Organoids And Spheroids Market: By Type (Organoids, Spheroids); Method (Organoids, Spheroids); Source (Organoids, Spheroids); Application (Developmental Biology, Personalized Medicine, Regenerative Medicine, Disease Pathology Studies, Drug Toxicity & Efficacy Testing); End-User (Biotechnology and pharmaceutical industries, Academic & Research Institutes, Hospitals and diagnostic centers); Region— Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: 19-Oct-2025 | | Report ID: AA0423418

Market Snapshot

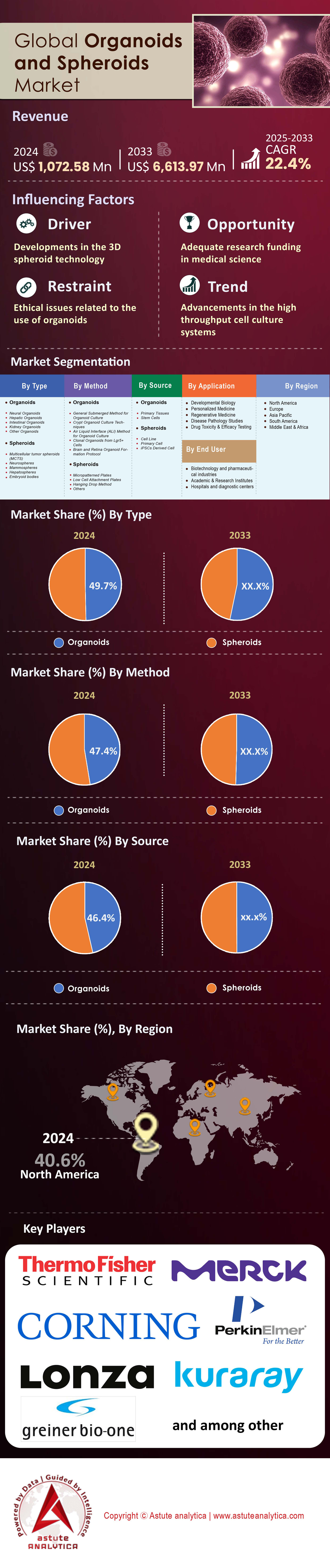

Organoids and spheroids market size was pegged at US$ 1,072.58 million in 2024 and is projected to attain a valuation of US$ 6,613.97 million by 2033 at a CAGR of 22.4% during the forecast period 2025-2033.

Key Findings Shaping the Market

- Based on type, organoids segment is poised to dominate the market, with expectations to generate over 53% of the revenue.

- Based on application, developmental biology segment is set to dominate the market, capturing a significant 32.1% market share.

- When it comes to end users, pharmaceutical and biotechnology industry segment is poised to assert its dominance in the organoids and spheroids market, projected to capture over 47.4% of the revenue share.

- North America to remain a major contributor to the market with over 40.60% market share.

- Organoids and spheroids market is poised to reach US$ 6,613.97 by 2033.

A significant driver of current activity is the tangible success seen in clinical oncology applications. The ability to establish 108 patient-derived organoids from 135 samples with a 7-day turnaround for drug sensitivity results is creating direct clinical demand. Furthermore, with 22 active US clinical trials using organoids to guide cancer therapy, hospitals and research centers are increasingly adopting these models. The capacity to screen 1,200 drugs on pancreatic cancer PDOs demonstrates a scale of inquiry that is compelling for pharmaceutical partners seeking to repurpose existing therapeutics or stratify patient populations for trials.

The demand is also shaped by the industrialization of research and development processes. An automated platform capable of testing 15,000 spheroids per day at a cost of just CHF 2 per test makes large-scale screening economically viable for industry players. An operational efficiency like it is complemented by the establishment of robust biobanks, such as the Human Cancer Models Initiative with its portfolio of over 200 organoid models. The acquisition of a company holding 70 validated organoid models by Merck KGaA further underscores the high value placed on established, well-characterized 3D model libraries.

A clear regulatory and funding tailwind is solidifying demand within the Organoids and spheroids market. The submission of at least 15 new drug applications to the FDA with organoid data highlights a growing acceptance by regulatory bodies. A shift like it is reinforced by significant funding, including a EUR 15 million allocation from the European Research Council to replace animal models and a US$ 10 million private investment in Sinai Health's organoid platform. Such financial commitments provide the stability and resources needed for long-term research and commercialization efforts.

