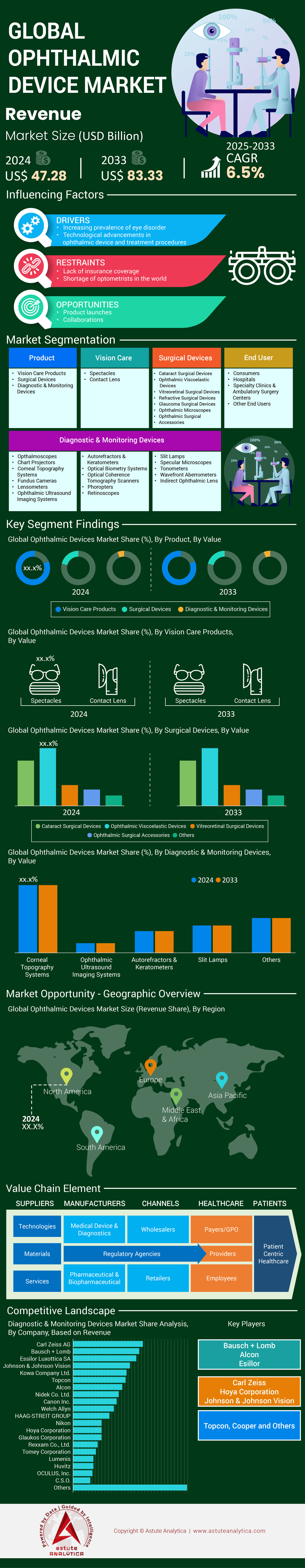

Ophthalmic Devices Market: By Product (Vision Care Products, Surgical Devices, Diagnostics & Monitoring Devices); Vision Care (Spectacles, Contact Lenses); Surgical Devices (Cataract Surgical Devices, Ophthalmic Viscoelastic Devices, Vitreoretinal Surgical Devices, Refractive Surgical Devices, Glaucoma Surgical Devices, Ophthalmic Microscopes, Ophthalmic Surgical Accessories); Diagnostic & Monitoring Devices ( Opthalmoscopes, Chart Projectors, Corneal Topography Systems, Fundus Cameras, Lensometers, Ophthalmic Ultrasound Imaging Systems, Autorefractors & Keratometers, Optical Biometry Systems, Optical Coherence Tomography Scanners, Slit Lamps, Indirect Ophthalmic Lens); End Users (Consumers, Hospitals, Specialty Clinics & Ambulatory Surgery Centre); Region– Industry Dynamics, Market Size, and Opportunity Forecast For 2025-2033

- Last Updated: Apr-2025 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0621081 | Delivery: 2 to 4 Hours

| Report ID: AA0621081 | Delivery: 2 to 4 Hours

Market Snapshot

Ophthalmic devices market was valued at US$ 47.28 billion in 2024 and is forecast to reach US$ 83.33 billion by 2033 at a CAGR of 6.5% during the forecast period 2025-2033.

The surge in demand for ophthalmic devices is anchored in the escalating global burden of eye diseases, particularly cataracts, glaucoma, and diabetic retinopathy, which cumulatively account for a majority of preventable vision loss. Aging populations and rising diabetes prevalence—with over 537 million adults affected globally—are exacerbating ocular complications, necessitating advanced diagnostic and surgical interventions in the ophthalmic devices market. Devices like optical coherence tomography (OCT) and phacoemulsification systems are critical for managing these conditions, with OCT emerging as a frontline tool for detecting retinal disorders due to its non-invasive imaging capabilities. Concurrently, the average wait time for cataract surgery in high-income countries has dropped below 3 months, reflecting the efficiency gains from automated phacoemulsification devices. This demand is further amplified by tele-ophthalmology platforms, which enable remote screening in rural regions, reducing diagnostic delays by over 50% in underserved areas.

