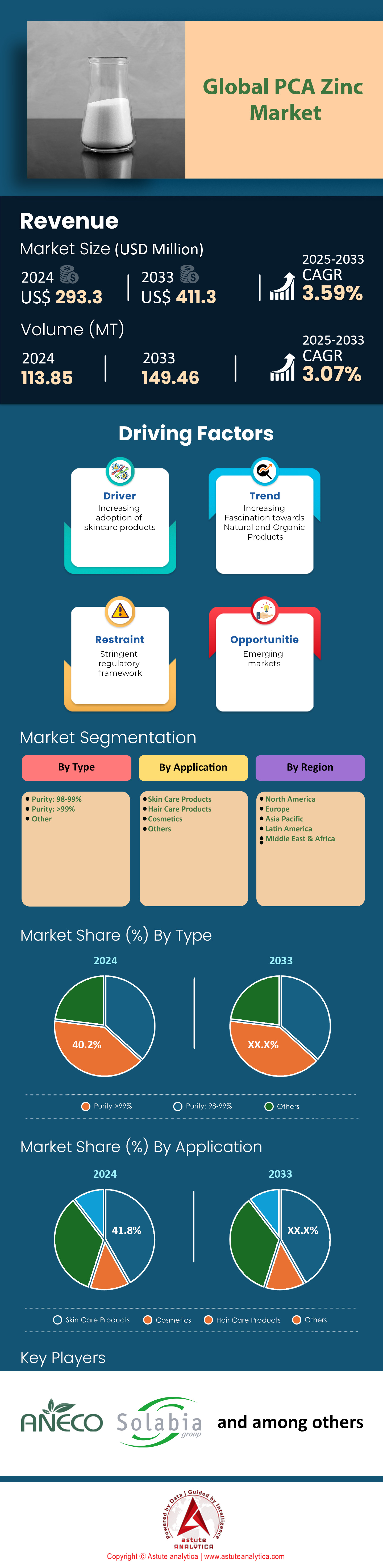

PCA Zinc Market: By Type (Purity: 98-99%, Purity: >99%, Others); Applications (Skin Care Products, Hair Care Products, Cosmetics, Others); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: 11-Dec-2024 | | Report ID: AA1224998

Market Scenario

PCA zinc market was valued at US$ 293.3 million in 2024 and is projected to hit the market valuation of US$ 411.3 million by 2033 at a CAGR of 3.59% during the forecast period 2025–2033.

The PCA zinc market is witnessing remarkable growth, driven by its diverse applications and increasing demand across industries. PCA zinc, or Zinc Pyrrolidone Carboxylic Acid, is a zinc derivative widely used in skincare, haircare, and industrial applications. In 2023, global refined zinc production reached approximately 13.86 million metric tons, with China leading as the largest producer, contributing around 4 million metric tons. The global consumption of refined zinc was slightly lower at 13.66 million metric tons, reflecting a small production surplus. This balance highlights the robust nature of the zinc market, which includes PCA zinc as a key segment. Additionally, Australia holds the largest zinc reserves globally, with 64 million metric tons, ensuring a steady supply for future demand.

The rising demand for PCA zinc is primarily fueled by its extensive use in skincare and personal care products. Known for its sebum-regulating, anti-inflammatory, and antimicrobial properties, PCA zinc is a popular ingredient in acne treatments, moisturizers, and anti-aging formulations. Beyond personal care, it plays a critical role in industrial sectors such as construction and automotive manufacturing, particularly in the production of galvanized steel for corrosion resistance. A notable trend in the market is the growing preference for high-purity PCA zinc, especially in applications like electronics and pharmaceuticals, where purity levels of ≥99% are essential. This segment is experiencing swift growth due to its superior performance in advanced technologies and high-end consumer products.

Global trade dynamics for zinc and its derivatives, including PCA zinc, remain vibrant. In 2023, the global trade value of zinc ores and concentrates exceeded $8.91 billion, with exports valued at $8.66 billion, reflecting strong international demand. Key factors driving the growth of PCA zinc include urbanization, expanding automotive industries, and increasing consumer awareness of skincare benefits. Furthermore, technological advancements in production processes and the rising adoption of sustainable practices are fueling demand. As industries innovate and expand, the market for high-purity PCA zinc is expected to grow rapidly, supported by its critical role in cutting-edge applications and environmentally friendly solutions.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Increasing Consumer Demand for Natural Skincare Ingredients Drives PCA Zinc Market Growth

The global skincare industry has witnessed a significant shift towards natural and organic ingredients, with consumers increasingly seeking products that are safe, effective, and environmentally friendly. This surge in consumer demand is a primary driver of PCA zinc market growth. PCA zinc, known for its sebum-regulating and antimicrobial properties, aligns well with these consumer preferences. According to a report by Astute Analytica in 2023 the global natural skincare products market was valued at approximately US$10 billion, demonstrating substantial consumer interest in such products. This trend is fueling the incorporation of PCA zinc in various skincare formulations.

