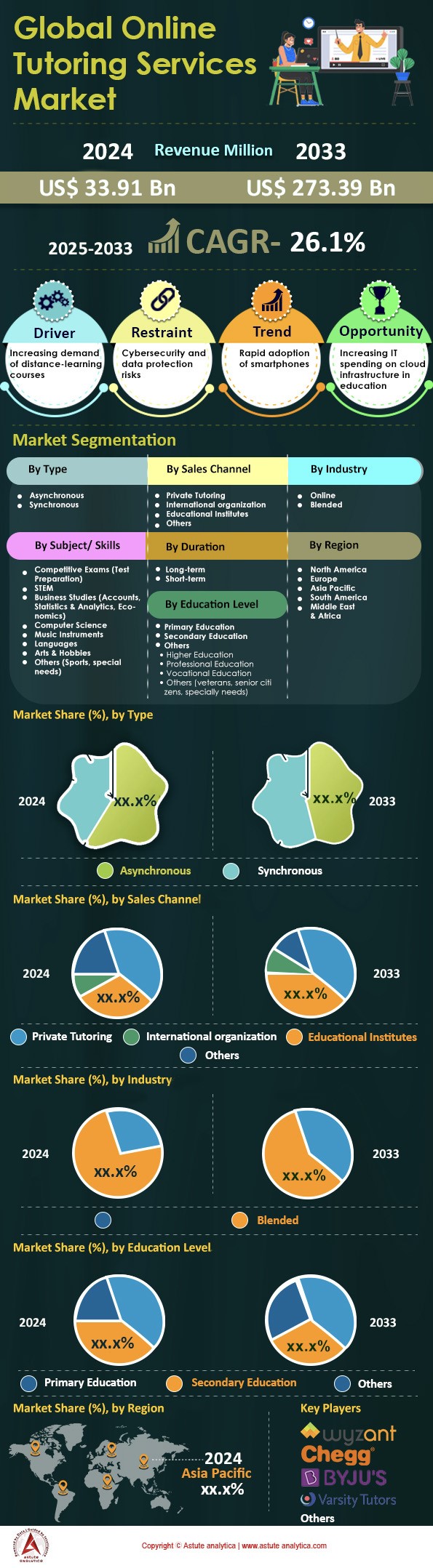

Online Tutoring Services Market: By Type (Asynchronous and Synchronous); Sales Channel (Private Tutoring, International organization, Educational Institutes and Others); Industry (Online and Blended); Education Level (Primary Education, Secondary Education and Others); Subject/Skills ( Competitive Exams (Test Preparation), STEM, Business Studies (Accounts, Statistics & Analytics, Economics), Computer Science, Music Instruments, Languages, Arts & Hobbies and Others (Sports, special needs)); Duration (Long-term and Short-term); and Region—Industry Dynamics, Market Size and Opportunity Forecast for 2025–2033

- Last Updated: Jan-2025 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0522238 | Delivery: 2 to 4 Hours

| Report ID: AA0522238 | Delivery: 2 to 4 Hours

Market Snapshot

Online tutoring services market was valued at US$ 33.91 billion in 2024 and is estimated to reach US$ 273.39 billion by 2033 at a CAGR of 26.1% during the forecast period 2025-2033.

The demand for online tutoring services is surging as more learners seek flexible, specialized, and on-demand educational support. The primary consumers include K-12 students, college undergraduates, test preparation candidates, and working professionals pursuing career advancement. Fueling this rise is the growing sophistication of digital infrastructures in the online tutoring services market, which ensures seamless connectivity worldwide. In 2024, Chegg recorded 1.2 million quarterly paid subscriptions, reflecting heightened interest among college-level learners. As of early 2024, Preply attracted 600,000 monthly active language learners from diverse age brackets. Meanwhile, Vedantu onboarded 8,500 new instructors between January and September 2024, showcasing a swift expansion of teaching networks. Among these rapidly evolving platforms, TutorMe reported 700,000 high-school learners seeking STEM support in mid-2024, underscoring the strong appeal of subject-specific expertise.

