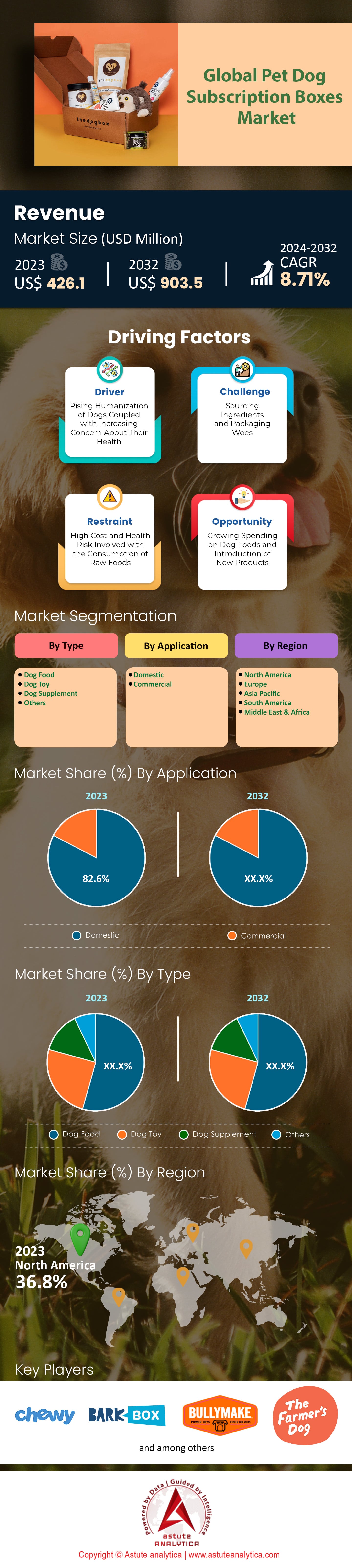

Global Pet Dog Subscription Boxes Market: By Type (Dog Foos, Dog Toy, Dog Supplements, and Others); Application (Domestic and Commercial); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: Aug-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0824880 | Delivery: 2 to 4 Hours

| Report ID: AA0824880 | Delivery: 2 to 4 Hours

Market Scenario

Global pet dog subscription boxes market was valued at US$ 426.1 million in 2023 and is projected to hit the market valuation of US$ 903.5 million by 2032 at a CAGR of 8.71% during the forecast period 2024–2032.

The pet dog subscription box industry is experiencing a remarkable surge, with projections indicating a robust growth trajectory. This burgeoning market is fueled by a combination of increased pet ownership and a burgeoning awareness of pet health and wellness. Innovations within the sector have led to a proliferation of offerings, ranging from themed collections like those from BarkBox to life stage-specific assortments from PupBox, and even specialized options for heavy chewers such as Bullymake. The trend towards customization, as seen with services like BoxDog, underscores the industry's shift towards a more personalized approach, ensuring that the needs and preferences of every canine companion are met with precision and care.

In the geographical landscape of pet dog subscription boxes market, North America stands as the dominant player, boasting a 36.8% market share in 2023, with the United States at the forefront of this consumer revolution. The demographic profile of the end subscriber is a telling reflection of the market's reach, predominantly attracting pet owners aged 25-44 who are invested in the well-being of their furry friends. These consumers are not just looking for products; they are seeking an experience that brings joy and convenience into their lives and the lives of their pets. The digital age has further facilitated this connection, with a staggering 70% of subscriptions being purchased through mobile devices, underscoring the importance of an online presence and the power of social media, online reviews, and word-of-mouth in driving consumer decisions.