PCA zinc's popularity is further bolstered by its efficacy in treating common skin concerns like acne and aging. The global anti-acne market was estimated to be worth around US$4.8 billion in 2023, with a significant portion of products utilizing PCA zinc for its therapeutic benefits. Moreover, the anti-aging market, valued at over $50 billion globally in 2023, is increasingly adopting PCA zinc in product formulations due to its ability to support skin elasticity and texture. These market valuations indicate a strong demand base that supports PCA zinc market growth.

The rise of informed consumers conducting their own product research has also contributed to this demand. A survey conducted by the Personal Care Products Council in 2021 found that over 70% of consumers read ingredient labels before purchasing skincare products. Additionally, the number of skincare products containing PCA zinc available on the market increased to over 1,000 in 2023, reflecting the ingredient's growing acceptance. With the global skincare market projected to reach $190 billion by 2025, the inclusion of PCA zinc in products is expected to expand, driven by this increasing consumer demand for natural and effective skincare solutions.

Trend: Increasing Use of PCA Zinc in Men's Grooming Products is a Notable Market Trend

The men's grooming industry has been experiencing robust growth, with male consumers showing increased interest in skincare routines and products. A notable trend within this market is the rising use of PCA zinc in men's grooming products, driven by the ingredient's effectiveness in addressing skin issues common among men, such as oily skin and acne. The global men's personal care market was valued at $127 billion in 2023, highlighting a significant opportunity for PCA zinc products tailored to men.

Manufacturers are capitalizing on this trend by developing specialized products that incorporate PCA zinc, such as facial cleansers, moisturizers, and aftershave lotions. The number of men's grooming products launched worldwide containing PCA zinc increased to over 500 in 2023, indicating growing product development activity. Additionally, a survey by Astute Analytica in 2023 found that 60 million male consumers are interested in skincare products that address specific concerns like acne and oiliness, which PCA zinc effectively targets.

The increasing visibility of men's grooming products containing PCA zinc in retail channels has also contributed to market growth. In 2023, major retailers reported a significant increase in sales of men's skincare products featuring natural ingredients like PCA zinc. Furthermore, e-commerce platforms have noted a rise in searches and purchases of PCA zinc products by male consumers, with online sales in this segment reaching an estimated $2 billion in 2023. This trend underscores the potential for PCA zinc to capture a larger share of the men's grooming market as awareness and availability continue to expand.

Challenge: Regulatory Hurdles and Safety Approvals Significantly Challenge PCA Zinc Market Expansion Efforts

The PCA zinc market faces significant challenges due to stringent regulatory requirements and safety approvals necessary for cosmetic ingredients. Regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Chemicals Agency (ECHA) require extensive testing to ensure product safety and efficacy, which can be time-consuming and costly. Industry reports indicate that obtaining regulatory approval for new skincare ingredients can take up to two years and cost manufacturers over $1 million in compliance expenses.

These hurdles can impede market entry and innovation, particularly for small and medium-sized enterprises (SMEs) that may lack the resources to navigate complex regulatory landscapes. A 2023 survey by the Cosmetic, Toiletry, and Perfumery Association found that 65% of SMEs cited regulatory compliance as a major barrier to introducing new products containing ingredients like PCA zinc. Additionally, differences in regulations across regions mean that products approved in one market may require additional testing or modifications to be sold elsewhere, further complicating global market expansion.

Moreover, heightened scrutiny over ingredient safety has led to increased consumer demand for transparency, putting additional pressure on manufacturers to provide comprehensive safety data. In 2023, there were over 200 product recalls in the cosmetic industry due to regulatory non-compliance, emphasizing the risks involved. Companies must invest in thorough research and robust quality control measures to meet regulatory standards, which can slow down product development and increase costs. These challenges necessitate strategic planning and substantial investment, potentially limiting the growth of the PCA zinc market despite strong consumer demand.

Segmental Analysis

By Type

High-purity PCA zinc, exceeding 99% purity, is widely sold globally and is also controlling over 40.2% market share. This is because it meets the stringent quality and safety standards required in high-end applications, particularly in the cosmetics and pharmaceuticals industries. This exceptional purity ensures that the zinc PCA used in products is free from impurities that could affect efficacy or cause adverse reactions. In 2023, with increasing regulatory scrutiny and consumer awareness, manufacturers prioritize high-purity ingredients to guarantee product safety. For example, leading pharmaceutical companies have adopted >99% pure PCA zinc to formulate topical medications, ensuring consistent therapeutic outcomes and meeting rigorous compliance standards.

The demand for >99% purity grade PCA zinc over other available purity levels is driven by the critical need for consistency, performance, and safety in end products. Regulatory bodies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) mandate strict purity criteria for active ingredients. In 2023, the EMA updated its guidelines, emphasizing the necessity for high-purity raw materials to minimize the risk of contamination. This regulatory environment compels manufacturers to opt for >99% pure PCA zinc. Additionally, products utilizing high-purity PCA zinc have demonstrated superior stability and effectiveness, which is vital for maintaining brand reputation and consumer trust.

