Global Overhead Console Market: By Type (Front Overhead Console, Rear Overhead Console); Component (Storage Compartment, Light Modules, Information Display Screen, Climate Control System, Microphones, Others); Material (Polypropylene, Acrylonitrile-Butadiene-Styrene (ABS), Styrene Maleic Anhydride (SMA), Others); Vehicle Type (Passenger Vehicle, Commercial Vehicle); Distribution Channel (OEM, Aftermarket); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: 22-Nov-2024 | | Report ID: AA0423392

Market Scenario

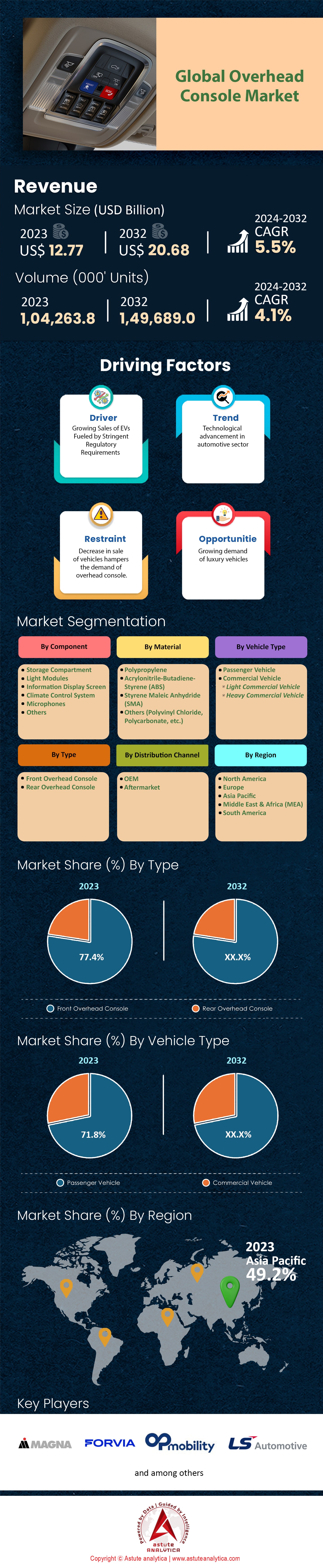

The global overhead console market was valued at US$ 12.77 billion in 2023 and is projected to attain a valuation of US$ 20.68 billion by 2032, growing at a CAGR of 5.5% during the forecast period 2024-2032. In terms of volume, the market is expected to project a CAGR of 4.1% during the forecast period.

The global overhead console market is expected to have extensive growth in the coming years due to technological developments, increased purchase of luxury cars, and large scale adoption of electric and hybrid cars. As per estimates, global production of vehicles is expected to reach around 85 million units in 2023 which presents a substantial market for overhead console manufacturers. Overhead consoles have become common with the integration of advanced features such as GPS, Bluetooth, and rearview camera display as it improves consumer experience and comfort and safety systems. The in car entertainment system which is associated with the consoles reached valuation of US$ 40 billion in 2023, demonstrating the increasing demand in advanced systems in vehicles.

An important factor increasing the demand for the overhead console market is the demand for luxury vehicles. According to estimates, global sales of luxury vehicles will exceed 12 million units in 2023, mainly fueled by the increasing contribution of countries such as China and India. The Chinese luxury car market alone is expected to sell more than 4 million units, while the forecast estimates of luxury vehicle sales in India this year is about 50,000 units. Consumers in these markets display an enthusiastic inclination towards vehicles with high end features which entail the use of complex overhead consoles. In fact, the automotive electronics market which include overhead consoles is also projected to increase to US$ 260 billion by 2024, pointing to the growing prominence of electronic components in cars produced today.

The population throughout the world demanding electric and hybrid vehicles will also be an essential factor in the growth of the overhead console systems market. In the year 2023, electric vehicle sales reached more than 14.2 million units, hybrid vehicle sales experienced 53% growth as compared to 2022. These types of vehicles in the overhead console market usually need an overhead console for implementation of better functionalities such as battery management system, energy usage display, and connection with charging stations. ADAS are more widely used with more than 60 million equipped vehicles in the year 2023 globally. Many of these vehicles use overhead consoles to incorporate these systems. However, a major concern continues to be the installation and maintenance of advanced overhead consoles. One of the ways to address this future concern, manufacturers of the overhead systems can incorporate designs that will reduce the costs as vehicle requirements in terms of electric and autonomous cars configurations will be more of a necessity than an accessory.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Growing Demand for Advanced Automotive Interiors Enhancing Driver Comfort and Convenience