To Get more Insights, Request A Free Sample

Emerging Opportunities Signal New Frontiers for Market Expansion and Growth

- The Organoids and spheroids market is expanding into cosmeceuticals and chemical safety testing: Driven by tightening regulations on animal testing, companies are adopting 3D skin and eye organoid models. For example, a 2024 initiative by L'Oréal is scaling up its production to 100,000 skin organoid units annually for toxicology screening. Moreover, the U.S. Environmental Protection Agency (EPA) outlined a plan in 2025 to approve 5 specific organoid-based assays as valid alternatives for industrial chemical safety assessments, creating a new, regulated industrial market for these advanced models.

- A futuristic opportunity is emerging in the field of Organoid Intelligence or Biocomputing: Research teams are harnessing the computational power of brain organoids. In 2024, a John Hopkins University project received US$ 500,000 in initial funding to develop a biocomputer using 10,000 interconnected brain organoids. Researchers at the University of Sussex demonstrated in early 2025 that a single brain spheroid could learn to control a 5-joint robotic arm, showcasing the potential for creating living processors. A consortium of 8 European labs was formed in 2025 to standardize protocols for these biocomputing platforms.

Industrial Scale-Up and Automation Catalyze Market-Wide Commercial Adoption

The Organoids and spheroids market is rapidly moving toward industrial-scale production. A key driver is the development of advanced bioreactors; for instance, a new system launched in 2024 enables the culturing of over 5,000 uniform spheroids in a single 500 mL vessel. Automation is also paramount, with one new robotics platform introduced in 2025 capable of processing 75 individual microplates without human intervention. A push for scale like it is supported by significant corporate investment, including a US$ 25 million expansion of a GMP-certified organoid production facility in Massachusetts announced in 2024.

Standardization is keeping pace with its growth, solidifying demand for reproducible, high-quality models. In 2024, ATCC released 15 new authenticated organoid-qualified cell lines for use as industry benchmarks. The US Patent Office also saw a surge in filings, with over 80 new patents for organoid manufacturing processes submitted in 2024 alone. Contract Research Organizations (CROs) are expanding their offerings, with at least 12 major CROs now providing GMP-grade organoid screening services. These developments, from bioreactor capacity to new quality-control standards, are making organoids a viable and scalable solution for commercial labs.

Complex Assembloids and Co-Culture Systems Unlock Deeper Biological Insights

The demand is surging for more sophisticated models that better recapitulate human physiology. The field of "assembloids"—the fusion of different organoids—is a key frontier; more than 30 unique assembloid models were reported in scientific literature in 2024. These models are crucial for studying inter-organ communication. For example, a 2025 study detailed the first co-culture of 12 different commensal bacterial species with human intestinal organoids, opening new avenues for microbiome research. Similarly, the integration of up to 5 distinct immune cell types into tumor spheroids is now enabling more predictive immuno-oncology studies.

The complexity of these advanced systems is increasing at a rapid pace. A new brain organoid model developed in 2025 successfully incorporated 14 different neural cell types, creating an unprecedented level of biological fidelity. The functional lifespan of these models is also extending; a new microfluidic platform in 2024 maintained a vascularized liver organoid for over 90 days. Funding bodies are recognizing the importance of its work, with one NIH grant in 2024 awarding US$ 3 million to a consortium of 7 labs developing multi-organ systems to study viral infections, further driving demand within the Organoids and spheroids market for these next-generation research tools.

Segmental Analysis

Organoids Poised to Revolutionize the Organoids and Spheroids Market Landscape

The organoids segment is asserting its dominance in the Organoids and spheroids market, with projections indicating it will capture over 53% of the revenue. This leadership stems from their advanced ability to replicate the complex structure and function of human organs, offering superior physiological relevance compared to simpler models. A significant catalyst for growth was the FDA Modernization Act 2.0, signed into law in 2022, which encourages the use of non-animal models in preclinical studies. Consequently, the number of clinical trials using organoid technology reached 106 by early 2024, demonstrating their increasing acceptance in translational research. The academic and research communities are driving this momentum, with a surge in publications from 6,222 between 2009 and May 2024 to 10,023 just between 2019 and 2023.

Substantial government and private funding underscores the segment's potential. In 2025, the NIH launched the Standardized Organoid Modeling (SOM) Center, backing it with an initial $87 million to create reproducible models. Further investments in 2024 include a $14 million grant from the U.S. National Science Foundation for organoid intelligence research, a $10 million investment in Sinai Health's new organoid engineering platform, and a $7.5 million NIH award for immune organoid research. A reflection of this rapid expansion is the establishment of 60 new organoid-focused laboratories globally in the past year alone.

- Organoids are capable of self-assembly and self-organization, mimicking in-vivo organ development.

- They can be cryopreserved and biobanked for long-term studies and future use.

- Patient-derived organoids retain the genetic and phenotypic characteristics of original tumors.