Surgical ophthalmic devices, such as femtosecond lasers and vitrectomy machines, are central to addressing advanced ocular pathologies. Their adoption in the ophthalmic devices market is driven by precision and safety: femtosecond lasers, for instance, reduce surgical complications in cataract procedures by 30% compared to manual techniques. In diabetic retinopathy management, single-use vitrectomy kits minimize infection risks, particularly in high-volume settings like India, where government programs conduct over 6 million cataract surgeries annually. These trends are mirrored in North America and Europe, where regulatory approvals for AI-integrated surgical systems—like Alcon’s AI-driven intraocular lenses—are accelerating adoption in specialty clinics. Emerging markets, meanwhile, leverage modular surgical kits to streamline high-throughput procedures, aligning with initiatives to eliminate avoidable blindness, which currently constitutes 80% of global vision impairment cases.

Regionally, innovation is concentrated in North America ophthalmic devices market, where Alcon and Johnson & Johnson dominate with AI-enhanced diagnostics and premium intraocular lenses. In Asia-Pacific, India’s National Programme for Control of Blindness, targeting 450 million screenings annually, is propelling demand for portable slit lamps and low-cost OCT systems. Carl Zeiss Meditec’s recent launch of adaptive optics for personalized myopia management underscores the shift toward precision devices, while Bausch Health’s investments in gene therapy platforms target hereditary retinal diseases. Collaborations between OEMs and telehealth startups, particularly in Africa, are expanding access to diabetic retinopathy screening, reducing treatment delays by 40% in pilot regions. These dynamics illustrate a convergence of demographic pressures, technological innovation, and equity-focused healthcare policies, positioning ophthalmic devices as pivotal tools in global eye health strategies.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Aging Global Population Increasing Demand for Cataract and Glaucoma Treatments

The global aging population is a primary catalyst for the surge in demand for ophthalmic devices market growth, particularly in cataract and glaucoma care. According to the World Health Organization (WHO), the number of individuals aged 60+ will reach 1.4 billion by 2030, with age-related eye disorders directly correlated to this demographic shift. In Japan, where 33.9% of the population is over 65 (2023 National Institute of Population data), annual cataract surgeries exceed 1.5 million, driven by an 80% prevalence rate of cataracts in those aged 75+. Similarly, glaucoma—a leading cause of irreversible blindness—affects 3.5 million Americans aged 40+, as per the Glaucoma Research Foundation, with 50% remaining undiagnosed. The U.S. National Eye Institute reports that glaucoma-related blindness costs the economy $2.86 billion annually in lost productivity and healthcare expenses. Developing regions are equally impacted: Africa, home to 54 million people over 60, faces a 15% glaucoma prevalence rate, four times higher than global averages, due to genetic susceptibility and delayed screenings.

Manufacturers in the ophthalmic devices market like Alcon and Johnson & Johnson are scaling production of intraocular lenses (IOLs) and tonometers, with Alcon shipping 22 million IOLs globally in 2023, a 17% year-over-year increase. Innovations such as Light Adjustable Lens (LAL) technology, which allows post-surgical vision customization, are critical to addressing this demand. The WHO’s 2025 Action Plan for Eye Care emphasizes tripling surgical workforce capacity in low-income nations, highlighting the urgency of systemic responses to demographic pressures.

Trend: Minimally Invasive Procedures Gaining Traction for Faster Patient Recovery

Minimally invasive glaucoma surgery (MIGS) and micro-incision cataract surgery (MICS) are redefining ophthalmic care in the ophthalmic devices market by reducing recovery times from weeks to days. The FDA’s 2023 approval of Nova Eye Medical’s iTrack Advance Microcatheter—a device enabling 28-minute glaucoma procedures with a 98% success rate in lowering intraocular pressure (IOP)—exemplifies this shift. In 2024, Heidelberg Engineering’s Anterion system, used in 1,200 clinics globally, reduced diagnostic time for glaucoma from 15 minutes to 90 seconds through AI-powered anterior segment tomography. Surgeons at Singapore National Eye Centre reported in Ophthalmology that MICS procedures using sub-2.2mm incisions decreased post-operative corneal edema by 62% compared to traditional phacoemulsification. Meanwhile, Glaukos’ iStent inject W, implanted in 150,000 patients since 2021, achieves sustained IOP reduction below 15 mmHg in 70% of cases, with 90% of patients discontinuing topical medications within six months.