The automobile sector in 2023 seems to have changed its focus in respect to comfort and ease of use for the driver, which, in turn, seems to be increased growth in the overhead console market. There is a clear shift in consumers’ preferences, they want a vehicle that is more than simply a mode of transportation. Overhead consoles have transitioned from an ordinary shelf of items into a sophisticated combination of control systems for infotainment purposes including ambient light and communication devices. The figures on the Global Production of Vehicles reported by the OICA (International Organization of Motor Vehicle Manufacturers) indicate that the worldwide output of vehicles went up to around 92 Million in 2023. These vehicles are equipped with high-level capabilities overhead consoles that are in line with the consumer’s appetite for a better-looking vehicle. Leading automotive manufacturers are engaged in innovative research that will culminate in new leads and product introductions in the form of new overhead console designs.

In modern automobile design, the integration of such developments as advanced technologies into overhead console market is becoming a trend. For example, a majority of car models from the year 2023 are fitted with touch screen control on the overhead console for convenient access to information and entertainment systems. In addition, over 25 million vehicles built in 2023 had such systems as integrated ambient lighting, which has improved the overall beauty of the car cabin and its comfort. The demand for such features in the automobile industry highlights the key role of comfort and convenience for a driver as a major driver for growth in the overhead console industry.

Trend: Adoption of Customizable, Modular Consoles with Enhanced Aesthetics and Functionality

A growing trend in the overhead console market is the modular and custom made overhead consoles. This provides an opportunity for the manufacturers to provide a wide range of customized options that improves beauty and utility that addresses the ever growing demand of consumers. With desktop designs, upgrading and new technology applications are easily accommodated without completely revamping the vehicle's interior. It is reported that in 2023, more than 30 million vehicles manufactured have been equipped with custom built overhead consoles. This adaptation is due to an increase in the desire of the consumers to own personalized and flexible vehicles that suit their lifestyle. Interchangeable panels, custom lighting and modular storage are the features that are making the cut as they allow drivers to individualize their interior environment.

The trend in the overhead console market is also aided by the development of new manufacturing methods such as 3D printing and advancement of materials used in the production of modular parts. Now industry reports suggest that a decrease in production time by up to 20% has been achieved by the implementation of modular overhead consoles which has enabled manufacturers to supply the market with new products on demand. The equilibrium in the trend towards customization and modularise is fostering the user experience and is one of the factors driving the growth of the market for overhead consoles in 2023.

Challenge: High Costs of Advanced Consoles Limiting Adoption in Economy Vehicle Segments

the overhead console market has witnessed high complexities as the costs related to advanced consoles still stand a challenge. The argument here is that although the year 2023, for instance, saw the addition of advanced technologies into overhead consoles thus making it more expensive to mass produce or supply these features into lower end economical vehicle segments without incurring losses. Information from the automotive sector shows that overhead consoles that are a high tech advanced have the potential to increase the retail price of a vehicle in the range of US$ 500 to 1000. For the manufacture of economical vehicles, it stands as a major barrier. There are several differences between the economy and the luxury vehicle segments. As a result, around 15 million economy cars, or about 30% of total global production, grossed advanced overhead console features out of an intended 60 million units in 2023.

In view of this, manufacturers are now looking for ways that are more affordable by providing alternative materials and having less complex designs for advanced overhead consoles. Others are thinking of joint ventures with suppliers to enhance the feature at a lower cost. It is possible to speak about the complete absence of loaded overhead consoles in southern segments, as well as their distribution across vehicle segments, as an absence of features in the market would invariably hamper prospective development.

Segmental Analysis

By Type

The global overhead console market is categorized by type, into front overhead consoles and rear overhead consoles. The front overhead console segment is expected to dominate the market with over 77.4% market share. Recent data indicates that the global automotive market expansion is increasing the need for better automotive experiences, as 75% of the latest automotive models have enough advanced driver assistance systems (ADAS) which are mostly placed in the front overhead console. First, front overhead consoles are located at the front of the car, where the driver and the front seat passenger can reach out easily. Such access improves the satisfaction of the users by enabling instant command over certain functions such as the illumination, the opening of sunroofs and the storage compartments.