Developmental Biology Spearheads Innovation in the Organoids and Spheroids Market

The developmental biology segment is set to dominate the Organoids and spheroids market, capturing a significant 32.1% share. Its leadership is driven by the unparalleled insights these 3D models offer into fundamental biological processes like organogenesis, embryogenesis, and tissue development. The ability to visualize these intricate processes in real-time within human-relevant systems is a primary reason for their widespread adoption. This segment has a rich history, beginning with the successful cultivation of the first intestinal organoids in 2009, which set the stage for future research. A landmark 2013 paper on brain organoids further accelerated the field, opening new avenues for understanding neural development.

The impact is seen across various research areas, with brain organoids becoming the most-cited type, underscoring their value in complex neuroscience studies. Technological innovation continues to push boundaries, exemplified by the 2024 development of a "brain-on-chip" system using lab-grown human brain matter. These models are also crucial for comparative studies, enabling researchers to explore the differences between animal and human development. Massive investment, such as the European Union's infusion of over €70 million into organoid and organ-on-chip projects, fuels this research engine. With over 2,000 studies currently underway globally, many focusing on developmental questions, the segment's influence is set to expand.

- Models enable the study of lineage specification and cellular differentiation.

- Researchers use intestinal organoids to investigate complex gastrointestinal disorders.

- Organoid systems offer a robust platform for modeling genetic inheritance.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

Pharmaceutical Industry Drives Unprecedented Growth in Organoids and Spheroids Market

The pharmaceutical and biotechnology industry segment is the primary end-user in the Organoids and spheroids market, projected to capture over 47.4% of the revenue share. The segment's dominance is a direct result of the urgent need for more predictive and human-relevant preclinical models. A staggering 90% of drugs that appear safe in animal models ultimately fail to gain FDA approval, creating a massive efficiency gap that organoids can fill. Recognizing this, regulatory bodies are shifting their stance; in April 2025, the FDA announced intentions to end animal testing requirements for new monoclonal antibody drugs. Industry adoption is accelerating rapidly, with over 500 pharmaceutical companies now integrating organoid technology into their R&D workflows.

This industrial pivot is fostering a vibrant ecosystem. In 2024 alone, over 300 collaborations were formed between pharmaceutical firms and specialized biotech startups. The broader landscape includes over 1,200 biotech companies actively investing in organoid research and more than 200 offering specific organoid-related products and services. The clinical pipeline reflects this trend, with organoid-based research expected to be a key component in nearly 400 upcoming clinical trials. To meet rising demand, companies like Molecular Devices are scaling up, opening new facilities in 2024 for patient-derived organoid manufacturing, while CROs like Crown Bioscience launched advanced screening platforms in late 2023. The startup scene is also booming, with 100 companies now focused on organoid research models.

- Organoids accelerate preclinical oncology drug discovery and validation.

- Patient-derived models allow for personalized drug screening and efficacy testing.

- The technology helps predict drug toxicity with higher accuracy.

To Understand More About this Research: Request A Free Sample

Regional Analysis

North America Drives Global Innovation with Dominant Market Leadership

North America leads the Organoids and spheroids market with over 40.60% market share; a position built on robust funding and advanced infrastructure. In 2024, the U.S. National Cancer Institute (NCI) funded 45 new research projects specifically focused on developing patient-derived cancer organoids. The FDA's Center for Drug Evaluation and Research (CDER) also launched a pilot program in 2024 to qualify 5 different organ-on-a-chip platforms for regulatory submissions. Further, U.S. research institutions initiated 28 new clinical trials using organoids for patient stratification in 2024. In Canada, the Canadian Institutes of Health Research (CIHR) allocated CAD 15 million to a new national network for regenerative medicine, which includes 8 organoid-focused research hubs.

The region's commercial ecosystem is equally dynamic. In 2024, Boston's biotech hub saw the launch of 6 new startups dedicated to organoid-based drug discovery services. The United States Patent and Trademark Office (USPTO) also granted over 120 new patents related to 3D cell culture and microfluidics in the same year. Major academic centers are expanding capabilities; for instance, Stanford University opened a new 20,000-square-foot facility in 2025 dedicated to high-throughput organoid screening. The Society for Laboratory Automation and Screening (SLAS) 2025 conference in Boston featured over 50 presentations on organoid automation, while a 2024 Department of Defense grant provided US$ 7 million for developing organoid models of traumatic brain injury.