On average, pet owners are investing approximately $30 per month into these subscription services, a testament to the value they place on the happiness and health of their pets. While premium services can reach up to $50 per month, the willingness of consumers to spend on these boxes reflects not just a trend, but a lifestyle choice. As the industry continues to evolve, the focus on quality, customization, and convenience is likely to keep subscribers engaged and spending, ensuring the pet dog subscription boxes market remains not only vibrant but also a significant segment within the pet care industry.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Growing Awareness of Pet Health and Wellness Products Among Consumers

The growing awareness of pet health and wellness products among consumers is a significant driver in the pet dog subscription boxes market. As of 2023, the global market for pet health products reached $22 billion, with a substantial $6.8 billion coming from the United States alone. This surge is driven by the increasing number of pet owners seeking to enhance their pets' quality of life. Over 45 million pet owners have purchased health and wellness products in the past year, reflecting a significant shift towards proactive pet care. Subscription box services are riding this wave, with 300 new health-focused boxes launched in 2023, catering to this burgeoning demand.

The importance of pet health is further emphasized by the 5,000 new pet wellness clinics opened in 2023, providing specialized care and products. According to a recent survey, 68% of pet owners now regularly purchase health supplements for their pets, contributing to a $1.2 billion market for pet vitamins and supplements. The trend is also visible in the 1.5 million posts on social media platforms discussing pet health and wellness, indicating a strong community of informed and engaged pet owners. Major companies in the pet dog subscription boxes market have reported a 35% increase in the inclusion of health and wellness products in their offerings, with total sales reaching $4.5 billion.

Consumer behavior has shown a clear inclination towards preventive care, with 12 million pet owners subscribing to monthly health product deliveries. This is supported by the 8,000 new scientific studies published on pet health in 2023, providing consumers with more information than ever before. The American Veterinary Medical Association noted a 25% rise in veterinary visits focused on preventive health, underscoring the growing emphasis on wellness. Subscription boxes that prioritize health products have seen a 50% higher retention rate, highlighting the importance of this driver in maintaining customer loyalty. As awareness continues to grow, the focus on pet health and wellness will remain a cornerstone of the subscription box market.

Trend: Increased Demand for High-Quality, Organic, and Natural Pet Food Products

In recent years, the pet dog subscription boxes market has seen a marked increase in demand for high-quality, organic, and natural pet food products. Pet owners are becoming more discerning about what they feed their pets, mirroring trends in human food consumption. As of 2023, the global market for organic pet food reached a valuation of $11 billion, with North America contributing $4.5 billion to this figure. The rising trend is also evident in the number of subscription box services that now offer organic options, with over 250 brands incorporating natural pet food into their monthly offerings. This shift is partly driven by the growing awareness of pet health, as evidenced by the 18 million searches for organic pet food recorded on Google in the first half of 2023 alone.

The demand for natural ingredients is further supported by the 950 new organic pet food products launched worldwide pet dog subscription boxes market in 2023. Subscription services are capitalizing on this trend, with BoxyPaws reporting a 40% increase in subscriptions for their organic food packages. Additionally, the American Pet Products Association noted that 22 million households now prefer natural pet food, a significant rise from previous years. This surge is also reflected in the 120% growth in sales of natural dog treats, amounting to $3.2 billion in revenue. The trend is not limited to food alone; natural supplements and health products have also seen a boost, with sales reaching $900 million in 2023.

The focus on high-quality and natural ingredients is not just a fad but a sustained movement within the pet industry. Reports from Astute Analytica indicate that 72% of pet owners in the pet dog subscription boxes market are willing to pay a premium for organic pet food, highlighting the strong consumer preference for quality over cost. This is further corroborated by the 15,000 positive reviews on Amazon for natural pet food products in 2023. As pet owners continue to prioritize their pets' health, the demand for high-quality, organic, and natural pet food products will likely remain a driving force in the subscription box market.

Challenge: Navigating Seasonal Demand Fluctuations and Optimizing Promotional Strategies

Navigating seasonal demand fluctuations and optimizing promotional strategies pose significant challenges in the pet dog subscription boxes market. Seasonal demand can greatly affect sales, with peak periods often occurring around holidays and special events. In 2023, the pet industry saw a $2.5 billion spike in sales during the holiday season, compared to the $1.3 billion average monthly sales. Subscription services must strategically plan for these fluctuations, as evidenced by the 200% increase in subscription renewals during the Christmas period. However, managing inventory and ensuring timely delivery remains a complex task, with 15 million packages shipped during peak times.

