable expansion, with a rising number of outlets established across the nation. Major urban centers like Metro Manila, Cebu, and Davao have become hotspots for new chain restaurant openings, reflecting the strong demand in these areas. The market's value has reached impressive levels, indicating substantial investment and confidence from both local and international players. Notably, several international brands have entered the Philippine market in 2023, enhancing the diversity of dining options available to consumers.

Major types of chain restaurants flourishing in the country include fast-food outlets, casual dining restaurants, coffee shops, and specialty cuisine chains. Fast-food chains remain dominant in the chain restaurant market, with local giants like Jollibee Foods Corporation operating thousands of outlets under various brands nationwide. International fast-food chains such as McDonald's and KFC have also expanded their presence, catering to the convenience-driven preferences of modern consumers. Casual dining restaurants like Max's Restaurant and Shakey's Pizza provide family-friendly environments and have grown their footprints in key cities and provinces. The coffee shop segment has witnessed significant growth, with global brands like Starbucks and local establishments expanding their number of stores to meet the rising coffee culture among Filipinos. Specialty cuisine chains, offering Korean, Japanese, and other international flavors, have gained popularity, reflecting the evolving palates of Filipino consumers and their desire for diverse culinary experiences.

Consumer demand driving the growth of chain restaurant market in the Philippines. The expanding middle class, estimated to include millions of individuals with higher disposable incomes, has increased the frequency of dining out and exploring new food options. Urbanization has led to the development of numerous new shopping malls and commercial centers in 2023, providing prime locations for restaurant expansions. The cultural importance of food as a means of socialization encourages Filipinos to dine out regularly with family and friends. Additionally, the proliferation of food delivery services and mobile apps has made it more convenient for consumers to access their favourite chain restaurants, further boosting the industry's reach. These factors collectively contribute to the sustained growth and dynamism of the chain restaurant market in the Philippines.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Rising Middle Class with Increased Disposable Income

The rise of the middle class in the Philippines is a pivotal factor in the expansion of restaurant chains. As of the latest figures, there are approximately 12 million middle-class households in the country, with projections indicating an addition of 2 million by 2030. These households have an average annual income of 324,000 PHP, with disposable income often directed towards dining and lifestyle experiences. The food service sector is a significant contributor to the economy, with a valuation of 1.4 trillion PHP. In Metro Manila alone, there are over 23,000 dining establishments, with an average of 1,000 new restaurants opening each year. The sector's growth is also evidenced by the 5,600 food and beverage service enterprises registered in 2023. On a broader scale, the Philippines has seen 50 new international restaurant brands entering the market in the past year. Furthermore, a survey indicated that approximately 15 million Filipinos dine out at least once a week, driving the demand for diverse culinary options.

This burgeoning middle class has not only spurred domestic investment but also attracted global giants in the Philippines chain restaurant market. With urbanization accelerating, cities like Cebu and Davao are witnessing a restaurant boom, with 1,500 new venues launched annually. The average spend per dining experience is around 500 PHP, reflecting the willingness to indulge in quality food. The influx of international chains has led to increased competition, pushing local players to innovate and expand. The tourism industry, which sees an influx of 8 million visitors annually, further supports the restaurant sector. This growth trajectory is poised to continue, with the middle class's sustained rise offering a stable customer base for both local and international restaurant chains.

Trend: Adoption of Digital Ordering and Delivery Platforms

The digital transformation in the Philippines' chain restaurant market is revolutionizing consumer interaction. With 60 million downloads of food delivery apps like GrabFood and FoodPanda, the demand for digital services is evident. These platforms handle up to 500,000 daily transactions, reflecting the convenience-seeking behavior of consumers. The country has 89 million internet users, many of whom prefer digital solutions for everyday tasks, including food ordering. The digital payment ecosystem supports this trend, with 45 million e-wallet accounts facilitating seamless transactions. As a result, 80% of restaurant chains have incorporated online ordering systems, adapting to changing consumer preferences.

