Global Outdoor Products Market: By Products (Equipment, Apparel , Accessories) Equipment (Tents and Tarps (Tents, Sunshades, Tarps, Shelters); Tables and Chairs (Tables, Chair/Benches, Others); Cooking Utensils and Tableware (Cookers, Dutch Ovens, Cooking Tools, Tableware); Shrubs and Cots (Sleeping Bags, Shrugs, Mats, Air beds, Others); Coolers and Jugs, Bottles, Jugs, Cooler Boxes, Coolants); Stoves and Fuels (Stove Supplies, Burners, Smoking and Smoker Equipment, Torches/Fire starters, Lighting, Lanterns and Lantern Supplies, Headlamps, Handheld lights); Field Gear (Carry Carts, Gas Lighters, Portable Ashtrays, Stoves, Heaters, Map, Measures, Others); Climbing Equipment (Trekking GPS, Helmets, Trekking Poles); Other Outdoor Equipment (Blankets, Insect and Insecticidal Supplies, Portable Toilets, Showers, Others)); Distribution Channel (Online and Offline); Region— Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: Apr-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0823567 | Delivery: 2 to 4 Hours

| Report ID: AA0823567 | Delivery: 2 to 4 Hours

Market Scenario

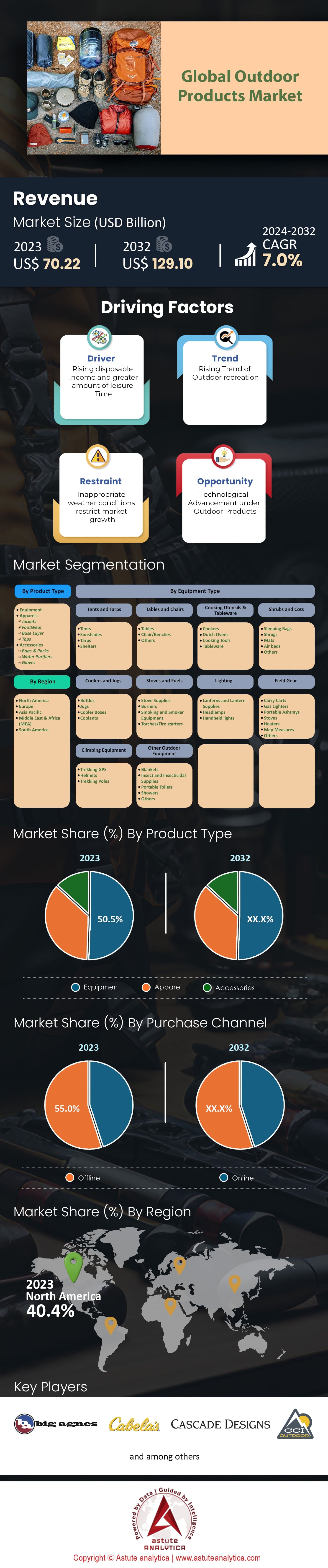

Global outdoor products market was valued at US$ 70.22 billion in 2023 and is projected to reach market size of US$ 129.10 billion by 2032 at a CAGR of 7.0% during the forecast period 2024–2032.

Outdoor products encompass a wide range of items used for recreational, sporting, or survival purposes in open-air environments. This category includes products like tents, camping equipment, hiking gear, fishing rods, outdoor furniture, recreational vehicles, sports equipment, clothing, and accessories tailored for outdoor activities. In 2023, the European market led with a share of 33.5%, primarily due to an increase in outdoor recreational activities and a rise in health-conscious individuals.

Within the technology landscape, advancements in materials and design have played a vital role in the outdoor products market. For instance, the development of lightweight and durable materials has allowed for more compact and portable equipment. Smart technology integration such as GPS in outdoor watches or weather-resistant features in clothing adds value and functionality to these products. Wherein, government regulations concerning safety and environmental sustainability also shape the market. In regions like the European Union, stringent rules on materials and production methods promote eco-friendly practices. This has led to a rise in demand for sustainably manufactured outdoor products.

Consumer analysis shows a diverse demand in different age groups. Millennials are found to be the most engaged in outdoor activities, accounting for 42% of the market share in 2023, followed by Generation X at 30%. The preference for outdoor fitness, adventure sports, and nature-oriented vacations has led to increased sales in this demographic. In line with this, the market exhibits a competitive nature, with top players like The North Face, Columbia, and Patagonia collectively holding a significant chunk of the market share.