Europe Fosters Collaborative Research and Regulatory Advancement

Europe’s market position is defined by strong collaborative frameworks and regulatory leadership. The Innovative Health Initiative (IHI), a partnership between the EU and industry, committed EUR 40 million in 2024 to 4 new projects aimed at standardizing organoid use in drug safety testing. In the UK, the Medical Research Council (MRC) awarded over GBP 8 million in grants for organoid-based disease modeling in 2024. Germany’s Helmholtz Association also launched a new research program with 6 dedicated labs to develop multi-organoid systems. In 2025, the European Medicines Agency (EMA) published its first draft guideline on the use of organoid data in regulatory filings, providing a clear path for industry.

The region's biotech hubs are centers of intense activity. The Hubrecht Institute in the Netherlands, a pioneer in the field, entered into 10 new commercial licensing agreements in 2024 for its organoid technologies. Switzerland’s ETH Zurich spun out 3 new companies focused on spheroid analysis platforms. Meanwhile, a French consortium received EUR 5 million to create the first large-scale European biobank for inflammatory bowel disease organoids. The annual Organoids conference in Cambridge, UK, saw attendance from over 400 unique industry and academic entities in 2024, and at least 20 European CROs have now received certification for Good Laboratory Practice (GLP) compliant spheroid assays.

Asia Pacific Emerges as a Powerhouse of Growth and Investment

The Asia Pacific region is rapidly becoming a critical hub for the Organoids and spheroids market, fueled by substantial government investment. China’s "14th Five-Year Plan" for biotechnology, updated in 2024, specifically allocated CNY 300 million to establish 5 national organoid research centers. Japan’s Agency for Medical Research and Development (AMED) funded 15 new projects in 2025 to advance iPSC-derived organoids for regenerative medicine. South Korea’s Ministry of Health and Welfare also approved 8 new clinical trials using spheroid-based cell therapies in 2024.

An investment like it is fostering a vibrant commercial landscape. In Singapore, the A*STAR research agency partnered with 4 multinational pharmaceutical companies in 2024 to co-develop liver organoid toxicity panels. India saw a 50% increase in patent applications for 3D cell culture technologies between 2023 and 2024, with over 60 new filings. South Korean biotech companies have launched at least 10 new commercial organoid-on-a-chip products in 2024. Furthermore, a new 100,000-square-foot biopark dedicated to regenerative medicine opened in Shanghai in early 2025, housing over 20 companies working with 3D cell models.

Top Players in Global Organoids and Spheroids Market

- 3D BioMatrix

- 3D Biotek LLC

- AMS Biotechnology (Europe) Limited

- ATCC

- Cellesce Ltd

- Corning Incorporated

- Greiner Bio-One

- Hubrecht Organoid Technology (HUB)

- InSphero/Perkin Elmer

- Kuraray

- Lonza

- Merck KGaA

- Prellis Biologics

- STEMCELL Technologies Inc.

- Thermo Fisher Scientific, Inc.

- Other Prominent Players.

Market Segmentation Overview:

By Type

- Organoids

- Neural Organoids

- Hepatic Organoids

- Intestinal Organoids

- Kidney Organoids

- Other Organoids

- Spheroids

- Multicellular tumor spheroids (MCTS)

- Neurospheres

- Mammospheres

- Hepatospheres

- Embryoid bodies

By Method

- Organoids

- General Submerged Method for Organoid Culture

- Crypt Organoid Culture Techniques

- Air Liquid Interface (ALI) Method for Organoid Culture

- Clonal Organoids from Lgr5+ Cells

- Brain and Retina Organoid Formation Protocol

- Spheroids

- Micropatterned Plates

- Low Cell Attachment Plates

- Hanging Drop Method

- Others

By Source

- Organoids

- Primary Tissues

- Stem Cells

- Spheroids

- Cell Line

- Primary Cell

- iPSCs Derived Cell

By Application

- Developmental Biology

- Personalized Medicine

- Regenerative Medicine

- Disease Pathology Studies

- Drug Toxicity & Efficacy Testing

By End User

- Biotechnology and pharmaceutical industries

- Academic & Research Institutes

- Hospitals and diagnostic centers

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2024 | US$ 1,072.58 Million |

| Expected Revenue in 2033 | US$ 6,613.97 Million |

| Historic Data | 2020-2023 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Unit | Value (USD Mn) |

| CAGR | 22.4% |

| Segments covered | By Type, By Method, By Source, By Application, By End User, By Region |

| Key Companies | 3D BioMatrix, 3D Biotek LLC, AMS Biotechnology (Europe) Limited, ATCC, Cellesce Ltd, Corning Incorporated, Greiner Bio-One, Hubrecht Organoid Technology (HUB), InSphero/Perkin Elmer, Kuraray, Lonza, Merck KGaA, Prellis Biologics, STEMCELL Technologies Inc., Thermo Fisher Scientific, Inc., Other Prominent Players. |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)