The demographic of all vehicle users in the overhead console market is changing rapidly as contemporary cars are now becoming increasingly sophisticated due to innovations in overhead centralized consoles with features such as GPS. While these innovations may have made cars expensive and difficult to acquire for normal users, luxury vehicles are being equipped with these features and are seeing growing demand, dominating the shelves with advanced features which help boost safety. In 2023, nearly 65% of the available vehicles globally contained these innovative parts further reinforcing the stance of luxury cars, which promptly saw an increase in sales of 20% over the span of a year. The emergence of electric cars can also be linked with the increase in these features as the key selling point for electric vehicles are innovative designs with advanced technology present inside the car. These cutting-edge vehicles garner attention as they stand out more than a gasoline car’s traditional look.

Overhead vehicles that are rolling off the production line now only have around 10 million units worth of sales, with the latest models emphasizing innovative internal designs, and advanced features such as an overhead console. In an electric vehicle market which has exploded in the past few years with a considerable volume of sales, 80% of consumers buying overhead vehicles stress the importance of cars having intricate interior patterns with advanced overhead consoles.

By Component

Overhead console market is dominated by light module with revenue share of 36.6% in 2023. This trend is largely caused by the high demand by customers for better interior visibility while at the same time improving the car interior aesthetics. Today's cars come equipped with advanced LED lights that are programmable for features such as ambient lighting which has become a marketing angle for car builders. In 2023, over 50 million LED light modules were incorporated in new vehicles worldwide indicating the revolution in the use of these advanced lighting systems.

One of the reasons for the light module’s popularity in the overhead console market is the inclusion of advanced smart lighting technologies that add safety and functionality. For example, many luxury vehicles are now equipped with adaptive lighting systems which self-adjust to the driving conditions in the vehicle. Such systems not only increase a driver’s sight when driving, but also help in alleviating eye fatigue whenever it is night. During the same period, over 15 million cars were fitted with the adaptive lighting systems, which speaks for the great role they play in modern automobiles. Also, the emergence of electric and self-driving cars that already have complex interior light for the better satisfaction of the passengers has increased the rate of use of new light modules.

The growth in the encompassing trend of smart and connected cars also benefits the light module segment. Many of the recent overhead vehicle consoles have been fitted with integrated lighting that can link with other vehicle systems such as navigation and infotainment for a better feel. For instance, more than 12 million of cars manufactured in 2023 had cars that used ‘voice’ commands to control the lights in the vehicle. The latter focuses on the growing number of consumers that want their vehicles to be more engaging in terms of controlling them.

By Material

Polypropylene has emerged as the most popular material within the overhead console market with more than 43.6% share due to its portfolio of properties that best fit the needs of the automotive industry. Polypropylene has impressive tensile strength combined with being lightweight and is widely applied in the car interiors for the purpose of decreasing the overall car weight and hence the fuel consumption. In 2023 over 1.5 million tons of polypropylene was used by global automotive companies for the production of vehicles, showing how accepted this material has become. It has also an advantage of being resistant to moisture and chemicals which makes it suitable for harsh automotive environments This has seen an increase in the demand for polypropylene.

Additionally, its low cost and wide range of application characteristics are also important considering the automobile competitive environment. Polypropylene is able to perform all these functions effectively while being cheap for the manufacturers. When compared with other types of materials, the cost for producing overhead consoles using polypropylene is far cheaper, thus making it possible to use for both high end and regular cars. Also, being able to be shaped into complex designs, it provides interior component designers with greater possibilities to tool ergonomic forms.

Polypropylene is gaining popularity in the overhead console market not only due to its application benefits but its environmental impact as well. As automotive manufacturing gears more towards the sustainable direction, the recyclability of polypropylene is directly in line with the global vision to cut down the negative impacts of production activities. In 2023, for instance, in excess of half a 500,000 tons of recycled polypropylene went into use in motor vehicle parts thereby adding to the economic cycle of supply chains which many manufacturers subscribe to. Such tangible acts of commitment to reducing carbon on the automotive supply chain further boosts the automakers’ brand image while at the same time responding to the rising demand for automobile consumption, thus presenting an even a stronger alternative for polypropylene as a material for overhead console saturation.

By Distribution Channel

According to the distribution channel, the overhead console market is dominated in majority by the OEM segment. It accounted for well over 90.6% of the market share. According to a survey, 85% of buyers prefer to use OEM installations since they are better integrated and compatible with the vehicle system. Overhead consoles are most often defaulted to being fitted into vehicles at the manufacturing stage ensuring the raw overhead console can best be fitted with the internal design and other electronics within the vehicle. The manufacturers are then able to embed the latest technologies into the overhead consoles while ensuring that the overhead unit is able to meet any specifications and quality standards that may be set for new vehicles.