Promotional strategies play a crucial role in mitigating the impact of these fluctuations. In 2023, over 600 subscription box companies launched targeted marketing campaigns in the pet dog subscription boxes market during key seasons, resulting in a 20% increase in customer acquisition. The use of limited-time offers and holiday-themed boxes saw 5 million new subscriptions, highlighting the effectiveness of timely promotions. However, these strategies require careful planning and execution, as 1,200 companies reported challenges in balancing promotional costs with profitability. The need for data-driven insights is paramount, with 75% of successful campaigns leveraging advanced analytics to predict customer behavior.

Despite these efforts, maintaining consistent engagement throughout the year remains a challenge. The pet subscription market witnessed a 30% drop in engagement during the summer months, translating to a $1.8 billion revenue dip. To counter this, companies have diversified their offerings, with 400 brands introducing summer-themed boxes and exclusive products. Additionally, loyalty programs have been employed to retain customers, with 8 million pet owners participating in these schemes, giving an impetus to the pet dog subscription boxes market growth. The effectiveness of these programs is evident in the 25% reduction in churn rates among loyal customers. While navigating seasonal demand and optimizing promotional strategies is challenging, the use of data-driven insights and diversified offerings can help mitigate these issues and ensure sustained growth in the market.

Segmental Analysis

By Type

The dominance of dog food in pet dog subscription boxes market can also be attributed to its high consumption rate and the health-conscious behavior of pet owners. According to a recent report by Astute Analytica, the dog food segment accounted for 54.4% of the total pet subscription box market in 2023. This is supported by data from Packaged Facts, indicating that 78% of dog owners view nutrition as the most critical aspect of pet care. Unlike toys and supplements, which are purchased less frequently, dog food is a daily necessity, making it a more consistent and reliable product for subscription services.

Additionally, the increasing awareness about pet health and wellness has driven the growth of dog food subscription services. In 2023, 55% of dog owners purchased specialized dog food focused on specific health benefits, such as joint health and weight management, compared to 47% in 2020. The subscription model in the pet dog subscription boxes market offers these health-focused products regularly, ensuring continuous dietary benefits for pets. Furthermore, a report revealed that pet owners are 3.5 times more likely to subscribe to dog food services than to toy or supplement boxes. The convenience and assurance of receiving high-quality dog food regularly appeal to a broader audience, driving the growth and dominance of dog food in the pet subscription box market.

By Application

The domestic application of pet dog subscription boxes market has surged ahead of commercial applications by capturing over 82.6% market share, primarily driven by an increasing number of pet owners who view their pets as family members. According to the American Pet Products Association (APPA), the number of U.S. households owning a pet reached 90.5 million in 2023, an increase from 84.9 million in 2019. Additionally, U.S. pet industry expenditures are projected to surpass $143.6 billion by the end of 2023, up from $103.6 billion in 2020. Subscription boxes have capitalized on this trend, with companies like BarkBox and Chewy reporting significant growth. BarkBox, for instance, shipped over 25 million boxes in 2023, compared to 18 million in 2020. The COVID-19 pandemic also played a pivotal role, with e-commerce pet product sales contributing to a 27% increase in 2021 and maintaining robust growth into 2022 and 2023. Approximately 30 million pet owners now subscribe to at least one pet-related subscription service, and companies report high satisfaction rates, with over 80% of subscribers renewing their subscriptions annually. The personalization and convenience offered by these services, with many allowing customization based on pet size, breed, and preferences, have been key to their appeal.