This shift in the chain restaurant market has led to reduced foot traffic in physical establishments, with about 70% of consumers opting for online orders over dine-in experiences. The rise of cloud kitchens, which cater solely to delivery orders, has been noteworthy, with 450 new facilities operating nationwide. The number of delivery drivers has increased to 150,000, ensuring efficient service across urban and suburban areas. Restaurants are also leveraging technology for customer engagement, with virtual loyalty programs attracting 10 million members. The digital shift not only enhances convenience but also opens avenues for data-driven marketing strategies, allowing restaurants to personalize offerings. This trend is set to grow, driven by technological advancements and evolving consumer behavior, reshaping the future of the restaurant industry in the Philippines.

Challenge: Fluctuating Supply Chain Costs

Supply chain volatility is a significant challenge for Philippine chain restaurant market, impacting pricing and profitability. The cost of staple ingredients like rice and pork has seen notable increases, with rice priced at 50 PHP per kilogram and pork at 300 PHP per kilogram. These fluctuations have prompted 40% of restaurants to revise their menus to maintain economic viability. The logistics sector faces its challenges, with fuel prices reaching 70 PHP per liter, directly affecting delivery expenses. The devaluation of the Philippine peso, now at 56 PHP to the US dollar, has raised import costs for international ingredients, crucial for diverse menu offerings.

In 2023, the country imported 50 million metric tons of key food items, highlighting its reliance on global supply chains. Thus, heavily influencing the chain restaurant market growth. Natural calamities, such as typhoons, have further disrupted local agricultural production, leading to a 20% reduction in fresh vegetable availability. In response, 500 restaurants have formed partnerships with local farms to ensure a steady supply chain. Despite these efforts, inflation remains a pressing issue, with rates impacting overall operational costs. These factors have collectively led to a decline in profit margins, with some establishments reporting a 15% drop in net income. Navigating these challenges requires strategic planning and innovation, with many restaurants exploring cost-effective sourcing and supply chain optimization to sustain their operations.

Emerging Trends in the Philippines Chain Restaurant Market

The Philippines chain restaurant market is currently experiencing several transformative trends. One significant trend is the increasing consumer demand for healthier food options. This shift is driven by a growing awareness of health and wellness, prompting restaurants to offer more nutritious menu items. In 2023, the number of restaurants offering plant-based menu items increased by 150 establishments. Additionally, sustainability is becoming a crucial focus, with many chains adopting eco-friendly practices, evidenced by 200 restaurants transitioning to biodegradable packaging. The integration of technology is another major trend, as restaurants implement digital ordering systems and AI to enhance customer experience, with over 2,500 outlets now offering mobile app ordering services. These trends are reshaping the market landscape, pushing chains to innovate and adapt to changing consumer preferences.

Fast Food Chains' Strategic Responses

In response to these burgeoning trends in the Philippines chain restaurant market, fast food chains in the Philippines are actively diversifying their menus to include healthier options, such as salads and plant-based meals. This aligns with the global movement towards healthier eating habits, with chains reporting a 30% increase in demand for low-calorie items. Chains are also embracing sustainability by minimizing waste and using eco-friendly packaging, appealing to environmentally conscious consumers, with 100 outlets reducing plastic usage by 50%. Furthermore, technology plays a pivotal role in their strategy, with many chains enhancing their digital presence through mobile apps and online ordering systems. These initiatives have led to an increase of 500,000 app downloads in the past year, improving customer convenience and helping chains stay competitive in a rapidly evolving market.

The impact of these trends is evident in several key statistics. The Philippines' food service industry is projected to grow significantly, with sales reaching a record $15 billion in 2023. The adoption of digital solutions has led to a notable rise in online food delivery services, with a 40% increase in delivery orders. Additionally, the focus on sustainability has resulted in a 25% increase in restaurants implementing eco-friendly practices. The number of consumers using digital payment methods has risen to 5 million, highlighting the shift towards technology-driven convenience. These statistics underscore the dynamic nature of the Philippines chain restaurant market and highlight the strategic responses of fast food chains to maintain their competitive edge.