The study of the global outdoor products market suggests that the bargaining power of suppliers is moderate due to the availability of various material sources. The threat of new entrants is low, given the established brands' dominance and significant capital requirement. BA buyer's bargaining power is medium, with various options but brand loyalty playing a role. The threat of substitutes is low, and competitive rivalry is high due to product differentiation and brand positioning.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Growing Efforts to Maintain Health and Wellness

The global outdoor products market is being significantly propelled by the global surge in health and wellness-focused lifestyles. This transformation is underscored by a remarkable statistic: approximately 62% of adults across the globe reported heightened engagement in outdoor activities explicitly for health-related reasons in 2020. This trend not only dovetails with the rise in gym memberships, which experienced a notable uptick of 3.7% in 2023 alone, but it also translates into an increased inclination toward outdoor fitness endeavors such as hiking, cycling, and running.

Outdoor activities have adroitly been positioned as dual-purpose tools: they serve as platforms for physical exercise while also addressing the essential aspect of mental well-being by fostering a profound connection with nature. This burgeoning health and wellness inclination has concomitantly propelled sales of outdoor products that cater to this ethos. Sports equipment, outdoor apparel, and related accessories are witnessing a commendable growth rate of 5.8% on an annual basis. The momentum behind this trend is anticipated to persist, with projections indicating that the market value of health-centric outdoor products will attain a substantial USD 34.5 billion by the year 2025.

Restrain: Environmental Concerns and Regulations

Despite the promising growth in the outdoor products market, the industry is grappling with a significant restraint originating from heightened environmental concerns and increasingly stringent government regulations. An appreciable portion of outdoor products, particularly items like clothing and accessories, has conventionally relied on synthetic materials, accounting for an estimated 48% of the market in 2023. Regrettably, these materials carry a conspicuous environmental footprint, both in terms of their manufacturing processes and eventual disposal.

Governments across the globe have taken cognizance of this environmental challenge and have consequently embarked on the path of imposing more exacting regulations on manufacturing practices. The overarching goal is to mitigate carbon emissions, minimize waste generation, and curtail the usage of hazardous substances in the global outdoor products market. A pertinent case in point is the European Union, where the implementation of new environmental regulations in 2020 precipitated an approximate 2.3% reduction in sales for products that fell short of eco-friendly standards.

This regulatory landscape has necessitated a paradigm shift for manufacturers, spurring investments in research and development to engineer environmentally conscious products. This shift, while commendable in its intent, has inadvertently led to a deceleration in the growth of certain market segments, posing challenges that necessitate innovative solutions to navigate the intricacies of sustainability.

Trend: Technological Integration in Outdoor Products

A prominent and transformative trend unfurling within the global outdoor products market is the harmonious integration of technology. Whether it manifests as GPS-enabled timepieces, intelligent tents, or garments equipped with built-in weather sensors, the amalgamation of technology with conventional outdoor gear is heralding a paradigm shift in consumer expectations.

This technology-driven evolution is palpably evident in the market's valuation for tech-integrated outdoor products, which stood at an impressive USD 26.7 billion in 2023. Forecasts predict a compounded annual growth rate (CAGR) of 7.5% through 2032, underscoring the sustained traction this trend is gaining. A pivotal driver of this evolution is the considerable influence wielded by millennials and Generation Z, who collectively represent a formidable 57% of the outdoor products market for such products. Their discerning demand centers around multifunctional offerings that seamlessly align with their digitally connected lifestyles.

The infusion of technology into outdoor products is not merely conferring augmented functionalities, but it's also imparting a crucial safety dimension. A case in point is the impressive 11% surge in sales of GPS-equipped hiking gear witnessed in 2022. This surge is emblematic of a growing awareness of safety considerations intertwined with outdoor pursuits. The enduring influence of this technology-led trend is poised to continue shaping the market landscape, fueling innovative endeavors, and engendering fresh avenues for growth.

Segmental Analysis

By Products

The product segment of the global outdoor products market is primarily categorized into apparels, accessories, and equipment. In 2023, the equipment segment held a commanding lead with a 50.5% market share. The equipment segment majorly covers a wide range of items, from tents and tarps to stoves and fuels. Its growth can be attributed to the rising interest in camping and hiking, leading to a projected annual growth rate of 7.6% over the next 7 years. Within this category, tents and tarps capture around 14% of the market, Cooking Utensils and Tableware approximately 9%, Climbing Equipment around 18.5%, with the remaining percentage spread across other items.

The apparel sub-segment includes clothing items like jackets and footwear designed specifically for outdoor activities. With approximately 36% of the product market share, it's growing steadily, driven by the rising trend toward adventure sports and outdoor activities. On the other hand, the accessories sub-segment accounted for around 13.2% of the market share in 2023 as it primary covers products such as water purifiers and gloves finding traction among outdoor enthusiasts.