Real-world data from 40 U.S. ambulatory surgery centers in the ophthalmic devices market showed that MIGS adoption cut hospital readmissions for glaucoma by 33% in 2023. However, device costs remain a barrier: the iStent inject W costs $1,950 per unit, limiting its use outside high-income markets. Despite this, the trend toward minimally invasive techniques is irreversible, with Bausch + Lomb projecting that 65% of ophthalmic surgeries will utilize MIGS or MICS devices by 2026.

Challenge: High Device Costs Restricting Affordability in Developing Regions

Exorbitant pricing of advanced ophthalmic devices perpetuates care disparities in emerging economies across the global ophthalmic devices market. For instance, a standard phacoemulsification machine costs $85,000–$130,000, equivalent to the annual healthcare budget of rural hospitals in India, where 66% of blindness cases result from untreated cataracts. A 2024 report by the International Agency for the Prevention of Blindness (IAPB) revealed that Sub-Saharan Africa has only 1.2 cataract surgeons per million people—20 times fewer than Europe—due to reliance on imported $25,000 IOLs. Though Aurolab’s $10 IOLs have been distributed to 6 million patients since 2020, sterilization challenges and a 30% postoperative complication rate in resource-limited settings undermine their impact.

Additionally, the World Bank estimates that 43 low-income countries in the ophthalmic devices market spend less than $50 per capita annually on healthcare, forcing ophthalmologists to reuse single-use devices like $380 corneal trephines, increasing infection risks. Regulatory inconsistencies worsen access: the FDA’s 2022 recall of 12,000 mislabeled Alcon trocars disrupted Kenya’s cataract surgical rate (CSR), delaying 8,000 surgeries. While NGOs like SEE International donate $500 manual small-incision cataract surgery (MSICS) kits, scaling remains slow, with only 150 kits shipped to Nigeria in 2023. Without subsidies or localized manufacturing, WHO’s goal of a 30% global reduction in treatable blindness by 2030 remains unattainable.

Segmental Analysis

By Product Type

The vision care products segment, comprising spectacles, contact lenses, and lens care solutions, commands a 56.40% share of the ophthalmic devices market due to their universal applicability, affordability, and recurring demand. This segment thrives on the global prevalence of refractive errors, which affect over 2.2 billion people, including myopia, hyperopia, and presbyopia, as reported by the WHO. Unlike surgical or diagnostic devices, vision care products address both corrective and preventive needs, catering to a broader demographic—from children to the elderly. The rising incidence of digital eye strain, linked to prolonged screen time across all age groups, has further normalized the use of blue-light-blocking glasses, positioning spectacles as both medical and lifestyle products. Additionally, contact lenses are increasingly adopted for their convenience and aesthetic appeal, particularly among younger populations in urban centers.

Key end users of the ophthalmic devices market include optical retail chains, online eyewear platforms, and independent optometrists. The dominance of optical retailers stems from their ability to offer integrated services, such as eye exams and immediate product accessibility, creating a one-stop solution for consumers. For instance, India’s National Programme for Control of Blindness has facilitated the distribution of over 6 million spectacles annually through public health campaigns, underscoring the role of government partnerships in driving volume sales. Meanwhile, innovations like daily disposable contact lenses and silicone hydrogel materials are addressing hygiene concerns and comfort, sustaining repeat purchases. This segment’s growth is also propelled by the lack of surgical infrastructure in low- and middle-income countries, where spectacles remain the primary intervention for correctable vision impairment, accounting for over 75% of cases in regions like Sub-Saharan Africa.