Several factors contribute to this robust expansion in the online tutoring services market. Enhanced user experience, personalized study plans, and round-the-clock availability have transformed online tutoring into a crucial supplement to formal schooling. VIPKid extended its reach to 40 additional countries in 2024, tapping into diverse linguistic markets that crave interactive learning sessions. Wyzant reported 90,000 monthly sessions dedicated to specialized test preparation in 2024, illustrating how exam-focused students are actively embracing virtual assistance. Moreover, Tutor.com introduced 750 new tutors for advanced placement subjects, addressing the escalating performance demands of high-achieving learners. As institutions increasingly partner with ed-tech firms, the influx of qualified educators and advanced learning tools bolsters the quality of remote instruction, further propelling adoption rates across multiple demographic groups.

Today’s online tutoring services market landscape is also shaped by innovation, as providers experiment with interactive whiteboards, AI-driven platforms, and collaborative study groups. In 2024, 50 premier universities worldwide formed educational alliances with prominent platforms like Coursera, bridging resource gaps for students who desire flexible coaching. During the same period, UpSkill Tutors saw 180,000 monthly enrollments from working adults aiming for professional growth. Meanwhile, leading AI-powered platforms developed 25,000 personalized lesson modules daily, highlighting real-time adaptability to different learning needs. With user satisfaction on the rise, online tutoring continues to gain traction, affirming its pivotal role in modern education.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Rapid Adoption of Personalized Digital Learning Solutions across Varied Educational and Professional Landscapes Worldwide

This driver in the online tutoring services market stems from the heightened need for tailored support, as learners increasingly seek streamlined resources that adjust to their pace. In 2024, Oak National Academy launched 400 custom study modules designed specifically for remote learners requiring specialized content. These bite-sized lessons focus on individual skill gaps, providing a more precise path to mastery. Meanwhile, Byju’s integrated 600 interactive practice quizzes for post-graduate test prep courses, illustrating an emphasis on targeted revision strategies. The global appetite for subject-focused tutoring continues to grow, prompting the introduction of 100 new digital tutoring startups this year. Such offerings span diverse fields—from advanced STEM topics to foreign language instruction—catering to students and professionals who prioritize convenience, flexibility, and expertise over generic study approaches.

Growing data-driven insights in have propelled this momentum further in the online tutoring services market. During 2024, ClassIn implemented 2,000 real-time analytics features into its teaching ecosystem, enabling tutors to fine-tune lesson delivery based on immediate student performance indicators. This level of personalization drives greater engagement while also reducing repetitive study patterns. In a parallel development, edX offered 50 specialized nano-degree pathways across multiple professional skill domains, catering to learners seeking credible qualifications alongside practical training. TutorVista also introduced 20 AI-driven lesson adaptation prototypes for test prep segments, ensuring that each student’s strengths and weaknesses inform the next phase of instruction. Together, these innovations spotlight a worldwide commitment to meeting diverse educational needs, which extends beyond typical classroom contexts. As digital platforms refine personalization strategies, more students and working professionals gravitate toward interactive learning experiences that promise long-term skill development.

Trend: Growing Integration of AI-Powered Virtual Tutoring Tools with Advanced Adaptive Assessment and Deep Analytics

The trend toward AI-powered tutoring represents a game-changing shift in how students and professionals interact with educational content in the online tutoring services market. Platforms increasingly rely on intelligent algorithms to offer real-time guidance, adaptive quizzes, and predictive learning pathways that respond to individual performance. In 2024, Brainly introduced 15,000 AI-generated topic summaries, which condensed complex concepts into accessible outlines for math and science learners. Course Hero took a similar route by developing 4,500 automated concept explanations tailored to popular undergraduate courses, thereby speeding up homework assistance. Meanwhile, Photomath elevated user engagement by processing 5 million step-by-step problem solutions each month, demonstrating the sheer demand for AI-based tutoring. These capabilities underscore a major leap toward data-enriched learning, reducing the time spent searching for relevant explanations or solutions.

