Organ on a chip market: Product and Services (Products (Instruments and Organ-on-a-Chip Devices (Liver-on-a-Chip, Lung-on-a-Chip, Intestine-on-a-Chip, Kidney-on-a-Chip, Heart-on-a-Chip, Others) and Services); Application (Drug, Discovery, Toxicology Research, and Others); End Users (Academic and Research Institutes, Pharmaceutical & Biotechnology Companies, Others); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: 10-Apr-2025 | | Report ID: AA1124967

Market Scenario

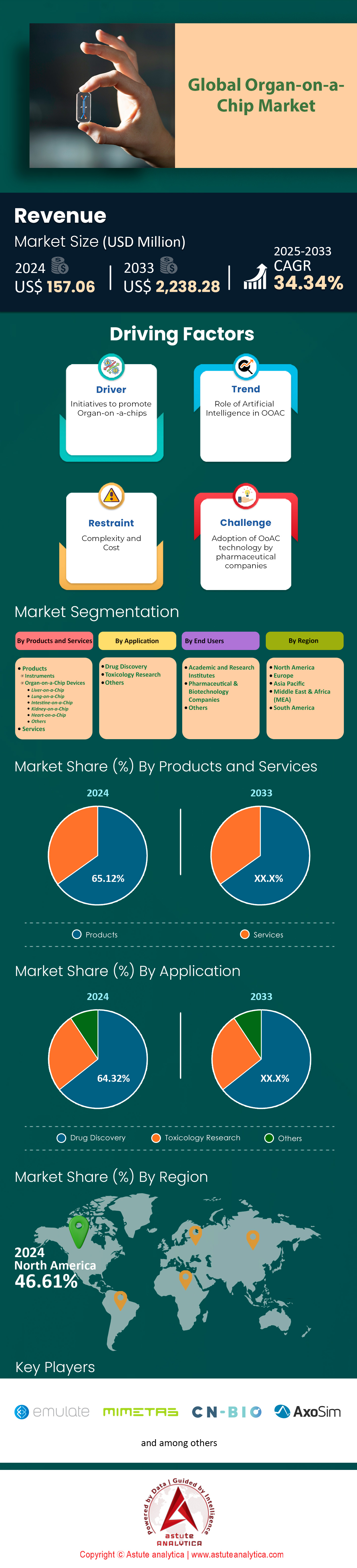

Organ on a Chip Market was valued at US$ 157.06 million in 2024 and is projected to hit the market valuation of US$ 2,238.28 million by 2033 at a CAGR of 34.34% during the forecast period 2025–2033.

The organ on a Chip Market market is experiencing unprecedented momentum, evidenced by significant funding rounds such as CN Bio Innovations' $21 million Series B investment in April 2024, with $10 million from Bayland Capital alone. This surge in investment is directly tied to the FDA's increasing acceptance of organ-on-chip data in drug development processes, particularly through their ISTAND Pilot Program which recently approved the first liver chip submission for drug-induced liver injury assessment The regulatory landscape's evolution, coupled with the FDA Modernization Act 2.0's emphasis on alternative testing methods, has created a fertile ground for organ-on-chip adoption across major pharmaceutical companies.

Strategic collaborations are reshaping the organ-on-a-chip market's trajectory, as demonstrated by MIMETAS's recent partnership with Argenx for IND applications and their involvement in the €124 million Dutch National Growth Fund project for animal-free biomedical innovation. These partnerships are yielding tangible results, particularly in oncology and neurology research, where companies like Cedars-Sinai are utilizing Heart-Chip models to study cancer drug cardiotoxicity. The technology's ability to replicate human-specific responses is proving invaluable for drug development, leading to increased adoption by pharmaceutical companies seeking to reduce clinical trial failures and accelerate drug development timelines.