Key factors enabling the dominance of this high-purity PCA zinc include technological advancements in purification processes and the rising demand for premium quality products. Innovative refining techniques, such as advanced crystallization and membrane filtration developed in 2023, have made it more feasible to produce PCA zinc at >99% purity on an industrial scale. Moreover, consumers are increasingly knowledgeable about product ingredients, with market research indicating a significant uptick in the number of consumers seeking products with high-quality, pure components. This shift in consumer preferences drives manufacturers to adopt high-purity PCA zinc to meet market expectations and remain competitive in the global marketplace.

By Applications

PCA zinc is heavily used in skincare products due to its potent antimicrobial, anti-inflammatory, and sebum-regulating properties, making it highly effective in treating acne and oily skin conditions. In line with this, the segment is currently holding over 41.8% market share. As the zinc salt of pyrrolidone carboxylic acid (PCA), it naturally occurs in the skin and plays a role in maintaining skin hydration. In 2023, the skincare industry has seen a surge in demand for products that offer targeted solutions for common skin issues without harsh side effects. PCA zinc fits this need perfectly by inhibiting the growth of acne-causing bacteria like Propionibacterium acnes, reducing inflammation, and controlling excessive oil production.

Major skincare products utilizing PCA zinc include anti-acne creams, oil-control lotions, facial cleansers, and dandruff shampoos. Brands such as La Roche-Posay and Neutrogena have incorporated PCA zinc into their formulations to enhance efficacy against breakouts and scalp conditions. The aspect driving the demand for PCA zinc in skincare products is its ability to deliver clinical results while being gentle on the skin. In 2023, dermatologists have increasingly recommended PCA zinc-containing products as a first-line treatment for mild to moderate acne, citing its effectiveness and low risk of irritation compared to traditional treatments like benzoyl peroxide.

The potential of PCA zinc in skincare products is significant, with ongoing research in 2023 exploring its use in novel formulations and delivery systems. The rise of personalized skincare has led to an increased interest in ingredients that can be tailored to individual needs, and PCA zinc's versatility makes it an ideal candidate. Additionally, the global skincare market has seen growth in the demand for products with multifunctional benefits. PCA zinc not only addresses acne but also supports skin barrier function and hydration. As consumers continue to seek comprehensive skincare solutions, PCA zinc's role is expected to expand, leading to its inclusion in a broader range of products and further driving its demand in the industry.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

The Asia Pacific region stands as the largest producer and consumer of zinc in the world, primarily due to its vast natural reserves and booming industrial sectors. Zinc is a crucial metal used extensively in manufacturing and construction, particularly for galvanizing steel to prevent corrosion. The region's rapid urbanization and infrastructure development have fueled the demand for zinc. In 2023, Asia Pacific countries collectively produced a substantial portion of the global zinc output. China alone produced 4.2 million metric tons of zinc in 2023, marking an increase from 4.14 million metric tons in 2021. Australia, another key player, holds the world's largest zinc reserves, estimated at about 69 million metric tons. The abundance of zinc resources and escalating industrial activities make the Asia Pacific region dominant in the global zinc market.

Within the Asia Pacific region, China is the undisputed leader in zinc production and consumption. In 2023, China produced 4.2 million metric tons of zinc, solidifying its position as the world's top zinc producer by a significant margin. China's vast industrial base and continuous infrastructure projects drive its high demand for zinc, while its large-scale mining operations support its leading production status. Australia's significant zinc reserves, estimated at about 69 million metric tons, position it as a critical supplier in the region. Other important countries include India and South Korea, which contribute to both production and consumption due to their growing industrial sectors. The synergy of production and consumption within these key countries underpins the region's dominance.

The Asia Pacific region is expected to maintain its dominance in zinc production and consumption due to continued economic growth and infrastructure development. China's Belt and Road Initiative and ongoing urbanization efforts are projected to increase the demand for zinc in construction and manufacturing. Additionally, technological advancements and investments in mining capabilities in countries like China and Australia will enhance production efficiency. With Australia holding zinc reserves of approximately 69 million metric tons and ongoing exploration activities, the region has the resources to sustain high production levels. The development of new applications for zinc in various industries, such as renewable energy and advanced electronics, further contributes to the region's future prospects. The strategic focus on sustainable practices and the expansion of industrial capacities are highly lucrative insights indicating that the Asia Pacific region will keep its dominance intact in the years to come.

Top Players in PCA Zinc Market

- SOHO ANECO Chemicals

- Solabia Group

- Shanghai oli Industrial Co., Ltd.

- Other Prominent Players

Market Segmentation Overview:

By Type

- Purity: 98-99%

- Purity: >99%

- Other

By Application

- Skin Care Products

- Hair Care Products

- Cosmetics

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)