Segmental Analysis

By Product Type

Food chains in the Philippines chain restaurant market is leading the way with market share of 75.93% due to the cultural significance and emotional connection that Filipinos have with certain brands, such as Jollibee, which is not just a fast-food chain but a cultural icon tied to many personal and family memories. This emotional attachment is a powerful driver of consumer preference. With Jollibee operating over 1,500 branches across the country and generating annual revenue exceeding $4 billion in 2023, it exemplifies the brand's stronghold in the market. Additionally, the convenience and affordability offered by food chains make them an attractive option for the busy urban lifestyle prevalent in the Philippines. The fast-paced growth of the restaurant and foodservice industry, with sales projected to exceed $1 trillion in 2024, indicates a robust market environment that supports the expansion of food chains. McDonald's, with its 700th store recently opened, and Chowking, maintaining over 600 outlets nationwide, further illustrate the extensive reach and popularity of these chains. Furthermore, the rise of health-conscious consumers has led many fast-food brands to innovate their menus, offering healthier options that appeal to a broader audience, with the number of fast-food chains offering plant-based menu options doubling since 2020.

Apart from this, the strategic location of outlets in high-traffic areas, coupled with aggressive marketing campaigns, ensures high visibility and accessibility in the chain restaurant market. The integration of technology, such as online food delivery platforms, has expanded consumer reach and convenience, allowing customers to order from a wide array of restaurants. As of 2023, online food delivery services have reached over 10 million active users, with an average of 500,000 delivery orders daily. Market players are also adapting to changing consumer preferences by offering localized menu items that cater to Filipino tastes, a strategy employed successfully by Jollibee. Additionally, the economic landscape, characterized by a growing middle class with increased disposable income, supports the expansion of food chains, including 50 new food chain entries this year alone. The total number of registered food establishments in the Philippines now exceeds 100,000, providing employment to an estimated 1 million Filipinos in the fast-food industry. As the restaurant industry continues to evolve, brands are focusing on sustainability and ethical sourcing to appeal to environmentally conscious consumers, ensuring the continued dominance of food chains in the Philippine market.

By Type

In the Philippines, Quick Service Restaurants (QSRs) have become the cornerstone of the chain restaurant market, driven by the country's fast-paced urban lifestyle and increasing consumer demand for convenience. The bustling urban centers, particularly Metro Manila, host over 7,000 QSR outlets, reflecting the need for quick, affordable dining options that cater to a growing middle-class population. Key players like Jollibee, McDonald’s, and KFC dominate the landscape, with Jollibee alone boasting over 1,500 outlets nationwide. This prevalence underscores the brand's deep cultural resonance and adaptability to local tastes, offering dishes that blend Western fast food with Filipino flavors. Additionally, the expansion of delivery apps has facilitated the reach of QSRs, with food delivery transactions surpassing 200 million in 2023. The increasing number of dual-income households, estimated at over 12 million, further fuels the demand for quick meal solutions, as families seek convenient options amidst their busy schedules.

The rise of digital connectivity in the Philippines chain restaurant market, with over 90 million internet users as of 2023, has significantly influenced consumer behavior, with a substantial portion of QSR sales now occurring online. This digital shift is complemented by the growing trend of cashless payments, supported by over 28 million e-wallet users, enhancing the efficiency and appeal of QSRs. Furthermore, the QSR industry has adapted to health-conscious trends by introducing plant-based options and healthier meal choices, catering to the burgeoning wellness market which counts over 20 million health-conscious consumers. The emphasis on value for money remains a critical factor, with Filipinos spending an average of 30 minutes per meal, making QSRs an ideal choice for time-constrained individuals. The robust growth of the tourism sector, attracting over 8 million visitors annually, also bolsters the QSR industry, as these establishments offer a familiar and quick dining experience for tourists.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Top Players in Philippines Chain Restaurant Market

- Bigg's Diner

- Caffe La Tea

- Gallery by Chele

- Jollibee

- Mang Inasal Philippines, Inc.

- Starbucks Corporation

- Tapa King

- Toyo Eatery

- Wolfgang Steakhouse PH

- Other Prominent Players

Market Segmentation Overview:

By Product Type

- Beverages

- Tea

- Others

- Food

By Restaurant Type

- QSRs

- Fine Dining

- Others

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)