By Distribution Channel

By distribution channels, the global outdoor products market is segmented into online and offline. The offline segment primarily includes retail stores, specialty shops, and supermarkets and is projected to continue dominating with a 55% market share. However, offline distribution channels such as supermarkets and specially stores are slowly losing their market share to online platforms and have started to indicate broader shifts in consumer behavior and a move toward the convenience of online shopping.

On the other hand, the online distribution channel has been gaining traction, now accounting for 45% of the market share. It has witnessed a growth rate of 8% in 2023, showing the growing popularity of convenience among consumers about online shopping and the availability of a wider range of products. Our study suggests this shift towards online distribution is likely to continue as the rise in e-commerce platforms and digital marketing strategies deployed by outdoor product companies become prominent.

To Understand More About this Research: Request A Free Sample

Regional Analysis

Europe to stay second largest region in the global outdoor products market, holding over 26.8% revenue share, which translates to around US$ 18.9 billion as of 2023. This dominance is attributed to the outdoor culture prevalent in countries such as Germany, France, the United Kingdom, and Switzerland. In Europe, the average family that often goes on outdoor trips spends approximately USD 800 annually on outdoor equipment, including camping gear, hiking accessories, fishing equipment, and other outdoor necessities. The increase in spending is influenced by the growing popularity of outdoor trips, with the average European family planning around 2.5 outdoor trips per year. Online shopping has also fueled this market, with popular sites like Amazon, Decathlon, and Go Outdoors accounting for 42% of outdoor equipment sales in the region in 2023. The convenience of online shopping, coupled with extensive product ranges and competitive pricing, has appealed to European consumers.

In contrast, the Asia Pacific outdoor products market represents an evolving landscape with immense growth potential. Outdoor activities are becoming more popular in countries like China, Japan, South Korea, and Australia. The average family that goes on outdoor activities in the region spends around USD 150 on outdoor equipment annually, and this number is projected to increase with rising disposable income and urbanization. In 2022, the average number of outdoor trips planned by families in the Asia Pacific was around 1.8, reflecting a growing interest in outdoor recreation. E-commerce platforms such as Alibaba, Flipkart, and JD.com are significant contributors to outdoor products sales in the region, accounting for 38% of total sales in 2022. The rising internet penetration, coupled with the availability of international brands, has made these platforms preferred shopping destinations.

The regional analysis of the Europe and Asia Pacific outdoor products market highlights distinctive patterns in the outdoor products market. Europe's dominance is backed by strong outdoor culture, significant spending on equipment, and popular online shopping platforms, ensuring a robust market. Simultaneously, the Asia Pacific presents a burgeoning market fueled by increasing interest in outdoor activities, changing lifestyles, and the growth of e-commerce. These trends and numerical insights offer a comprehensive view of the dynamics shaping the outdoor products market in these critical regions, reflecting both the established European market and the emerging potential in the Asia Pacific.

Top Players in the Global Outdoor Products Market

- Big Agnes

- Cabela's Inc

- Cascade Designs

- Eureka!

- GCI Outdoor

- Kelty

- Marmot Mountain LLC

- Mountain Hardwear

- Sierra Designs

- Other Prominent players

Market Segmentation Overview:

By Product

- Equipment Type

- Apparels

- Jackets

- Footwear

- Base Layer

- Tops

- Accessories

- Bags & Packs

- Water Purifiers

- Gloves

By Equipment Type

- Tents and Tarps

- Tents

- Sunshades

- Tarps

- Shelters

- Tables and Chairs

- Tables

- Chair/Benches

- Others

- Cooking Utensils and Tableware

- Cookers

- Dutch Ovens

- Cooking Tools

- Tableware

- Shrubs and Cots

- Sleeping Bags

- Shrugs

- Mats

- Air beds

- Others

- Coolers and Jugs

- Bottles

- Jugs

- Cooler Boxes

- Coolants

- Stoves and Fuels

- Stove Supplies

- Burners

- Smoking and Smoker Equipment

- Torches/Fire starters

- Lighting

- Lanterns and Lantern Supplies

- Headlamps

- Handheld lights

- Field Gear

- Carry Carts

- Gas Lighters

- Portable Ashtrays

- Stoves

- Heaters

- Map Measures

- Others

- Climbing Equipment

- Trekking GPS

- Helmets

- Trekking Poles

- Other Outdoor Equipment

- Blankets

- Insect and Insecticidal Supplies

- Portable Toilets

- Showers

- Others

By Distribution Channel

- Online

- eMarketplaces

- Brand Website

- Offline

- Supermarket/ Hypermarket

- Hardware Stores

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia & New Zealand

- Rest of APAC

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0823567 | Delivery: 2 to 4 Hours

| Report ID: AA0823567 | Delivery: 2 to 4 Hours

.svg)