The organ on a chip market's most promising aspect lies in its expansion beyond traditional drug testing into personalized medicine applications. Recent breakthroughs, such as the Alveolus Lung-Chip's success in studying bacterial pneumonia and the NIH's use of Liver-Chip for radiation-induced liver injury research demonstrate the technology's versatility and potential for patient-specific treatment optimization. This evolution is supported by enhanced data analytics capabilities, with companies integrating AI and machine learning to analyze the complex datasets generated by these sophisticated platforms. The convergence of these technological advances with growing regulatory support and substantial private investment signals a transformative period for the organ-on-chip industry, particularly in areas of high unmet medical need.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver Focus: Growing Need for Accurate Human-Mimetic Models

The global pharmaceutical sector is searching for better models that can effectively reproduce human biophysics in order to advance drug discovery and development. Animal testing, simple cell cultures and similar procedures are forgotten in history because they are inadequate in predicting human responses which might lead to unfortunate expensive ‘failures’ late in development. Data showed that mass drug development expenditures to exceed $2.5 billion dollars in 2023 for a single useful drug, highlighting the tendency of booming losses instead of profits. Wherein, organ-on-a-chip market seems to be the solution for this problem since it provides a framework that approximates the human organ system’s intricacies which in turn enhances testing procedures. More than 200 organotypic chips including liver and lung models to aid in metabolism and respiratory disease research were reported in 2023 alone. It is believed that these chips played a significant role in pre-clinical screening of toxicity and minimized adverse events during clinical testing. A study published in 2023 showed that liver-on-a-chip models were able to predict liver toxicity 85% of the times, clearly better than conventional methods have ever.

This trend is further illustrated by the increasing partnership between the academia and the industrial players. For example, in collaboration with a research university in 2023, a top pharmaceutical firm was able to create a heart-on-a-chip which closely replicates cardiac arrhythmia. Such partnerships are important for the development of OoC technology and its wider incorporation into the industry’s drug development processes.

Trend Focus: Integration of Artificial Intelligence with Organ-on-a-Chip Systems

AI and OoC Technologies Fusion Convergence became one of the vivid trends in organ-on-a-chip market. AI boosts the functionality of OoC systems through advanced data comprehension and forecasting technology. This combination makes it possible to continuously observe and interpret the complicated biological responses unfolding in the chips. In 2023, more than 60% of all newly initiated organ on a chip platforms made use of AI algorithms for data processing. For instance, the AI-based kidney-on-a-chip improved specificity of the nephrotoxic effect screening of newly created compounds. An US-based AI startup rolled out in 2023 an AI powered OoC platform that can accurately predict drug induced organ damage with minimal error margin. Besides, training of algorithms also enabled approximation of the disease advancement in the organ chips thus giving further understanding of its pathophysiology.

This introduction of AI does not only speed up the process of researching but also improves the accuracy of the results obtained in the organ-on-a-chip market. AI generates value from the datasets created by the OoC experiments through identifying detailed features and reactions otherwise regarded as noise during normal analysis. This tendency is expected to deepen with funding for AI installation rising to over US$ 500 million in 2023, what was definitely do not happen before.

Challenge Focus: Limited Standardization Across Different Organ-on-a-ChipPlatforms

The organ-on-a-chip market faces standardization issues across its different platforms. In 2023, a survey showed that OoC devices manufacturers designed more than 70% of devices to have unique shapes, functional materials, and their own protocols. Therefore, this unevenness makes it difficult to harmonize results obtained from different studies and also delays the use of organ on a chip data for approval of new drugs. The use of diverse organ systems for modeling and different proprietary technologies for developing ooc systems make bringing about uniformity complex. For example, while one company may utilize silicone-based chips, another may utilize polymer-based materials which leads to disparities in the cellular response. To counter this drawback, international consortia formed in 2023 aim at developing uniform guidelines regarding the OoC development and testing procedures. Adopting a chip model has potential but FDA argues for a single standard validation process. In 2023, the FDA published a draft guidance document which specified the areas which should be covered in the OoC data included in BA submissions.

Segmental Analysis

By Product & Services

Based on product & services, product segment that comprises instruments as well as the OOC devices such as liver on chip, lung on chip, heart on chip devices is currently dominating the organ-on-a-chip market with over 65.12% market share. This is owing to increased use and development in technology. A high demand for these devices has come up as they are more relevant for human models in drug testing and modeling of diseases. The increase in the chronic diseases and the requirement for individualized medicines has increased the utilization of OOC products leading to intensive use in R and D.