By Vision Care Products

Spectacles dominate the vision care segment of the ophthalmic devices market by capturing nearly 62% market share due to their non-invasive nature, low cost, and adaptability to diverse visual and lifestyle needs. The global surge in pediatric myopia, affecting nearly 30% of children aged 5–15, has intensified demand for prescription glasses, particularly in Asia-Pacific countries like China and South Korea, where screen-based education and limited outdoor activity exacerbate eye strain. Spectacles also serve as a frontline solution for age-related presbyopia, which impacts 1.8 billion adults globally, as per WHO estimates. Advances in lens technology, such as progressive and photochromic lenses, have enhanced their functionality, catering to multifocal needs and light sensitivity.

The segment’s leadership in the ophthalmic devices market is further reinforced by the expansion of online eyewear retailers, which democratize access through virtual try-ons and home delivery, reducing dependency on physical stores. For example, platforms like Warby Parker and Lenskart have capitalized on telehealth integration, allowing consumers to upload prescriptions and receive customized products within days. In emerging markets, government initiatives like Brazil’s “Ótica Solidária” program distribute free or subsidized spectacles to low-income populations, addressing unmet needs. The cultural normalization of eyewear as a fashion accessory also drives demand, with luxury brands like Gucci and Ray-Ban offering designer frames that blend medical utility with aesthetic appeal.

By Diagnostics & Monitoring Devices

Ophthalmic ultrasound imaging systems hold a significant 13.70% share of the diagnostics and monitoring segment in the ophthalmic devices market due to their irreplaceable role in assessing posterior eye structures when optical methods are obstructed, such as in cases of dense cataracts or vitreous hemorrhage. These systems are critical for diagnosing conditions like retinal detachment and intraocular tumors, particularly in aging populations where 1 in 4 adults over 60 suffer from cataracts, as noted by the CDC. The portability and cost-effectiveness of ultrasound devices compared to advanced modalities like MRI make them preferable in resource-constrained settings, where 50% of eye clinics in rural India rely on ultrasound for preoperative evaluations.

The demand for these systems in the ophthalmic devices market is further driven by their integration into comprehensive eye care protocols. For instance, 3D ultrasound biomicroscopy enables high-resolution imaging of anterior chamber angles, aiding in glaucoma management. Surgeons performing 12 million cataract surgeries annually globally depend on ultrasound for biometry measurements to calculate intraocular lens power. Additionally, the rising prevalence of diabetic retinopathy, which affects one-third of the 537 million diabetics worldwide, necessitates frequent monitoring via ultrasound to detect complications like vitreous hemorrhage. The systems’ versatility in emergency settings—such as trauma assessments—and their compatibility with telemedicine platforms further solidify their clinical utility.

By End Users

Consumers’ overwhelming 56.40% share of the ophthalmic devices market reflects the shift toward self-managed eye care, particularly for non-surgical needs. The proliferation of over-the-counter (OTC) products, such as reading glasses and lubricating eye drops, empowers individuals to address mild refractive errors and dry eye syndrome without clinical intervention. For example, 240 million adults globally use OTC readers, driven by the ease of purchase in pharmacies and supermarkets. The post-pandemic surge in e-commerce has further accelerated this trend, with online sales of contact lenses and eyewear growing by 25% annually in regions like North America.

Hospitals and clinics, while critical for complex procedures, face limitations in scalability compared to consumer channels in the ophthalmic devices market. Specialty clinics, however, are adopting hybrid models, offering same-day eyewear dispensing alongside exams to retain patient footfall. The consumer segment’s dominance is also tied to preventive health trends, with 40% of adults under 35 proactively purchasing blue-light-blocking glasses to mitigate digital eye strain. In contrast, surgical and diagnostic devices require specialized training and infrastructure, constraining their uptake outside tertiary care centers. This dichotomy highlights the market’s reliance on consumer-driven, high-volume products to sustain growth, particularly in demographics prioritizing convenience and immediate solutions.