Developers continue to refine these AI-powered models, ensuring that students receive context-sensitive explanations and targeted practice. In the same year, Quizlet launched 8,000 AI-curated flashcard sets aimed at language proficiency training, transcending rote memorization through spaced repetition and adaptive difficulty levels. Equally noteworthy, Toppr integrated 1,200 personalized feedback loops to guide students through exam simulations, pinpointing specific weaknesses that can be addressed in real time. Rosetta Stone, one of the key players in the online tutoring services market, also introduced 55 advanced AI-driven accent training modules, enabling learners to fine-tune their pronunciation through immediate speech analysis. Taken together, these innovations showcase a broader adoption of machine learning that enhances the tutoring experience. By harnessing deep analytics, online tutoring platforms can provide a richer understanding of student progress and tailor instruction to yield meaningful outcomes faster than ever.

Challenge: Ensuring Content Quality and Credibility within Online Learning Platforms Amid Global Tutor Expansion Demands

As online tutoring services market scales up to meet a global surge in demand, one critical challenge emerges: maintaining consistent standards of content quality and tutor credibility. In 2024, Udemy removed 2,400 courses that failed standardized quality benchmarks, reflecting the growing necessity for strict evaluation. Coursera introduced 350 subject accreditation protocols, ensuring that instructors meet specific requirements for course reliability. By mid-2024, an independent education watchdog identified 500 unverified tutors operating across major platforms, highlighting the need for more transparent vetting processes. This influx of new educators, while beneficial for addressing regional skill gaps, also prompts questions about the reliability of their material. Fake certifications, unqualified tutors, and misleading course titles pose significant risks, underscoring the importance of robust oversight.

To counter these concerns in the online tutoring services market, platforms and accreditation bodies are intensifying their efforts. TutorOcean rolled out 1,100 automated credential checks in mid-2024, streamlining the verification process before tutors begin teaching. In the same period, Teachable implemented 90 content audits each month to maintain consistent curriculum standards and identify plagiarized or incomplete courses. Skillshare also integrated 200 peer-review committees dedicated to investigating questionable modules and imposing penalties on non-compliant tutors. Such measures reflect the rising demand for transparency, as learners expect credible resources that align with their academic or professional objectives. Ultimately, grappling with rapid tutor expansion involves more than just recruiting talent—it entails cultivating a system of checks and balances that protects both student outcomes and marketplace integrity.

Segmental Analysis

By Sales Channel

Private tutoring has emerged as the most influential segment within online tutoring services market with over 54.8% market share due to its capacity for tailored instruction, flexible scheduling, and specialized expertise. Recent data shows that Chegg, one of the leading private tutoring platforms, recorded about 7.7 million global subscribers in 2023, demonstrating how extensively learners rely on direct, one-on-one support. In 2023, Tutor.com facilitated roughly 25 million live sessions across multiple subjects, indicating sustained growth in personalized help since 2000. Wyzant, concentrating primarily on U.S. high school and college students, reported connecting over 80,000 tutors with learners. Meanwhile, VIPKid, specializing in language training, served upward of 1 million active students in 2022 from Asia. Preply noted 140,000 new signups monthly in 2023, reflecting high demand for personal guidance. Varsity Tutors provided more than 1,000 subjects, highlighting private tutoring’s vast subject coverage. Collectively, these players illustrate that private tutoring’s individualized approach resonates across demographics.

The key providers in the online tutoring services market are often global platforms like Chegg and Varsity Tutors, alongside regional leaders such as BYJU’S in India. Their offerings span test prep, STEM subjects, and language learning. The primary consumers include middle and high school students who benefit from individualized exam training, as well as working professionals investing in skill development. In 2022, Brainly documented 350 million overall users worldwide, many leveraging private tutor support. Across Europe, MyTutor in the UK hosted about 250,000 sessions in a single academic term. Recent surveys show that over 85% of high school test-takers in certain districts seek private tutoring for college entrance exams, reflecting the mounting pressure to achieve top scores. These highly specific user trends and adoption rates underscore how individualized attention and adaptive learning experiences keep private tutoring firmly in the lead within the online tutoring services market.

By Education level

Secondary education’s commanding presence in the online tutoring services market with over 38.1% market share stems from the intensity of high school academic demands and the pivotal role of standardized tests in university admissions worldwide. For instance, Varsity Tutors handled approximately 1.2 million high school-level sessions in 2022, reflecting the surge in demand for advanced mathematics, language arts, and science help. Similarly, Khan Academy reported that among its 20 million monthly learners, a large share are secondary-level students seeking subject tutoring rather than general educational resources. In South Korea, high-pressure high school entrance exams have fueled an online private tutoring culture, where Etoos enrolled nearly 300,000 candidates in its digital courses last year.