In 2023, a number of key industry players in the organ-on-a-chip market have come forward to invest substantially into OOC devices so that new products that are more advanced than the current ones can be developed. Such developments have transformed OOC devices into cheap and easy to use systems which in turn encourages more and more institutions and companies to use them. Such renewed growths in the quality and use of these products propagates the growth of the organ on chip market maintaining it in a highly dynamic state. Moreover, supportive legislation and cooperation between industry and academia have facilitated the uptake of OOC products as opposed to services. The absence of OOC device standards and guidelines in 2023 have resulted in lack of confidence among end-users, thus weakening the procurement of goods. The potential of OOC devices to provide better predictive human models that reduce the cost and time required for drug development have made them popular options hence justifying the growth of this product segment in the market.

By Application

Based on application, organ-on-a-chip market finds its largest demand in drug discovery due to its potential to revolutionize the drug development process. In 2023, the segment held over 64.32% market share. The pharmaceutical sector operates under considerable constraints to decrease both the time and capital expenditure incurred while completing the new drug life cycle. OOC devices are beneficial in that they provide accurate human organ models whereby drug responses are more accurate than when carrying out the studies on animal models. With this kind of increased precision, there is a reduced probability of clinical trial termination in later stages which translates to a saving of resources by the companies.

One reason that makes organ-on-a-chip technology appealing is its potential to enhance the effectiveness of its applications in drug development. Among the works from 2023, important accomplishments in microfluidics and biomaterials allowing OOC platforms to be developed that are capable of closely modeling complex human organs have also been reported. Therefore, it is possible to create normal physiological conditions in which numerous drugs might be screened at once, and in this way promising drugs can be identified more rapidly. The great flexibility in the designs of devices in organ-on-a-chip marketplace allows the models to direct and concentrate on certain diseases so that the understanding of the mechanisms of those diseases is improved, while new treatments may be established.

Out of the key factors that are contributing towards the growth the solid financing of organ-on-a-chip projects, collaborations of pharmaceutical and technology companies, and favorable policy regimes. In 2023, a number of regulators have appeared more willing to accept the data that emerges from OOC studies since they deem it helpful in predicting how people are expected to respond. The organ-on-a-chip market’s capacity to generate outcomes rapidly, and its ability to reduce animal testing requirements as mentioned previously, are further characteristics which have made it possible for companies to make necessary adjustments and improvements in order to satisfy the demand of the pharmaceutical market.

By End Users

Pharmaceutical and biotechnology companies are the primary consumers of the organ-on-a-chip market due to their critical need for advanced tools that enhance drug development efficiency. In 2023, these companies are actively seeking technologies that can reduce the high costs and lengthy timelines associated with bringing new drugs to market. organ on a chip devices provide highly predictive human organ models that can identify potential drug failures early in the development process, thereby minimizing costly late-stage clinical trial failures.

These companies lead the market as they have the resources and infrastructure to adopt and integrate organ on a chip technology extensively. In 2023, significant investments have been made by pharmaceutical giants to incorporate OOC platforms into their R&D pipelines, support the organ-on-a-chip market growth further. Collaborations between OOC developers and pharmaceutical companies have resulted in tailored OOC systems that meet specific research needs, further solidifying their reliance on these technologies. The ability to conduct more efficient and ethical research, with reduced use of animal models, aligns with the evolving goals of these industries. Moreover, the global scale and influence of pharmaceutical and biotechnology companies contribute to their control of the highest market share. In 2023, their widespread adoption of OOC devices has set industry standards and driven market trends. Their emphasis on innovation and improving success rates in drug development keeps them at the forefront of utilizing cutting-edge technologies like OOC, reinforcing their position as leading end-users in the market.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

North America: Pioneering Innovation Through FDA Support and Strategic Investments

North America continues to dominate the organ-on-a-chip market, propelled by robust FDA engagement and substantial private investments. The FDA’s ongoing collaboration with companies such as Emulate through cooperative research agreements has fostered a favorable regulatory landscape for the adoption of organ-on-a-chip technologies. This supportive environment, coupled with major funding rounds like Caris Life Sciences’ recent $168 million raise, underscores the region’s dedication to driving innovation. Leading industry players—including MIMETAS, InSphero, and TARA Biosystems—are integrating artificial intelligence and machine learning into their organ-on-a-chip platforms, expanding analytical capabilities and predictive modeling accuracy. Supported by a thriving pharmaceutical sector, these technological advancements are accelerating drug discovery processes and reducing the overall costs associated with preclinical research.