To Understand More About this Research: Request A Free Sample

Regional Analysis

North America: Aging Demographics and Technological Innovation Drive Market Leadership

North America’s dominance in the ophthalmic devices market is anchored in its advanced healthcare infrastructure, high adoption of precision technologies, and a rapidly aging population requiring vision care. The United States, contributing the majority of the region’s share, benefits from robust R&D investments by industry leaders like Alcon and Bausch Health, which prioritize AI-driven diagnostic tools and next-generation surgical systems. Regulatory frameworks, including streamlined FDA approvals for devices like femtosecond lasers and intraoperative wavefront aberrometers, accelerate commercialization. The prevalence of diabetes-related eye conditions, affecting over 38 million Americans, underscores demand for retinal imaging systems and vitrectomy devices, while cataracts—linked to 50% of adults over 75—drive volume in phacoemulsification systems. Additionally, the proliferation of tele-ophthalmology platforms addresses rural care gaps, with 30% of U.S. clinics now offering remote diabetic retinopathy screenings.

Private insurance coverage and Medicare reimbursements further sustain procedural volumes in the US ophthalmic devices market, ensuring accessibility to premium devices like multifocal intraocular lenses. Strategic partnerships, such as Johnson & Johnson’s collaboration with surgical AI startups, enhance procedural accuracy in cataract surgeries, reducing postoperative complications. However, cost pressures persist, with hospitals prioritizing cost-efficient, high-throughput devices like preloaded IOL injectors to manage operational expenses. The region’s leadership is further reinforced by academic-industry alliances, such as the NIH-funded development of gene therapies for inherited retinopathies, positioning North America at the forefront of curative ophthalmology.

Europe: Regulatory Harmonization and Cross-Border Care Boost Adoption

Europe’s ophthalmic devices market thrives on standardized regulatory protocols under the EU Medical Device Regulation (MDR), which prioritizes safety and efficacy for advanced diagnostic and surgical tools. Countries like Germany and France lead in adopting optical coherence tomography (OCT) systems, driven by state-funded screening programs for glaucoma and age-related macular degeneration (AMD). The region’s aging population, with 20% over 65, amplifies demand for cataract surgery devices, while diabetic retinopathy management—linked to 61 million European diabetics—fuels investments in pan-retinal photocoagulation lasers. Cross-border initiatives, such as the European Eye Epidemiology Consortium, facilitate data-driven device development, optimizing technologies for diverse patient cohorts.

Government-led initiatives in the Europe ophthalmic devices market like the UK’s National Health Service (NHS) eyecare vouchers ensure affordability of spectacles and contact lenses, maintaining consumer-driven demand. Meanwhile, Eastern Europe’s growth is propelled by EU-funded upgrades to ophthalmic infrastructure, with 40% of Polish clinics modernizing surgical suites with phacoemulsification units. Challenges include reimbursement disparities, prompting manufacturers like Carl Zeiss Meditec to offer modular pricing for ultrasound imaging systems. The region also sees rising demand for minimally invasive glaucoma surgery (MIGS) devices, reflecting a shift toward outpatient care models. Europe’s emphasis on sustainability is reshaping product design, with companies introducing recyclable contact lens packaging to align with EU circular economy goals.

Asia-Pacific: High Burden of Preventable Blindness Fuels Rapid Growth

Asia-Pacific’s ophthalmic devices market is expanding rapidly due to the high prevalence of avoidable vision impairment, affecting over 400 million individuals, and government-led initiatives targeting cataract surgical backlogs. India and China dominate demand, with India’s National Programme for Control of Blindness conducting 7 million cataract surgeries annually, reliant on cost-effective phacoemulsification systems and intraocular lenses. Portable diagnostic devices, such as handheld OCT units, are gaining traction in rural areas, where 60% of screenings occur in community health camps. The region’s diabetic population, exceeding 220 million, drives uptake of non-mydriatic retinal cameras for retinopathy monitoring, while pediatric myopia epidemics in East Asia spur demand for orthokeratology lenses.