The segment becomes more lucrative in the online tutoring services market because students preparing for crucial examinations often invest heavily in comprehensive study packages, from mock tests to one-on-one coaching. VIPKid, typically associated with language tutoring, adapted its platform to offer 30,000 advanced English sessions per month targeted at high school exam prep in 2022. In England, MyTutor saw a 40% rise in GCSE-focused tutoring signups in a calendar quarter. Meanwhile, Tutorful recorded close to 15,000 tutoring hours monthly for A-level subjects in 2023, emphasizing the momentum at the upper secondary stage. College Board’s advanced placement courses, served by multiple online platforms, accounted for 2.7 million exam takers in 2022 who often enroll in supplementary e-tutoring. Chinese provider TAL Education addresses secondary learners specifically for gaokao readiness, enrolling thousands daily. These case-specific statistics underscore how final-year academic stakes make secondary education a prime driver in online tutoring, securing its dominance over primary or tertiary segments.

By Subject/Skills

The demand for competitive exam preparation has surged in online tutoring services market and is currently accounting for 41.7% market share because higher scores frequently translate to better career and academic opportunities. The competitive exam segment is leading the market with over Key tests include the SAT, ACT, GMAT, GRE, JEE (India’s engineering entrance), and China’s gaokao. Magoosh reported 200,000 active monthly users in 2022 across its GRE and GMAT platforms, illustrating how digital test prep has replaced traditional haul-around books. In India, BYJU’S test prep app attracted over 100,000 new JEE and NEET aspirants in a single month last year, highlighting the magnitude of exam pressure. Kaplan, a longstanding name in standardized testing, delivered 1.8 million practice test sessions in 2021. Similarly, Princeton Review supported 500,000 SAT and ACT modules for global learners in the same period.

The largest consumer base consists of high school graduates and recent university alumni targeting prestigious colleges or professional opportunities in the online tutoring services market. For instance, as of 2022, Chegg recorded 80,000 unique monthly visitors focusing exclusively on competitive exam prep resources. Among Chinese high school learners, New Oriental online classes delivered 4,000 hours of gaokao-targeted tutoring weekly. GMAC, the GMAT’s governing body, identified a 12% increase in test registrations from 2020 to 2021, prompting more online prep usage. Meanwhile, the popularity of IELTS/TOEFL, crucial for non-native English speakers, has driven platforms like Cambly to host 50,000 daily sessions worldwide. These tests demand rigor, personalized practice, and advanced analytics—capabilities that online tutoring, with adaptive technologies and immediate feedback, is well-equipped to deliver. Thus, competitive exam coaching remains a high-stakes, high-volume domain that continues to accelerate overall online tutoring adoption.

By Industry

Blended learning’s rise with over 80% market share in online tutoring services market on combining digital tools with human instruction to offer versatile student engagement. Recent surveys indicate that about 70% of U.S. community colleges partnered with providers like Pearson MyLab to fuse e-textbooks, interactive modules, and online tutoring. In the K-12 sector, edtech platforms such as Edmentum supported around 1.6 million blended learners in 2022, demonstrating growing school adoption. TutorMe, a service featuring live chat and recorded lectures, reported 800,000 tutoring sessions in the 2021-2022 school year. In the same period, a major district in California logged 220,000 successful interventions through its blended tutoring pilot. On a global scale, BYJU’S combined offline sessions at partner centers with online coaching for more than 5,000 Indian schools.

Blended tutoring’s dominance in the online tutoring services market is driven by flexible technology integration, real-time analytics that track student progress, and immediate feedback loops. This format addresses teacher shortages, especially in specialized STEM areas, by supplementing conventional classroom lessons with guided online practice. In 2022, a philanthropic initiative in Singapore reported 15,000 students participating in blended math and science tutoring, citing improved exam readiness. The availability of recorded sessions on Tutor.com—over 1.5 million archives in 2022—allows for self-paced study, a significant advantage over purely face-to-face models. Additionally, Australian provider Cluey Learning once documented that 85% of the students using their blended approach experienced measurable grade improvements within six months. Coupled with robust software solutions like Blackboard Collaborate and Google Classroom, joined by interactive tools such as Desmos for math, the blended tutoring structure has secured a high rate of student satisfaction and institutional endorsement.