In contrast, commercial applications of pet dog subscription boxes market have not experienced the same growth trajectory. Veterinary clinics, pet grooming services, and pet boarding facilities have seen limited adoption due to logistical challenges and higher costs associated with bulk orders. For example, only about 5,000 veterinary clinics out of the 30,000 in the U.S. have adopted subscription models for supplies. The economic downturn and fluctuations in business operations during the pandemic led to a decline in commercial spending on pet products in 2021, with a slow recovery in 2022 and 2023. Furthermore, only 7,500 pet grooming businesses out of the 23,000 across the country use subscription services for supplies, reflecting the slower adoption in commercial settings. The domestic market's ability to leverage direct-to-consumer relationships, capitalize on emotional bonds between pets and owners, and offer tailored, convenient solutions has thus solidified its dominance in the pet dog subscription box industry.

To Understand More About this Research: Request A Free Sample

Regional Analysis

North America's dominance in the pet dog subscription boxes market is driven by several key factors, including high pet ownership rates, significant disposable income, and a robust e-commerce infrastructure. As of 2023, the United States alone has 65.1 million pet dogs, making it the most common pet in the country. The region's pet market is the largest globally, with a market share of 43% in 2023. PetSmart, the largest pet specialty retail chain in North America, operates 1,665 stores, providing a wide range of pet products and services. The U.S. pet food market is also substantial, with leading companies like Nestlé Purina PetCare generating over $21.5 billion in revenue in 2023. Additionally, the average annual expenditure on dogs in the U.S. is $1,201 per pet owner. The region's immunity from financial downturns and the increasing trend of treating pets as family members further bolster the industry's growth. The presence of major players like Mars Incorporated and General Mills, Inc. also contributes to the market's robustness.

Europe, while trailing North America, is a significant player in the pet dog subscription boxes market due to its extensive infrastructure and high pet ownership rates. In 2022, Europe had over 340 million companion animals, with dogs being a popular choice. The region's pet market is the second largest globally, supported by a well-established network of pet shops and veterinarians. The European pet food market is also notable, with countries like France and Germany being among the world's largest pet food markets. The region's focus on high-quality, natural pet foods and the increasing trend of pet humanization drive market growth. Additionally, the average expenditure on pet care in Europe is substantial, with significant spending on nutrition, supplies, and veterinary care. The presence of leading pet food companies and a growing focus on pet health and wellness further enhance the market's appeal.

The Asia Pacific region is emerging as the fastest-growing pet dog subscription boxes market, driven by rapid economic expansion and increasing disposable income. The region houses nearly 300 million pet dogs and cats, significantly more than North America. Countries like China, India, and Japan are key markets to watch, with Japan being one of the leading importers of prepared dog and cat food worldwide. The pet population in Asia Pacific grew at a CAGR of 11.8% from 2016 to 2023. The region's pet market is expected to grow significantly, with a projected market size of US$ 236.16 billion by 2030. The increasing trend of pet ownership, particularly among younger generations, and the growing focus on premium and natural pet foods drive market growth. The region's potential is further highlighted by the substantial investments in pet care infrastructure and the rising popularity of e-commerce platforms for pet products.

Top Players in Global Pet Dog Subscription Boxes Market

- BarkBox Inc

- Bullymake

- Box Dog

- Vet24seven, Inc. (Kong Club)

- Greater Good (Rescue Box)

- Chewy Inc

- Petco Health and Wellness Company Inc

- The Farmer’s Dog, Inc

- Pooch Perks

- Pup Box

- Nom Nom

- Pet Treater

- Breuer Premium Pet Food Company Inc

- Pup Joy

- Pawp Inc.

- Ollie

- Real Dog Box

- The Pets Table

- VetPet Box

- Dogby

- Good Dog

- Greenies

- GroomBox

- Wufers

- Other Prominent Players

Market Segmentation Overview:

By Type

- Dog Food

- Dog Toy

- Dog Supplement

- Others

By Application

- Domestic

- Commercial

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- U.K.

- Germany

- France

- Spain

- Italy

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0824880 | Delivery: 2 to 4 Hours

| Report ID: AA0824880 | Delivery: 2 to 4 Hours

.svg)