Due to the integration, reliability, and warranty factors involved, customers are more inclined to use OEM installed overhead consoles. Given that vehicles are becoming more high tech in the overhead console market, wherein systems for navigation, connectivity, and safety become more intertwined, the argument of how important OEMs are for reliable overhead console solutions strengthens. In 2023, it was the case that OEM smart systems were integrated into 78% of new vehicles. The introduction of superior touch controls in overhead consoles activated by OEMs and voice activation systems are advancing how consumers see the commodities and what they prefer. Last year, overhead consoles that were controlled by AI and voice recognition systems increased by 20%.

As much as there are options for modifying or even replacing overhead consoles through the aftermarket segment, it remains quite a fraction as compared to the OEM segment. Rather the aftermarket sales have only been increasing by a mere 3% in 2023, clearly emphasizing the supremacy of the OEM segment. There is a significant complexity with the installation of sophisticated overhead consoles and potential interference of vehicle systems thus making OEM supply more appealing to consumers and auto manufacturers. As the automotive market continues to grow across the world and technology improves, the OEM segment looks poised to hold and perhaps even increase its position as the undisputed leader in the overhead console market. It is believed that the share of the OEM market will be more than 90% until the end of the decade.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

Asia Pacific region is strong contributor in the global overhead console market considering the factors that aid in the growth and invention in the region. This region held 49.3% revenue share in 2023 and it produced over 51.8 Million vehicles as such this region holds the top position in terms of car production. There is a strong need for the overhead consoles as many automobile industries like, Toyoda, Suzuki, Honda, Hyundai and Nissan produce millions of vehicles per year. Also, China being the biggest automotive market sold nearly over 21.5 million vehicles, many had overhead console systems installed. Hence, it also shines to display demand and supply characteristics for increasing smarter technologies like voice-controlled assistant and augmented reality displays in the automobile.

There has been a decisive and global advent into electric and autonomous vehicles in the overhead console market, with the most evident being in Asia Pacific, China having sold 9.05 million only in 2023, which makes it the largest ev market. This trend does call for more advanced overhead consoles that are able to support the likes of battery management systems and autonomous driving interfaces. The region is further innovating as seen from the inclusion of green materials in the automotive design, with Japan and South Korea looking to spearhead green manufacturing initiatives. Moreover, the explosion of 5G networks across the region is helping connected vehicle technologies such as real time navigation and remote diagnostics built into the overhead consoles further expand.

The automotive overhead console market in Asia Pacific is further enhanced through conducive government policies and along with strategic initiatives. Countries like Vietnam and Indonesia have introduced comprehensive plans to develop their automotive industries so that they can manufacture hundreds of thousands of electric vehicles in a year by 2030. Development projects such as the One Belt One Road initiative of China are improving infrastructure thereby developing the automotive supply chain. Also, Asia Pacific’s automotive research and development spending surpassed $50 billion in 2023 with a focus on technologies such as artificial intelligence and IoT in vehicles. Apart from such factors, the region’s manufacturing capabilities and the consumers’ love for advanced vehicles reinforce Asia Pacific’s stance as a focal point for overhead console manufacturing and its advancements in the automotive industry.

List of Key Companies Profiled:

- Grupo Antolin

- HELLA GmbH & Co. KGaA

- IAC Group

- LS Automotive India Pvt Ltd.

- Magna International Inc.

- Methode Automotive Solutions

- Plastic Omnium SE

- Shanghai Daimay Automotive Interior Co., Ltd.

- Yanfeng Automotive Interior

- Other Prominent Players

Market Segmentation Overview:

By Type:

- Front Overhead Console

- Rear Overhead Console

By Component:

- Storage Compartment

- Light Modules

- Information Display Screen

- Climate Control System

- Microphones

- Others

By Material:

- Polypropylene

- Acrylonitrile-Butadiene-Styrene (ABS)

- Styrene Maleic Anhydride (SMA)

- Others (Polyvinyl Chloride, Polycarbonate, etc.)

By Vehicle Type:

- Passenger Vehicle

- Commercial Vehicle

- Light Commercial Vehicle

- Heavy Commercial Vehicle

By Distribution Channel:

- OEM

- Aftermarket

By Region:

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)