To Understand More About this Research: Request A Free Sample

Regional Analysis

Asia Pacific’s predominance in online tutoring services market is closely linked to intense academic cultures, a soaring population of digital-first students, and persistent emphasis on higher education. Among China’s vast student base, TAL Education volunteered data showing over 10 million cumulative online sessions in 2022, with a heavy concentration in middle and high school test prep. India’s BYJU’S, which had 115 million registered learners in 2023, exemplifies the region’s formidable appetite for digital mentorship. In Japan, Benesse Corporation’s Shinkenzemi online service boasted about 1 million monthly active subscribers in 2022, showcasing the popularity of tailored, at-home learning. With South Korea’s prevalence of after-school hagwons, Etoos’ online wing reached an enrollment of 300,000 in the past year. These sizable user bases underline how robust competition for top universities and coveted professions fosters explosive adoption rates for Asia Pacific tutoring.

China, India, and South Korea anchor this regional dominance in the online tutoring services market. In 2024, the Indian government reported 260 million K-12 enrollments, making the potential for e-tutoring enormous. China’s gaokao, which attracted 11.9 million test-takers last year, has motivated tens of thousands to sign up for digital revision resources such as Koolearn. Japan’s demographic of tech-savvy parents invests in early academic support, while Australia’s Cluey Learning serviced about 500 schools in 2023 with blended or fully online models. Reflecting diverse educational structures, the Asia Pacific region also prompts providers like Pearson, Coursera, and Varsity Tutors to expand local offerings, including specialized language and college prep programs. By capitalizing on mobile apps and high broadband penetration, these players see remarkable traction.

Growth drivers include government-led digital initiatives, affordable devices, and the cultural prioritization of academic milestones. In 2023, Samsung documented shipping over 18 million tablets across Asia, many used for tutoring platforms. Edtech philanthropic partnerships—like the one in rural Indonesia that added 150,000 e-learning scholarships—also spark higher adoption. Innovative local services such as Yuanfudao in China deploy AI-based question banks with 4 billion queries solved to date. This synergy of technology, exam-focused rigor, and societal impetus for top-tier certificates leads Asia Pacific to continue outpacing other regions in scale, diversifying both subjects and consumer segments at an unmatched rate.

Top Companies in the Online Tutoring Services Market:

- Chegg Inc.

- TutorEye Inc.

- Tutor.com

- Varsity Tutors

- TakeLessons

- iTutorGroup

- Preply

- Wyzant, Inc.

- Ambow Education

- Other Prominent Players

Market Segmentation Overview:

By Type:

- Asynchronous

- Synchronous

By Sales Channel:

- Private Tutoring

- International organization

- Educational Institutes

- Others

By Industry:

- Online

- Blended

By Education Level:

- Primary Education

- Secondary Education

- Higher Education

- Professional Education

- Vocational Education

- Others (veterans, senior citizens, specially needs)

By Subject/Skills:

- Competitive Exams (Test Preparation)

- STEM

- Business Studies (Accounts, Statistics & Analytics, Economics)

- Computer Science

- Music Instruments

- Languages

- Arts & Hobbies

- Others (Sports, special needs)

By Duration:

- Long-term

- Short-term

By Region:

- North America

- U.S.

- Canada

- Mexico

- Europe

- The UK

- Germany

- France

- Italy

- Spain

- Russia

- Poland

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

View Full Infographic

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2024 | US$ 33.91 Billion |

| Expected Revenue in 2033 | US$ 273.39 Billion |

| Historic Data | 2020-2023 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Unit | Value (USD Bn) |

| CAGR | 26.1% |

| Segments covered | By Type, By Sales Channel, By Industry, By Education Level, By Subject/Skills, By Duration, By Region |

| Key Companies | Chegg Inc., TutorEye Inc., Tutor.com, Varsity Tutors, TakeLessons, iTutorGroup, Preply, Wyzant, Inc., Ambow Education, Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0522238 | Delivery: 2 to 4 Hours

| Report ID: AA0522238 | Delivery: 2 to 4 Hours

.svg)