Local manufacturing hubs in China and South Korea ophthalmic devices market are reducing dependency on imports, with companies producing 70% of global spectacle frames and low-cost OCT systems. Japan’s aging society prioritizes advanced glaucoma drainage devices and presbyopia-correcting IOLs, supported by universal health coverage. Meanwhile, Southeast Asia’s growth is constrained by fragmented reimbursement systems, prompting partnerships like Aravind Eye Care’s telemedicine networks in Myanmar to bypass infrastructure gaps. The region’s focus on AI integration, such as Singapore’s deployment of deep learning algorithms for diabetic retinopathy grading, positions it as a testing ground for scalable solutions. Despite progress, accessibility hurdles persist, with 1 ophthalmologist per 100,000 people in rural Bangladesh, necessitating decentralized device distribution models.

Top Companies in the Ophthalmic Devices Market

- Alcon

- Bausch + Lomb

- Canon Inc.

- Carl Zeiss Meditec AG

- Clearlab SG PTE, Ltd.

- EssilorLuxottica SA

- Glaukos Corporation

- Haag-Streit Holding

- HEINE Optotechnik

- Hoya Corporation

- Johnson & Johnson Vision

- Lumenis

- Luneau Technology Group

- Neo Vision

- Nidek Co. Ltd.

- OcuLentis

- STAAR Surgical Company

- Topcon Corporation

- Ziemer Ophthalmic Systems AG

- Marco

- Kowa Optimed. Inc.

- Oculus Inc.

- Reichert, Inc.

- Beye, LLC(Keeler)

- CSO srl

- Takagi

- Rexxam

- Inami

- Welch Allyn

- Huvitz

- Plusoptix

- Tomey

- Volk

- Ellex Medical Laser Limited

- Iridex Corp.

- Other Prominent players

Market Segmentation Overview

By Product

- Vision Care Products

- Surgical Devices

- Diagnostic & Monitoring Devices

By Vision Care

- Spectacles

- Contact Lenses

By Surgical Devices

- Cataract Surgical Devices

- Ophthalmic Viscoelastic Devices

- Vitreoretinal Surgical Devices

- Refractive Surgical Devices

- Glaucoma Surgical Devices

- Ophthalmic Microscopes

- Ophthalmic Surgical Accessories

By Diagnostic & Monitoring Devices

- Ophthalmoscopes

- Chart Projectors

- Corneal Topography Systems

- Fundus Cameras

- Lensometers

- Ophthalmic Ultrasound Imaging Systems

- Autorefractors & Keratometers

- Optical Biometry Systems

- Optical Coherence Tomography Scanners

- Perimeters/Visual Field Analyzers

- Phoropters

- Retinoscopes

- Slit Lamps

- Specular Microscopes

- Tonometers

- Wavefront aberrometers

- Indirect Ophthalmic Lens

By End Users

- Consumers

- Hospitals

- Specialty Clinics & Ambulatory Surgery Centers

- Other End Users

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia & New Zealand

- ASEAN

- Cambodia

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

View Full Infographic

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2024 | US$ 47.28 Bn |

| Expected Revenue in 2033 | US$ 83.33 Bn |

| Historic Data | 2020-2023 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Unit | Value (USD Bn) |

| CAGR | 6.5% |

| Segments covered | By Product, By Vision Care, By Surgical Devices, By Diagnostic & Monitoring Devices, By End Users, By Region |

| Key Companies | Alcon, Bausch + Lomb, Canon Inc., Carl Zeiss Meditec AG, Clearlab SG PTE, Ltd., EssilorLuxottica SA, Glaukos Corporation, Haag-Streit Holding, HEINE Optotechnik, Hoya Corporation, Johnson & Johnson Vision, Lumenis, Luneau Technology Group, Neo Vision, Nidek Co. Ltd., OcuLentis, STAAR Surgical Company, Topcon Corporation, Ziemer Ophthalmic Systems AG, Marco, Kowa Optimed. Inc., Oculus Inc., Reichert, Inc., Beye, LLC(Keeler), CSO srl, Takagi, Rexxam, Inami, Welch Allyn, Huvitz, Plusoptix, Tomey, Volk, Ellex Medical Laser Limited, Iridex Corp., Other Prominent players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0621081 | Delivery: 2 to 4 Hours

| Report ID: AA0621081 | Delivery: 2 to 4 Hours

.svg)