Asia Pacific: Rapid Market Expansion Through Government Support and Innovation

The Asia Pacific region is witnessing remarkable expansion in the organ-on-a-chip market, fueled by proactive government initiatives and emerging local biotech firms. Countries like Japan, South Korea, and Singapore are serving as innovation hubs, supported by institutes such as the Institute of Bioengineering and Nanotechnology (IBN) and the RIKEN Institute. Notable companies—Anhui Luohua Biotechnology Co. Ltd., Beijing Daxiang Biotech Co., Ltd, and MineBio Life Sciences Limited—are making significant strides in creating cost-effective, user-friendly organ-on-a-chip solutions. Moreover, strategic alliances, like the one between CN Bio and Altis Biosystems, are hastening the adoption of organ-on-a-chip technologies in the region. Pharmaceutical giants including Takeda Pharmaceutical and Daiichi Sankyo are further propelling market growth by leveraging liver-on-a-chip devices for enhanced drug metabolism and toxicity assessment during preclinical stages.

Europe: Regulatory Excellence Driving Sustainable Market Development and Growth

Europe’s organ-on-a-chip market is characterized by robust regulatory frameworks and collaborative research efforts, leading to sustainable growth. The European Medicines Agency (EMA) and the European Centre for the Validation of Alternative Methods (ECVAM) are actively promoting organ-on-a-chip solutions as viable alternatives to animal testing. Generous funding programs, including Horizon Europe’s €95.5 billion research and innovation budget, reinforce the region’s commitment to encouraging cutting-edge advancements. To standardize terminology and technical specifications, the European Organ-on-Chip Society (EUROoCS) is spearheading international harmonization efforts, enhancing both innovation and interoperability. Despite challenges such as high implementation costs and technological complexities, the European market is poised for a robust CAGR from 2025 to 2033, with countries like Germany, the UK, France, and the Netherlands emerging as key contributors to this upward trajectory.

Recent Developments in the Organ on a Chip Market

Recent Funding & Investments (2024)

April 2024

- CN Bio Innovations Ltd. secured $21 million in Series B investment round

- $10 million from Bayland Capital

- $5.5 million from CN Innovations Holdings Ltd.

- Focus: Advancing Heart-on-a-Chip technology

Strategic Partnerships & Collaborations (2024)

June 11, 2024

- MIMETAS partnered with Argenx

- Purpose: Support for Investigational New Drug (IND) application

- Technology: Utilized OrganoPlate platform for human in vitro disease assay

July 7, 2024

- Project SECRET involving MIMETAS received €2.5 million EU funding

- Focus: Research on perinatal cell secretomes

June 4, 2024

- MIMETAS collaborated with Naturalis Biodiversity Center and Vrije Universiteit Amsterdam

- Purpose: Research into snakebite toxicity using 3D blood vessel model

Product Launches & Research Developments in the Organ-on-a-Chip Market (2024)

January 27, 2025

- MIMETAS launched OrganoPlate UniFlow (UF)

- Feature: Unidirectional, gravity-driven pumpless flow system

- Application: Drug discovery and disease research

Clinical Research Breakthroughs (2024)

- Universitätsmedizin Berlin: Used Alveolus Lung-Chip for bacterial pneumonia study

- NIH: Utilized Liver-Chip for radiation-induced liver injury research

- Cedars-Sinai: Employed Heart-Chip model for cancer drug cardiotoxicity studies

Top Players in the Organ on a Chip Market

- Emulate, INC.

- Mimetas B.V.

- Valo Health

- AIM Biotech Pte. Ltd.

- AxoSim, Inc.

- InSphero

- CN Bio Innovations Ltd

- SynVivo, Inc.

- TissUse GmbH

- AlveoliX AG

- Other Prominent Players

Market Segmentation Overview:

By Product & Services

- Products

- Instruments

- Organ-on-a-Chip Devices

- Liver-on-a-Chip

- Lung-on-a-Chip

- Intestine-on-a-Chip

- Kidney-on-a-Chip

- Heart-on-a-Chip

- Others

- Services

By Application

- Drug Discovery

- Toxicology Research

- Others

By End Users

- Academic and Research Institutes

- Pharmaceutical & Biotechnology Companies

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)